Abstract

The research article tested the efficiency of chilli futures market in India with respect to price discovery and price stabilization. Various tests employed indicate there is long run equilibrium relation exists between spot and future price in chill commodities. Future market for red chilli in India is leading the spot market in impounding future expectations about the future spot price. The results also corroborates that similar relationship is exists in case of other agro commodities as per the studies conducted by others.

Introduction

Organized commodity markets have been existing in India for centuries. The more easily understood markets are those that trade in agricultural commodities. The physical market is the traditional market and is usually referred to as the "cash and carry market" or the "spot market". The inherent characteristic of the physical market is that the transactions in this market are subject to price risk. The main problems of the physical market in general and 'agricultural markets in India' in particular are:

• Lack of proper price dissemination and transparency in price discovery process, • Fragmented, isolated and unorganized markets,

• Lack of proper certification and standardization of commodities, • Long chain of intermediaries,

• Cartelization of intermediaries with multiple levels of intermediation, • Processors are not allowed to buy directly from cultivators (in most states), • High volatility of prices.

* Professor, Department of P.G. Studies and Research in Commerce, Gulbarga University, Gulbarga

** Assistant Professor in Commerce in Commerce, Government First Grade College, Agara, HSR Layout, Bangalore - 560102.

Price Discovery in Indian Commodity Market

A Study of Red Chilli Futures

Cash and forward contracts are the two important instruments in physical commodity markets. Cash transactions involve immediate delivery or sometime in the future. A forward contract is a bilateral agreement in which a buyer and seller agree upon the delivery of a specified quality and quantity of an asset on a specified future date at a pre-determined price. While the forward transactions have the advantage of being customized, they have the following limitations:

• The contracts are private and negotiated, bilaterally, between two parties. Therefore, there are no exchange guarantees.

• The prices are not transparent as there is no reporting requirement.

• There are no regulations for establishing market stability and protection of market players. • Lack of standardization leads to illiquidity in the absence of a secondary market. • The profit or loss is realized only on the maturity date.

• Settlement is only through actual delivery or offsetting by cash delivery.

The above said limitations have necessitated the need for futures contracts in commodity markets. Futures contracts are evolved out of forward contracts. The future contracts are exchange-traded versions of forward contracts. The futures contracts provide benefits such as price discovery, liquidity, price risk management, price dissemination, absence of counter party risk as against cash and forward contracts.

The reintroduction and expansion of the commodity futures trading in India, has opened discussions on concept, development and issues associated with it. The liberal economic policy and opening up and integration of Indian financial and commodities markets with world markets have certainly necessitated studies vis-à-vis derivative trading in commodities. This is supported by other reforms in agricultural marketing sector such as amendment to APMC Act by many state governments, setup of electronic spot commodity exchanges, etc. Futures contracts perform two important functions viz., price discovery and price risk management with reference to the given commodities, which are useful in various segments of the economy. It is useful to producers because they can get an idea of the price likely to prevail at a future point of time and therefore, decide between various competing commodities. It enables the consumer to get an idea of the price at which the commodity would be available at a future point of time. India basically an agrarian country has a long history of commodity derivatives as back in 18751. But this sector remained underdeveloped due to constant government intervention

in many commodity markets to control prices.

Derivative trading in commodities in India is growing at rapid pace in recent times. This growth is attributable due to establishment of various commodity exchanges and Indian government policy to encourage futures trading in commodities. Government of India has set up Forward Markets Commission (FMC), headquartered at Mumbai, in 1953 under Forward Contracts (Regulation) Act, 1952. FMC is a regulatory authority which regulates, recognizes or withdraws the recognition of commodity exchanges in India. The FMC, also monitors and supervises the activities of commodity exchanges in India.

There are, at present 26 commodity exchanges, working in India, engaged in derivative trading in both agricultural and non agricultural commodities. The prominent commodity exchanges are, the Indian Pepper and Spice Trade Association, Kochi, National Multi Commodity Exchange of India Ltd., Multi Commodity Exchange of India Ltd., National Commodity and Derivatives Exchange Ltd., etc.

Initially, the Indian futures markets for agricultural commodities were not much developed and matured in terms of price discovery and price risk management compared to non-agricultural commodities such as gold, copper, silver, crude oil, etc. This is evident from the high volumes being recorded in non-agricultural commodities compared to agricultural commodities in futures markets in India.

Objective of the Study

The basic objective of this study is to test the price discovery of an agricultural commodity, the price of which is volatile and subject to demand and supply constraints along with other factors such as free from government restrictions, export/import opportunity, storability for reasonable period, etc. The study also intends to know stakeholders' view on agricultural commodity futures in India.

Literature Review

Jian Yang, David A. Bessler and David J. Leatham2 in their article have examined

that the price discovery performance of futures markets for storable and non-storable commodities in the long run, allowing for the compounding factor of stochastic interest rates. The evidence shows that asset storability does not affect the existence of co-integration between cash and futures prices and the usefulness of future market in predicting future cash prices. Jian Yang, R. Brian Balyeat and David J. Leatham3 in

2 ‘Asset Storability and Price Discovery in Commodity Futures Markets: A New Look’, published in The Journal of Futures Markets, Vol.24, No.3, pp 279-300(2004).

their paper examined that the lead-lag relationship between futures trading activity (volume and open interest) and cash price volatility for major agricultural commodities. Granger casualty tests and generalized forecast error variance decompositions show that an unexpected increase in futures trading volume unidirectionally causes an increase in cash price volatility for most commodities. R. Salvadi Eswaran and P. Ramasundaram4in their paper examined the Bartlett's test on price discovery in a

sample of four agricultural commodities traded in futures exchanges which have indicated that price discovery does not occur in agricultural commodity futures market. The econometric analysis of the relationship between price, return, volume, market depth and volatility has shown that the market volume and depth are not significantly influenced by the return and volatility of futures as well as spot markets. Sunil Kumar5

in his study has conducted an investigation into the futures markets in agricultural commodities in India. The results obtained from regressions for a sample of five commodities traded in six exchanges reveal that these futures exchanges fail to discover prices and provide efficient hedge against the risk emerging from price volatility. The futures markets in these commodities are not efficient and futures prices are not unbiased predictors of the future ready rates. Gurpreeth Singh Sahi6 in his article 'Influence of

Commodity Derivatives on Volatility of Underlying Asset' studied the impact of introducing commodity futures contracts on the volatility of the underlying commodity, in the Indian context. Empirical evidence from GARCHX methods suggests that in wheat, turmeric, sugar, cotton, raw jute and soybean oil, the nature of spot price volatility has not changed with the onset of futures trading. Granger casualty tests show that an unexpected increase in futures trading volume unidirectionally causes an increase in cash price volatility for wheat, turmeric, sugar, raw jute and soybean oil.

Data and Methodology

The study is based on secondary data, spot and future prices of a popular agricultural commodity i.e., 'Red Chilli' were collected from NCDEX for the period of 2006 to 2011. Augmented Dicky Fuller Test (ADF)7 is used to check the stationary of the

4 ‘Whether Commodity Futures Market in Agriculture is Efficient in Price Discovery? – An Econometric Analysis’ published in Agricultural Economics Research Review, Vol.21, (Conference Number) 2008, pp-337-344. 5 ‘Price Discovery and Market Efficiency: Evidence from Agricultural Commodities Futures Markets’ published in

South Asian Journal of Management, April-June 2004 edition.

6 ‘Influence of Commodity Derivatives on Volatility of Underlying Asset’ published in The ICFAI Journal of Derivative Markets, Vol. IV, No.3, July-2007 (ISSN 0972-9119) JEL Classification: C22, G13, G14

series. Johansen Trace Test8 is used to know the co-integration between stationary

variables. Unrestricted Co-integration Rank Test (Maximum Eigen value) to know long-run equilibrium relationship between spot and futures prices. Granger Causality9 test

is conducted to know the lead-lag relationship between series. To conduct these tests, the researcher has used SPSS and E-View software.

The Study: India is the largest producer, consumer and exporter of chillies in the world. India also has the largest area under chillies in the world. Chillies are the most common spice cultivated in India. The major producing states are Andhra Pradesh, Karnataka, Madhya Pradesh, Orissa, Maharashtra and Tamil Nadu. Andhra Pradesh alone commands around 53.27% of the chilli production in India. The major chilly growing districts of Andhra Pradesh are Guntur, Warangal, Khammam, Krishna and Prakasham. Chilli has well established spot markets. Guntur, Warangal, Khammam in Andhra Pradesh; Raichur, Bellary, Byadagi in Karnataka are the major spot markets at the production centers. Guntur is Asia's largest market for chillies. Normally, about 80 lakh to one crore bags of chillies (each bags carries approximately 30 to 50 kgs) is traded during the season in Guntur market alone. India's chilly exports are on a positive note and currently rank first when compared to other spices. The exports of chillies has increased significantly from 2003-04 onwards. Indian chili is mainly exported to USA, Sri Lanka, Bangladesh, the Middle East and the Far East.

The Chilli Futures Trading

In India, NCDEX is offering futures contracts in Chilli. At present Chilli (Paala) traded as LCA 334 with Guntur as delivery centre with Warangal in Andhra Pradesh as additional delivery centre. The commodity displays high volatility, with the prices heavily dependent on season, production in different producing tracts spread across the country, demand from exporters and the stock available at the cold storages. The prices of the major chilly varieties sold in the country are correlated with each other. As a result, the players in other varieties can also hedge their risks through this single variety (LCA-334) being traded in futures contracts.

8 In statistics, the Johansen test named after Søren Johansen, is a procedure for testing co-integration of several I(1) time series. This test permits more than one co-integrating relationship so is more generally applicable than the Engle–Granger test which is based on the Dickey–Fuller (or the augmented) test for unit roots in the residuals from a single (estimated) co-integrating relationship.

The Analysis

Analysis of Spot and Future Prices of Chilli for the Period of April 2006 to August 2011

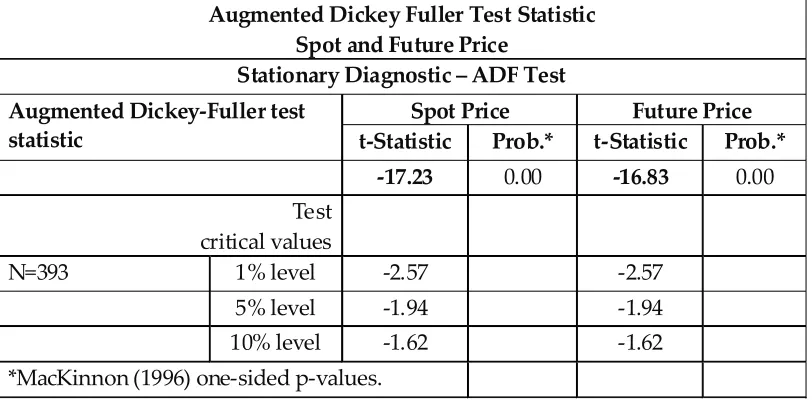

To check the stationary of the series - ADF Test

Table 1 : ADF Test

Augmented Dickey Fuller Test Statistic Spot and Future Price

Stationary Diagnostic – ADF Test Augmented Dickey-Fuller test

statistic

Spot Price Future Price t-Statistic Prob.* t-Statistic Prob.*

-17.23 0.00 -16.83 0.00 Test

critical values

N=393 1% level -2.57 -2.57

5% level -1.94 -1.94

10% level -1.62 -1.62

*MacKinnon (1996) one-sided p-values.

The table 1, clearly shows that null hypothesis of no unit roots for both the time series are rejected at their first differences since the ADF test statistics values are less than the Critical Value at level of 1%, 5% and 10%.. Thus the variables are stationary and integrated for same order. i.e. I(1).

To know the cointegration between stationary variables - Johansen Trace test:

Table 2 : Unrestricted Cointegration Rank Test (Trace)

Unrestricted Cointegration Rank Test (Trace)

Hypothesized Trace 5 Percent 1 Percent

No. of CE(s) Eigen value Statistic Critical Value Critical Value

None ** 0.04 23.51 15.41 20.04

At most 1 ** 0.02 8.02 3.76 6.65

*(**) denotes rejection of the hypothesis at the 5%(1%) level

Table 3 - Unrestricted Cointegration Rank Test (Maximum Eigen value)

Unrestricted Co integration Rank Test (Maximum Eigen value) Hypothesized Max-Eigen 5 Percent 1 Percent

No. of CE(s) Eigen value Statistic Critical Value Critical Value

None ** 0.04 15.49 14.07 18.63

At most 1 ** 0.02 8.02 3.76 6.65

*(**) denotes rejection of the hypothesis at the 5%(1%) level

MaSpot-eigenvalue test indicates 2 cointegrating equation(s) at the 5% level

In the Table 2 Trace Test indicates the existence of two integrating equations at 5% level of significance. Also, the table 3, Maximum Eigen Value test makes the confirmation of this result. Thus, the two variables of the study have long-run or equilibrium relationship between them.

To know the lead-lag relationship between series - Granger Causality test:

Table 4 - Granger Causality Test

Granger Causality Test

Lag-5

Null Hypothesis N F-Statistic Probability @ 5% Future does not Granger Cause Spot 388 4.41 0.00 1 Spot does not Granger Cause Future 0.99 0.43 1

The table 4 shows the result of Granger Causality Test; calculated F values are significantly greater from the critical value at lag of 5. This indicates null hypothesis is rejected and the alternative hypothesis is accepted. This shows that there is causality from futures to spot market in impounding the information in its prices. This makes clear that any changes in future price causes change in spot prices. But model two indicates that, any change in spot prices does not lead to changes in future prices. This is supported by statistically, since F value < than critical value and P value is >.05. So, there exists only unidirectional causality from future market to spot market but not vice versa.

Conclusion

Granger's Causality Test is employed. From the table 2 and 3, the result showed the calculated values are greater than table value and it indicating there is long run equilibrium relation exists between spot and future price in chill commodities. Since there exists long run relationship between spot and future prices of chilli, there will be causal relationship between these series. In other words, existence of lead-lag relationship between them is possible. To prove this, Granger's causality test is conducted. This will show which market lead and which market lag in impounding the information in its price. The result of test which showed in Table 4, that Future market are leading the spot market in impounding future expectations about the future spot price. But in vice versa is not supported. By and large we can conclude that future markets for red chilli are more efficient in discovering the future spot prices.

References

1. John C. Hull, 'Options, Futures and Other Derivatives', Prentice - Hall of India 2. www.mcxindia.com, website of Multi Commodity Exchange of India

3. Susan Thomas, Agricultural commodity markets in India; Policy issues for growth, May 21, 2003.

4. www.ncdex.com, the website of National Commodity and Derivative Exchange of India,

5. Wikipedia, the web dictionary 6. Spices Board, India