Public Expenditure and Economic Growth Nexus in Nigeria: A Time Series Analysis

Full text

Figure

Related documents

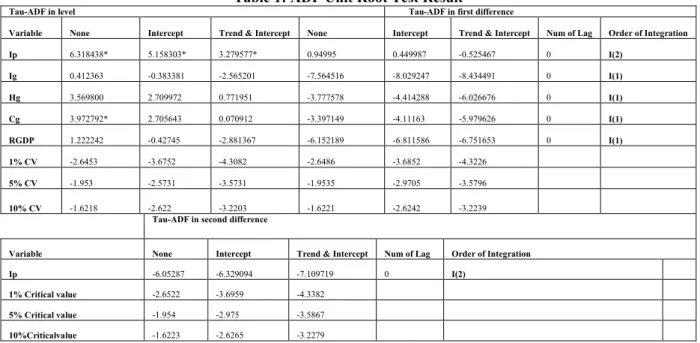

The variables used in the study include GDP (proxy for Economic growth), Government capital expenditure (proxy for Capital), foreign private investment (proxy for FDI),

The research tries to analyze the nature of causality between economic growth (GDP), foreign direct investment (FDI), Agriculture Rate (AGRI), energy consumption (EC) and

An augmented Solow model study by Oluwatobi and Ogunrinola (2011) on the impact of government capital expenditure on education and its effect on economic growth

Given the problems enumerated above, the aim of this work is to analyze the impact of public consumption, private investment, public investment and total expenditure on

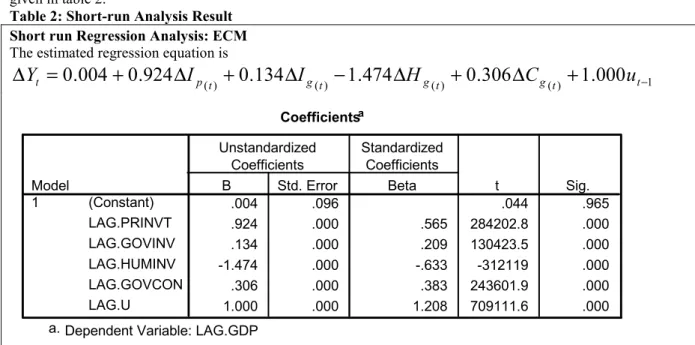

Therefore, there is long-run equilibrium relationship and causality running from the regressors: aggregate private consumption expenditure, gross government expenditure,

This research examines the impact involving macroeconomic variables like Government Spending expenditure, Gross capital formation, Households, and NPISHs Final

The work of Abu and Abdullahi (2010) in their short-run analysis of recurrent and capital expenditures, as well as government spending on agriculture, education, defence, health

The variables used in the study include GDP (proxy for Economic growth), Government capital expenditure (proxy for Capital), foreign private investment (proxy for FDI),