Compound Real Option Valuation with Phase Specific Volatility: a Multi phase Mobile Payments Case Study

Full text

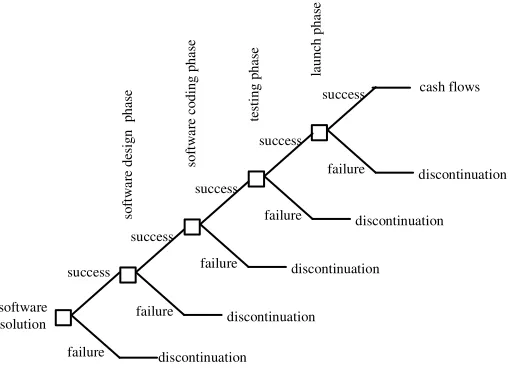

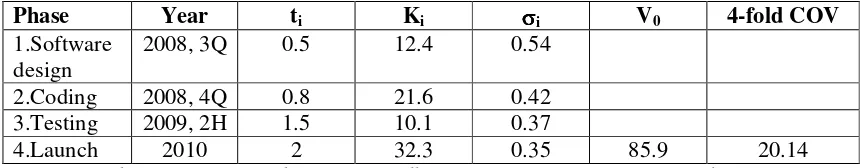

Figure

Related documents

With the MBT approach, we not only target at test execution automation, but also enable automated test case generation to tackle high flexibility and efficiency

However, the main focus of this study was to determine whether therapist empathy could increase over the course of therapy and whether relationships between therapist empathy,

Several of the project's outcomes, in particular two according to the development perspective of the PBL approach: 1) the use of the platform by students and users is not limited

Subsequently, the section “Adapting PBL to an existing LU” describes the procedure where two members of our campus team designed a final PBL course that consists in a

Subject matter experts for each asset and a study of the historical frequency of failure (called the Mean Time Between Failures – MTBF) can help determine the optimal interval

investigation into the physico-chemical properties changes of palm biodiesel under common rail diesel engine operation for the elucidation of metal corrosion and

The topics in these cases include generally accepted accounting principles, bad debt expense, inventory methods, depreciation methods, lease capitalization, deferred income

The course begins with students’ exploration of their own social locations, alliances and resistances to social justice through critical engagement of interdisciplinary readings