IMPACT OF MERGERS AND ACQUISITION ON INDIAN BANKS: A STUDY ON MERGERS OF ICICI BANK AND BANK OF RAJASTHAN

Full text

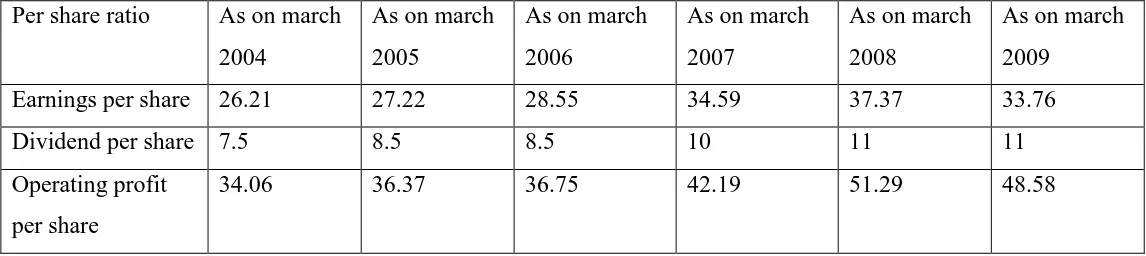

Figure

Related documents

The profitability of Islamic banks is measured using return on assets (ROA), while the factors suspected of affecting profitability are capital risks are

Working Capital Ratios Current Ratio Quick Ratio Cash Ratio Defensive Interval Profitability Ratios Return on Sales Gross Profit Margin Operating Profit MarginA. Net Profit

a) Sebagian besar siswa Kelas VIII C pada umumnya partisipasi belajar IPS masih rendah dan pasif. Pada pertemuan siklus 1 ini guru banyak terlibat di dalam

It is important to be able to correctly identify the three types of queen cell (see also Figures 1-3). Only the presence of swarm cells means that the colony is intent on

The travel management company assists in policing the policy, but the ultimate tool is corporate responsibility and the expense reporting system... ©2014 Partnership

3 Comparison of fatigue lives between predicted and measured results using regression- based strain-dependent models for ambient rubberized mixtures (a) 5ºC; (b) 20ºC.. 4 Comparison

Berdasarkan nilai T Statistik dari penelitian yang dilakukan menyatakan bahwa Customer Experience memiliki hubungan yang signifikan dan positif terhadap Customer

15) The firm's advertisements in Ohio, with the knowledge and acquiescence of respondent, contained false, misleading, or non-verifiable claims regarding its success