INFLUENCE OF FOREIGN INSTITUTIONAL INVESTORS ON MOVEMENTS OF INDIAN STOCK EXCHANGE

Full text

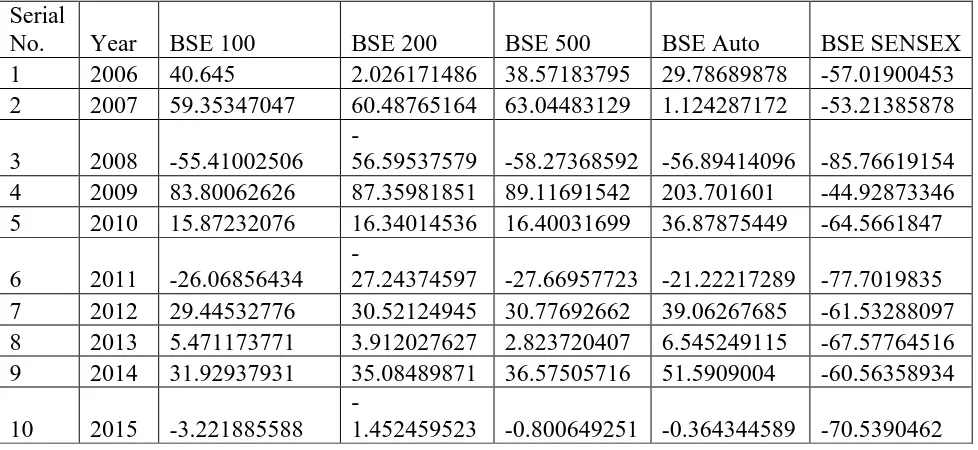

Figure

Related documents

institutional investors have high technology and better knowledge in dealing with available information, which can reduce the stock price synchronicity and stable

The relationship between the two countries is asym- metric: advanced countries are characterised by an institutional investors’ sector which invests in both domestic and

The aim of this master thesis is to analyze the characteristics and the effects of transactions by foreign investors in the Istanbul Stock Exchange on three

We could conclude from the previous analysis that, although the correlation coefficients of the various investors’ categorize vary over time, foreign institutional

Prior to 2006, the Securities and Exchange Board of India (SEBI) allowed the use of a modified form of book building mechanism in which allocation in the institutional

In this paper, we empirically analyse the level of foreign exchange reserves in India and study the sources of accretion to foreign exchange reserves and investment

Particularly, to provide answers to questions of whether these entrances and exits cause a change in ISE-all return index, and whether foreign investors make their decisions of

Further Chkili and Nguyen (2014) studied the volatility spillover effect between stock market and foreign exchange market in BRICS countries (Brazil, Russia, India,