Stochastic Dominance and Investors’ Behavior towards Risk: The Hong Kong Stocks and Futures Markets

Full text

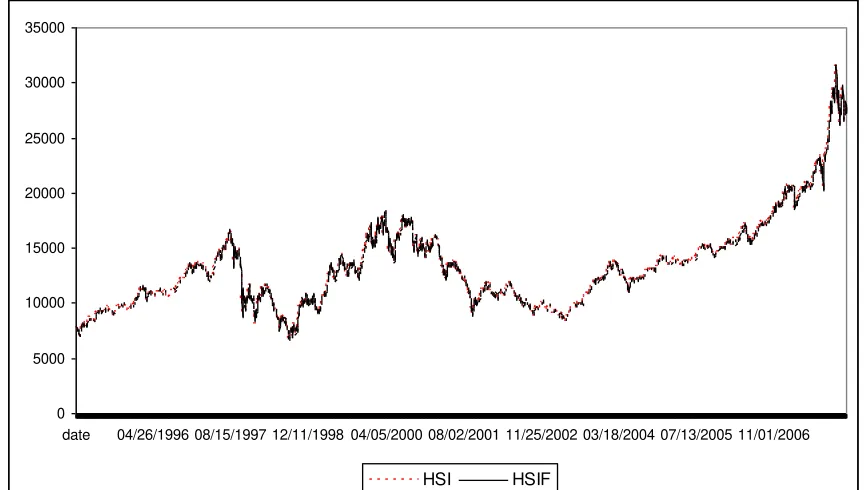

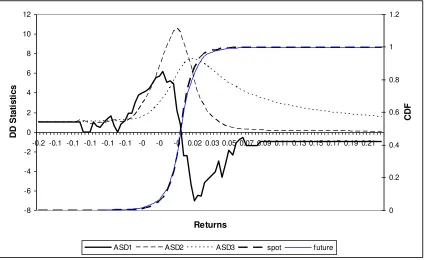

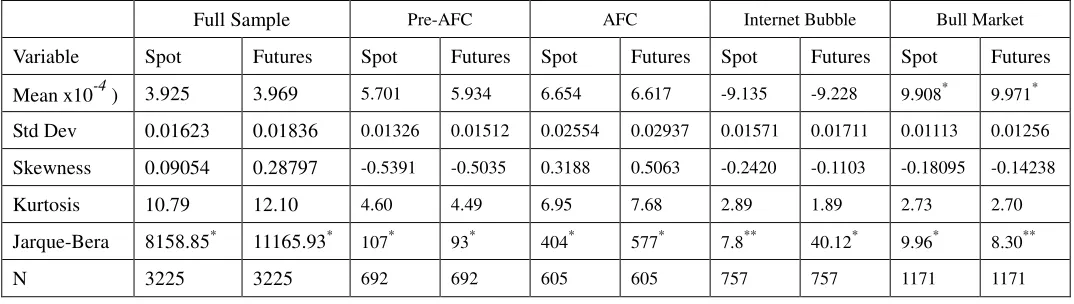

Figure

Related documents

The extracted polar lipids were then subjected to different qualitative tests, which were test for ester, Acrolein test, Liebermann-Burchard test, and test for

Taken together, this study indicates that while STEC are common in the Zambian dairy cattle these strains would not be classified as EHEC and are unlikely to be associated

She comes into the street and looks at the woman. She lives in Cable Street. I don't know what number,' she answers. You go back to the Rose and Crown and talk to the other people..

In table 2 we calculated the scoring again and figured out that the money type that is most similar to crypto currency is the Free Banking Era Banknote or wildcat money.. A

The PortaSIP server sends an INVITE request to that address (providing the proper credentials), and then proceeds in basically the same way as if it were communicating directly

The minor differences observed in the relative expression of the reporter gene between transgenic lines with mutated motifs in all footprints (Dmut_Pmut) and those with a subset

Study predictors of DDI included and its criteria were: (a) prescriber characteristics [medical specialty; number of prescribers at each prescription; prescribing week day

Publications offers a complete suite of market reports aimed at the molecular diagnostic space including: Molecular Diagnostics Markets , Molecular Diagnostics in Infectious