University of Pennsylvania

ScholarlyCommons

Publicly Accessible Penn Dissertations

1989

Imperfectly Competitive Financial Markets

Jorge Caballe Vilella

University of Pennsylvania

Follow this and additional works at:

https://repository.upenn.edu/edissertations

Part of the

Economics Commons

This paper is posted at ScholarlyCommons.

https://repository.upenn.edu/edissertations/2676

For more information, please contact

repository@pobox.upenn.edu

.

Recommended Citation

Vilella, Jorge Caballe, "Imperfectly Competitive Financial Markets" (1989).

Publicly Accessible Penn Dissertations

. 2676.

Imperfectly Competitive Financial Markets

Abstract

The first part of this dissertation, titled "Strategic Behavior and Asymmetric Information in Financial

Markets", studies the effects of changes in the precision of both public and private information in financial

markets in which traders are not price-takers but act strategically. Two different mechanisms of price

formation are considered. The first one is a mechanism with market orders and competitive market makers.

The second one is based on limit orders and market clearing. Under both regimes, the disclosure of more

public information increases the expected profits of liquidity traders at the expense of privately informed

agents. These results are potentially changed in two cases: when the acquisition of private information is costly

and when the disclosure requirements are not uniform across firms and we allow for discretionary liquidity

traders. The implications for price volatility, trading volume, incentives to produce private information,

efficiency of associations of investors and mechanism design are explored.

In the second part (a joint work with Murugappa Krishnan) titled "Insider Trading and Asset Pricing in an

Imperfectly Competitive Multi-Security Market", we study a multi-security financial market in a correlated

environment with asymmetric information and imperfect competition, in which market makers learn about

each return from every order flow, even as an informed trader manipulates what they can learn. Our model is a

generalization of a single-security model by Kyle. In contrast to a previous analysis by Admati under perfect

competition, where the effect of a correlated environment is only to generate various ambiguities, strategic

behavior restores various theoretical regularities, and can "neutralize" all of the correlatedness arising from the

structure of returns and liquidity noise. Even with imperfect private information, strategic behavior helps

generate an equilibrium with simpler structure, which is valuable for applications, especially for justifying

traditional event study procedures even when there is private information.

Degree Type

Dissertation

Degree Name

Doctor of Philosophy (PhD)

Graduate Group

Economics

First Advisor

Beth Allen

Subject Categories

Economics

O rd e r N u m b e r 9015068

Imperfectly com petitive financial markets

Caballe Vilella, Jorge, Ph.D.

U niversity o f Pennsylvania, 1989

U M I

300 N. Zeeb Rd. Ann Arbor, MI 48106

I M P E R F E C T L Y C O M P E T I T I V E F I N A N C I A L M A R K E T S

J o r g e C a b a l l e V i l e l l a

A D i s s e r t a t i o n

in

E c o n o m i c s

P r e s e n t e d t o t h e F a c u l t i e s o f t h e U n i v e r s i t y o f P e n n s y l v a n i a in

P a r t i a l F u l f i l l m e n t o f t h e R e q u i r e m e n t s f o r t h e D e g r e e of

D o c t o r of Philo s o p h y .

1 9 8 9

S u p e r v i s o r o f D i s s e r t a t i o n

G r a d u a t e G r o u p C h a i r p e r s o n

D E D I C A T I O N S

T o m y p a r e n t s

T o C l a r a

ii

ACKNOWLEDGMENTS

I a m gr a t e f u l to all t h e p e o p l e w h o h a v e h e l p e d m e to m a k e t his

d i s s e r t a t i o n .

F irst, I a m gr a t e f u l t o the m e m b e r s o f m y d i s s e r t a t i o n

c omm i t t e e : B e t h A l l e n (advisor), R i c h a r d K i h l strom, G e o r g e Mai l a t h a n d

A n d r e w P o s t l e w a i t e f o r t h e i r a d v i c e a n d en c o u r a g e m e n t . I h a v e a l s o

b e n e f i t e d f r o m v e r y he l p f u l c o m m e n t s b y P a t r i c i o Arrau, Utpal

B h a t t a c h a r y a , J a m e s Foster, N i c k G onedes, Y u k i k o Hirao, M a t t h e w Jackson,

M u r u g a p p a K r i s h n a n (who h a s a l s o c o - a u t h o r e d a pa r t o f thi s

d i s s e r t a t i o n ) , P e t e Kyle, Bill Novshek, P i e t r o R e i chlin, K. Rao

K adi y a l a , As a n i S a r k a r , T i m V anZandt, J e a n - L u c V i l a a n d p a r t i c i p a n t s at

w o r k s h o p s at P e n n a n d at IESE, Spain.

A m o n g t he p e o p l e that h e l p e d to m a k e life at P e n n m u c h easier,

I w o u l d like to m e n t i o n Albe r t Ando, C a r m e n A n s o tegui, G u i l l e r m o C a l v o

a n d A n t o n i o V illanacci. I a m s p e c i a l l y g r a t e f u l to D a v e C a s s f o r h i s

u n c o n d i t i o n a l support.

M y t w o y e a r s o f g r a d u a t e s t u d i e s at the U n i v e r s i t a t A u t o n o m a of

B a r c e l o n a w e r e a l s o a v e r y impo r t a n t p e r i o d in m y l ife that i n f l u e n c e d

m y s u b s e q u e n t education. I t h a n k s p e c i a l l y p r o f e s s o r s X a v i e r

C a l s a m i g l i a , J o a n M a r i a Esteban, A n d r e u M a s - C o l e l l a n d J o a q u i m S i l v e s t r e

b e c a u s e w i t h t h e i r a c a d e m i c g u i d a n c e a n d e n c o u r a g e m e n t p e r s u a d e d m e to

c o n t i n u e m y s t u d i e s in t he U n i t e d States.

F i n a l l y I w ant to t h a n k m y w i f e C l a r a for, a m o n g o t h e r

iii

i n v a l u a b l e things, h e r t i r e l e s s h e l p in t y p i n g t he m a n u s c r i p t m a n y

times.

F i n a n c i a l s u p p o r t at d i f f e r e n t s t a g e s o f m y s t u d i e s p r o v i d e d by

B a n k o f Spain; CIRIT, G e n e r a l i t a t o f Cata l u n y a ; a n d S c h o o l o f A r t s a n d

S c i e n c e s at the U n i v e r s i t y o f P e n n s y l v a n i a is g r a t e f u l l y a c k n o w l e d g e d .

iv

A B S T R A C T

I M P E R F E C T L Y C O M P E T I T I V E F I N A N C I A L M A R K E T S

J o r g e C a b a l l e V i l e l l a

B e t h A l l e n

T h e f i r s t par t o f t h i s d i s s e r t a t i o n , t i t l e d " S t r a t e g i c B e h a v i o r

a n d A s y m m e t r i c I n f o r m a t i o n in F i n a n c i a l Ma r k e t s " , s t u d i e s t h e e f f e c t s of

c h a n g e s in t h e p r e c i s i o n o f b o t h p u b l i c a n d p r i v a t e i n f o r m a t i o n in

f i n a n c i a l m a r k e t s in w h i c h t r a d e r s a r e not p r i c e - t a k e r s b u t a ct

s t r a t e g i c a l l y . T w o d i f f e r e n t m e c h a n i s m s o f p r i c e f o r m a t i o n a r e

co n s i d e r e d . T h e f i r s t o n e is a m e c h a n i s m w i t h m a r k e t o r d e r s a n d

c o m p e t i t i v e m a r k e t makers. T h e s e c o n d o n e is b a s e d o n l imit o r d e r s a n d

m a r k e t c l e aring. U n d e r b o t h regimes, t he d i s c l o s u r e o f m o r e p u b l i c

i n f o r m a t i o n i n c r e a s e s t h e e x p e c t e d p r o f i t s o f l i q u i d i t y t r a d e r s at the

e x p e n s e o f p r i v a t e l y i n f o r m e d agents. T h e s e r e s u l t s a r e p o t e n t i a l l y

c h a n g e d in t wo cases: w h e n t h e a c q u i s i t i o n o f p r i v a t e i n f o r m a t i o n is

c o s t l y a n d w h e n t h e d i s c l o s u r e r e q u i r e m e n t s a r e n o t u n i f o r m a c r o s s f i r m s

a n d w e a l l o w f o r d i s c r e t i o n a r y l i q u i d i t y traders. T h e i m p l i c a t i o n s f or

p r i c e vola t i l i t y , t r a d i n g volume, i n c e n t i v e s to p r o d u c e p r i v a t e

i n f ormation, e f f i c i e n c y o f a s s o c i a t i o n s o f i n v e s t o r s a n d m e c h a n i s m

d e s i g n a r e explored.

In t he s e c o n d p a r t (a j o i n t w o r k w i t h M u r u g a p p a K r i s h n a n )

t i t l e d " I n s i d e r T r a d i n g a n d A s s e t P r i c i n g in a n I m p e r f e c t l y C o m p e t i t i v e

v

M u l t i - S e c u r i t y Market", we s t u d y a m u l t i - s e c u r i t y f i n a n c i a l m a r k e t in a

c o r r e l a t e d e n v i r o n m e n t w i t h a s y m m e t r i c i n f o r m a t i o n a n d i m p e r f e c t

c o m p e t i t i o n , in w h i c h m a r k e t m a k e r s l e a r n a b o u t e a c h r e t u r n f r o m e v e r y

o r d e r flow, e v e n as a n i n f o r m e d t r a d e r m a n i p u l a t e s w h a t t h e y c a n learn.

O u r m o d e l is a g e n e r a l i z a t i o n o f a s i n g l e - s e c u r i t y m o d e l b y Kyle. In

c o n t r a s t to a p r e v i o u s a n a l y s i s b y A d m a t i u n d e r p e r f e c t co m p e t i t i o n ,

w h e r e t h e e f f e c t o f a c o r r e l a t e d e n v i r o n m e n t is o n l y t o g e n e r a t e v a r i o u s

a m b i g u i t i e s , s t r a t e g i c b e h a v i o r r e s t o r e s v a r i o u s t h e o r e t i c a l

r e g u l a r i t i e s , a n d c a n "n e u t r a l i z e " all o f t h e c o r r e l a t e d n e s s a r i s i n g

f r o m t h e s t r u c t u r e o f r e t u r n s a n d l i q u i d i t y noise. E v e n w i t h im p e r f e c t

p r i v a t e in f o r m a t i o n , s t r a t e g i c b e h a v i o r h e l p s g e n e r a t e a n e q u i l i b r i u m

w i t h s i m p l e r s t r u cture, w h i c h is v a l u a b l e f o r a p p l i c a t i o n s , e s p e c i a l l y

f o r j u s t i f y i n g t r a d i t i o n a l ev e n t s t u d y p r o c e d u r e s e v e n w h e n t h e r e is

p r i v a t e inform a t i o n .

vi

TABLE OF CONTENTS

P A R T 1: S T R A T E G I C B E H A V I O R A N D A S Y M M E T R I C I N F O R M A T I O N IN F I N A N C I A L

M A R K E T S 1

1. I n t r o d u c t i o n a n d R e l a t e d L i t e r a t u r e 2

2. T h e M o del w i t h M a r k e t O r d e r s a n d C o m p e t i t i v e

M a r k e t M a k e r s 12

2. A. T h e Mod e l 12

2.B. E q u i l i b r i u m 19

3. T h e W e l f a r e E f f e c t s o f P u b l i c I n f o r m a t i o n 2 2

3 . A. F r e e P r i v a t e I n f o r m a t i o n 2 2

3.B. C o s t l y I n f o r m a t i o n A c q u i s i t i o n 26

4. P r i c e V o l a t i l i t y a n d T r a d e V o l u m e I m p l i c a t i o n s 31

5. S t r a t e g i c L i q u i d i t y T r a d e r s 35

6. T h e E f f e c t s o f P r i v a t e I n f o r m a t i o n 42

7. C o m m o n P r i v a t e I n f o r m a t i o n 46

8. A M o n o p o l i s t i c M a r k e t f o r I n f o r m a t i o n 50

9. A s s o c i a t i o n s o f I n v e s t o r s 5 7

10. A R a t i o n a l E x p e c t a t i o n s M o d e l w i t h I m p e r f e c t C o m p e t i t i o n 60

10.A. T h e Mod e l 60

10.B. E q u i l i b r i u m 6 5

11. C o m p a r a t i v e S t a t i c s o f the R a t i o n a l E x p e c t a t i o n s w i t h

I m p e r f e c t C o m p e t i t i o n Model 68

12. A C o m p a r i s o n R e s u l t 7 3

v ii

13. Conclusion

- Appendix

- References

75

79

87

PART 2: INSIDER TRADING AND ASSET PRICING IN A N IMPERFECTLY COMPETITIVE

MULTI-SECURITY MARKET (with Murugappa Krishnan) 94

1. Introduction 95

2. Model 99

3. Equilibrium 105

4. General Properties of Equilibrium 113

5. Perfect Private Information 127

6. A Two-Asset Example 129

7. Conclusion 139

- Appendix 141

- References 150

viii

L I S T O F T A B L E S

P A R T 1

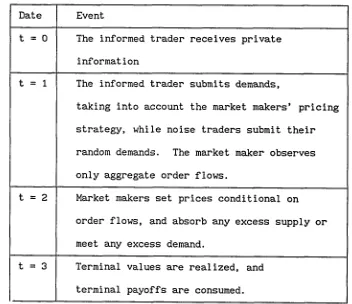

T a b l e 1 — T i m e S t r u c t u r e o f t he M a r k e t O r d e r s M o d e l 18

P A R T 2

T a b l e 1 — T i m e S t r u c t u r e o f B a s i c M o d e l 105

T a b l e 2 — L i m i t s 132

T a b l e 2 — L i m i t s (con t i n u e d ) 133

T a b l e 3 — C o m p a r a t i v e S t a t i c s 133

T a b l e 3 — C o m p a r a t i v e S t a t i c s (cont i n u e d ) 134

ix

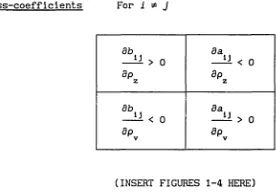

L I S T O F I L L U S T R A T I O N S

P A R T 1

F i g u r e 1 — P r o d u c t i o n o f P r i v a t e I n f o r m a t i o n

F i g u r e 2 — E x p e c t e d D e m a n d F u n c t i o n

P A R T 2

F i g u r e la — a

i (pv ; P z 5

F i g u r e lb — a

i (pz ; P v 5

F i g u r e2a — a

J (pv ; p z } *1*J

F i g u r e2b — a

J (Pz ; PV)>i*J

F i g u r e3a — b

l (pv : p z )

F i g u r e3b — b 1 (pz; pv) F i g u r e4a — b j(Pv ; p 2 ). F i g u r e4b — b j(p z : P v ). F i g u r e5a — ECirCpv; p j )

F i g u r e5b — E(ir(pz; p ^ )

F i g u r e 6 — E(n(p ) |m s e c u r i t i e s ) , p = 0

93 93 152 152 152 152 153 153 153 153 154 154 154

Part 1

STRATEGIC BEHAVIOR AND ASYMMETRIC INFORMATION

IN FINANCIAL MARKETS

1

1. INTRODUCTION AND RELATED LITERATURE

This paper studies the effects of public disclosure of

information by firms about the return of the securities they issue.

More generally, I will study the effects of changes in the precision of

both p ublic and private information in financial markets. This problem

has been addressed in several papers following the path-breaking work by

Hirshleifer (1971). Among others, I mention the papers by A llen

(1987b), Diamond (1985), Hakansson, Kunkel and Ohlson (1982), Ross

(1979), Verrecchia (1582b) and Kyle (1984).

The papers by Allen, Diamond and Verrecchia are the ones that

are most closely related to the present one. The difference between

their approach and mine is that they assume a p erfectly competitive

financial market in the tradition of Grossman a nd Stiglitz (1980) or

Diamond and Verrecchia (1981). I will follow instead the paradigm

pioneered by Kyle (1984, 1985, 1986), Glosten and Milgrom (1985) and

Kihlstrom and Postlewaite (1983). These authors depart from the

previous models by assuming that each agent in the market has a

nonnegligible effect on prices and each agent takes into account this

effect in order to formulate his optimal demand for risky asset. These

models of imperfect competition seem appropriate to study the

performance of thin markets with few traders who are aware of the fact

that they can influence the equilibrium prices, markets with dominant

2

traders, or markets with price setters (market makers) who make

inferences from the observed demand in order to price the traded

securities.

The traditional model of rational expectations with fully

revealing prices, as stated by Grossman (1976, 1978, 1981a) Grossman and

Stiglitz (1976) or Kihlstrom and Mirman (1975), has been subject to

several criticisms. The first problem raised by B eja (1977) and

Grossman a nd Stiglitz (1980) refers to the incentives to use private

information in such markets. If the equilibrium price becomes a

sufficient statistic for all the information in the market, then there

are no incentives for the agents to use their private information,

especially if this information is costly. Agents can observe the

equilibrium price and make all the relevant inferences from this

sufficient statistic. But if all the agents disregard their private

information, then prices cannot aggregate all the existing information

in the economy. This paradox has been s olved in two different ways.

First, Grossman (1977) and Grossman and Stiglitz (1980)

eliminate the possibility of fully revealing prices b y introducing a

source of noise that is uncorrelated with the return of the risky asset.

In this case, prices depend on the realizations of both private signal

and noise. Thus, Grossman and Stiglitz s how that there are still

incentives to become informed because not all the private information is

revealed to the uninformed agents through the price system. There have

been several stories that justify the existence of noise in financial

markets. We c an associate this noise with a random supply of risky

asset or with the random demand for asset made by agents that are

3

l i q u i d i t y c o n s t r a i n e d o r w h o s e t r a d i n g is d e t e r m i n e d e x c l u s i v e l y b y

l i f e - c y c l e reasons.

A n o t h e r s o l u t i o n to t h e G r o s s m a n - S t i g l i t z p a r a d o x c o m e s f r o m

t h e w o r k b y M i l g r o m (1981) w h i c h s p e c i f i e s the e x t e n s i v e f o r m o f a

s e c o n d - p r i c e a u c t i o n f o r a s i n g l e object. In t h i s auction, p r i c e s are

s u b m i t t e d f i r s t b y t h e b i d d e r s a n d a f t e r w a r d s t h e a u c t i o n e e r s e l e c t s t he

s e c o n d h i g h e s t p r i c e as the o ne at w h i c h t h e t r a n s a c t i o n is c a r r i e d out.

T h e a g e n t w h o g e t s t he o b j e c t is the a g e n t w h o h a s s u b m i t t e d the h i g h e s t

bid. G i v e n t h i s s e q u e n c e of moves, b i d d e r s a r e f o r c e d to u s e t h e i r

( p r o b a b l y co s t l y ) p r i v a t e i n f o r m a t i o n e v e n if th e e q u i l i b r i u m p r i c e

b e c o m e s f u l l y r e v e a l i n g 1.

A n o t h e r c r i t i c i s m to t he m o d e l s w i t h f u l l y r e v e a l i n g p r i c e s

c o m e s f r o m th e f a c t that if the n u m b e r o f a g e n t s is f i n i t e a n d a g e n t s

k n o w h o w p r i c e s a r e formed, t h e n t h e y s h o u l d a ct s t r a t e g i c a l l y in o r d e r

to m a n i p u l a t e t he e q u i l i b r i u m price.

B e c a u s e t he p r i c e t a k i n g a s s u m p t i o n in m a r k e t s w i t h f e w a g e n t s

l e a d s to t h e " s c h i z o p h r e n i c b e h a v i o r " p r o b l e m p o s e d b y H e l l w i g (1980),

th e (noisy) r a t i o n a l e x p e c t a t i o n s l i t e r a t u r e i n f i n a n c i a l m a r k e t s h a s

f o c u s e d o n l a r g e m a r k e t s w i t h a c o n t i n u u m o f agents, e a c h of t h e m w i t h

n e g l i g i b l e w e i g h t w i t h r e s p e c t to t he w h o l e market.

T h e s o l u t i o n o f th e s e p r o b l e m s s u g g e s t e d b y the l i t e r a t u r e o n

. i m p e r f e c t c o m p e t i t i o n that I will f o l l o w us e s p a r t i a l l y s o m e o f t he

T h e e q u i l i b r i u m p r i c e in M i l g r o m (1981) is a n o r d e r s t atistic. Usually, o r d e r s t a t i s t i c s a r e n o t su f f i c i e n t , but M i l g r o m is a b l e to p r o v i d e a n e x a m p l e of a u c t i o n w h o s e e q u i l i b r i u m p r i c e r e v e a l s all the p r i v a t e i n f o rmation.

4

i d e a s m e n t i o n e d above. F o r instance, s e v e r a l m o d e l s b y K y l e (1984,

1985, 1986) h a v e a s o u r c e o f n o i s e (due to l i q u i d i t y c o n s t r a i n e d

t r a d e r s ) tha t p r e v e n t s p r i c e s f r o m b e i n g f u l l y r e v e a l i n g so tha t

i n f o r m e d a g e n t s s t i l l h a v e i n c e n t i v e s to p a r t i c i p a t e in t he market.

A n o t h e r f e a t u r e o f K y l e ’s m o d e l s is that, as in M i l g r o m

(1981), t h e p r i c e is s e l e c t e d at t he e n d o f t h e a uction. H owever, the

s t r a t e g i c v a r i a b l e s f o r t he a g e n t s a r e not p r i c e s a n y m o r e b u t q u a n t i t i e s

( A d mati a n d P f l e i d e r e r (1988a) a n d K y l e (1985)) o r d e m a n d s c h e d u l e s

( J a c k s o n (1988) a n d K y l e (1986)). Theref o r e , g i v e n t h i s e x t e n s i v e f o r m

o f t h e game, a g e n t s a r e f o r c e d to u s e t h e i r p r i v a t e i n f o r m a t i o n in the

f i r s t s t a g e o f t he game.

Finally, the m o s t imp o r t a n t d e p a r t u r e f r o m t h e n o i s y r a t i o n a l

e x p e c t a t i o n s l i t e r a t u r e is tha t t h e p r i c e t a k i n g a s s u m p t i o n is relaxed.

T h e n u m b e r o f i n f o r m e d a g e n t s is a s s u m e d f i n i t e a n d t h e s e a g e n t s b e h a v e

s t r a t e g i c a l l y b e c a u s e t h e y k n o w t h e m e c h a n i s m b y w h i c h the p r i c e s a r e

formed.

As I h a v e menti o n e d , A l l e n (1987b), D i a m o n d (1985) a n d

V e r r e c c h i a (1982b) h a v e s t u d i e d t h e i s s u e o f the v a l u e o f i n f o r m a t i o n in

f i n a n c i a l m a r k e t s in t he c o n t e x t o f a n o i s y r a t i o n a l e x p e c t a t i o n e c o n o m y

w i t h p e r f e c t c o m p e t i t i o n , in w h i c h a g e n t s a r e c h a r a c t e r i z e d b y c o n s t a n t

a b s o l u t e r i s k a v e r s i o n u t i l i t y f u n c t i o n s a n d all r a n d o m v a r i a b l e s a r e

n o r m a l l y dis t r i b u t e d . E v e n t h o u g h the c o m p u t a t i o n s a r e s o m e w h a t

involved, t h e s e a u t h o r s a r e a b l e t o g i v e e x p l i c i t s o l u t i o n s to the

e q u i l i b r i u m a n d to s i g n the e f f e c t s o f t h e i r c o m p a r a t i v e s t a t i c s

e x p e r i m e n t s .

Th e A l l e n a n d D i a m o n d m o d e l s y i e l d d i f f e r e n t p r e d i c t i o n s a b o u t

t h e e f f e c t s o f p u b l i c i n f o r m a t i o n o n n o n - l i q u i d i t y t r a d e r s ’ welfare.

T h e s e r e s u l t s d e p e n d o n t he w a y in w h i c h n o i s e is i n troduced. A n

a d d i t i o n a l s i g n i f i c a n t f a c t o r is t hat the p r i v a t e i n f o r m a t i o n is c o m m o n

t o all i n f o r m e d a g e n t s in A l l e n ’s p a p e r w h e r e a s it is d i v e r s e in

D i a m o n d ’s case.

V e r r e c c h i a (1982b) p o i n t s o ut t h e d i f f i c u l t y o f a n s w e r i n g the

q u e s t i o n a b o u t t he v a l u e o f p u b l i c o r p r i v a t e information. H e a r g u e s

t h a t s l i g h t l y c h a n g i n g t h e s c e n a r i o s a n d t h e s e q u e n c e o f e v e n t s o f the

m o d e l s w o u l d c h a n g e t he r e s u l t s d r a m a t i c a l l y . A n i n t e r e s t i n g a n a l y s i s

i n V e r r e c c h i a ’s p a p e r r e f e r s to t h e i n c e n t i v e s to a c q u i r e p r i v a t e

i n f o r m a t i o n w h e n m o r e p u b l i c i n f o r m a t i o n is ava i l a b l e . H i s r e s u l t s s a y

tha t t h e d i s c l o s u r e o f p u b l i c i n f o r m a t i o n r e d u c e s t h e a m o u n t of

i n f o r m a t i o n p r o d u c e d p r i vately.

O n t he o t h e r hand, K y l e (1984) s t u d i e s t h e e f f e c t s of

d i s c l o s i n g a p u b l i c s i g n a l in a n i m p e r f e c t l y c o m p e t i t i v e f i n a n c i a l

market. H i s a n a l y s i s f o c u s e s o n a f u t u r e s m a r k e t f o r a n a g r i c u l t u r a l

g o o d w h e r e the r e t u r n o n t he f u t u r e d e p e n d s o n t h e p o s i t i o n s t a k e n b y

s p e c u l a t i v e t r a d e r s a n d t h e r a n d o m d e m a n d f o r t h e g o o d m a d e b y

n o n - s p e c u l a t i v e c o n sumers. H e c l o s e s t he m o del b y u s i n g a m a r k e t

c l e a r i n g c o n d i t i o n in w h i c h t h e p r i c e o f t h e g o o d is d e t e r m i n e d a f t e r

t h e s p e c u l a t i v e r o u n d o f t r a d e is c o n c l u d e d a n d t h e s t o c h a s t i c d e m a n d is

r evea l e d . O n t h e contr a r y , t h e m a r k e t I w i l l c o n s i d e r is like t h e o n e

m o d e l e d b y D i a m o n d (1985) o r Adma t i a n d P f l e i d e r e r (1988): a m a r k e t f o r

a n a s s e t w i t h a r a n d o m r e t u r n tha t is i n d e p e n d e n t o f t h e a c t i o n s t a k e n

b y t he s p e c u l a t i v e t r a d e r s d u r i n g the r o u n d o f trade. H owever, K y l e ’s

r e s u l t s a b o u t t h e e f f e c t s o f p u b l i c i n f o r m a t i o n a r e s i m i l a r to mine.

6

S o m e o f t h e q u e s t i o n s a d d r e s s e d in p r e v i o u s p a p e r s a r e

a n a l y z e d h e r e in the c o n t e x t o f i m p e r f e c t l y c o m p e t i t i v e f i n a n c i a l

markets. I w ill f o c u s m a i n l y o n a m a r k e t w i t h a f i n i t e n u m b e r o f a g e n t s

w h o o w n d i v e r s e p i e c e s o f p r i v a t e i n formation. L i q u i d i t y c o n s t r a i n e d

a g e n t s a r e t h e s o u r c e of n o i s e i n th i s market. T h e m e c h a n i s m o f p r i c e

f o r m a t i o n is m o d e l e d in two d i f f e r e n t ways. I f i r s t c o n s i d e r a mod e l

w i t h c o m p e t i t i v e m a r k e t m a k e r s w h o s e l e c t a p r i c e e q u a l to t h e e x p e c t e d

r e t u r n o f t h e r i s k y a s s e t c o n d i t i o n a l o n all i n f o r m a t i o n a v a i l a b l e to

them. T h e s t r a t e g i c v a r i a b l e s o f i n f o r m e d a g e n t s a r e q u a n t i t i e s ( m arket

or d e r s ) o f r i s k y a s s e t t hat t h e y w a n t to b u y o r sell. Se c o n d l y , I

b r i e f l y s t u d y a m o del t hat r e s e m b l e s th e t r a d i t i o n a l n o i s y r a t i o n a l

e x p e c t a t i o n s m o d e l w i t h p e r f e c t c o m p e t i t i o n i n w h i c h p r i c e s a r e f o r m e d

b y a u t o m a t i c m a r k e t c l e a r i n g a f t e r all d e m a n d f u n c t i o n s (limit

or d e r s ) a r e s u bmitted. Mo s t o f m y r e s u l t s h o l d i r r e s p e c t i v e o f the

m e c h a n i s m u n d e r c o n s i d e r a t i o n .

O n e s h o r t c o m i n g o f m y a p p r o a c h is that, as in A d m a t i a n d

P f l e i d e r e r (1988a), E a s l e y a n d O ’H a r a (1987), G l o s t e n a n d M i l g r o m (1985)

a n d K y l e (1985), f o r t r a c t a b i l i t y I a s s u m e that p a r t i c i p a n t s in the

m a r k e t a r e r i s k neutral. R i s k n e u t r a l i t y n e g a t e s s o m e r e s u l t s in th e

p r e v i o u s literature. H owever, t h i s e x e r c i s e h a s i n t r i n s i c v a l u e b e c a u s e

p r o v i d e s a n e x p l i c i t e q u i l i b r i u m f o r a c a s e w h e r e p e r f e c t c o m p e t i t i v e

e q u i l i b r i u m f a i l s to exist. If t h e r i s k n e u t r a l a g e n t s ( i n d e x e d b y n)

a r e p r i c e t a k e r s a n d o b s e r v e a s i g n a l s a b o u t th e r e t u r n v o f a n asset, t h e i r d e m a n d w ill b e x n = -oo if E ( v | s ) < p, x = oo if E ( v | s ) > p o r

X n = ^-0°’ + “ ^ ^ = P* O n l y in t h e i m p r o b a b l e c a s e i n w h i c h s = s f o r all n, d o e s e q u i l i b r i u m exist. In t h i s case, p = E( v | s ) is t h e

7

e q u i l i b r i u m price.

W i t h i m p e r f e c t c o m p e t i t i o n t h e "gen e r i c " n o n - e x i s t e n c e r e s u l t

is c h a n g e d b e c a u s e a g e n t s ta k e i nto a c c o u n t t h e i r e f f e c t s o n prices.

E a c h a g e n t r e d u c e s h i s i n t e n s i t y o f r e a c t i o n t o p r i v a t e i n f o r m a t i o n in

o r d e r to r e d u c e the a m o u n t o f i n f o r m a t i o n r e v e a l e d to t h e m a r k e t m a k e r

o r to o t h e r agents. T h e r e v e l a t i o n o f i n f o r m a t i o n w o u l d p u s h t h e p r i c e s

u p w h e n i n f o r m e d a g e n t s r e c e i v e g o o d n e w s a n d e l i m i n a t e p a r t o f th e

p r o f i t s t h a t t he a g e n t s w o u l d o b t a i n if p r i c e s d i d not r e a c t to

i n d i v i d u a l actions.

F u r t h e r m o r e , t h e a s s u m p t i o n o f r i s k n e u t r a l i t y c o m p l e m e n t s the

i m p e r f e c t c o m p e t i t i o n a s s umption. In t h i n m a r k e t s w i t h f e w agents,

u s u a l l y t h e t r a d e r s a r e a g e n t s w h o a r e e i t h e r (wealthy) i n s i d e r s o r

mu t u a l f u n d s w i t h v e r y h i g h r i s k b e a r i n g c a p a city. A f u r t h e r a d v a n t a g e

o f t h e r i s k n e u t r a l i t y a s s u m p t i o n is th a t p e r m i t s o n e t o c o n c e n t r a t e

e x c l u s i v e l y o n s t r a t e g i c i n t e r a c t i o n s a m o n g p a r t i c i p a n t s in the

f i n a n c i a l market.

T h e s e v e r a l a s p e c t s a n d r e s u l t s o f t h e p a p e r a r e s u m m a r i z e d as

follows:

I mo d e l p u b l i c i nformation, as in D i a m o n d (1985) o r K y l e

(1984), a s s u m i n g tha t all a g e n t s a r e a b l e to o b s e r v e a c o m m o n s i g n a l

a b o u t t h e r e t u r n o f t he r i s k y a s s e t in a d d i t i o n to t h e i r p r i v a t e

s i g nals. M o r e p r e c i s e p u b l i c i n f o r m a t i o n m a k e s i n f o r m e d a g e n t s w o r s e

o f f b e c a u s e it d i s s i p a t e s the i n f o r m a t i o n a l a d v a n t a g e o f t h e s e a g e n t s

w i t h r e s p e c t to t he l i q u i d i t y traders, e v e n if t h e i r r e l a t i v e

i n f o r m a t i o n a l p o s i t i o n w i t h r e s p e c t to t he m a r k e t m a k e r a n d o t h e r

s t r a t e g i c t r a d e r s r e m a i n s u n changed. M o r e p u b l i c i n f o r m a t i o n m a k e s the

market more liquid, i.e., prices becomes less sensitive to order flows.

This in turn implies a transfer of expected profits from informed

traders to liquidity traders.

My above result is potentially changed in two cases. First,

if private information is costly, the number of informed agents

decreases when more precise public information is disclosed. This

implies that the new e quilibrium will involve less competition among

insiders. This n ew equilibrium may generate less surplus for liquidity

traders. Secondly, liquidity traders in a multi-securities world are

attracted to the most liquid market. This fact alters camouflage

opportunities across markets.

I study the effects of more precise information release o n the

behavior of the price process and the expected volume of transactions

done by the market maker. The volatility of prices increases in an

economy where public information is more intensively released, because

prices can more accurately replicate returns. The expected volume of

the market m a ker’s trade decreases as public information becomes more

precise in the market orders model.

Private information exhibits decreasing returns in my models.

Too much private diverse information may be harmful to informed agents.

This result does not hold in the market orders model with common private

information across agents. In this case, the informed a g e n t s ’ advantage

with respect to the market maker always increases.

Another issue studied here concerns the efficiency of

syndicates of investors. I consider two kinds of associations of

investors: associations in which its members precommit ex ante to share

th e i r p r i v a t e i n f o r m a t i o n a n d a s s o c i a t i o n s t hat s u b m i t c o l l e c t i v e

d e m a n d s o n b e h a l f o f its members. T h e r e l a t i v e e f f i c i e n c y of t h e s e

a s s o c i a t i o n s f r o m t h e p o i n t o f v i e w o f t h e i n f o r m e d a g e n t s is

i n d e p e n d e n t o f the p r e c i s i o n of p u b l i c information.

I a l s o s t u d y t he p e r f o r m a n c e o f a v e r y s t y l i z e d m o n o p o l i s t i c

ma r k e t f o r i n f o rmation. F o r m a r k e t s w i t h a s i n g l e i n s i d e r w h o c a n

p r o d u c e p r i v a t e informa t i o n , t h e i n d u c e d c h a r g e o f i n c e n t i v e s to p r o d u c e

p r i v a t e i n f o r m a t i o n w h e n f u r t h e r p u b l i c i n f o r m a t i o n is r e l e a s e d d e p e n d s

o n t h e a v e r a g e c o s t o f p r o d u c i n g s u c h p r i v a t e i nformation.

Finally, I o b t a i n t h e f o l l o w i n g c o m p a r i s o n result: if p r i v a t e

i n f o r m a t i o n is v e r y p r e c i s e c o m p a r e d to the p u b l i c info r m a t i o n , t h e n

i n f o r m e d a g e n t s a r e b e t t e r o f f w h e n t he p r i c e is d e t e r m i n e d b y

c o m p e t i t i v e r i s k n e u t r a l m a r k e t m a k e r s t h a n w h e n it is f o r m e d b y

a u t o m a t i c m a r k e t clea r i n g . T h e c o n v e r s e is t r u e f o r l i q u i d i t y traders.

T h i s r e s u l t is a c o n s e q u e n c e o f the d e c r e a s i n g r e t u r n s a s s o c i a t e d w i t h

p r i v a t e i n f o r m a t i o n a n d t h e i n f o r m a t i o n s h a r i n g i n v o l v e d in t h e limit

o r d e r s model.

T h e p a p e r is o r g a n i z e d as follows:

S e c t i o n 2 p r e s e n t s a m o d e l w i t h m a r k e t o r d e r s a n d m a r k e t

makers. T h i s model h a s a l s o t w o k i n d s of agents: i n f o r m e d a g e n t s a n d

l i q u i d i t y traders. I o b t a i n th e B a y e s i a n - N a s h e q u i l i b r i u m o f t he

p r o p o s e d g a m e w h e n t h e r e is a v a i l a b l e a p i e c e o f p u b l i c i n f o r m a t i o n

m o d e l e d l ike in D i a m o n d (1985).

S e c t i o n 3 d e r i v e s s o m e w e l f a r e i m p l i c a t i o n s o f i n c r e a s i n g the

p r e c i s i o n of p u b l i c i n f o r m a t i o n w h e n the p r i v a t e i n f o r m a t i o n is f r e e a n d

w h e n it is costly.

10

S e c t i o n 4 s t u d i e s s o m e e m p i r i c a l i m p l i c a t i o n s of r e l e a s i n g

p u b l i c i n f o r m a t i o n o n p r i c e v o l a t i l i t y a n d v o l u m e o f t r a d e d o n e b y t he

m a r k e t maker.

S e c t i o n 5 m o d i f i e s t h e p r e v i o u s m o del b y i n t r o d u c i n g

d i s c r e t i o n a r y l i q u i d i t y t r a d e r s that c h o o s e o p t i m a l l y i n w h i c h m a r k e t

t h e y will s u b m i t t h e i r demands.

S e c t i o n 6 a n a l y s e s the e f f e c t s o f i n c r e a s i n g t h e p r e c i s i o n o f

p r i v a t e informa t i o n .

S e c t i o n 7 c o n s i d e r s the c a s e o f c o m m o n p r i v a t e information.

T h i s c a s e is u s e f u l in o r d e r to a n a l y z e th e p e r f o r m a n c e o f a

m o n o p o l i s t i c m a r k e t f o r i n f o r m a t i o n ( S e c t i o n 8) a n d t h e e f f i c i e n c y o f

a s s o c i a t i o n s o f i n v e s t o r s (S e c t i o n 9).

S e c t i o n 10 c o n s i d e r s a d i f f e r e n t mo d e l o f p r i c e f o r m a t i o n in

th e s a m e s p i r i t a s in J a c k s o n (1988) a n d K y l e (1986). T h e e q u i l i b r i u m

p r i c e is d e f i n e d b y m a r k e t c l e a r i n g w h e r e a g e n t s ’ s t r a t e g i e s a r e d e m a n d

f u n c t i o n s ( limit orders). T h e c o m p a r a t i v e s t a t i c s e x p e r i m e n t s of

s e c t i o n s 3, 4 a n d 6 a r e p e r f o r m e d f o r the n e w mo d e l i n S e c t i o n 11.

S e c t i o n 12 c o m p a r e s b o t h m e c h a n i s m s f r o m th e p o i n t o f v i e w o f

t he e x p e c t e d p r o f i t s o f b o t h t y p e s o f agents.

S e c t i o n 13 c o n c l u d e s t he paper.

11

2. T H E M O D E L W I T H M A R K E T O R D E R S A N D C O M P E T I T I V E M A R K E T MAKERS.

W e a r e g o i n g to s t u d y the p r i c e f o r m a t i o n o f a s i n g l e a s s e t in

a m a r k e t w i t h t h r e e k i n d s o f agents: i n f o r m e d traders, n o i s e t r a d e r s a n d

m a r k e t makers.

T h e r e a r e T l i q u i d i t y Cor nois e ) trad e r s , i n d e x e d b y t, i n the m arket. T h e n o i s e t r a d e r s e i t h e r b u y o r s ell q u a n t i t i e s o f r i s k y a s set

m o t i v a t e d b y l i q u i d i t y c onstraints. T h e s e l i q u i d i t y c o n s t r a i n t s c a n be

j u s t i f i e d b y l i f e - c y c l e r e a s o n s a n d o t h e r n e e d s t hat a r i s e o u t s i d e t he

f i n a n c i a l market. T h e impo r t a n t f e a t u r e o f th e b e h a v i o r o f t h e s e

l i q u i d i t y t r a d e r s is that t h e y tr a d e f o r r e a s o n s tha t a r e not r e l a t e d to

t h e p a y o f f o f f i n a n c i a l asset. I w ill a s s u m e t h a t t he net d e m a n d z f o r

. s h a r e s o f e a c h l i q u i d i t y t r a d e r t is n o r m a l l y d i s t r i b u t e d . W i t h o u t loss o f g e n e r a l i t y , a s s u m e that z t h a s z e r o m e a n a n d v a r i a n c e e q u a l to <r2 f o r

al l t, a n d C o v ( z . z ) = 0 f o r m * k. T h e r e f o r e , t h e t o t a l net d e m a n d

T m k

z = E z f o r s h a r e s b y t he l i q u i d i t y traders, is n o r m a l l y d i s t r i b u t e d

U l

w i t h z e r o m e a n a n d v a r i a n c e cr2, w h e r e <r2 = Ter2 > 0.

A l t e r n a t i v e l y , i n t erpret t h e n o i s e z a s a r a n d o m s u p p l y

o f r i s k y a s s e t (cf. G r o s s m a n a n d S t i g l i t z (1980) a n d D i a m o n d a n d

V e r r e c c h i a (1981), a m o n g others). I n t h i s c a s e I do n ot n e e d to w o r r y

a b o u t t h e w e l f a r e i m p l i c a t i o n s o n t h e l i q u i d i t y t r a d e r s o f o u r

c o m p a r a t i v e statics.

F i n ally, I m ust s a y that t h e a m o u n t o f n o i s e p a r a m e t e r i z e d b y

t h e v a r i a n c e cr2 m a y b e v e r y small, b u t in a n y c a s e I n e e d it in o r d e r

12

to a v o i d h a v i n g f u l l y r e v e a l i n g prices.

T h e r e a r e N i n f o r m e d t r a d e r s ( i n d e x e d b y n) in t h e m a r k e t w h o t r a d e o n t h e b a s i s o f p r i v a t e i n f o r m a t i o n a b o u t t h e f u t u r e p a y o f f o f the

r i s k y asset. T h e y a r e not a w a r e o f t h e e x a c t n e e d s o f t h e l i q u i d i t y

c o n s t r a i n e d traders. However, t h e y k n o w t h e p a r a m e t e r s o f t he

d i s t r i b u t i o n o f the total net d e m a n d s z f o r s h a r e s b y t h e n o i s e traders.

I c o n s i d e r a s i n g l e a s s e t w h o s e e x p e c t e d r e t u r n v is n o r m a l l y d i s t r i b u t e d w i t h m e a n v a n d p r e c i s i o n (the i n v e r s e o f t h e va r i a n c e ) e q u a l to x e (0, co). E a c h i n f o r m e d t r a d e r r e c e i v e s a p i e c e of p r i v a t e

i n f o r m a t i o n t hat t a k e s the f o r m o f a s i g n a l s w h e r e s = v + e . T h e n o i s e c o f t h e s i g n a l is a l s o n o r m a l l y d i s t r i b u t e d w i t h m e a n 0 a n d

p r e c i s i o n x ^ > 0 f o r all n (i.e., s is i n f o r m a t i v e a b o u t t h e r e t u r n v).

I a s s u m e tha t the f i r m i s s u i n g t he a s s e t c a n b e f o r c e d b y l a w

to d i s c l o s e at n o c o s t r e l i a b l e i n f o r m a t i o n a b o u t the e x p e c t e d r e t u r n of

th e asset. I d i s r e g a r d t he d i r e c t c o s t s o f p r o d u c i n g i n f o r m a t i o n a n d

th e i n d i r e c t c ost o f d i s c l o s i n g r e l i a b l e i n f o r m a t i o n u s i n g c o s t l y

s i g n a l s a s d i v i d e n d s ( B h a t t a c h a r y a (1979), M i l l e r a n d R o c k (1985)) o r

c a p i t a l s t r u c t u r e (Ross (1977)). T h i s a s s u m p t i o n a l l o w s o n e to f o c u s

e x c l u s i v e l y o n t he e f f e c t s o f p u b l i c i n f o r m a t i o n o n the s t o c k mar k e t

t r a d e r s ’ welfare. Sp e c i f i c a l l y , a s in D i a m o n d (1985), I a s s u m e that the

f i r m is e n f o r c e d to r e l e a s e a p u b l i c si g n a l s q t hat t a k e s th e f o r m

5o - ^ + So '

w h e r e e q h a s a n o r m a l di s t r i b u t i o n , w i t h z e r o m e a n a n d p r e c i s i o n t q > 0.

W e c a n i m a g i n e that t h e level of p r e c i s i o n t q c a n be e n f o r c e d b y t h e l e g i s l a t o r in the f o l l o w i n g way. T h e f i r m m u s t be a u d i t e d a n d

13

t h e a u d i t o r h a s to r e l e a s e all t h e i n f o r m a t i o n t h a t h e is a b l e to

o btain. T h e p r e c i s i o n t q is c o n t r o l l e d e x a n t e b y e s t a b l i s h i n g t h e

d i f f e r e n t a c t i v i t i e s o f the f i r m that s h o u l d be audited. B y e n l a r g i n g

t h e s et o f a u d i t e d a c t i v i t i e s , t h e p r e c i s i o n x q is increased. All the

p a r t i c i p a n t s in t he m a r k e t o b s e r v e t h e r e a l i z a t i o n o f s q b e f o r e the t r a n s a c t i o n s a r e conducted.

I a s s u m e that (v, z, ...e^, e Q ) are m u t u a l l y i n d e p e n d e n t

r a n d o m variables.

De n o t e t he o p t i m a l d e m a n d o f t h e i n f o r m e d t r a d e r n as

x = x (s , s ) w h e r e x (...) is a m e a s u r a b l e f u n c t i o n o f s a n d s 2 .

n n n 0 n n 0

N o t e that the d e m a n d s a r e n o t a l l o w e d to be c o n t i n g e n t o n p r ices; thi s

p o s s i b i l i t y will be s t u d i e d in S e c t i o n 10. N o t e a l s o t h a t x (*,•)

d e n o t e s t h e d e m a n d s t r a tegy, x is t h e q u a n t i t y d e m a n d e d a s a r a n d o m

varia b l e , a n d x d e n o t e s the r e a l i z a t i o n of thi s r a n d o m varia b l e .

All i n f o r m e d t r a d e r s a r e a s s u m e d to b e r i s k neu t r a l , tha t is

to say, t h e y o n l y c a r e a b o u t m a x i m i z i n g the e x p e c t e d f u t u r e payoff.

T h i s a s s u m p t i o n is c o n s i s t e n t w i t h t h e b e h a v i o r o f m u t u a l f u n d s that

h a v e a v e r y d i v e r s i f i e d p o r t f o l i o a n d t hat a r e r i s k n e u t r a l a s a group.

O u r model h a s two p eriods. In p e r i o d 1 e a c h t r a d e r s u b m i t s

ma r k e t o r d e r s to a m a r k e t m a k e r w h o is a l s o a s s u m e d to b e r i s k neutral.

T h e m a r k e t m a k e r e s t a b l i s h e s a p r i c e p f o r t he r i s k y a s s e t o n c e he has

o b s e r v e d the total n e t q u a n t i t y d e m a n d e d b y t he t r a d e r s a n d t h e p u b l i c

signal. It is impor t a n t to n o t e tha t t h e mar k e t m a k e r o n l y o b s e r v e s

2 G i v e n the a s s u m p t i o n s o n t h e p r i c i n g rul e b e l o w (mainly, l i n e arity), m i x e d s t r a t e g i e s a r e n e v e r o p t i m a l f o r insiders.

14

"total demands". Thus, he c a n n o t k n o w if a n o r d e r c o m e s f r o m a n

i n f o r m e d t r a d e r o r f r o m a n o i s e trader.

I a s s u m e c o m p e t i t i o n a m o n g ma r k e t makers. T h i s c o m p e t i t i o n

a m o n g p r i c e s e t t e r s f o r c e s t h e m to s e l e c t a p r i c e s u c h tha t t h e y e a r n

z e r o e x p e c t e d p r o f i t s . T h e r e a s o n s f o r t h i s a r e e x a c t l y t h e s a m e that

f o r c e p r i c e to e q u a t e the m a r g i n a l c ost in t h e B e r t r a n d m o d e l o f

o l i g o p o l i s t i c competi t i o n . T h e m a r k e t m a k e r is p r e p a r e d to b u y o r sell

a n y a m o u n t o f r i s k y a s s e t t hat is s u p p l i e d o r d e m a n d e d 3 . N e i t h e r the

m a r k e t m a k e r n o r the i n f o r m e d a g e n t h a v e s h o r t - s e l l i n g cons t r a i n t s .

Thus, a ma r k e t m a k e r m u s t sell v s h a r e s w h e r e w is t h e net t o tal o r d e r f l o w

N

w = £ x n (sn> s Q ) + z . (2.1) T he z e r o p r o f i t c o n d i t i o n (or m a r k e t e f f i c i e n c y c o n d i t i o n )

i m p l i e s that

p = p(w, s Q ) = E(v|w,

SQ)

. (2.2) T h e p r i c e s e l e c t e d e q u a l s the e x p e c t e d r e t u r n c o n d i t i o n a l o na ll i n f o r m a t i o n a v a i l a b l e to t h e m a r k e t maker. T h e m a r k e t m a k e r use s

th e o r d e r f l o w to m a k e i n f e r e n c e s a b o u t v b e c a u s e it c o n t a i n s p a r t of

T h e a s s u m p t i o n of c o m p e t i t i v e m a r k e t m a k e r s is c o n s i s t e n t w i t h th e i n s t i t u t i o n a l a r r a n g e m e n t s o f t he O v e r - t n e - c o u n t e r (OTC) m a r k e t or th e I n t e r m a r k e t T r a d i n g S y s t e m (ITS) that f o r c e s c o m p e t i t i o n b e t w e e n the N e w Y o r k S t o c k E x c h a n g e (NYSE) m o n o p o l i s t i c s p e c i a l i s t s a n d regi o n a l spec i a l i s t s . F o r o t h e r r u l e s o f d y n a m i c m a r k e t m a k i n g w i t h i n v e n t o r y costs, s e e A m i h u d a n d M e n d e l s o n (1980), G a r m a n (1976) o r O ’H a r a a n d O l d f i e l d (1986).

15

th e p r i v a t e i n f o r m a t i o n o w n e d b y i n f o r m e d a g e n t s 4 .

P r i c e s a r e r a n d o m v a r i a b l e s that a r e m e a s u r a b l e w i t h

r e s p e c t to o r d e r f l o w s a n d t he p u b l i c signals. p(.,.), p a n d p d e n o t e

t h e p r i c i n g rule, t h e e q u i l i b r i u m p r i c e a s a r a n d o m v a r i a b l e a n d t he

r e a l i z a t i o n o f t h i s r a n d o m v a r i a b l e re s p e c t i v e l y .

In p e r i o d 2, the r e a l i z a t i o n o f v is o b s e r v e d a n d e a c h ag e n t r e c e i v e s h i s payoff.

T h i s s e q u e n c e of e v e n t s to d e t e r m i n e p r i c e f o r m a t i o n looks

l i k e t h e o n e u s e d b y A d m a t i a n d P f l e i d e r e r (1988a), D i a m o n d a n d

V e r r e c c h i a (1987) E a s l e y a n d O ’Ha r a (1987), G l o s t e n a n d M i l g r o m (1985),

G o u l d a n d V e r r e c c h i a (1985) a n d K y l e (1985) a n d r e s e m b l e s t h e s t r u c t u r e

p r o p o s e d b y th e a l r e a d y c l a s s i c a l p a p e r o f K r e p s a n d W i l s o n (1982) o n

s e q u e n t i a l eq u i l i b r i u m . But m y a p p r o a c h f o l l o w s m o r e c l o s e l y t h e

a r t i c l e s b y K y l e a n d A d m a t i a n d P f l e i d e r e r b e c a u s e I a s s u m e that the

m a r k e t m a k e r s e l e c t s a s i n g l e p r i c e a f t e r h e h a s o b s e r v e d t h e o r d e r

A t h i r d p o s s i b l e J u s t i f i c a t i o n o f the r a n d o m v a r i a b l e z is to a s s u m e t hat t h e r e is s o m e n o i s e i n the c o m m u n i c a t i o n c h a n n e l b e t w e e n t h e i n f o r m e d s p e c u l a t o r s a n d t h e m a r k e t maker. T h i s m e a n s t h a t t h e ^ m a r k e t m a k e r is o n l y a b l e to o b s e r v e a g a r b l e d o r d e r flow. O b v i o u s l y z m ust be a g a i n u n c o r r e l a t e d to all o t h e r r a n d o m variab l e s .

16

f l o w . 5

G o u l d a n d V e r r e c c h i a (1985) a l t e r t h i s s e q u e n c e o f events. In

t h e i r p a p e r th e m a r k e t m a k e r s e l e c t s the p r i c e f i r s t a n d a f t e r w a r d s the

i n f o r m e d a g e n t s s u b m i t d e m a n d s c o n d i t i o n a l o n p r i c e a n d p r i v a t e

i n f o r m a t i o n 6 .

D i a m o n d a n d V e r r e c c h i a (1987), E a s l e y a n d O ’H a r a (1987) a n d G l o s t e n a n d M i l g r o m (1985) s t u d y the p o s s i b i l i t y o f b i d - a s k s p r e a d s (i.e., a b u y i n g p r i c e a n d a s e l l i n g one) i n a d y n a m i c setup. G l o s t e n a n d Milg r o m , f o r instance, a s s u m e t hat in e a c h p e r i o d o f t i m e t h e r e is o n l y t h e p o s s i b i l i t y of b u y i n g o r s e l l i n g a u n i t o f asset. F r o m t h i s o b s e r v e d b ehavior, the m a r k e t m a k e r i n f e r s p a r t o f the i n f o r m a t i o n c o n t a i n e d in th e o r d e r f l o w u s i n g u p d a t i n g b a y e s i a n rules. T h e ag e n t w h o s u b m i t s t he ma r k e t o r d e r in e a c h p e r i o d is s e l e c t e d r a n d o m l y a n d c a n be e i t h e r a n i n f o r m e d t r a d e r o r a n o i s e trader. W i t h t h i s s t r u c t u r e t he m a r k e t m a k e r c a n s e l e c t o n l y tw o c o n t i n g e n t p r i c e s (the s e l l i n g p r i c e a n d t he b u y i n g one) b e f o r e t he o r d e r f l o w is o b s erved. F i n a l l y , t h e p o s s i b i l i t y o f s e q u e n t i a l l e a r n i n g b y t he m a r k e t m a k e r is n o t a n a l y z e d in o u r (e s s e n t i a l l y ) o n e - p e r i o d model.

6 In G o u l d a n d V e r r e c c h i a (1985) th e a s s u m p t i o n o f r i s k a v e r s i o n c a n n o t b e r e laxed, b e c a u s e t he p r i c e is f i x e d b y th e s p e c i a l i s t f i r s t a n d r i s k n e u t r a l i t y w o u l d le a d i n f o r m e d t r a d e r s to t a k e i n f i n i t e p o s i t i o n s i n t he r i s k y as s e t h e l d by.

17

Th e f o l l o w i n g ta b l e s u m m a r i z e s the s e q u e n c e o f events:

T a b l e 1 — T i m e S t r u c t u r e o f t h e M a r k e t O r d e r s Model

D a t e 1. a) - Th e p u b l i c signal s q= v+ e Q is a n n o u n c e d a n d o b s e r v e d b y everybody.

- T h e i n f o r m e d a g e n t s o b s e r v e s = v + e .

- T h e l i q u i d i t y t r a d e r s o b s e r v e t h e i r f i n a n c i a l n e e d s z .

b) - T h e i n f o r m e d a g e n t s s u b m i t n et d e m a n d s x ( s ,s )

n n 0

co n d i t i o n a l o n p u b l i c a n d p r i v a t e i n f o r m a t i o n to

th e m a r k e t maker.

- T h e l i q u i d i t y t r a d e r s s u b m i t t h e i r n et d e m a n d s z

c) - T h e m a r k e t m a k e r s e l e c t s a p r i c e t hat e q u a t e s the e x p e c t e d r e t u r n c o n d i t i o n a l t o t h e p u b l i c sign a l

a n d t h e o r d e r flow, p= E(v|w, sq ).

d) - T r a n s a c t i o n s a r e c a r r i e d out at t h e p r i c e s e l e c t e d b y the mark e t m a k e r in c). All t h e d e m a n d s are

a b s o r b e d b y the mar k e t maker.

D a t e 2 - Th e r e t u r n v is r e v e a l e d a n d e a c h a g e n t r e c e i v e s this r e t u r n m u l t i p l i e d b y the q u a n t i t y o f a s set

boug h t o n D a t e 1.

2.B. E q u i l i b r i u m .

O n l y i n f o r m e d t r a d e r s m a k e s t r a t e g i c d e c i s i o n s in t h e model.

T h e y w a n t t o m a x i m i z e e x p e c t e d p r o f i t s c o n d i t i o n a l o n t h e i r i nformation.

T h e o p t i m a l d e m a n d f o r r i s k y a s s e t o f i n f o r m e d a g e n t n is

Xn^Sn’ V = argmax E [[^ ~

P

50 j]x |sn>

S0JT h e N a s h e q u i l i b r i u m o f t h e g a m e we a r e s t u d y i n g c o n s i s t s o f N

s t r a t e g i e s ^ ( s ^ , sq ), n = 1 that m a x i m i z e t h e e x p e c t e d p r o f i t s f o r e a c h i n f o r m e d trader, g i v e n t he o b s e r v e d s i gnals, a n d a p r i c e

f u n c t i o n p(w, s q ) that m a k e s the e x p e c t e d p r o f i t s o f t h e m a r k e t m a k e r

e q u a l t o z e r o f o r e a c h p a i r o f p u b l i c s i g n a l a n d o r d e r flow.

I r e s t r i c t a t t e n t i o n to l i n e a r a n d s y m m e t r i c eq u i l i b r i a ,

w h e r e x n C®n . sq ) a n d p(w, sq ) a r e l i n e a r f u n c t i o n s 7 . T h e q u e s t i o n o f e x i s t e n c e o f n o n l i n e a r e q u i l i b r i a in t h i s s e t u p r e m a i n s u n a n s w e r e d but

s e e m s i m p l a u s i b l e u n d e r G a u s s i a n assumpt i o n s .

Th e p r o o f s m a k e e x t e n s i v e u s e o f the f o l l o w i n g l e m m a w h i c h is

a v e r s i o n o f t he p r o j e c t i o n t h e o r e m f o r n o r m a l l y d i s t r i b u t e d r a n d o m

v a r i a b l e s .

7 F o r n o n l i n e a r e q u i l i b r i a u n d e r d i f f e r e n t d i s t r i b u t i o n a l as s u m p t i o n s , s e e G a l e a n d H e l l w i g (1987) a n d L a f f o n t a n d M a s k i n (1988).

19

LEMMA 2.1: Let v, be normally and independently distributed random variables with E(v) = v and E(ufc) = 0 , (k = 1 K) and precisions t^, respectively.

Then:

^Var (v | v + v + u r ) J TV + 2

r , xv v + S T k( v + v

E(*R

*

5*

5

*

5J ^

--Tv * 2 Tk=l k

Proof: It follows from DeGroot (1970, p. 55). Now, I can state now m y first result:

PROPOSITION 2.2: There exists a unique symmetric, linear equilibrium

which is given by

p = p(w, sQ ) = S + A w + yso , and

x = x(s , s ) = a + ,3s + K s , where

20

P ro o f : S e e the appendix. ■

N o t e t hat th e e q u i l i b r i u m c a n be w r i t t e n in t h e f o l l o w i n g way:

[

t v + ts]f

.." V r + x ° = P[ V E(^l^o)J ’

(2>3)

T V + X S

p(w, so ) = + ° ° + A w = E ( v | s q ) + A w . (2.4) v o

T h e q u a n t i t i e s d e m a n d e d b y e a c h a g e n t d e p e n d o n t he d e v i a t i o n

o f t h e p r i v a t e i n f o r m a t i o n w i t h r e s p e c t to th e p o s t e r i o r e x p e c t a t i o n

a f t e r o b s e r v i n g t h e p u b l i c signal. O n t h e o t h e r hand, t h e p r i c e of the

a s s e t w ill be equal to the p o s t e r i o r e x p e c t a t i o n a f t e r o b s e r v i n g s q pl u s

21

a t e r m t hat e m b o d i e s t h e i n f o r m a t i o n c o n t a i n e d in t h e o r d e r flow.

It is s t r a i g h t f o r w a r d to p r o v e tha t th e u n c o n d i t i o n a l

e x p e c t a t i o n ECx^Cs^, s q )) o f i n d i v i d u a l d e m a n d s is e q u a l to z e r o and,

f r o m this, t h a t E(p(v, s q )) = v, i.e., p r i c e s a r e u n b i a s e d e s t i m a t e s o f returns.

E q u a t i o n (2.3) a n d (2.4) i m p l y t hat a n a l y z i n g the e f f e c t s o f

t h e d i s c l o s u r e o f p u b l i c i n f o r m a t i o n is a m e q u i v a l e n t p r o b l e m to

s t u d y i n g t h e e f f e c t s o f a r e d u c t i o n in the v a r i a n c e o f the p r i o r

d i s t r i b u t i o n o f v.

T h e c o e f f i c i e n t A in P r o p o s i t i o n 2 . 2 is t h e in v e r s e o f t he

d e p t h of the market, a c c o r d i n g to K y l e ’s (1985) termi n o l o g y . In o t h e r

words, 1/A m e a s u r e s th e o r d e r f l o w r e q u i r e d to c h a n g e t he p r i c e o f t he

r i s k y a s s e t b y o n e dollar. B y inspection, A is d e c r e a s i n g in tq .

T h e r e f o r e the d e p t h o f th e m a r k e t is i n c r e a s i n g i n t q . T h i s r e f l e c t s th e f act that, w h e n m o r e p u b l i c i n f o r m a t i o n is av a i l a b l e , m a r k e t m a k e r ’s

in f e r e n c e s a r e less d e p e n d e n t o n t h e o r d e r flow. T h e n ext s e c t i o n g i v e s

a m o r e d e t a i l e d e x p l a n a t i o n o f th i s impo r t a n t fact.

3. T H E W E L F A R E E F F E C T S O F P U B L I C INFORMA T I O N .

3 . A. F r e e p r i v a t e inform a t i o n .

Th e w e l f a r e e f f e c t s o f p u b l i c d i s c l o s u r e o f i n f o r m a t i o n b y

f i r m s a r e p a r a m e t e r i z e d b y tq . H i g h e r v a l u e s o f t q m e a n m o r e s t r i n g e n t d i s c l o s u r e r e q u i r e m e n t s . O u r a n a l y s i s r e q u i r e s c o m p u t a t i o n o f e x p e c t e d

22

p r o f i t s f o r b o t h t y p e s o f a g e n t s b e f o r e t he r e a l i z a t i o n s o f t h e r a n d o m

v a r i a b l e s a r e o b served.

C O R O L L A R Y 3.1: E x p e c t e d p r o f i t s o f i n f o r m e d t r a d e r s a r e

F o r a l i q u i d i t y c o n s t r a i n e d in d i v i d u a l t r a d e r t (bef o r e h e is

a b l e to o b s e r v e h i s l i q u i d i t y needs), e x p e c t e d p r o f i t s a r e

ECir1) = - AE(z2) =

Proof: F o r t h e i n f o r m e d traders, c o m p u t e

E(7in) = e|\v - p ) x j = e|\v -

S

- Aw - rsQ)(a + + KSQ)jw h e r e w is d e f i n e d i n (2.1) a n d (a, /3, k,5, A, y) a r e g i v e n in P r o p o s i t i o n 2.2.

Fo r the l i q u i d i t y c o n s t r a i n e d t r a d e r s c o m p u t e

E [(v - p)zj =

e[[

v- 5 -

xn

zj - ySQ]zJ

to obtain, a f t e r s o m e algebra, the e x p r e s s i o n s g i v e n in t h e Corollary.