Executive Compensation, Firm Performance, and State Ownership in China: Evidence from New Panel Data*

Full text

Figure

Related documents

To test our first hypothesis, that firm performance is optimal when the compensation structure of the CEO is identical to that of the firm, we take the absolute difference of

To illustrate the effect of education and market reform on productivity and wage, we need to measure variables such as value added, number of employed persons, labour compensation,

By arguing that state ownership enables firms in emerging economies to receive political patronage but that state ownership differs in terms of corporate governance and

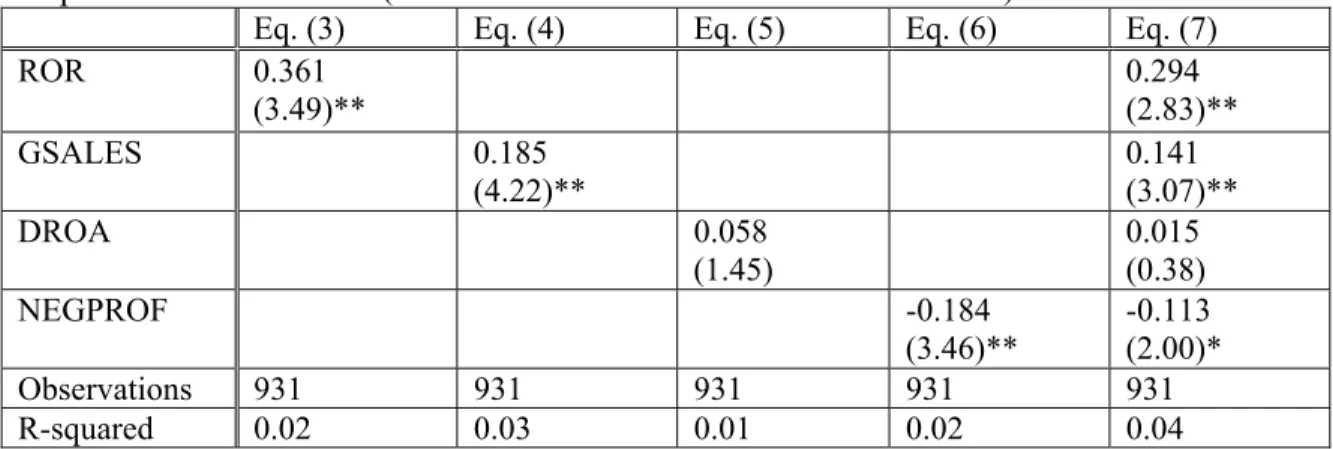

Five forms of REIT CEO compensation are used to examine the influences of firm performance: (1) change in CEO salary (CSalary), (2) cash bonuses (BONUS), (3) the change in CEO

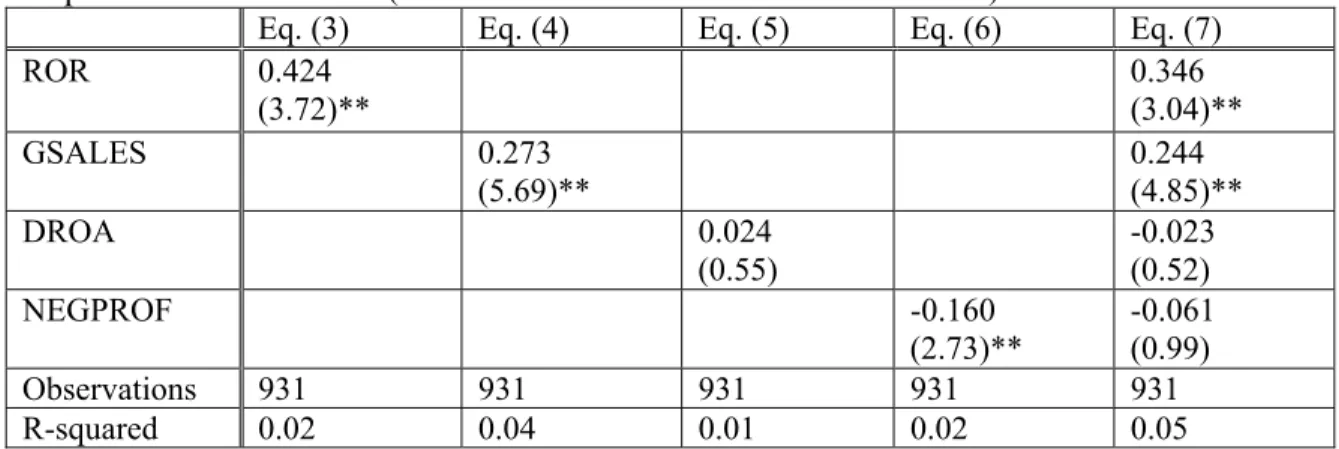

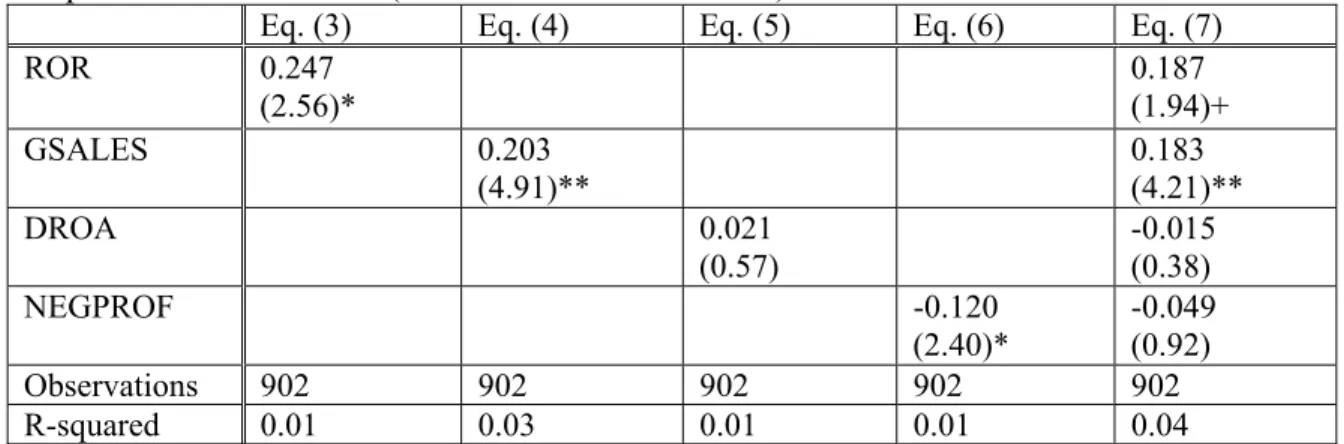

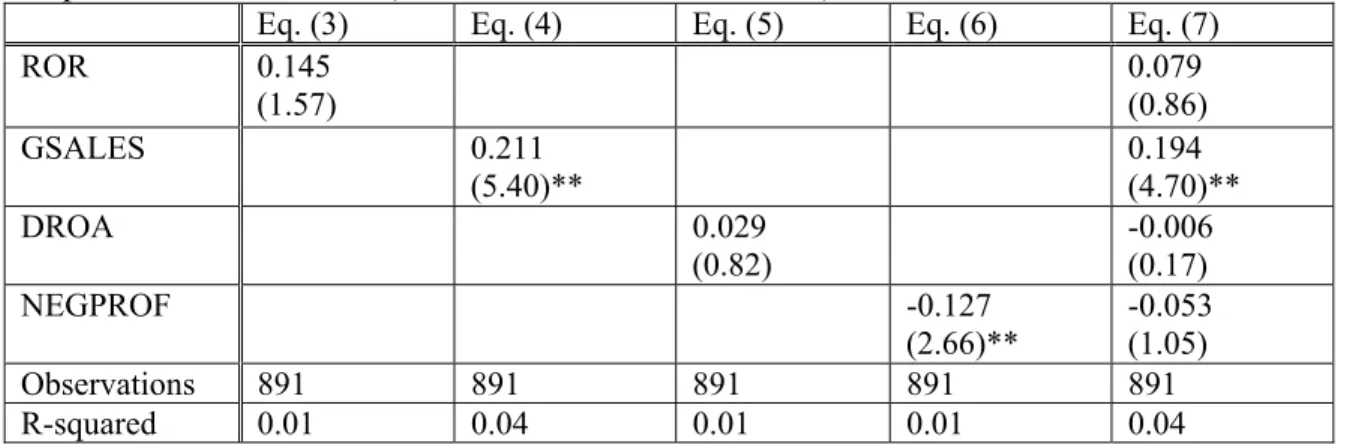

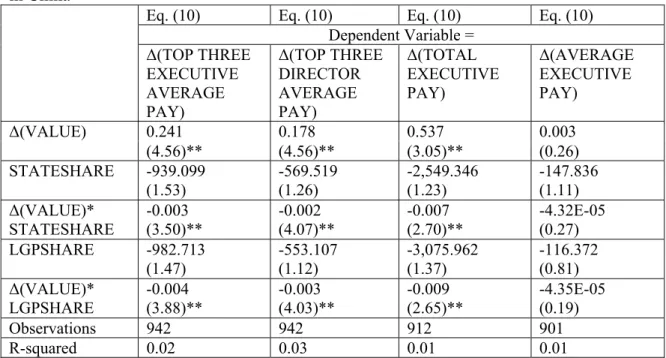

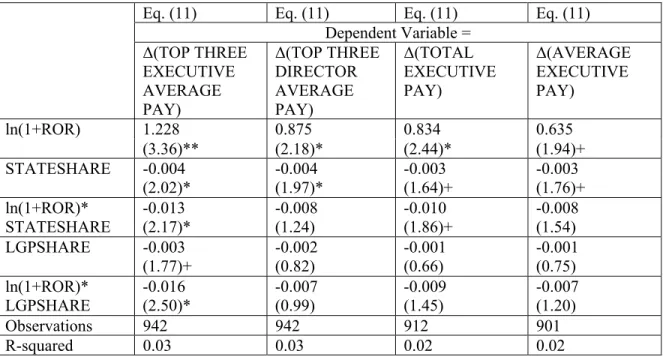

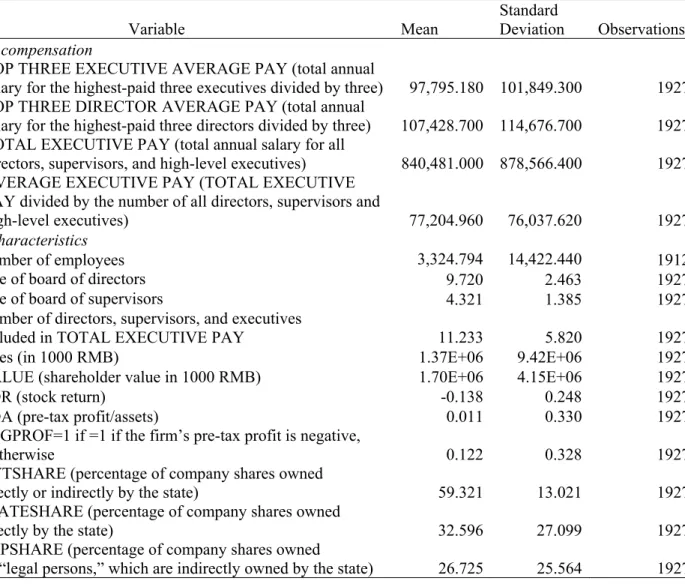

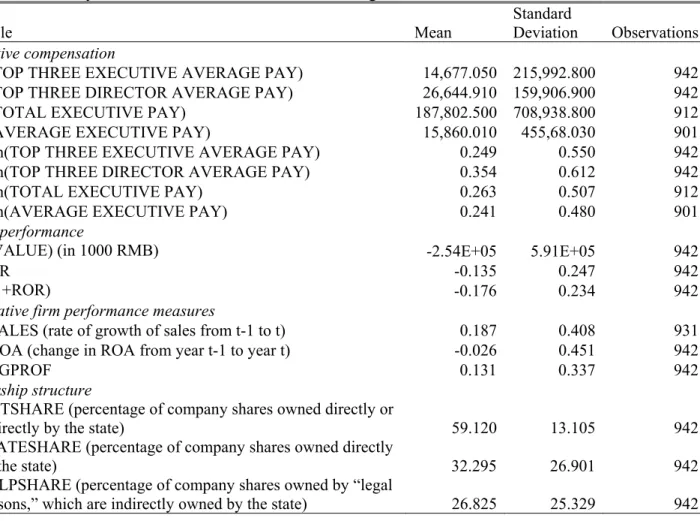

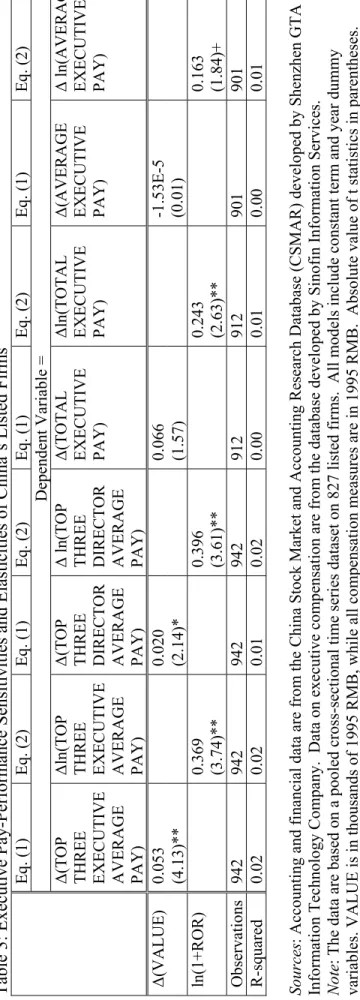

The purpose of this paper is to explore the mechanisms of corporate governance used by listed firms in the Chi- nese emerging capital market, and the effect of govern- ance

In order to clarify the executive compensation in Thai listed companies, this section provides basic information about the executive compensation payments, firm performance,

However, recent studies of the listed firms in China do not find convincing evidence that state ownership weakens the negative relationship between firm profitability

In the same vein, Lin and Fu (2017) analysed the effects of institutional ownership on firm performance of listed firms in China and concluded that large