Loyalty, Rewards and Value

What Do We Want from Our Customers?

Insights from a Webcast sponsored by SAS and the Center for Hospitality

Research at Cornell University’s School of Hotel Administration

Originally broadcast in December 2009

Featuring:

michael mccall

, Visiting scholar, cornell university center for

Hospitality research

In a bid to encourage greater sales and return visits, the national café chain instituted a customer loyalty program. For a nominal annual fee, patrons could enjoy discounts at any of the chain’s locations around the country.

Customers loved it; what a great way to save money on their favorite coffee drinks. Company executives, though, were divided into two camps:

(A) “This is great; we now get customer data we wouldn’t otherwise have had.” (B) “This doesn’t bring in new revenues; the only customers willing to pay the

upfront fee are the ones who knew they would recoup that fee – the ones who would have been loyal, long-term customers anyway.”

Loyalty and reward programs are typically designed to achieve four objectives: increase customer spending, improve retention, maintain competitive position and capture new customer data. but do such programs actually achieve those aims? there’s no doubt that today’s programs yield useful customer data, but what about the other objectives? as membership in such programs continues to increase, many firms are left wondering whether their programs buy loyalty and increase customer value, or simply add costs without securing repeat patronage. that was the topic of a December 2009 webcast sponsored by the cornell university center for Hospitality research and sas. In the one-hour, interactive webcast:

• Michael McCall, Visiting scholar at the cornell university center for Hospitality research, presented some intriguing findings from his research on customer loyalty programs and just what they do (or don’t do) for the companies that use them.

• David C. Ogden, Principal analytics consultant at sas, discussed how to measure the impact of customer loyalty programs on customer lifetime value – essential knowledge for any company that hopes to use these programs to build profitability, not just to reel in more customers.

A Long History of Customer Loyalty/Reward Programs

the granddaddy of all reward programs was the original s&H green stamp program. For those too young to remember, s&H green stamps were a form of trading stamps popular in the united states from the 1930s until the late 1980s. customers received stamps at the checkout counter of supermarkets, department stores, gas stations and other retailers. stamp books could be redeemed for products selected from a catalog. During the heyday of the program in the 1960s, the company issued three times as many stamps as the us Postal service, and the printed rewards catalog was the largest publication in the country.

For all its popularity though, the s&H green stamps program didn’t deliver much customer information that could be parlayed into smarter marketing. retailers had a general belief that customers preferred a business that offered green stamps, but they didn’t know who those customers were, how frequently they purchased or anything else about them.

the face of customer loyalty/reward programs changed dramatically when american airlines launched the aadvantage frequent flier program in 1981, mccall said. the first such loyalty program in the world, it remains the largest, with some 57 million members. the most active members – based on amount and price of travel booked – are designated as aadvantage Gold, aadvantage Platinum and aadvantage executive Platinum elite members, with special privileges and rewards at each tier. In 2009, aadvantage members redeemed program miles for $6.9 million in free airline tickets, ticket upgrades, discounted car rentals and hotel stays, merchandise, or other products or services offered through partners.

“Here we have a lot more information about who the customer is, how frequently they were able to fly and so on,” mccall said. “this was the start of the modern-day rewards program.” However, other airlines quickly followed suit, forcing each other to start competing on the basis of their frequent flier benefits.

today, there is a wide array of reward programs in virtually every industry segment. In addition to 77 airlines, almost all of the major hotel chains have loyalty cards that allow guests to earn points (redeemable for discounts, future stays or other prizes), airline miles or both.

these programs are so widespread that consumers now expect that their favored hospitality and gaming companies will offer some sort of loyalty program, mccall said. “this is a cultural change that probably needs to be managed better. If we look at the current state of affairs – everybody has a rewards program – there needs to be more strategic and measurable focus as to where we’re going to take this.”

Designing an Effective Customer Loyalty/Rewards Program

“If we look at it empirically, it’s not clear that companies are necessarily getting positive effects from these loyalty/rewards programs, and there may even be some negative effects” mccall noted. “In some cases, we may be giving away products that we don’t need to give away. some people may not even like the rewards program they belong to. If that happens, they’re still going to do business with you, but you’re not going to get that positive attitude you were hoping for.”

“you know, I have this customer reward program. It is kind of expensive but, I feel like I have to have a program because everyone else has one. Honestly, I don’t know what, if anything, it actually does for me.”

– A Millennium Group Hotel Manager (2009)

■

to reduce customer defection and track their best patrons, many hos-pitality and gaming organizations include a loyalty program as part of their customer relationship man-agement strategy. but how does an organization strike a balance between improving the customer experience and controlling costs?mccall and fellow researchers researched this question – whether customer loyalty/ reward programs actually influence consumers to change their behaviors, and if so, which factors of a program have the greatest influence. the study used focus groups and surveys to measure such elements as consumers’ perceptions of brand equity, cumulative satisfaction, loyalty program quality and share of wallet.

the research showed that customer loyalty/reward programs could have significant effects on the amount a consumer was willing to spend with a business – if the consumer already had a favorable view of the brand and perceived the loyalty program to be a quality offering.

the results of our informal webcast poll seemed to support this finding. audience members were asked if the reward programs to which they personally belong create brand loyalty in them. more than half the audience, 56 percent, said, “yes; I belong to some very high-quality programs that offer excellent rewards.” another 21 percent said, “No, the program just provides discounts on items we probably would have bought anyway.” Very few (only 4 percent) indicated that a rewards program could persuade them to remain loyal to a supplier they didn’t like.

“as perceptions of the quality of loyalty programs improve, the positive effects of brand equity and satisfaction increase,” mccall said. “this is further justification for the need to not only have a loyalty program, but to ensure it is viewed as ‘quality’ by your customer base.”

the perceived quality of a customer loyalty program hinges on a number of factors – represented in a conceptual model developed with clay Voorhees of michigan state university. the model proposes that loyalty program success depends on design attributes in three categories:

• Program tiers. silver, gold, platinum – membership tiers based on the amount and dollar value of the customer’s purchases can be powerful incentives and a good way to reward your best customers with the best rewards. “current research seems to suggest that three tiers is probably a good number,” mccall said, but the latest research suggests a new twist. more on that later.

• Rewards. rewards have to be commensurate with the tier level. “you want to reward the best customers with what they perceive as good value – but not give them more reward than they’re entitled to,” mccall said. “People like to feel that they have earned their rewards. they don’t want something for nothing.”

• Customer factors. the program design needs to fit the customer. “there’s a certain exclusivity that comes along with being a part of a rewards program,” said mccall. “these are the cool Person’s clubs.” People of similar status share certain commonalities and feel a connection, if the program is handled correctly.

Loyalty program design factors

Loyalty program effectiveness

Structure of program tiers Program tiers

Number of tiers

tier transitions

►

Indicators of a well-designed program Increased purchase frequency

Decreased customer price sensitivity customer advocacy

extended relationship lengths Increased share of wallet

Development of consumer community and connectedness

stronger company performance Structure of Rewards reward type reward magnitude reward frequency reward framing

►

Customer Factors customer‐program fitrole of the customer

►

McCall and Voorhees (2010), Cornell Hospitality Quarterly

another cornell study delves deeper into the influence of loyalty/rewards programs over time. this research looks at eight years of transactional data – 1.2 million transactions – from 100,000 loyalty program members in the lodging industry. How do people behave in a loyalty program over a long period of time? Do things change as they move through tiers? Does their spending accelerate or decelerate? How do these trends align with customer demographics?

mining this rich data resource, the team found that loyalty program members could be grouped into eight segments. For five of these segments – 75 percent of the survey population – membership in the loyalty program had no effect on either spending or loyalty.

“customers in two other segments appeared to increase spending based on the loyalty program,” said mccall. Of greatest note was the finding that “one highly valuable segment accounted for the majority of the spending, but those customers were grouped with other ‘lesser’ consumers in the top tier of the program.

“these results suggest a need for an ultra-premium category that is reserved for a very small minority,” mccall said. “In casino terms, you might call them the ‘high-rolling’ group. these people probably have very different needs and expectations from a loyalty program. this is a group we want to pay very close attention to, if our intention is really to give our best customers the best rewards.”

Determining Which Customers Are Valuable

Does your customer loyalty program achieve what you hope it will: to encourage more business from the customers who bring you the best value? and just who are these high-value customers? Frequency of purchases is not necessarily a good indicator of high-value, if transaction value is low. High purchase volume is not a good indicator, if the customer is costly to serve. the span of a customer’s past history with you is no guarantee they will return in the future.

“a lot of companies are collecting data they wouldn’t get without having a loyalty program in place, and they’re using it to do analysis that they couldn’t do otherwise,” said Ogden of sas. “but oftentimes they are not measuring the economic value that is being generated. Do they really know whether the loyalty program is increasing margins and retention? can they empirically quantify the effects of the program on these things?” In determining economic value, revenue is only part of the picture; profitability is certainly more important. but there can even be risks to basing decisions on a customer’s current profitability. external events and life milestones will materially affect a customer’s needs, behaviors and profitability over time. acting on a present-day view of profitability, a company could misjudge customers with current low profits as having low future potential.

to consider the future profit potential of customers, you would calculate customer lifetime value (cLV) – a measure of a customer (or segment) as a long-term investment. customer lifetime value can be defined as the net present value of the likely future profits from an individual customer – a measure of true value spanning the past, present and future.

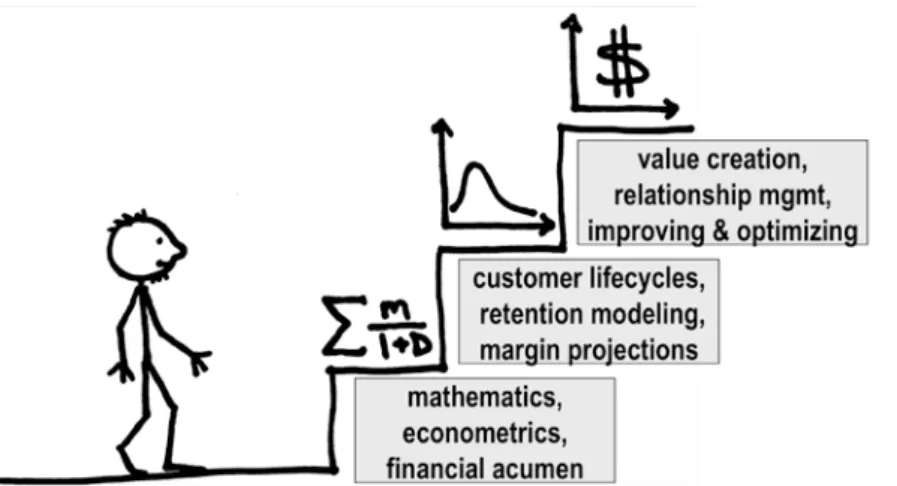

“the basic concept is fairly straightforward,” Ogden said. “customer lifetime value is a sum of the profits you get from a customer over the lifetime of the relationship with that customer. there’s some math that involves discounting to present value, but the basic concept is fairly straightforward. calculate customer-level profitability, project that into the future, adjust for retention probability, discount to net present value – and sum it up.”

Figure 1. Customer lifetime value – visualizing the math.

■

a loyalty program is a suboptimal investment if it stimulates more low-value business or underlow-values your highest-value customers. but do you really know which are which, based on a 360-degree view of their relationships with you?■

customer lifetime value can be defined as the net present value of the likely future profits from an individual customer – a forward-looking view of value creation.“that’s an oversimplification of the process,” Ogden conceded. “when you actually start to implement the methodology to project what is going to happen in an unknown future, it leads you down the path to some fairly complicated analytical techniques, such as predictive modeling and forecasting.”

a hospitality or gaming company can choose to have its cLV calculations be as simple or as complex as it wishes – restricted only by imagination, realism and processing capacity. “there is no one single way to calculate future value,” Ogden said. “there are differing perspectives on the specifics of how various elements are formulated and represented, and on the mathematics you can use.”

at its simplest level, the cLV calculation assumes that people are creatures of habit; you can extrapolate from past trends to predict future trends. by looking at other customers with similar demographics and patterns, you can make assumptions about this customer. by using discounted cash flow (DcF) investment evaluation math over multiple periods, you can show anticipated future profits in present-day dollars.

the process gets trickier when you want to consider factors other than what happened in the past – and weigh the probabilities of certain future occurrences that may or may not happen. based on what you do know about the customer – such as age, occupation, geographic location, income, education and credit history – you can make reasonable assumptions about what you do not know – such as how likely a customer is to visit your property again, and the products and services they are likely to purchase at various stages in the relationship.

“whenever you’re predicting the future, obviously you can’t do it perfectly,” Ogden said. “cLV calculations are sensitive to many moving parts. If you have inaccurately calculated your historic margins, you’re going to inaccurately project your future margins. If you are developing a retention model, you could have a good model or a bad model. when you put it all together with the mathematics, I’ve seen formulas out there that are just plain inappropriate for how they’re being used, so you can even fall apart on the math.” Don’t let those risks deter you, Ogden emphasized. “Just because there’s some possibility of being inaccurate doesn’t mean you can’t reap some incremental value by going down the path. as long as you are directionally correct, you’re going to add some value and make a better decision than you would have just by guessing.”

Customer Lifetime Value and the Customer Loyalty Program

Getting back to our coffee shop example … is the customer rewards program

delivering true economic returns, or is it just delivering more customer data? Is it costing more than it should, by offering discounts to customers who would have bought the coffee anyway?

Intuitively, the answers wouldn’t be clear. Our webcast poll suggests that a large number of people who use loyalty programs would have been loyal anyway. but maybe getting all that new customer data is worth the cost of the rewards being given out. who knows? customer lifetime value takes the guesswork out of these questions. cLV calculations show you which customers are most likely to offer the highest value over the long term, which in turn identifies the core attributes you should consider as you design and assess a loyalty program – and enables you to assess the performance of the program over time.

“cLV methodology will provide some better measurement of the value that your loyalty program is generating,” Ogden said. “you need to ask, ‘am I generating more cash flow as a result of this or not?’ If the answer is no, the next step is to ask, ‘How I can change the program to achieve my objectives, whether directly or indirectly?’ that should be the end game. you can fall back on the claim that ‘I’m getting more data.’ well, then you need to be using the data to generate more future cash flow. Otherwise your loyalty program isn’t accomplishing what it needs to do.”

■

“ ultimately you want to figure out how to design and optimize the customer loyalty program to gen-erate economic value – not in an ambiguous sense of the word, but a defensible dollar figure that mea-sures true returns on investments, a figure that you can confidently put into a business case.”David Ogden Principal Analytics Consultant, SAS

Closing Thoughts

with loyalty programs emerging as a must-have in hospitality and gaming, organizations need to make sure their programs actually create brand loyalty and not just program

loyalty. they need to carefully manage the various aspects of program design to create a perception of high quality. and they need to measure both the present and potential results through the lens of customer lifetime value.

Our presenters provided some takeaway recommendations for companies setting out to design or revamp a customer loyalty program:

• Avoid creating price sensitivity among customers. “If you offered me a $100 discount, I’ll probably take that cash back, but now you have gotten me focused on price and not necessarily the experience of your business or your property,” mccall cautioned. beware of the possibility of actually turning loyal customers into price-sensitive customers, who are then more likely to defect for a lower-priced offer.

• Think carefully about tier program management. “rewards are easy to give, hard to take away,” mccall said. “Once you’ve earned platinum status, being demoted to silver or tinfoil is not something you’re going to particularly appreciate.”

• Think carefully about what the customer values. “they might take that discount, but they might be just as happy with something else that makes them feel special or privileged,” mccall said. “customer engagement – perception of value, connection and community – is what you should be appealing to.”

• Quantify program performance. a customer lifetime value calculation identifies your most valuable customers, so you can optimize the program to maximize not just for brand loyalty and retention, but for enduring economic value in real dollar terms.

It has been nearly 30 years since american airlines rolled out its aadvantage program. “we were one step away from Dec writers back then,” mccall quipped. “with the amount of statistical and methodological sophistication we have now, we can completely rethink how we design and manage loyalty programs. at a recent conference, I heard Jim Davis, senior Vice President and chief marketing Officer at sas, make the statement that ‘we are no longer talking about best practices; we’re looking at next practices.’ that’s really the direction and focus we need to have.”

For More Information

Find research, publications reports, news archives and more from the cornell university center for Hospitality research at www.hotelschool.cornell.edu/research/chr. For more about analytics for the hospitality and gaming industry, visit sas on the web at

www.sas.com/industry/hospitality.

Download sas white papers about customer lifetime value from

www.sas.com/whitepapers.

This Webcast was the third in a seven-part series, “Insights and Innovations for Hospitality and Gaming,” sponsored by The Center for Hospitality Research at Cornell University’s School of Hotel Administration and SAS. Each Webcast highlights a hot topic in the hospitality and gaming industry, including data quality, labor planning, customer loyalty, sustainability and more.