Exchange rate exposure, foreign currency derivatives and the introduction of the euro : French evidence

Full text

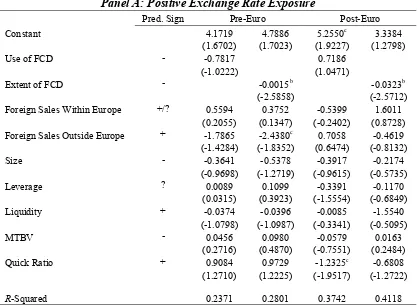

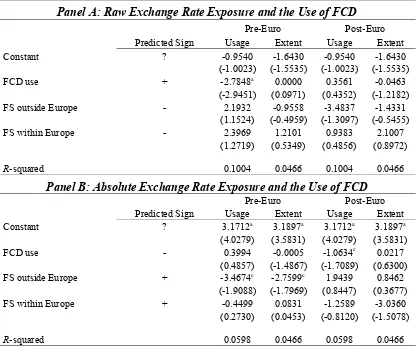

Figure

Related documents

Using the sample of all S&P 500 non¯nancial ¯rms for 1993, we ¯nd that a ¯rm's exchange-rate exposure is positively related to its ratio of foreign sales to total sales,

Even though the insignificant results between foreign currency derivatives use and Tobin’s Q are negative indicating that foreign currency derivatives use is

We investigate the modeling and numerical valuation of cross-currency interest rate derivatives with strong emphasis on long-dated foreign exchange (FX) interest rate hybrids,

When a firm encounters a positive economic exposure, the “use of home currency debt with currency swaps dominates both foreign currency debt financing and

When the inflow of short-term foreign capital stops , the central bank has to sell foreign exchange reserves to support the domestic currency and maintain the

We investigate the modeling and numerical valuation of cross-currency interest rate derivatives with strong empha- sis on long-dated foreign exchange (FX) interest rate hybrids,

Foreign currency loans, securities.. Deutsche Bundesbank event.pdf III. Contingent short-term net drains on *) °). foreign currency assets

This chapter defines the meaning of foreign exchange and related terms, how foreign exchange rate is determined, study of foreign exchange rate regimes (fixed and flexible