Taxation and bond market investment strategies: Evidence from the market for Government of Canada bonds

Full text

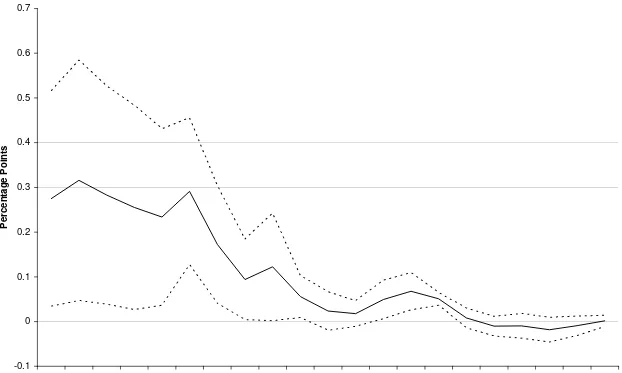

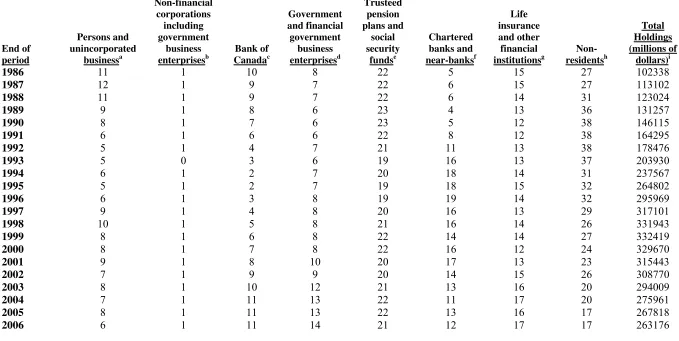

Figure

Related documents

The fact that agricultural land fragmentation occurring at the fringes of Adelaide can be identified and characterized using gradient analysis and landscape metrics (regardless of

As an international financial centre, the country/region should be in an important position in the global financial market, with multinational financial institutions willing

In order to raise national literacy levels, national standards were created with the goal of increased, and more rigorous, deeper cognitive goals for students (Schweingruber,

Proposition 4: If a MNC dominated by the individualistic identity orientation acquires a social enterprise dominated by the collectivistic identity orientation, high

In this paper the authors try to present the development and changes in the theories and practice of Human Resource Management in most of the countries established on the territory

Intuitively, we know that an increase in the private good production decreases the price and that a higher investment level in the public good increases the price.. Hence, it depends

For example, if your library enjoys strong support among senior citizens, they may be a primary audience for a ballot initiative on funding.. Teachers and parents are vital to

Analyze all of the production data across various functions, operations and systems to update underwriting criteria, rates, riders and policy language. These failures in the