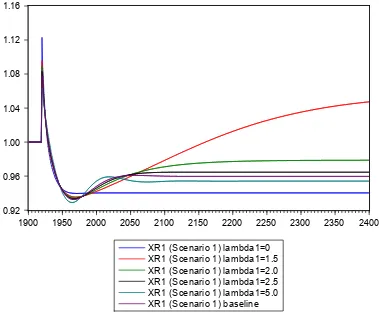

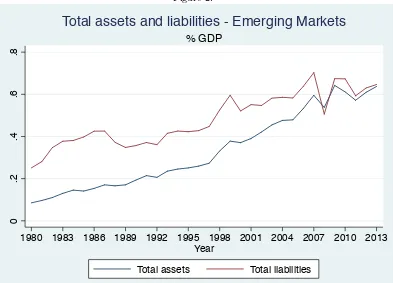

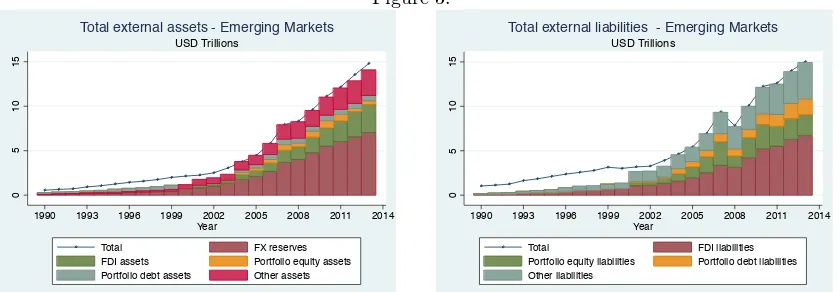

Institutional investors and emerging markets with intermediate exchange rate regimes: A stock flow consistent model

Full text

Figure

Related documents

Notwithstanding Section 191.13 of the Huber Heights Code of Ordinances, or any other provision requiring the payment of penalties and interest, the City Tax Administrator is

You may also wish to put a bullet pointed list of key study areas such as programming, presentation skills and the use of engineering software.. Work /

Identify common causes of sodium, potassium, and phosphorus derangements in hospitalized adult patients on parenteral nutrition.. Calculate sodium concentrations in

Q.37 The system shown in the figure consists of block A of mass 5 kg connected to a spring through a massless rope passing over pulley B of radius r and mass 20 kg.. Q.38 In

Our firm’s seasoned investment team follows proven, disciplined investment processes to manage fixed income, equity, and cash assets.. Our unique investment approach looks

A Novel AES benchmark design is proposed for the classes of DoS, Leakage Current and Dynamic Power based Trojan designs so that they bypasses all standard

FSA2140 Eléments de droit industriel[22.5h] (2 credits) (in French) Gilbert Demez FSA2300 Religious Science Questions[15h] (2 credits) (in French) Bernard Van Meenen