DBS in the Multiple-Dwelling Unit (MDU) Market

1 Goal

Looking beyond rural and suburban households, Direct Broadcast Service (DBS)

providers are in a race to capture subscribers living in Multiple Dwelling Units (MDUs). MDUs include apartment buildings, townhomes, and condominiums (anything greater than two units). Previously considered a niche market, MDUs have become the hot topic in the television programming industry. DBS providers are focusing time, money, and attention in this area because it is considered an untapped market with potential for enormous revenue [8]. The goal of this paper is to show that DBS in the MDU market will be a successful venture. To accomplish this, our paper will (1) introduce you to the technology currently available, (2) use the SWOT (Strengths, Weaknesses, Opportunities and Threats) Analysis Tool to prove there is opportunity for success, (3) through

economic analysis, identify the size of the MDU market and show the subsequent

revenue gains that DBS providers could realize by focusing in this area, (4) identify what marketing strategies DBS providers are using to tap into this market, and (5) outline current policy and regulation and explain how it will help or hinder the success of DBS providers.

service is available to them and figure they couldn’t purchase and install their own dish on the landlords roof. On the other hand, the MDU owner doesn’t know that it could enhance the value of their property, and at the same time, offer residents an alternative choice for television programming. Moreover, the MDU owner could actually profit from it! The DBS provider, by capturing the sale of satellite service to one MDU owner can realize programming fees from multiple residents. For all the reasons above, DBS in the MDU market becomes a relevant topic to explore.

3 The Analysis

3.1 Current TechnologyThe reception of DBS in apartments, townhomes, and condominiums presents a technical challenge concerning how they distribute the signals among multiple DBS receivers. In a standard DBS installation (one-family home), the signal distribution to more than one TV is possible, but both TVs must view the same channel from the receiver [1]. In order to view a different channel, an additional DBS receiver must be used. The dish itself must have a dual LNB (Low Noise Blockdown-Amplifier) to supply signal to the second receiver. The technology needed to make this work in a MDU (i.e. allowing 3 or more TVs to receive DBS signals) includes DBS Signal Distribution and a Multi-Switch solution [2].

DBS Signal Distribution

In order to understand the technology, it is important to cover some basics of signal distribution in a DBS satellite system. The receiving satellite dish receives distant signals from a satellite in geosynchronous orbit high above the Earth. By the time these signals arrive at the dish they are weak; approximately -55 dBm signal strength [3]. The

DBS dish acts as a collector of the signals, and in the process focuses and reflects the signal into the LNB. The LNB converts the high frequency signal, 11.7 – 12.2 GHz (GigaHertz) signal down to 950 – 1450 MHz ( MegaHertz) so it can travel on standard size RG-6 coax cable. Without this down-conversion the signal loss on the medium (coax-cable) would be too great to be useful. The coax travels between 100-150 feet to terminate into the DBS receiver. Even at this lower frequency, the line loss is 6dB per 100 feet at 1 GHz [2]. Average useable signal strength at the receiver is between – 55 and -35 dBm [4].

Because of the very low signal levels that satellites transmit, they incorporate a signal transmission technique called “polarization” in order to limit the interference between adjacent frequencies. To receive these signals, the LNB must be polarized one way to receive even number frequencies and the other way to receive odd numbered frequencies. To switch between channels, the LNB must change its polarization. This is accomplished by using voltages generated by the DBS receiver. The receiver supplies 14 volts on the line to select right-hand circular polarization (RHCP) and 18 volts to select left-hand circular polarization (LHCP). With dual LNBs, two receivers can be used to receive different channels at the same time allowing viewers to watch different programming on each TV utilizing the same dish [3]. This works well for 2 receivers, but would be impractical for use in an apartment complex of 100 units. Even if each unit required only 1 DBS receiver, 50 dual LNB dishes would be required. Talk about dish-clutter!

The Multi-Switch solution

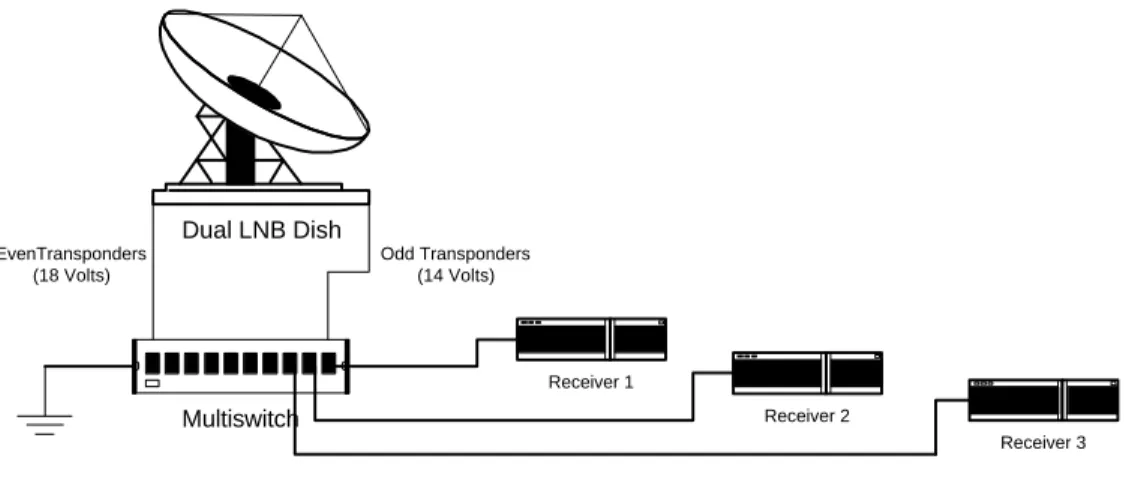

A Multi-Switch (often called a Magic-Switch or Voltage-Switch) enables up to 8 receivers to connect to 1 dual LNB dish and provides the viewers with channels on both the odd and even frequencies. The way the Multi-Switch accomplishes this is

straightforward. Instead of using voltages from the receiver to change the polarization of the LNB, the Multi-Switch sends a constant 14 volts to one LNB and a constant 18 volts to the second LNB. One LNB receives the even numbered channels and that the second LNB receives all the odd numbered channels. The Multi- Switch monitors each of the lines feeding the satellite signal to the receivers to sense whether the receiver at the end is sending 14 or 18 volts (i.e. tuned to an odd or even channel). The Multi-Switch then connects the receiver to the respective odd or even polarized LNB. If the viewer changes channels, the receiver sends the corresponding new voltage up the line to the Multi-Switch. The Multi-Switch interprets the change and disconnects that receiver from one LNB and reconnects it to the appropriate corresponding polarized LNB. (Figure 1)

Figure 1. Multi-Switch Architecture

Dual LNB Dish Multiswitch Odd Transponders (14 Volts) EvenTransponders (18 Volts) Receiver 1 Receiver 2 Receiver 3

MDU configurations consist of many cascading Multi-Switches daisy-chained together to provide multiple coaxial outputs, which can be wired to individual

apartments, condos or townhomes [3].

In order to receive local programming (i.e. VHF/UHF or off-air signals from local radio and TV stations) additional components are required known as Diplexors. Diplexors are used to combine the VHF/UHF signals (from an off air antenna) with the DBS signals, onto a common coax. The Diplexor then splits the signals off onto separate outputs [5]. In a common installation, two Diplexors are required for each line from the Multi-Switch to the viewer's DBS receiver. One is used at the Multi-Switch to combine the VHF/UHF signal with the DBS signal and one is used to split the signals at the DBS receiver. This enables an MDU installation to utilize existing building cable-plant wiring with minor modifications and/or additions [6].

In summary, even though the technology exists, some type of overall analysis is needed to determine whether this will succeed or fail in the marketplace. There are many different comparative analysis tools that can be used. The SWOT analysis was used for this paper.

3.2 The SWOT Analysis

When trying to predict success in an emerging market, the SWOT Analysis tool is the best place to start. A company must scrutinize their internal market structure to identify strengths and weaknesses, and then look to the external environment for competitive opportunities and threats.

STRENGTHS

• Unrealized Market Share - The most important strength that DBS has is the unrealized/untapped MDU market. DBS providers have tapped into commercial markets similar to MDU’s, such as hospitals, schools, etc., but as of today, the MDU residence market is still wide open [8]. Add to this the fact that DBS electronics are considered the best selling consumer electronics of all time, and you have the potential for success [29].

• A Complement to Existing Cable Service - DBS can be installed as a complement to the apartments existing service. The DBS system may be installed without obligation to each apartment renter [11] and in most cases, only those who choose to receive satellite programming will pay. All other residents remain unaffected and continue with their existing television provider.

• One-to-Many Advantage for DBS Provider - Right now, retail plays a crucial part in DBS distribution because consumers still feel the need to go into a store to check out a DBS system before they buy one [18]. The DBS provider gains an advantage because they only need capture the attention of the building owner and they get potentially many more subscribers. Also, the 1-to-many architecture is a more aesthetic solution for apartment communities helping to avoid "dish-clutter"[9].

• $$$ Incentive for MDU Owner - Apartment owners can retain ownership of the IRD box and rent to the tenants. This could be an incentive for the landlord to sell the DBS service [17]. There are also a growing number of MDU building owners who are using DBS to differentiate their properties in the competitive apartment rental marketplace.

• Cultural/Sociological Advantage for MDU Complexes - MDU, once installed in metropolitan/suburban complexes, can target cultural audiences with distinct foreign language programming. Hispanics today form the fastest-growing ethnic minority in the U.S. numbering ~ 27.5 million. America’s Latino shoppers spend $280 billion annually, presenting corporations an opportunity for new profits and market share. These corporations will seek to advertise and buy programming from DBS providers that will result in better viewing for the resident [13].

• Renter Does Not Incur Cost of Satellite Dish - The apartment renter does not have to incur the cost of the satellite “dish”. Most providers will lease the set top box and charge for monthly programming [21,22].

WEAKNESSES

• DBS Providers Must Form Alliances - DBS providers must develop and establish nationwide networks of Multiple System Operators (or MSO’s) to construct the MDU DBS infrastructure and to facilitate the sale, installation and maintenance of DBS systems [10,11,12]. If the DBS providers are not on top of MSO partnerships, they could lose significant metropolitan markets. The DBS provider will only be as good as the alliance they form [18]. Also, building these alliances is time consuming because of the effort it takes to form partnerships in many different areas. The Vice president for DirecTV stated “building the MDU market has been a expensive and time-consuming process” [26].

interviewees, DBS will have to be more flexible with their contracts in order to make this work. What works for one complex may not work for another [14].

• Renter may be at a Disadvantage - The renter could incur the imbedded cost of the satellite system in their rent, penalties for withdrawing from the service, and a higher increase in rent due to an increase in programming cost.

• Additional Costs to MDU Owner - One obstacle is to convince an apartment owner or builder to invest in the additional cost to install the required equipment. Looking at equipment cost (including the receiver per unit) the additional cost over a traditional cable TV installation is between $150 and $250 per unit [2].

COMPETITIVE OPPORTUNITIES

• Cable Rate Increases Are Driving People Toward DBS - The best card that DBS has to play is the known discontent of Cable TV monopolies. In some areas, cable’s most popular services rose more than 20% [27]. This will serve to drive MDU owners to look at DBS.

• Gives Residents an Alternative - A competitive opportunity for a DBS provider is the selling point of giving an apartment renter a choice. They will have an

alternative to cable that offers more choice and relief from rising cable costs.

• Multi-Use Promotes Competition - In the arena of competition, this is probably the most beneficial for the end-consumer. If the apartment has both cable and DBS, competition between DBS and CATV will lower prices for the consumer. COMPETITIVE THREATS

• Tough Competition for MDU Contracts

-

There is heated competition for MDU contracts, and there is a high market value for these contracts. In cases that wefound, the selling price MSO’s charge when they sell their subscribers was ~$1000 [7,28]. Even with this price, DBS providers will be jockeying for these contracts over the entire U.S.

• Exclusive Contracts “Lock-In” One DBS Provider

-

Exclusive contracts between DBS providers and MDU owners “lock-in” one provider preventing owners from switching. These exclusive contracts may motivate MDU owners to make decisions based on factors other than their tenant’s interest. Many exclusive contracts include monetaryawards to the MDU owner. Thus, an MDU owner is more likelyto base choice of provider and programming on compensation received, not on what is best or less costly for the tenant [14].• CATV is Embedded Provider in the Market - Cable TV enjoys nearly all the penetration of the MDU market. They can also keep hold of the MDU owner by increasing the already offered bulk discounts that they provide, and by convincing the building owner that there may be “dish clutter” on their roof.

Based on the above information, the provisioning of DBS in the MDU market deserves further investigation through economic and marketing analysis.

3.3 Economic Analysis

First, we will look at the size of this market. As of the latest data (Revised April 28 1998) from the U.S. Census Bureau there are ~30,000,000 MDU households. This accounts for 27.4% of total households, which is up from 15.3% in the 1980s [15]. US Department of

However, the penetration that DBS providers have gained is dismal considering the size of this market. For example, DIRECTTV/USSB, the largest provider with

~4,000,000 subscribers, only anticipates 100,000 MDU subscriptions by the end of 1998. A mere 2.5% of their market! [17,18] Therefore, the DBS providers stand to gain a large increase in revenue by increasing their presence in this business.

Looking at the sales figures for the three leading companies and the number of subscribers, the average annual revenue per subscriber is ~ $460. Using the numbers from the Census Bureau and the dollars per subscriber, the MDU market is an untapped gold mine worth an estimated $13.8 billion [17,19,20]. To capture this revenue, some innovative marketing techniques are being used.

3.4 Marketing Strategies

In order to build the customer base, it is imperative that the DBS provider's develop and establish nationwide networks of MSOs. They can then focus on providing alternative purchasing packages to the MDU owner. Some of the options we found include [21,22]: 1. (TENANT) PURCHASE OPTION: Each tenant choosing to subscribe to direct

broadcast services can purchase standalone receivers. The building is common wired though one central dish, with the use of Multi-Switches and Diplexors. The residents contact the DBS provider to establish service.

2. (COMPLEX) RENTAL OPTION: The complex can also put a receiver in each apartment, retaining ownership of the equipment and renting them (~$5 per month) [23] to the tenant. The tenant still initiates service through the DBS provider. Some of the MSO providers will install the equipment and wiring at no cost, and provide the owners and managers free service. The MSO providers take all the revenue.

3. TRANPORT OPTION: The complex can build a headend and provide the same programming throughout the building to all tenants. The complex would buy the programming from an authorized provider. If the owner/manager shares some of the cost, the providers will install the equipment and wiring, provide maintenance, and give the owner/manager a commission on programming.

Having done the SWOT, economic, and marketing analysis, the last area to consider is current policy/regulation and how it can help or hinder the success of the DBS providers.

3.4 Policy and Regulations

The FCC has recently taken steps to eliminate obstacles for competition in the MDU market. These steps include the adoption and enforcement of rules prohibiting

governmental and private restrictions, and establishing procedures to use internal wiring installed in an MDU building by the incumbent provider.

Prohibiting Governmental and Private Restrictions

Pursuant to Section 207 of the 1996 Act, the Commission has issued regulations to prohibit restrictions that impair a viewer's ability to receive video programming services through devices designed for over-the-air reception of television broadcast signals, MMDS, or DBS services [24]. This action gives more control and choice to consumers to select alternative sources of video programming without regard to certain restrictions imposed by local governments or community associations.

multipoint distribution services. The Commission sought comment in a pending Further Notice of Proposed Rulemaking on how to treat the placement of antennas on property in which the viewer does not have an ownership interest and exclusive use or control -- e.g., rental apartments and MDU common areas.

Inside Wiring

In the past, alternative service providers had difficulty competing with cable to serve the MDUs for two reasons. First, the owners did not want additional wires running throughout the hallways and second, they wanted the new provider to use the existing wiring. This resistance to multiple sets of wires denied MDU residents the ability to choose among competing service providers.

In October 1997, the Commission adopted inside wiring rules designed to promote competition for and within MDUs that provides certainty for alternative video

programming providers and the MDU owners. The Commission established procedures that would provide a timely and reliable way for an alternative video provider to

determine whether and how it will be able to use the existing inside wiring upon a change in service. These procedures cover the situations where the MDU owner wants to switch its entire building to an alternative service provider or wants to permit an alternative provider onto the premises to compete for the right to use inside wiring on a unit by unit basis.

Where the MDU owner chooses to switch the entire building to a different service provider, the owner must give the current operator a 90-day notice. The operator would have 30 days in which they may elect to: (1) remove the wiring and "restore the MDU to its prior condition" by the end of the original 90-day period, (2) abandon the wiring

without disabling it, or (3) sell the common wiring to the MDU owner, or if the owner chooses, to the alternative provider [25].

The Commission also proposes that the parties negotiate a "reasonable" price for common area wiring. If the parties fail to reach a negotiated price within 30 days from the operator's election, the incumbent must elect either to abandon or remove the wiring, and notify the MDU owner if and when it intends to terminate service before the end of the original 90-day period. The operator would have to remove the wiring and restore the MDU, if that is its election, by the end of the 90-day period, or it would be deemed abandoned.

4 Conclusion

In conclusion, DBS in the MDU market is a successful venture for several reasons. First, state of the art equipment has been developed to provide satellite programming to any number of residents with a single, small dish and a supporting distribution network. Second, there exists an untapped market of competition waiting for someone to pursue. Whether it is DBS, Wireless Cable, or some other telecommunications provider, someone is going to try and compete with the Cable Company for a piece of their revenue. And finally, Section 207 of the Telecommunications Act of 1996 started the process to ensure universal access to satellite programming and most importantly, the Telecommunications Act is helping to generate competition in the cable industry.

MDU market. Moreover, the cable companies are gearing up to offer additional services to the MDUs (i.e. cable modem, telephony, etc.). These, along with the bulk rate

discounts the cable companies already provide, create obstacles to the DBS provider, but nothing too great to overcome.

Also, it should be noted that a reason DBS is not “big” in the MDU market right now is that it has taken time to develop the MSO network infrastructure needed to penetrate the market. Now that DBS has its foot in the door, only time will tell how much revenue they could grab from the stronghold of cable TV.

Given more time, other areas that deserve further investigation are:

• NPV analysis taking into consideration economies of scale or pay off point.

• Other types of competition and penetration to the MDUs (i.e. Wireless, copper, etc,).

• DBS's ability to address future needs, such as increasing bandwidth requirements, satellite-delivered Internet with faster downloads, and new pay-per-view services.

References

1. Thompson Technical Training: DSS System Installation Training Manual, Thompson Consumer Electronics Inc., 1994.

2. Shawn McKane, DSS MDU Designer/Architect for Warren Companies, Private Interview, October 5, 1998.

3. Tech Talk Volume 1 Issue 6, http://www.dbsdish.com/reviews/tech1_6.html, July 15, 1998.

4. “Design Guidelines For Large Satellite IF Distribution Systems,” http://www.dssdirectv.com/guide.htm, September 20, 1998. 5. Satellite Warehouse. http://www.dssdirectv.com, October 5, 1998. 6. Phoenix TeleTronics, Inc. http://www.phoenix.tti.com, October 5, 1998. 7. “DirecTV, Inc. Launches Program To Serve Multiple-Family Dwelling Unit

8. Alan Breznick “DBS Players Board: This is our Moment,” Cable World, September 11, 1998.

9. “Be the First on Your Block to Offer DirecTV Programming,” http://www.directv.com/news, September 16, 1998.

10. “DirecTV, Inc. Signs Agreement with American Telecasting, Inc.,” http://www.directv.com/news, September 15, 1998.

11. Alan Breznick, “A DBS Shakeup,” Cable World, September 16, 1998.

12. “SkyView To Support MDU Network Sales Growth,” http://www.directiv.com/news, September 16, 1998.

13. “Portrait of Ethnic Diversity” and “Viewpoints,” presented at Seminar on Cultural Diversity, Lisle, Illinois. October 2, 1998.

14. Jan Strobel (Satellite Showcases, Inc.) Personal Interview, June 23, 1998. 15. Bob Bonnette, “Units in Structure,” U.S. Census Bureau, Census of Housing,

October 7, 1998.

16. “Characteristics of Apartments Completed: 1996,” U.S. Department of Housing and Urban Development, H131/96-A, July 1997.

17. DBS Digest, http://www.dbsdish.com, October 6, 1998.

18. “Norsat Subsidiary Diamond Pacific, Inc., Successfully Achieves Initial Targets in the U.S. MDU Market,” http://www.SkyREPORT.COM, October 09, 1998.

19. Company profiles: DirecTV, Echostar, Primestar, http://www.hover.com, September 25, 1998.

20. Sky Report, http://www.skyreport.com/dth-US.htm, September 25, 1998. 21. “Multiple Dwelling Unit, Echostar,”

http://www.dishnetwork.com/commercial/multihtml, October 06, 1998.

22. “Generation Next,” http://www.crols.com/gennext/satellite.html, October 12, 1998. 23. Monica Hogan, “DirecTV, Heartland Sign Landmark Deal,” Multichannel News,

April 20, 1998.

24. “ Cable Services Action – Commission Adopts Fourth Annual Report on Competition in Video Markets,” http://www.fcc.gov, October 18, 1998.

25. "FCC Proposes New Rules Giving MDU Owners More Control Of Cable Inside Wiring," http://www.crblaw.com/inside.htm, October 16, 1998.

26. Monica Hogan, “DirecTV Sets New Plan for MDU Business,” Multichannel News, January 19, 1998.

27. PR Newswire. “Cleveland-Based Popvision and DirecTV Team Up Against Cable,” http://www.bix.yahoo.com, June 21, 1998.

28. Kent Gibbons, “MSO’s Scramble in Face of MDU Clash,” Multichannel News, February 23, 1998.

29. “There’s a New Way to Brighten Up Your Building,” http://www.skyzone.com/1dishinfo, September 10, 1998.