Time to Plan, Time to Act

Achieving High Performance by Reforming

the Australian OTC Derivatives Market

Contents

Time to Plan, Time to Act

Achieving High Performance by Reforming

the Australian OTC Derivatives Market

Executive Summary

3

Backround 4

Analysis 6

Recommendations 10

The global financial

crisis of 2008 drew

considerable attention

to OTC derivatives and

sparked reforms around

the world. As a member

of the G20 group of

countries, Australia has

committed to the OTC

derivatives reform

agenda set out by G20

leaders in September

2009.

At a minimum, we can expect Australian dollar-denominated interest rate derivatives traded between Australian-based counterparties to be subject to mandatory, domestic central clearing. The implementation details and timeline for these changes remain uncertain, but Australian banks must be able to respond quickly once central clearing is mandated. Organisations that take steps now to prepare will be well positioned to invest when the regulatory fog clears.

Global capital markets

reforms

The global financial crisis of 2008 drew considerable attention to OTC derivatives and sparked reforms around the world. Valued at over US$600 trillion, the global OTC derivatives market is criticised for being overly complex and insufficiently transparent—and was widely blamed for build-up of excessive exposure and operational inefficiency during the crisis. On July 21, 2010, US President Barack Obama signed the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank) into law. Meanwhile, Europe is pursuing the European Market Infrastructure Regulation (EMIR) and other, broader initiatives such as Basel III. Reforms in both the United States and Europe will have deep and far-reaching implications for global capital markets and the business models of market participants.

As a member of the G20 group of countries, Australia has committed to the OTC derivatives reform agenda set out by G20 leaders in September 2009. Specifically:

“All standardised OTC derivative contracts should be traded on exchanges or electronic trading platforms, where appropriate, and cleared through central counterparties by end-2012 at the latest. OTC derivative contracts should be reported to trade repositories. Non-centrally cleared contracts should be subject to higher capital requirements.”1

In March 2011, the major market participants committed to supporting reform via a strategic roadmap presented to the OTC Derivatives Supervisors Group.2

Reform efforts have been plagued by delays. In the United States, the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC) postponed the deadline for Dodd-Frank implementation from

July 15, 2011 to the end of the year. Similarly, the European Parliament has delayed finalisation of the EMIR. Despite the uncertainty, a number of banks—Goldman Sachs, Barclays Capital and Deutsche Bank, for example—have already built or are in the process of building strategic clearing services for OTC derivatives.3 Meanwhile, Asia Pacific

G20 members such as Japan, China, India and South Korea have announced initiatives to create domestic CCPs.4

Objectives of OTC derivatives

reform

OTC derivatives reform aims to reduce counterparty risk and increase transparency. Figure 1 summarises key changes and their implications for the market and its participants.

A key pillar of the reforms is the introduction of mandatory clearing through a central counterparty (CCP) for certain classes of OTC derivatives. Until now, OTC derivatives trading in Australia has been conducted bilaterally, between clients and executing banks. Figure 2 describes how that process will change. As a first step in ensuring Australia meets its G20 commitment, the Australian Council of Financial Regulators (the Council) recently issued a discussion paper considering the question of central clearing of OTC derivatives in the domestic market.5 Unlike the United

States and Europe, Australia does not have a history of sell-side central clearing. Local clearing of listed derivatives is currently conducted by ASX Clear.

Client Executing Bank

Clearing Bank

Clearing House

Key:

Client-side trade leg Executing Bank trade leg New trade legs

In certain cases, a single bank will fulfil the executing and clearing roles. In other cases, new trade legs will be required between:

• Client and clearing bank. • Executing bank and clearing bank. All trades will be cleared by the clearing house.

Figure 2: How central clearing of OTC derivatives will work Figure 1: Overview of global OTC derivatives reform

Regulation

Description

Implication

Central Clearing • Financial companies to clear swaps centrally, with existing swaps to be grandfathered • Exception: non-financial companies

(end users)

• Liquidity demand of high initial margin • Daily variance margin

• Cash form of margin

Exchange Trading • All standardised swaps to be exchange-traded, where an exchange or swap-execution facility exists

• Exception: non-financial companies (end users)

• Inability to customise (important for hedging) • Standardisation of swaps

• Higher volume

Capital Requirements • Conservative requirements for dealers and major participants on cleared swaps • Higher capital requirements for dealers on

OTC positions

• Higher trading costs

• Greater focus on efficient capital allocation

Margin Requirements • Stringent initial margin requirements with clearing houses; further daily variance margins • Minimum margin requirements under debate

for OTCs

• Shrinking spreads (per-trade profit) • Daily margin calls

• Higher OTC trade costs

Post-Trade Reporting • Real-time price and volume reporting (T+1 for OTCs)

• Existing swaps also to be reported

• Price transparency • Standardisation of swaps • Reporting infrastructure

Analysis

Top considerations for

Australian regulators

As the Council develops its policy response and implementation plan, a number of considerations are top of mind:

Financial stability

The failure of any large Australian financial institution would ripple through the banking system and have repercussions for the entire economy. We were reminded how interconnected global markets really are in May 2011, when Moody’s downgraded credit ratings for Australia’s four largest banks due to concerns over their dependence on offshore funding.6

Security of key markets

Like regulators in other countries, the Council must be convinced that its chosen solution provides adequate control and oversight for markets and trades that are strategically important to the domestic economy.

Market disruption

Given Australia’s existing regulatory framework and small share of the global OTC derivatives market, the Council must decide whether downside risk is best mitigated by implementing certain G20

reforms—for example, increased capital charges for highly bespoke transactions and enhanced transaction reporting—or other measures better suited to the domestic market.

Pre-Reform Post-Reform

In addition to revenue channel changes, trade volumes are expected to increase as products become more “listed-like”.

Revenue

Channel Change Comment

Pe r-Tr ade Margi n Trade Volume P&L P&L Pe r-Tr ade Margi n Trade Volume

Execution Bid-ask spreads, broker fees and administration and legal fees expected to shrink due to increased standardisation, transparency and liquidity

Clearing Clearing fees, once explicit, likely to reduce over time due to increased price transparency

Collateral Potential for clearing banks to earn a fee to optimise the use of client collateral (see separate “call-out”)

Market efficiency

The Council acknowledges that the ultimate configuration of CCPs—single versus multiple, local versus

international—will have important consequences for market efficiency, including the cost of clearing and the ability of clearing members to net effectively across their trade portfolios.

Regulatory coordination

Although countries are focused on their own strategically important markets, harmonisation of rules across jurisdictions is a key G20 objective. The Council’s plans must be compatible with those of US and European regulators. Should Australia fail to move in lock step with these jurisdictions, the Council risks creating regulatory arbitrage opportunities, particularly for the world’s 14 largest OTC dealers (G14 dealers).

Political goodwill

The Council’s chosen solution must protect national interests and the domestic market, and still be perceived internationally as honouring Australia’s G20 commitments.

Based on the information available to date, we expect the scope of trades that will be subject to mandatory central clearing in Australia to:

• Include interest rate derivatives denominated in Australian dollars involving Australia-based counterparties.

• Exclude interest rate derivatives denominated in other currencies. • Exclude equity, credit and other

derivative asset classes where Australian trading is limited. • Exclude foreign exchange swaps and

forwards, which are exempted from central clearing under Dodd-Frank.7

Sydney-based ASX Clear will probably be the only CCP clearing interest rate derivatives in the domestic market in the foreseeable future, but LCH.Clearnet has shown interest in providing services to the Australian market. LCH.Clearnet’s SwapsClear is the biggest global CCP for interest rate derivatives, responsible for clearing 50 percent of interest rate swaps trades between G14 dealers. But first, the UK-based company will need to overcome two significant challenges: interoperability with a local CCP and the up-front capital commitments for smaller banks. The global CCP market

will likely continue to be fragmented in the near term, but consolidation is expected over time as CCPs merge to take advantage of scale efficiencies.

Top considerations for

Australian financial

institutions

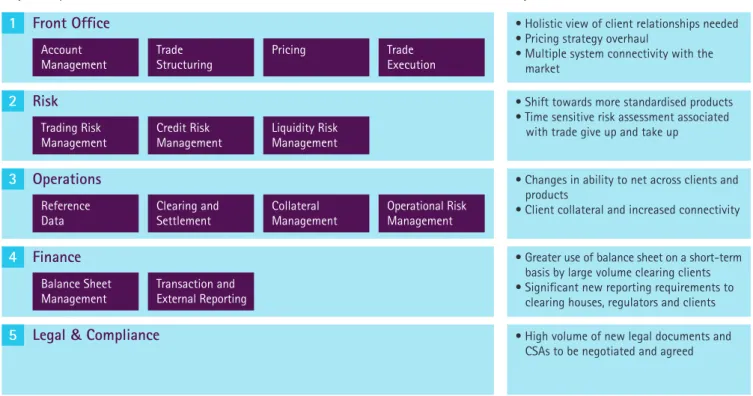

In the coming years, the OTC derivatives market is expected to become more “listed-like,” meaning more product standardisation, increased price transparency and liquidity, and higher trade volumes. These forces will exert downward pressure on bid-ask spreads and fees, reducing per-trade margins and challenging the effectiveness of banks’ current business models (see figure 3). Impending regulatory reform, while not responsible for this trend, will certainly exacerbate it. Clearing banks could profit from transforming client collateral into CCP-eligible cash and securities, provided they successfully navigate the wider collateral management reform implications. Australian banks will feel the effects of OTC derivatives reform throughout their organisations. Figure 4 examines which functions will be impacted and how.

Capability Implications

• High volume of new legal documents and CSAs to be negotiated and agreed

Legal & Compliance

5

• Greater use of balance sheet on a short-term basis by large volume clearing clients • Significant new reporting requirements to clearing houses, regulators and clients

Balance Sheet

Management Transaction and External Reporting

Finance

4

• Changes in ability to net across clients and products

• Client collateral and increased connectivity

Operations

3

Reference

Data Clearing and Settlement Collateral Management Operational RiskManagement

• Shift towards more standardised products • Time sensitive risk assessment associated with trade give up and take up

Risk

2

Trading Risk

Management Credit Risk Management Liquidity Risk Management

• Holistic view of client relationships needed • Pricing strategy overhaul

• Multiple system connectivity with the market

Front Office

1

Account

Management Trade Structuring Pricing TradeExecution

Choosing an appropriate

operating model

In a “worst-case” scenario, G20 regulators will hold to the end-2012 deadline for introducing central clearing. Given this tight timeline, Australian banks must decide soon whether to enter the clearing business and, if so, how extensively to invest. Figure 5 identifies three possible operating models and outlines the pros and cons of each option.

Banks that choose to build a clearing capability for the Australian market will need to assess the desirability and feasibility of extending these services to their international operations. The country’s largest banks already provide OTC services in Europe, the United States and Asia, all of which will be subject to mandatory central clearing shortly. Adding clearing to the mix would require linking up with other CCPs and investing in the necessary trade

routing infrastructure—a highly complex endeavour that is expected to be prohibitively expensive in the near term. By applying the classic prisoner’s dilemma model to the Australian banking market, we can gain insight into the considerations facing bank leaders as they select an operating model (see figure 6).

Each bank sees an incentive to invest in clearing capabilities in an attempt to gain market share in the execution business—an opportunity that evaporates when other banks also choose to invest in clearing capabilities. The industry would maximise its total payoff by collectively agreeing not to invest in clearing capabilities, but that would require trust and communication among individual players. Left to their own devices, all of the banks will choose to invest in clearing and end up worse off than if they had cooperated.

In reality, no one knows how much there is to gain—in terms of profit and market share—from investing in Model 3. Not only is the size of the pie uncertain, but also banks cannot be sure how many ways it will be split and so how big their piece will be.

Accenture’s work with G14 dealers suggests that they have similar reservations. Many international banks view clearing investments primarily as a way to protect their execution businesses. Although these capabilities could lure clearing business away from other banks and result in new revenue streams, most believe the upside is limited.

If the American and European experiences are any indication, the significant capital and complex operational change required to create a clearing capability will limit local CCP participation.

Figure 5: Operating model options for Australian banks under mandatory central clearing

The bank continues to provide an execution service to clients, but clients need to clear through another dealer

Limited additional investment needed to support a move to client clearing

Limited documentation required to commence trading

Limited credit exposure to the client once the trade has been given up to the clearer

Changes the client relationship to transactional in nature, and introduces the client to a competitor bank

Requires agreements to be in place with clearing banks jurisdiction of trade

Transparency of price to the clearing bank

The bank builds a clearing service to support its execution business

Offer full suite of services to existing clients

Capture revenue stream associated with clearing (clearing fees, margin interest)

May require less investment than clearing trades executed with other banks

Maintain confidentiality of execution price

Up-front investment needed to build a clearing capability and to negotiate legal agreements

Does not take advantage of potential revenue streams from non-executing clients

Potential for competitor clearing banks to offer a clearing service at a lower cost

The bank builds a clearing service that will support its execution business, in addition to offering clearing for non-executing clients

Offer full suite of services to existing clients, as well as potentially capture new clearing-only clients

Dominant brand positioning

May facilitate agreements with global banks for clearing on each others behalf in relevant location

Potentially significant up-front investment needed to develop a deep understanding of the regulations, to negotiate legal agreements with clients and executing banks and to build a clearing capability

Clearing business is likely to be highly price competitive and may not offer good margins in the long term

Executing Bank Executing Bank

Clearing Bank

Executing Bank Clearing Bank +

Also, the clearing business will be even less attractive to banks if some potential clients are exempted from mandated clearing due to their small market footprints.

Compete or collaborate?

The prisoner’s dilemma model suggests that cooperation among banks is unlikely, but certain market realities leave the door open for collaboration. Unlike the organisations in our model, the four large banks that dominate Australia’s banking market have an incentive to behave prudently, recognising that their decisions today will have implications for future interactions with their peers. Figure 7 identifies three possibilities for industry collaboration and outlines the pros and cons of each option.

Bank A Bank B Does not invest in clearing

Does not invest in clearing Invests in

clearing

Invests in clearing

Figure 6: Prisoner’s dilemma model applied to the Australian banking market

Figure 7: Options for collaborating on central clearing in Australia

Option1

Create a single, shared, not for-profit clearing bank

Could reduce the per-bank investment required to meet Australia’s central clearing obligations

Eliminates duplication of clearing technology across multiple banks

Makes it difficult to ensure confidentiality of proprietary data

Could be logistically challenging

Could prove more expensive than individual banks investing in their own clearing capabilities

Option 2

Agree to limit clearing to own execution business

Minimises impacts on the competitive environment of Australia’s banking industry

Requires the cooperation of all domestic and foreign banks operating in the local market

Creates a strong incentive for banks to renege on any agreement to chase additional clearing revenue and maximise their return on investment

Option 3

Lobby against mandatory central clearing in Australia

Acknowledges that Australia already has a robust regulatory framework and a strong banking system

Recognises that, since the financial crisis, global counterparts have increased capital buffers, de-leveraged, exited exotic trades and improved risk management

Could result in trading that is systemically/ strategically important for the Australian market being cleared abroad

May be perceived as inconsistent with Australia’s public commitment to G20 OTC derivatives reform

Once central clearing

is mandated, Australian

banks will need to begin

deploying their chosen

operating models

quickly. Whether that

occurs by the end-2012

implementation date or

later, banks that take

steps now to prepare

will be well positioned

when the regulatory

fog clears.

Accenture recommends that Australian banks immediately:

• Appoint senior executives to

coordinate strategy on OTC derivatives reform.

• Analyse the implications of these reforms for business models, products and clients.

• Meet with clients to discuss their service needs.

• Meet with regulators to understand reforms and influence policy development.

• Meet with other domestic and international banks to discuss service-sharing options.

Irrespective of the operating models that they ultimately decide to deploy, banks should delay investments until local regulation has been defined and implementation timelines have been confirmed. Now is the time to make strategic plans because the time for action is coming.

Notes

1 Leaders‘ Statement, G20 Pittsburgh

Summit, September 25, 2009.

2 Industry Letter to the OTC Derivatives

Supervisors Group, Operations Steering Committee, March 31, 2011,

http://www.isda.org/ c_and_a/pdf/ Supervisory_Commitment_Letter-31_ March_2011_FINAL.PDF.

3 “Barclays Capital Executes & Clears IRS

E-Transaction for Citadel,” Bloomberg (Press Release), April 16, 2011 and “Goldman Sachs and BlackRock Complete Electronically Executed and Centrally Cleared Credit Default Swap Trade,” Business Wire (Press Release), June 30, 2011.

4 “Regulatory reform puts risk

management under threat in Asia,” Asia Risk, July 5, 2011.

5 “Central Clearing of OTC Derivatives

in Australia,” Council of Financial Regulators, June 2011.

6 “Big four in ratings downgrade,”

Sydney Morning Herald, May 19, 2011.

7 “US Treasury will exempt FX swaps and

forwards from Dodd-Frank,” FX Week, May 2, 2011.

Additional resources

2010 Australian Financial Markets Report, Australian Financial Markets Association, 2010.

“2011 OTC Derivatives Prime Brokerage Survey: Into the unknown,” Global Custodian, January 1, 2011.

“ASX vs LCH in race to be Australia‘s OTC clearer,” Risk Magazine, August 1, 2011.

“Baum: lower margins but higher volumes in the new world order,” Futures and Options World, July 1, 2011.

“Centralized Clearing of OTC Derivatives: Devil in the Details,” Greenwich Associates, January 2010.

“Client clearing poses acute liquidity risks,” Risk Magazine, July 1, 2011.

“Collateral transformation needs to be carefully planned by clearing members, says Isda’s O’Connor,” Risk Magazine, July 12, 2011.

“LCH.Clearnet looking to provide competition to ASX Clear,” Reuters, June 21, 2011.

“Reforming OTC Derivative Markets: A UK Perspective,” Financial Services Authority and HM Treasury, December 2009. “Rehypothecation is being redefined,” Financial News, September 13, 2010. “VIEWPOINTS: OTC Derivatives Market Is Just Shifting,” American Banker, November 17, 2010

Copyright © 2011 Accenture All rights reserved.

Accenture, its logo, and High Performance Delivered are trademarks of Accenture.

About Accenture

Accenture is a global management consulting, technology services and outsourcing company, with approximately 236,000 people serving clients in more than 120 countries. Combining unparalleled experience, comprehensive capabilities across all industries and business functions, and extensive research on the world’s most successful companies, Accenture collaborates with clients to help them become high-performance businesses and governments. The company generated net revenues of US$25.5 billion for the fiscal year ended Aug. 31, 2011. Its home page is www.accenture.com.

About the authors

Stephan Sparrius is a Senior Manager in the Accenture Management Consulting practice in Sydney. He collaborated with Simon Murray and Guy Russell, as part of the local Capital Markets thought leadership team, to develop this point of view. Guy and Simon have experience in working on OTC transformation projects for global clients. Stephan has worked on transformation projects for major Australian banks and has consulted leading global banks in the Australian market. His focus is on operations transformation to deliver on bank’s Capital Markets strategic intent in the Australian, European and African markets.