Impact of oil price volatility on macroeconomic variables (A case study of Pakistan)

Full text

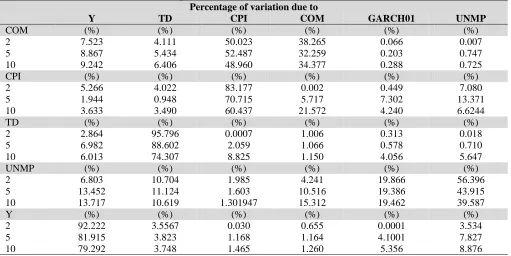

Figure

Related documents

It is not that the indispensability of mathematics to science confirms the mathematics used – that warrant may well come from considerations internal to mathematics – it is

In late April of 1991, three members of the senior management of Salomon-- John Gutfreund, Thomas Strauss, and John Meriwether--were informed that Paul Mozer, the head of the

Bentley Collection at the Boston Public Library, May 15 through June 15, 1992," The Accounting Historians Notebook : Vol... ACCOUNTING

Evaluation of PERSIANN-CDR Constructed Using GPCP V2.2 and V2.3 and A Comparison with TRMM 3B42 V7 and CPC Unified Gauge-Based Analysis in Global Scale..

Transferring the procurement of goods and services from direct payments and purchasing card transactions to purchase orders decreases the risk to our.. institution while

Keywords: Avalanche Effect, Chosen Plaintext Attack, Cipher Text Only Attack, Encryption Time, Frequency Analysis Attack, Known Plaintext Attack, Symmetric

The aim of this study was to determine if HRM can facilitate downstream analysis of multiple mutant lines identified by TILLING in order to characterise allelic series of EMS

In this paper, we focused our attention on Iran as a small open economy, which exports oil and estimated a Dynamic Stochastic General Equilibrium (DSGE) model with a