Hedonic price analysis of the quality characteristics of Anatolian hard red wheat

Full text

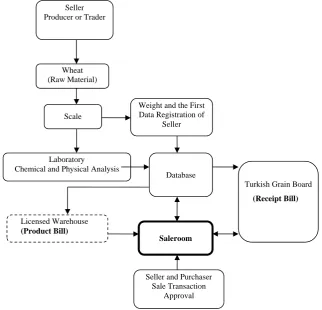

Figure

Related documents

It was decided that with the presence of such significant red flag signs that she should undergo advanced imaging, in this case an MRI, that revealed an underlying malignancy, which

This essay asserts that to effectively degrade and ultimately destroy the Islamic State of Iraq and Syria (ISIS), and to topple the Bashar al-Assad’s regime, the international

National Conference on Technical Vocational Education, Training and Skills Development: A Roadmap for Empowerment (Dec. 2008): Ministry of Human Resource Development, Department

Similarly, acenaphthylene and indeno (1, 2, 3-cd) pyrene were not detected in the control sample but were present in all smoked fish samples obtained from all the studied sales

19% serve a county. Fourteen per cent of the centers provide service for adjoining states in addition to the states in which they are located; usually these adjoining states have

Field experiments were conducted at Ebonyi State University Research Farm during 2009 and 2010 farming seasons to evaluate the effect of intercropping maize with

What differences should you watch out for between optimized data storage and the standard type of block access in STEP 7 (TIA