“Which product market strategy should FAAM Benelux apply, to increase their performance in the Dutch market and realize growth?” This report provides research to increase sales from customers and how to improve the performance of the company

Full text

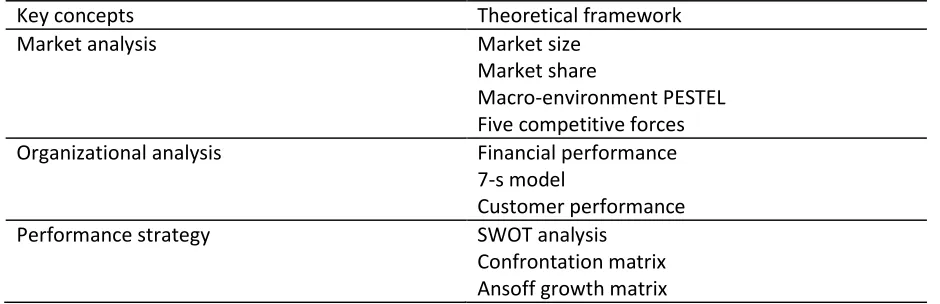

Figure

Outline

Related documents

Implementing changes in response to such observations in PlutoF involves only a few mouse clicks (Fig. The user also has the opportunity to re-designate a representative sequence

At open-access two-year public colleges, the goal of the traditional assessment and placement process is to match incoming students to the developmental or college- level courses

DEA analysis has also been used recently to assess the efficiency of the public sector in cross-country analysis in such areas as education, health (Afonso and St. Among

As breast cancer VEGF levels stay unchanged at low levels and increase with high concentrations of zoledronic acid, our study provides some limited evidence that the decreases in

Volunteer Co-ordinator Ph: 8517 5917 Passenger collection area Stonnington, Port Phillip & Glen Eira Travel destination area Stonnington, Port Phillip & Glen Eira

This study observed significantly greater in-patient hospital- izations and lower total and average annualized average medical expenses among those not reporting any

There have been several approaches to overcome this large matrix problem, such as imposing separability on covariance functions, tapering the covariance matrix, using

Post-colonial governments then reverted to centralisation at national level, destroyed alternate political organisations and limited the power of local government 728