Feature Optimization for Predicting Readability of Arabic L1 and L2

Full text

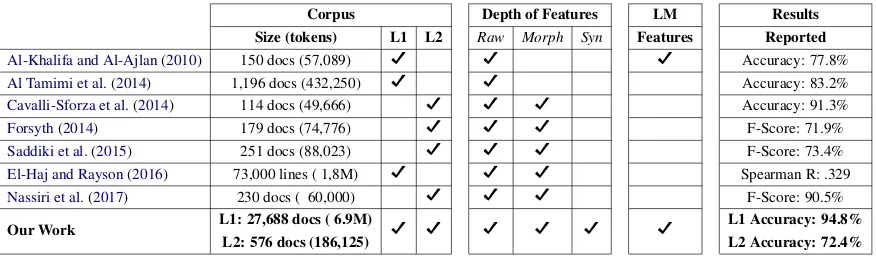

Figure

Related documents

International Symposium on Environmentally Conscious Design and Inverse Manufacturing (EcoDesign 2001) 12-15 December, 2001, Tokyo Big Sight, Japan. Man E., Browne J., “Development

Gauss-Markov theorem reduces linear unbiased estimation to the Least Squares Solution of inconsistent linear equations while the normal equations reduce the second one to the

RESPECT LIFE MONTH 1 Rosary in Plaza 8:15am PK Guardian Angel 2 St... 2015 Nam id velit non risus

Influence of the Application of Good Corporate Governance Principles, Organizational Commitment, Leadership Style and Internal Oversight on the Performance of Village

low versus high value products (Chopra, 2016), by the distribution channels used, and the extent to which the retailer is able to improve the shopping

This project is limited to the monitoring and removal using photo-Fenton‘s oxidation of three pharmaceuticals in wastewater with regards to the actual

The Eastview Landfill site will be CLOSED on Tuesday December 25, 2012 and there will be NO recycling and refuse collection on Tuesday, December 25, 2012.. The Eastview

In order to make the univariate model of portfolio value comparable to the n -variate volatility model of individual assets, we consider for the portfolio logarithmic returns..