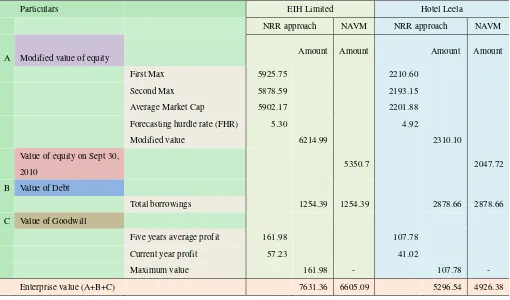

Business Valuation: Modelling Forecasting Hurdle Rate

Full text

Figure

Related documents

The internal rate of return is the discount rate that discounts a specified series of future cash flows to a specified

We calculate the future value of all positive cash flows at the terminal year of the project, the present value of the cash outflows at time 0; using the firm’s hurdle rate; and then

(3) the uncertainty in the future cash flows (Higher Risk .... Higher Discount Rate) A higher discount rate will lead to a lower value for cash flows in the future.. The discount

Future cash flows are discounted at the discount rate, and the higher the discount rate, the lower the present value of the future cash flows.. Determining the appropriate

Currently natural gas supports approximately 40% of total energy consumption in residential and commercial buildings sector and when including natural gas used

Full edition and audit edition students will meet with their instructor and classmates for an online conferencing event to evaluate the images turned in for this week’s

7. Continue the business with the partnership property on the death, retirement, insanity, civil interdiction or insolvency of a general partner, unless the right to

Whereas we found no evidence for the influence of provincial governance when a linear fixed-effect regression estimator was used, the results from a fixed-effect