International Financial Contagion: Evidence from the Argentine Crisis of 2001 2002

Full text

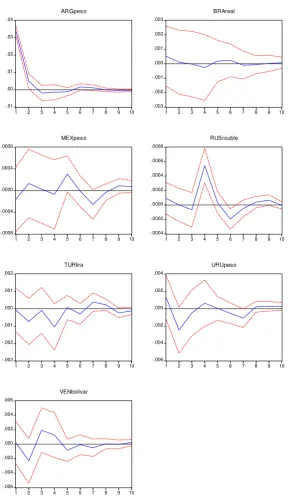

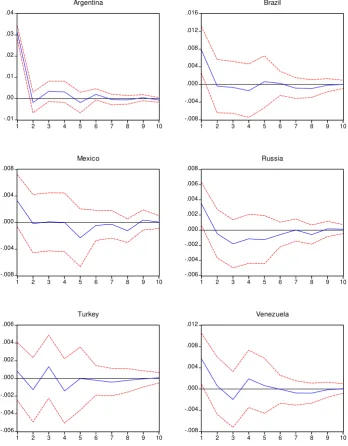

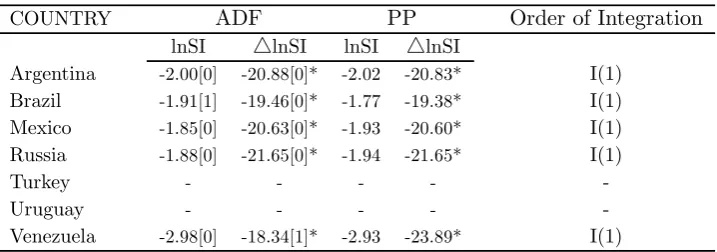

Figure

Related documents

The City Line will make it easier and more att- ractive to take public transport in the future, but the people who live, work or travel in Stockholm will be affected during the

In order to describe the interplay of the equity risk and the default risk of the issuer, we adopt a parsimonious, intensity-based default model, in which the default intensity

While there was no significant difference in the CD4 T- cell subtypes between the age groups in able bodied con- trols, the oSCI group had, compared to ySCI, higher proportions

In the following, I address the economy of guessing as it pertains to Peirce’s conception of abduction, arguing that there are economic considerations that pertain to the

When The Pearson Product-moment correlation coefficient was used to measure the strength and direction of the relationship, the findings was revealed a moderate,

2009 – 2011 Board Member, University of New Hampshire MPH Program Advisory Boards 2008 Board Member, Global Health Council’s Community Network Advisory Board 2003 – 2007

Present study showed idiopathic increase in plasma cortisol level from 2 nd to 5 th week in control group however, control group showed a decreased cortisol