AFRICAN DEVELOPMENT FUND

GHANA

THE PUBLIC FINANCIAL MANAGEMENT AND PRIVATE SECTOR

COMPETITIVENESS SUPPORT PROGRAMME PHASE I

(PFMPSCSP)

OSGE DEPARTMENT November 2015 Pu b lic Dis clos u re Au th o rized P u b lic Dis clo su re Au th o rized Pu b lic Dis clos u re Au th o riz edTABLE OF CONTENTS

CURRENCY EQUIVALENTS ... i

FISCAL YEAR ... i

WEIGHTS AND MEASURES... i

PROGRAMME INFORMATION ...iii

LOAN INFORMATION ...iii

PROGRAMME EXECUTIVE SUMMARY ... iv

I INTRODUCTION: THE PROPOSAL ... 1

II COUNTRY CONTEXT ... 1

2.1 Political Developments and Governance Context ... 1

2.2 Recent Economic Developments, Macroeconomic and Fiscal Analysis ... 2

2.3 Competitiveness of the Economy ... 4

2.4 Inclusive Growth, Poverty and Social Context ... 4

III GOVERNMENT DEVELOPMENT PROGRAM... 5

3.1 Government Overall Development Strategy and Medium-term Reform Priorities ... 5

3.2 Challenges to National Development Program ... 6

3.3 Consultation and Participation Processes... 6

IV BANK SUPPORT TO GOVERNMENT STRATEGY ... 7

4.1 Link with Bank Strategy ... 7

4.2 Meeting the Eligibility Criteria ... 7

4.3 Collaboration and Coordination with other Partners... 8

4.4 Relationship with Other Bank Operations ... 8

4.5 Analytical Works Underpinning ... 9

V THE PROPOSED PROGRAMME ... 10

5.1 Programme Goal and Purpose ... 10

5.2 Programme Components ... 10

5.3 Policy Dialogue ... 15

5.4 Loan Conditions………...15

5.5 Application of Good Practice Principles on Conditionality ... 16

5.6 External Financing Requirements and Sources ... 16

5.7 Application of Bank Group Policy on Non-concessional Debt Accumulation……… 16

VI OPERATION IMPLEMENTATION ... 16

6.1 Beneficiaries of the Programme ... 16

6.2 Impact on Gender, Poor and Vulnerable Groups ... 17

6.3 Impact on Environment and Climate Change ... 17

6.4 Implementation, Monitoring and Evaluation ... 17

6.5 Financial Management and Disbursement ... 18

VII LEGAL DOCUMENTATION AND AUTHORITY ... 19

7.1 Legal Documentation ... 19

7.2 Conditions Associated with the Bank’s Intervention ... 19

7.3 Compliance with Bank Group Policies ... 19

VIII RISKS MANAGEMENT ... 20

LIST OF TABLES

Table 1 :Key Macroeconomic Indicators, 2012-2017 ... 2

Table 2 : Link between the GSGDA II, MTR-CSP and the PFMPSCSP ... 7

Table 3 :Lessons Learned from Previous Bank Operations in Ghana ... 9

Table 4 : PFMPSCSP Prior Actions and Indicative Triggers ... 15

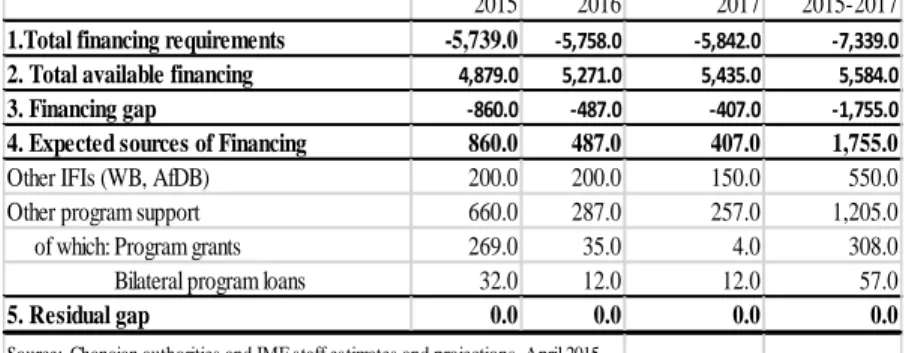

Table 5 : External Financing Requirements and Sources, 2015-2017 ... 16

Table 6: Potential Risks and Mitigation Measures ………….………...20

LIST OF ANNEXES Annex I: Letter of Development Policy

Annex II A: Operations Policy Matrix

Annex II B: Development Partners’ Reform Area Focus

Annex III: The IMF-sponsored Extended Credit Facility Program Press Release Annex IV: The Assessment of the PBO Eligibility Criteria for Ghana

i CURRENCY EQUIVALENTS As of October 2015 1 UA = 55.07 GHc 1 UA = 1.40 US$ 1 UA = 1.25 Euro FISCAL YEAR January 1 to December 31

WEIGHTS AND MEASURES

1metric tonne = 2204 pounds (lbs)

1 kilogramme (kg) = 2.200 lbs

1 metre (m) = 3.28 feet (ft)

1 millimetre (mm) = 0.03937 inch (“) 1 kilometre (km) = 0.62 mile

ii

ACRONYMS AND ABBREVIATION

AAF Automatic Adjustment Formula MDA Ministries, Departments and Agencies

ADF African Development Fund MDBS Multi-Donor Budget Support

AG Auditor General MDGs Millennium Development Goals

AGI Africa Governance Institute MDRI Multilateral Debt Relief Initiative

BEE Business Enabling Environment MoF Ministry of Finance

BOG Bank of Ghana MOTI Ministry of Trade and Industry

CAGD Comptroller and Accountant General Office MTDMS Medium Term Debt Management Strategy

CAR Commitment at Risk MTFF Medium Term Expenditure Framework

CIDA Canadian International Development Agency MTFF Medium Term Fiscal Framework

CF Consolidated Fund MTO Medium Tax Office

CFRA Country Fiduciary Risk Assessment MTR Medium Term Review

CSO Civil Society Organization NDC National Democratic Congress

CSP Country Strategy Paper NDPC National Development Planning Commission

CPIA Country Policy and Institutional Assessment NGO Non-Governmental Organization

DFID Department for International Development NPP New Patriotic Party

DO Development Objective

OECD Organization for Economic Cooperation and

Development DP

DPC

Development Partners

Development Policy Credit P2P Procure to Pay

DSA Debt Sustainability Analysis PAF Performance Assessment Framework

ECF Extended Credit Facility PAR Project at Risk

EITI Extractive Industries Transparency Initiative PBO Program-Based Operation

FDI Foreign Direct Investment PCR Project Completion Report

FM Framework Memorandum PEFA Public Expenditure and Financial Accountability

GAP Governance Action Plan PFM Public Financial Management

GAX Ghana Alternative Stock Exchange PFMPSCSP

Public Financial Management and Public Sector Competitiveness Support Project

GBS General Budget Support PFMRS Public Financial Management Reform Strategy

GCI Global Competitiveness Index PPA Public Procurement Authority

GDP Gross Domestic Product PPD Public-Private Dialogue

GHFO Ghana Field Office PPP Potentially Problematic Project

GIFMIS

Government Integrated Financial Management

System PRBESL

Poverty reduction and Business Environment Support Loan

GISP Ghana Institutional Support Project PRSL Poverty reduction support loan

GLSS Ghana Living Standards Survey PSDS Private Sector Development Strategy

GOG Government of Ghana PURC Public Utility Regulatory Commission

GSGDA Ghana Shared Growth and Development Agenda SF Statutory Fund

GSE Ghana Stock Exchange SME Small and Medium Enterprise

HDI Human Development Index SOE State-Owned Enterprise

HIPC Heavily Indebted Poor Countries (HIPC) TRIPS Total Revenue Integrated Processing System

ICF Investment Climate Facility TYS Ten Year Strategy

IFMIS Integrated Financial Management System WAEMU West African Economic and Monetary Union

IGF Internally Generated Fund WAMZI West African Monetary Zone

ISP Institutional Support Program WBGI World Bank Governance Indicators

IP Implementation Progress WDI World Development Indicators

iii

PROGRAMME INFORMATION

INSTRUMENT GENERAL BUDGET SUPPORT

PBO DESIGN TYPE PROGRAMMATIC OPERATION

LOAN INFORMATION Client’s information

BORROWER: REPUBLIC OF GHANA

EXECUTING AGENCY: MINISTRY OF FINANCE (MOF)

Financing plan for 2015, 2016, and 2017

Source Amount (2015) Amount (2016) Amount (2017)

ADF Loan UA 40.0 million UA 35.0 million N/A

WORLD BANK UA 106.6 million UA 106.6 million UA 106.6 million

CANADA UA 12.0 million N/A N/A

DENMARK UA 6.2 million N/A N/A

EU UA 145.0 million N/A N/A

DFID UA 22.2 million N/A N/A

GERMANY UA 22.7 million N/A N/A

SWITZERLAND UA 5.7 million UA 3.6 million UA 2.2 million

TOTAL COST UA 360.5 million UA 145.2 million UA 108.8 million

ADF key financing information

Loan currency Unit of Account (UA)

Interest Rate 1% per annum

Service charge 75 bps

Commitment fee 50 bps

Tenor 360 months

Grace period 60 months

*if applicable

Timeframe - Main stepping stones (expected)

Concept Note approval March 2014

Programme approval November 2015

Effectiveness November 2015

iv

PROGRAMME EXECUTIVE SUMMARY Programme

Overview

Program name: Ghana – Public Financial Management and Private Sector Competiveness Support Programme (PFMPSCSP).

Expected outputs: The key outputs of the Programme are (i) expanded tax base and rationalized expenditure system; (ii) improved budget credibility and transparency; and (iii) Enhanced viability and efficiency of the power sector, as well as increased SME access to finance.

Overall timeframe: 2015-2016, two year programmatic operation Programme

Outcomes

The Expected outcomes of the program are: (a) Strengthened fiscal consolidation; (b) Deepened and improved PFM system; and (c) Improved efficiency and competitiveness of the private sector.

Alignment with Bank priorities

The operation is closely aligned to two of the operational priorities of the Bank’s Ten-Year Strategy, 2013-2022, namely governance and accountability and private sector development, and reinforced by two of the new Bank Group High-5 institutional priorities1, namely “Industrialize Africa and Power Africa”. The program is also linked to the three pillars of the Bank Group Governance Strategic Framework and Action Plan, 2014-2018 (GAP II), [public sector and economic management, sector governance (energy) and investment and business climate]; as well as the Bank’s Private Sector Development Strategy, 2013-2017 (investment and business climate). Furthermore, the program is closely linked to one of the pillars of the Bank’s Country Strategy Paper for Ghana, namely improved governance and accountability.

Needs

Assessment and Justification

Ghana’s economy has been moving towards a serious risk of fiscal and debt distress since 2012, exacerbated by current fall in commodity prices on the world market, especially the recent drastic fall in the price of crude oil. The justification for Budget Support Operation (BSO) is premised on the need to create fiscal space for the government to implement fiscal consolidation. The proceeds of the budget support operation will also act as a buffer contributing to financial flows during the reform period in the face of the recent decline in revenue occasioned by falling commodity prices. The proceeds of the BSO could also assist the GOG in interest repayments, thereby reducing fiscal deficit and bringing credibility to the budget process. Furthermore, it could help GOG to continue payment of accumulated debt to power sector SOEs. Donor support for the government reform agenda is therefore imperative to ensure its success.

Harmonisation The Multi- Donor Budget Support (MDBS) platform in Ghana has not properly functioned over the past two years owing to failure to reach a joint PAF, weak DPs/GOG dialogue and the deterioration of the underlying principles on macroeconomic stability. In the absence of an active coordinated Policy Dialogue Framework, the PFMPSCSP is being closely coordinated with the IMF-Extended Credit Facility (ECF) and the World Bank Budget support operation. Consultations were also held with the other DPs to coordinate with their respective related operations, and get their views on the progress and issues relating to GOG policy reform program implementation. Such consultations will continue during PFMPSCSP implementation. Meanwhile, the monitoring of the Bank’s operation will rely on the results of the regular review of the IMF-ECF and possible joint monitoring and evaluation with the World Bank. However, DPs still place enormous importance on Ghana’s commitment to the Partnership Principles, and assessment of GOG performance against these is still required for other forms of financial aid provided to the country. DPs, including the Bank, therefore, agreed that policy dialogue on Macroeconomic Stability and PFM should continue firmly within the respective Sector Working Groups (SWGs), and that these groups will meet regularly. As Ghana’s Trusted Partner, the Bank is called upon to play a leadership role in coordinating engagement between DPs and GOG to foster the establishment of a new policy dialogue framework.

Bank’s Added Value

The proposed operation is the fifth general budget support program and the seventh Governance related operation the Bank is conducting in Ghana. This long term engagement with the country has allowed the Bank to acquire substantial knowledge and experience on various development issues (e.g., PFM, PSD, Energy, etc.). The Bank’s awareness about the development challenges Ghana is facing and its field presence are important assets. The proposed budget support builds on previous operations and programs financed by the Bank as well as other DPs, and lessons learned. The Bank can leverage its unique position as a reliable and trusted partner of choice, to engage in policy dialogue and help implement difficult reforms based on a consistent track record.

Contributions to Gender Equality and women’s empowerment

Fiscal consolidation and PFM reforms are likely to benefit women and vulnerable groups as improved fiscal space can accommodate increased pro-poor expenditures for better social services delivery. The focus on increasing electricity supply which has been a challenge due to the ongoing 3 year power rationing will also benefit women and youth involved in SMEs. The high cost of alternative sources of energy such as generators and the exorbitant price of fuel contribute to the high cost of doing business and discourage women from engaging in lucrative income-earning activities that depend on electricity, thus limiting opportunities for economic independence. Electrification is expected to reduce the time spent on fuel wood collection by household members, promote good health arising from less use of charcoal and increase the time spent on studying by boys and girls.

Policy dialogue and linked technical assistance

The proposed operation will focus on supporting fiscal consolidation policy actions, PFM reforms, and electricity sector reforms. Through this operation and the on-going Institutional Support Project, the Bank’s support will bring to Ghana solid expertise, knowledge transfer and best practices to inform the government’s reform agenda. The program will create a strong platform for policy dialogue and advisory services, with GHFO playing a leading role on the ground.

1 The new High-5 institutional priorities announced by the new President of the Bank Group are: Feed Africa, Power Africa, Industrialize Africa, Integrate Africa, and Improve the welfare of Africans.

v

RESULTS BASED LOGICAL FRAMEWORK

Country and project name: Ghana: Public Financial Management and Private Sector Competitiveness Support Programme (PFMPSCSP)

Purpose of the project : To restore macroeconomic stability through fiscal consolidation as a solid foundation for an inclusive and resilient economic growth

RESULTS CHAIN PERFORMANCE INDICATORS MOV RISKS/MITIGATION

MEASURES

Indicator (including CSI*) Baseline Target

IM

PA

C

T

Inclusive and resilient economic growth

Real GDP growth /

excluding oil sector 4% /4% (2014)

6.4%/4.7% (2016)

IMF, MoF,

Risks #1: Fiscal and external imbalances, complicated by heavy dependence reliance on foreign financing and a slowing economy due mainly to persisting energy crisis and declining commodity prices. Approaching the elections due in late 2016 may increase spending pressures Employment to active population

ratio Female: 65% Male: 67% (2013) Female: 68% Male: 69% (2016) Outcome 1

Fiscal consolidation enhanced

Revenue/GDP ratio 18.4% (2014) 19.6% (2016), 20.0% (2017) IMF/MoF Expenditure/GDP ratio 27.8% (2014) 25.4% (2016), 23.7% (2017)

Overall fiscal balance/GDP 9.4% (2014) 5.8% (2016), 3.7% (2017)

Wage bill 60% of total

non-interest recurrent expenditures 55% (2016) and 50% (2017) MoF OU T C OM E S Outcome 2

Public financial management strengthened

Aggregate expenditure outturn compared to original approved budget

35.1%

(PEFA 2013) < 30% (2016) and 25% (2017) MoF

Multi-year perspective in fiscal planning, expenditure policy and budgeting

Elements of MTFF and MTEF in place but not enforced (2013)

Pilot integration (and extended to key MDA) of MTFF and MTEF with Hyperion Budget Preparation

System launched (2016, 2017) MoF

Outcome 3

Competitiveness of the private sector enhanced

Global Competitiveness Index – rank 119th out of 144 (2015) 115 th (2016) and 110th (2017) WEF (World Economic Forum) Quality of electricity supply 127th out of 144

(2015)

110th (105th) out 148 or gain at least 10 places (2016, 2017))

WEF

Inflation, annual % change 136th out of 144

(2015) 93rd (90th) out of 148 or gain at least 10 places (2016, 2017) WEF OU PU T S

1. Strengthening Fiscal Consolidation 1.1 Tax base expanded and efficiency in

revenue collection improved

Deployment of the Total Revenue Integrated Processing System (TRIPS)

Four (4) offices are currently covered by TRIPS

12 offices covered by TRIPS (2016), 16 (2017)

MoF

Implementation of self-assessment system for all Medium Tax Offices (MTOs) to enhance compliance in tax payments 15 MTOs are currently practising self-assessment system

20 MTOs practise self-assessment system (2016), 26 (all, in 2017)

vi

1.2 Commitment controls and monitoring of expenditure arrears strengthened

Extending GIFMIS coverage to the management of Internally Generated Fund (IGF) and Statutory Fund (SF) on pilot basis. All Consolidated fund (CF) payments (66% of the National Budget) go through ex-ante control – from requisition to payment – on GIFMIS

GIFMIS coverage is extended to the management of all CF, Internally Generated Fund (IGF) and Statutory Fund (SF) (2017)

MoF and the likelihood of policy inconsistency/reversal in fiscal consolidation efforts. High social expectations on job creation due to expected increased oil production and revenue.

Mitigations: Prudent fiscal and monetary policies to be implemented under the IMF and the World Bank sponsored programs as well as the proposed operation are expected to prevent policy reversal and mitigate risks to growth as domestic interest rate abates, exchange rate becomes stable, energy shortage is addressed, and investors’ confidence is restored. This will improveGOG’s policy credibility, commitment to fiscal reforms and access to external financing. Improved diversification of sources of growth and export resulting from improved competitiveness will stimulate job creation and poverty alleviation.

Risks #2: Despite better global governance indicators, perceived corruption said to be high; and with the expected increase in the oil sector contribution to GDP, there is a concern that this may create further rent-seeking ; weak implementation capacity for reforms.

Mitigations: Commitment to anti-corruption initiatives is high on the agenda by the government; Donors’ interest and commitment to support Ghana in strengthening institutional capacity, including the establishment of the 1.3 Debt management improved Approving at the Ministerial level

the Medium-Term Debt Management Strategy 2014-17

Three-year Rolling Debt Strategy developed.

Medium-Term Debt Management Strategy being fully implemented (2016)

MoF

1.4 Fiscal risk of the payroll on budget reduced

Auditing the HR and Payroll systems

Lack of adequate and reliable Human Resources (HR) and payroll data resulting in potential ghost workers.

A reliable HR and Payroll data is available (2016), cleaning up implemented (2017)

MoF

Integrating Payroll to GIFMIS financials; GIFMIS HRMIS and GIFMIS Hyperion, to permit exercising budgetary control on payroll.

Separate payroll and GIFMIS systems in place.

Payroll, GIFMIS financials; GIFMIS HRMIS and GIFMIS Hyperion are integrated (2016)

MoF

Viable public agencies removed from government payroll

12 public agencies identified

6 public agencies removed from government payroll (2016), 12 in (2017)

MoF

Component II: Deepening the PFM Reforms 2.1 Strategic anchor for PFM reforms

strengthened Approval of the PFMRS by Cabinet. Comprehensive PFM reforms constrained by lack of Public Financial Management Reform Strategy (PFMRS).

PFMRS being implemented (2016) MoF

2.2 Budget Credibility enhanced Strengthening the Medium Term Fiscal Framework and Revenue Forecasting models Elements of MTFF and Revenue Forecasting are in place

MTFF and Revenue Forecasting models are progressively applied (2016, 2017)

MoF

Introducing control at commitment level by

implementing the Procure-to-Pay module of the GIFMIS

Procure-to-Pay module of the GIFMIS being tested

All procurement uses Procure-to-Pay module of the GIFMIS as a control mechanism at commitment level (2016)

MoF

2.3 Value for Money through improved procurement system

Approval of the draft Procurement Regulation by Cabinet and submission to Parliament

Lack of clear laydown procedures for contract

The draft Procurement Regulation by Cabinet and submission to Parliament (2016)

vii

Producing and disseminating a contract management manual

management A contract management manual is produced, disseminated (2016) and enforced (2017)

National Anti-Corruption Action Plan, and continued dialogue is high.

Risks #3: Implementation capacity of reforms may be low, particularly given the upcoming increased oil production. Increased fiduciary risk as revenue collection from oil increases; while expenditure control remains weak and a further accumulation of arrears may result.

Mitigations: Support to capacity building activities

and PFM related

institutions through the Bank’s GISP is being deployed; For the fiduciary risk, credible budget reforms and arrears clearance are being implemented. The GISP also strengthens the capacity of the audit which will itself mitigate the fiduciary risk within a medium term timeframe. Moreover, GISP provides support to the strength Parliament oversight of the budget through the establishment of a budget office

2.3 Budget Transparency and Accountability improved

Publishing annual financial statements generated from GIFMIS within the statutory deadline

Annual financial statements generated from GIFMIS available but not published

Annual financial statements generated from GIFMIS published within the statutory deadline (2016)

MoF

III. Enhancing Efficiency and Competitiveness of Private Sector 3.1 Efficiency and viability of the power

sector enhanced

Clearing the outstanding cross-debt between the Power SOEs and the GOG

Outstanding cross-debt between the Power SOEs and the GOG being audited

Outstanding cross-debt between the Power SOEs and the GOG payment plan implemented (2016), cross-debt cleared (2017)

Bank of Ghana (BoG) and MoP

Implementing a prioritized Cash Water Fall arrangement for electricity revenue sharing among power sector SOEs

Current electricity revenue sharing formula among power sector SOEs is inadequate

A prioritized Cash Water Fall arrangement for electricity revenue sharing among power sector SOEs is implemented (2016)

Ministry of Power (MoP) MoP

3.2 SME access to long-term finance, including women-owned SMEs improved

Listing at least 5 SME on the Alternative Stock Exchange (GAX)

Alternative Stock Exchange for SMEs established and 3 SME listed through the Bank ISP.

A total of 10 SME on the Alternative Stock Exchange are listed on the GAX (2016), 15 in 2017

ISP supervision reports

1

REPORT AND RECOMMENDATION OF THE MANAGEMENT TO THE BOARD OF DIRECTORS ON A PROPOSED LOAN TO THE REPUBLIC OF GHANA FOR THE PUBLIC FINANCIAL

MANAGEMENT AND PRIVATE SECTOR COMPETITIVENESS SUPPORT PROGRAMME PHASE I (PFMPSCSP)

I INTRODUCTION: THE PROPOSAL

1.1 Management submits the following Report and Recommendation for an ADF loan of UA 40 million (equivalent to about US$ 56.2 million) to the Republic of Ghana to finance the Public Financial Management and Private Sector Competiveness Support Programme Phase I(PFMPSCSP). This is the first of two consecutive operations in a programmatic series of General Budget Support (GBS) over the period 2015-2016 for a total indicative financing package of UA 75 million. The operation responds to the request from the Government of Ghana (GOG) submitted to the Bank in July 2014. The objectives of the operation are two-fold: to contribute to (i) strengthening fiscal consolidation and PFM reforms, and (ii) enhancing private sector-led competitiveness through improved access to electricity and SMEs’ access to finance. In view of Ghana’s deteriorating fiscal situation since 2012, a GBS is justified since it will create the fiscal space needed by the Government to implement fiscal consolidation in order to restore macroeconomic stability. A GBS will also provide a buffer of financial flows during the reforms period, in the face of recent revenue decline occasioned by falling commodity and oil prices. This will contribute to facilitating smooth implementation of the government budget. The operation will support GOG’s medium-term reform program as set out in the Letter of Development Policy (Annex I). Program implementation will be supported by an ongoing Bank Institutional Support Project which focusses on building institutional capacity for enhanced Public Financial Management (PFM) and private sector competitiveness.

1.2 The operation responds to the need for Ghana to build a strong foundation for inclusive and self-reliant economic growth. It is aligned with the country’s Medium Term National Development Policy Framework, the “Ghana Shared Growth and Development Agenda” (GSGDA) II, 2014 - 2017. The operation is built around three inter-related components: (i) Strengthening fiscal consolidation; (ii) Deepening PFM reforms; and (iii)

Enhancing efficiency and competitiveness of the private sector. PFM reforms will strengthen fiscal

consolidation in the medium to long term, while all three components will support enhancing the enabling environment for efficiency and competitiveness of the private sector. The proposed operation will build on the achievements of previous Bank Budget Support operations in Ghana in the areas of PFM and business enabling environment. It will complement the IMF Extended Credit Facility (ECF) for Ghana of SDR664.20 million (or about US$916 million) approved in April 2015 and the World Bank’s programmatic Development Policy Credit (DPC) of US$450 million for 2015-2017, approved in June 2015.

II COUNTRY CONTEXT

2.1 Political Developments and Governance Context

2.1.1 Ghana’s evolving dispensation of free political expression, civil liberties and press freedom present the country as an excellent example of relatively successful good political governance in West Africa. The December 2012 Presidential election was won by the National Democratic Congress (NDC) – led by President John Dramani Mahama by a very narrow margin. The peaceful adjudication, by the Supreme Court, of the challenge to the election results by the opposition – the New Patriotic Party (NPP) - and the eventual acceptance by both political parties of the Court ruling, has further consolidated Ghana’s democracy. The next parliamentary and presidential elections are due in late 2016, and past trends augur well for another successful poll that would further consolidate Ghana’s democratic credentials.

2.1.2 Ghana is highly rated in governance indicators. The CPIA score improved from 4.03 in 2010 to 4.19 in 2012, but declined to 3.99 in 2014 on account of the deteriorating macroeconomic situation. The 2014 Mo Ibrahim Governance Index ranked Ghana 7th out of 52 countries, with an overall score of 67.3 out of 100, a

2

slight improvement of 0.3 points over the past five years. Government is implementing measures to improve transparency and public/stakeholder participation in decision making. The Ghana Integrated Financial Management Information System (GIFMIS) is facilitating publishing financial accounting reports in a timely manner, thus enhancing transparency in the budget execution process. As a resource-rich country, Ghana was declared compliant with the Extractive Industries Transparency Initiative (EITI) in 2010 and has regularly been publishing the required reports, overseen by a multi-stakeholder group made up of representatives of civil society, private firms and government. Ghana has exceeded the minimum EITI requirements by providing information to citizen groups on transfer of mineral royalty revenues to mining districts and their utilization, thus further enhancing transparency.

2.1.3 However, these achievements notwithstanding, a number of governance challenges still remain to be urgently addressed, including a growing perception of corruption. Although corruption is relatively low in Ghana compared to many other African countries, there is a growing perception that corruption in the public sector is on the rise, especially in locally funded contracts. There have been some high profile cases being adjudicated, including the suspension in October 2015 of high court judges on allegations of bribery. Other cases are either under review by a commission of enquiry, or are in the process of being investigated. It should be noted, however, that actual indices of corruption contradict this perception. For example, Ghana’s score on the Transparency International Corruption Perception Index has been improving over the past three years from 45 to 46 and 48 out of 100 in 2012, 2013 and 2014 respectively. Ghana’s ranking also improved, albeit very slightly, from 63 in 2013 out of 177 countries to 61 in 2014 out of 175 countries. Government has started taking actions to combat contract-related corruption practices, including the amendment of the Public Procurement Act 2003 (Act 663), the ongoing revision of the 2007 Procurement Regulations, and the preparation of a Contract Management Manual to address weaknesses in the public procurement process. In terms of fragility lens analysis, fiscal risk has become a major concern and government has set in motion, a fiscal consolidation plan aimed at lowering the budget deficit and restoring macroeconomic stability. The declining international commodity and oil prices further complicates the fiscal risk. Ahead of the 2016 elections, the expectation of another close election may raise tensions, but a strong democratic track record and respect for rule of law are expected to prevail.

2.2 Recent Economic Developments, Macroeconomic and Fiscal Analysis

2.2.1 Ghana experienced robust growth with an average annual real GDP growth rate of about 6.0% over a period of five years up to 2010. Growth accelerated to 14.0% in 2011 on account of initial impact of oil production at commercial level and strong consumption. Growth declined to 8% in 2012 and further to 7.3% in 2013 due to lower oil production level2. In 2014 growth was 4.0% and in 2015 estimated at 3.5% (see Table 1), owing to challenges facing the productive sector pertaining to power shortages and depreciation of the currency, slowdown in performance of the mining, construction and transport sectors, and the declining prices of primary commodities (oil, gold and cocoa) on the world markets. In 2015, the economic downturn is estimated to represent a loss of about 25% of per capita income for Ghanaians from the 2013 level.

2

In 2013 and 2014 oil production was lower than projected due to the delays in the finalization of the Gas processing facility which affected the integrity of the oil well.

2012 2013 2014 2015 2016 2017

Est imat ions

Real GDP growth rate 8.0 7.3 4.0 3.5 5.7 9.4

Real GDP growth rate (non-oil) 7.3 6.7 4.0 2.3 4.7 5.5

Cons umer price index (end of period) 8.1 13.5 17.0 12.0 8.0 7.6

Termes of trade 2.9 -6.9 -6.3 9.7 -0.7 -4.1

Banks ' lending rate 25.7 25.6 29.0 … … …

Gvnt gros s capital formation 6.1 4.9 5.7 4.7 5.3 4.9

Current account balance -11.7 -11.9 -9.6 -8.3 -7.2 -5.5

Taxes 15.4 14.2 15.8 16.4 17.3 17.6

Wage bill 12.0 11.0 9.7 9.5 8.7 8.0

Debt interes t 3.2 4.7 6.2 7.2 5.9 5.2

Public debt 49.1 56.2 69.0 72.8 70.5 66.3

Fis cal balance (including grants ) -11.6 -10.5 -10.2 -7.3 -5.8 -3.7

GDP per capita (amount in U.S. dollars) 1,683.0 1,870.0 1,473.0 1,401.0 1,534.0 1,659.0

Source: IMF –Extended Credit Facility, April 2015. NB* The Wage Bill includes all compensations of employees: Wages and s alaries , deferred wage payments , and s ocial contributions .

Table 1 - Ghana: Key Macroeconomic Indicators , 2012-2017

P roject ions (Annual percentage change)

3

2.2.2 Ghana is faced with twin-double-digit fiscal and current account deficits, double-digit inflation, rising debt level, and low foreign reserves buffer compounded by falling commodity and oil prices. This has resulted in macroeconomic instability. Fiscal deficit was over 10% in 2012 and 2013, owing largely to increased wage bill and interest payment, and rose slightly to 10.2% in 2014, in spite of measures to control expenditure and raise revenue. The current account deficit stood at 11.7% of GDP in 2012 and 2013, and remained high at an estimated at 9.2 % in 2014, reflecting continued shortfalls in export earnings. As a consequence, gross international reserves hovered around 3 months of import cover over the past three years. With public debt (external and internal) stock reaching over 69% of GDP (end-2014) Ghana is facing a high risk of debt distress. With debt-service consuming 40% of tax revenues debt burden has become the second most important fiscal risk after the wage bill. The October 2015 issuance of a Eurobond, supported by a World Bank’s Policy-Based Guarantee (PBG) of up to US$400 million, generated proceeds of US$1.0 billion3

. While raising the external debt level, the recent issuances of Eurobonds helped to temporarily protect the local currency from further depreciation. Furthermore, high government domestic borrowing is raising the cost of credit and crowding out finance to the private sector, especially small and medium enterprises (SMEs). Concurrently, double-digit inflation persists, rising to 13.5% and 17.0% in 2013 and 2014 respectively, up from 8.1% in 2012. The rise in inflation reflected the sharp depreciation of the Cedi as well as the pass through effects of fuel and utility price adjustments that occurred in 2013 and 2014. The Cedi depreciated by 33% between January and December 2014, and has been extremely volatile during 2015. Financial inflows from development partners, including the IMF and the World Bank combined with favorable IMF reviews, have supported significant rebounds in the currency. However, the cedi has fallen again by 18% by end September 2015, from its level in January 2015.

2.2.3 The Mid-Year Review of the 2015 Budget, approved by Parliament in July 2015, revised the macroeconomic objectives underpinning the 2015-2017 medium term framework as follows: (i) an average real GDP (including oil) growth rate of about 6.4%, with growth increasing from a projected 3.5% in 2015 to 9.2% in 2017; (ii) an average non-oil real GDP growth rate of about 4.2%, with an acceleration from 2.3% in 2015 to 5.5% in 2017; (iii) an end-year inflation of 13.7%; (iv) fiscal deficit narrowing from 7.3% of GDP in 2015 to 3.5% (on cash basis) by 2017; (iv) current account deficit shrinking from 7.3% of GDP in 2015 to 4.9% in 2017 and (v) gross international reserves of at least 3 months of import cover in 2015 and 4 months by 2017. The bold and frontloaded fiscal adjustment, expected to halve the fiscal deficit by 2017, is on track, with the latest data at July 2015 showing a budget deficit of 3.1% of GDP, against a target of 4%. This would further free fiscal space, and contribute to macroeconomic stability and inclusive growth. Targeted social safety nets such as the cash transfer program and Livelihood Empowerment Against Poverty (LEAP), benefiting the poorest households, are expected to double in coverage to 150,000 households during 2015.

2.2.4 In the medium-term, key drivers of growth will continue to be commodity exports, construction and service-oriented activities. The expected gas production in 2015 and increase in oil production to around 200,000 barrels per day from 2016 would substantially raise GDP and stimulate growth of other sectors if the oil price recovers. However, sustainability of medium term growth prospects could be compromised by unpredictable exogenous factors such as deterioration in terms of trade, steady decline in commodity prices, rising public external debt, and the Ebola epidemic in some parts of the West Africa. Dependence on primary exports (gold, cocoa, oil, and gas), will make the Ghanaian economy increasingly vulnerable to changes in commodity prices. The dynamics of debt could also have adverse impact on future growth. The August 2015 Debt Sustainability Analysis (DSA)4 undertaken in the context of the First Review of the IMF-ECF showed that Ghana continues to face a high risk of debt distress with debt service-to-revenue ratio5 (currently standing at

3

This was a 15-year Eurobond ofUS$1 billion at a coupon rate of 10.75%.

4

IMF-First Review under the Extended Credit Facility Arrangement- August 2015. 5

4

40%) breaching the policy dependent threshold under the baseline. The DSA also revealed that GOG increasingly relied on short-term domestic T-bills to finance its fiscal deficit in the first half of 2015. But additional financing needs would be more difficult to meet since investors’ appetite for domestic and external loan has been waning. Part of Government’s debt strategy is to issue Eurobonds for a total amount of USD1.5 billion, the debt limit agreed with the IMF, in order to reduce pressures on domestic debt market and lengthen the average maturity of public debt by buying back short-term and high yield domestic debt. Ebola epidemic is not expected to impact Ghana’s medium term prospects as the risk of the outbreak has subsided in the region although it has had some impact on intra-regional trade and budget spending on Ebola preparedness. However, prudent fiscal and monetary policies being implemented under the IMF-sponsored and the World Bank programs as well as the proposed operation are expected to mitigate risks to growth as domestic interest rate abates, exchange rate becomes stable and investors’ confidence is restored.

2.3 Competitiveness of the Economy

2.3.1 Ghana is among the five-top ranked African countries in terms of Ease of Doing Business (DB). The 2015 World Bank DB report ranked Ghana 70 out of 189 countries coming behind Mauritius (28), South Africa (43), Rwanda (46), and Tunisia (60). Ghana also ranked among the top 50 countries in the area of getting credit (36) and registering property (43), but is lagging behind on indicators relating to resolving insolvency (161), trading across borders (120), dealing with construction permits (106), paying taxes (101), starting business (96), and getting electricity (71). Even in the area of getting credit in which Ghana is highly ranked, the exorbitant cost of credit undermines the country’s competitive position. High bank lending interest rate of about 29%, one of the highest in Africa, makes credit unaffordable to SMEs and is also a major source of the rising government domestic debt service. Limited information on potential borrowers is also associated with the prevailing high lending interest rate since coverage of the three existing private reference bureaux is as low as 10.4% of the adult population.

2.3.2 Ghana’s ranking has deteriorated from 111th in 2014 to 119th in 2015 on the Global Competitiveness Index (GCI) out of 144 countries. The country’s ranking is weaker in 2015 by 16 positions down from 103rd in 2012, owing largely to deterioration in macroeconomic environment (136th). Ghana’s strength is in the areas of judicial independence (49th place), wastefulness of government spending (49th place), efficiency of legal framework in settling disputes (43rd place), legal rights (24th place), women in labor force (10th place), quality of management of schools (48th place), and company spending on R&D (44th place). These gains notwithstanding, education levels and technological readiness continue to lag behind international standards and the labour market is characterized by inefficiencies related to adequate determination of cost of work and wage. The Association of Ghanaian Industries (AGI) in its monthly reports, often cite access to affordable credit and to reliable electricity supply among the key challenges adversely affecting competitiveness of the Ghanaian economy. The economy remains undiversified, relying heavily on primary commodities, namely cocoa, gold and oil which accounted for 75% of export receipts in 2014.

2.4 Inclusive Growth, Poverty and Social Context

2.4.1 Ghana has made great strides towards reducing poverty over the past two decades. The overall poverty rate declined from 31.9% in 2005/06 to 24.2% in 2012/13, while the extreme poverty rate declined from 16.5% to 8.4%. However, there are geographical disparities with the three northern regions having the highest incidence of poverty and 80% of the poor. The 2014 Human Development Index (HDI) for Ghana has also shown a gradual rise from 0.427 in 1990 to 0.573 in 2013, bolstered by increased per capita income. Nonetheless, income inequality has widened, with Gini Coefficient rising from 0.353 in 1992 to an average of 0.438 during 2000-2010, thus undermining the impact of economic growth on poverty reduction. In terms of the MDGs, current assessment shows that performance remains mixed. By 2013, extreme and overall poverty have both been reduced to more than half of their 1992 levels. The target for the HIV/AIDS component of HIV/AIDS, malaria and other diseases goal had also been attained by 2013. Current trends indicate that by

end-5

2015, Ghana would have attained the goals for Universal Primary education, under-5 mortality, and the safe water supply component of the environmental sustainability goal. However, Ghana may not be able to attain the goal for maternal mortality, the target for sanitation under the environmental sustainability goal, the goal for global partnerships, and the targets for other education levels by 2015. To promote inclusive growth, the government has instituted social protection programs to improve the health and capacity of the vulnerable segments in society. Some of the key social protection programs are the National health Insurance Scheme, the Livelihood Empowerment Against Poverty (LEAP) which provides cash grants to individuals in poorest households, National Youth Employment program, School Feeding Program, capitation grants, free exercise books and school uniforms, the abolition of mandatory school fees for basic education, and reduced electricity tariffs for initial consumption amounts. As indicated in the 2015 Budget document, GOG is rationalizing and improving target mechanisms of these programs to enhance their effectiveness.

2.4.2 Ghana has an appropriate institutional arrangement through the Ministry of Gender, Children and Social Protection, to promote gender equality through mainstreaming gender considerations (see Technical Annex III). The Ministry has finalized the Affirmative Action Bill and validation is on-going. The Ministry also co-sponsored the Interstate Succession and Property Rights of Spouses Bills with the Ministry of Justice and the Attorney-General. In addition, the Ministry will engage in Women’s Rights and Empowerment operations by conducting advocacy and sensitization programs on the need for including women at all levels of decision making using the Affirmative Action Legislation. GOG is committed to promoting women empowerment especially through access to land, labor, credit, markets, business services and education, as well as institutionalizing gender statistics production. Progress is noted in a number of indicators: gender parity in education stands at 0.90 and 0.86 in primary and secondary schools respectively; women account for 52% of the labor force; and are more engaged in service and agriculture related activities at 47% and 41% respectively. During 2015, the Ministry will support about 80 women groups engaged in processing of handcraft and agricultural products with technical and microcredit facility to enhance their empowerment and extend medical and financial support to women and girls suffering from obstetric fistula. In the area of broad national participation, gender parity in politics is rather low, as representation in Parliament stands at only 8.7%.

III GOVERNMENT DEVELOPMENT PROGRAM

3.1 Government Overall Development Strategy and Medium-term Reform Priorities

3.1.1 GOG has recently formulated a medium-term development framework, theGhana Shared Growth and Development Agenda (GSGDA) - II, 2014 – 2017, whose medium-term vision is“A stable, united, inclusive and prosperous country with opportunities for all”. Through implementation of the development agenda, Ghana hopes to transform into a full-fledged Middle Income Country with per capita income of around US$2,500 by 2017, and at least US$3,000 by 2020. The success of Ghana’s structural transformation rests on three strategic interventions namely: (i) strengthening and deepening the essential elements and institutions of good governance, (ii) promoting export-led growth through products that build on Ghana’s comparative strength in agricultural raw materials; and (iii) anchoring industrial development on prudent use of natural resources based on local value addition. Thus, the strategic direction of GSGDA-II is to leverage Ghana’s natural resource endowments and enhance agricultural potential and human resources for accelerated economic growth and job creation.

3.1.2 The GSGDA-II, priority policies are anchored on four pillars namely: (1) building a strong and resilient economy; (2) investing in people; (3) expanding infrastructure; and (4) maintaining transparent and accountable governance. In conjunction with these strategic pillars, interventions are structured around seven thematic areas namely, (i) Human Development, Productivity and Employment; (ii) Ensuring and Sustaining Macroeconomic Stability; (iii) Enhancing Competitiveness of Ghana’s Private Sector; (iv) Accelerated Agricultural Modernization and Sustainable Natural Resource Management; (v) Infrastructure and Human Settlements Development; (vi) Oil and Gas Development; and (vii) Transparent and Accountable Governance. It is within

6

these contexts that Ghana aims to enhance employment and income opportunities for rapid and sustained economic growth and poverty reduction.

3.1.3 Overall, the strategic thrust of the GSGDA is relevant and credible, and is capable of transforming Ghana into a middle-income country if well implemented. The development agenda addresses the causes of poverty by emphasizing inclusive growth underpinned by Ghana’s natural resource endowments and local value addition. The focus on fiscal consolidation in the short to medium term will promote macroeconomic stability as a solid foundation for long term inclusive economic growth.

3.2 Challenges to National Development Program

3.2.1 Structural problems of the economy have been compounded by recent macroeconomic challenges. Ghana’s economy relies mainly on primary commodities notably cocoa, oil and gold that contributed 75% of export receipts in 2014. The country has recently been characterized by rising debt levels that have pushed the economy into high risk of debt distress. Internal and external imbalances characterized by twin and double digit budget and current account deficits, combined with rising debt levels, pose significant challenges to macroeconomic management and erode market confidence for securing financing for public and private sector investments.

3.2.2 The continued power rationing and supply inefficiencies could further reverse achievements already attained in economic growth and foreign direct investment inflows. Ghana continues to face energy crisis which has intensified over the last 3 years, with frequent power rationing that has negatively affected business and led to increased cost of production, loss of employment and the closure of some SME operations. Although Ghana has a national electrification rate of more than 70%, ranking second after South Africa; increase (over 10% per annum) in industrial demand for power and challenges to power generation (as 47% of power generation is through thermal plants) calls for accelerated investment in the energy sector, as well as access to affordable supply inputs, such as natural gas. Another challenge is transport infrastructure (including ports) which is poor in many parts of the country, especially in the northern region, the main grain basket areas. Disparities in social development across regions also pose challenges for attainment of inclusive growth. The northern regions lag behind in most of the social indicators, especially in health and education.

3.2.3 Private sector development is hampered amongst other factors,6 by the high cost of credit which affects its competitiveness. Ghana has one of the highest interest rate spreads in Africa of over 20%, with bank lending interest rate reaching as much as 29% in 2014. This situation prevails despite Ghana’s financial sector being regarded as well-developed and competitive with 27 commercial banks (14 being foreign affiliates) that enjoy robust financial profitability and capitalization. The high cost of credit is partially attributed to government’s excessive borrowing from commercial banks leading to crowding out of private sector investment. The focus on fiscal consolidation will help to curtail government short-term domestic borrowing. In addition, the government will put concerted effort to addressing critical challenges including: changing the structure of the economy, increasing power generation capacity, creating the capacity and traction to implement structural reforms and judicious implementation of the Medium-Term Debt Management Strategy.

3.3 Consultation and Participation Processes

3.3.1 The GSGDA-II was prepared through a participatory process, involving public and private sector agencies, civil society groups, and Local Government agencies, using the mechanism of Cross Sectoral Planning Groups (CSPGs). Section 15 of the National Development Planning Commission Act 1994, Act 479, enjoins the Commission to establish CSPGs for the preparation of development policies, strategies and plans. In compliance with the Act, the National Development Planning Commission (NDPC) established CSPGs,

6

These include interrelated factors such as inappropriate policies, institutional capacity and infrastructure deficits with respect to access to power, transport, and ICT.

7

consisting of public sector, private sector, civil society, academia, the media, identifiable stakeholders, and individual experts for the thematic areas of the policy framework.

IV BANK SUPPORT TO GOVERNMENT STRATEGY 4.1 Link with Bank Strategy

4.1.1 The PFMPSCSP is linked to the two strategic pillars of the CSP. The emphasis of the programme on improved access to electricity is aligned to the infrastructure pillar, while the focus on PFM is aligned to the governance and accountability pillar. The program is also linked to pillars (ii), (iii) and (iv) of the government medium-term development agenda, the GSGDA II, relating to macroeconomic stability, transparent and accountable governance, and competitiveness of the private sector.

4.1.2 In addition, the operation is closely aligned to the operational priorities of the Bank’s Ten-Year Strategy (TYS), 2013-2022; two of the new Bank’s High-5 institutional priorities (Industrialize Africa and Power Africa); and the three pillars of the Governance Strategic Framework and Action Plan, 2014-2018 (GAP II). For the TYS, the alignment of the operation is with two priority areas namely governance and accountability (the fiscal consolidation and the PFM components of the operation), and private sector development (the component on enhancing the efficiency and competitiveness of the private sector through access to electricity and credit). For GAP II, the operation is linked to the strategic pillars on public sector and economic management, sector governance (energy) and Investment and business climate. Finally, PFMPSCSP is also consistent with the Bank’s Private Sector Development Strategy, 2013-2017 (pillar on investment and business climate). Table 2 (above) presents the strategic objectives and priorities of the GSGDA, CSP7 and PFMPSCSP. 4.2 Meeting the Eligibility Criteria

4.2.1The PFMPSCSP meets the Bank Group’s Programme Based Operations (PBO) eligibility criteria namely,

government commitment to poverty reduction and, inclusive growth, transition to green growth, macroeconomic stability, satisfactory fiduciary risk assessment, political stability and harmonization. The GSGDA II and the Ghana’s Private Sector Development Strategy (PSDS II) provide the foundations for Ghana’s medium term growth, poverty reduction and development agenda. Both are well designed in consultation with DPs and other stakeholders with clearly laid out implementation mechanisms. GOG’s medium-term macroeconomic and financial framework is

viable but high budget deficits pose a fiscal risk as indicated in paragraph 2.2.2. However, the government’s fiscal

consolidation effort and the stable political environment would help to mitigate this risk. With the preparation of the PFM Reform Strategy, a strong foundation is also being laid for comprehensive PFM reforms. The Bank’s operation has been closely coordinated with that of the World Bank and consultations were held with the IMF and bilateral development partners during the appraisal mission. A detailed description of how Ghana meets the eligibility criteria is provided in Annex IV.

7

To better reflect the operational priorities of the Bank Group TYS the initial two pillars of the 2012 CSP (i) improving productivity in Ghanaian enterprises and, (ii) supporting economic and structural reforms aimed at improving the business environment have been re-phrased to read (i) Support for Infrastructure Development and (ii) Support for Improved Governance and Accountability.

GSGDA II: 2014-2017 CSP: 2012-2016 PFMPSCSP: 2015 and 2016 Goal: To build a strong foundation for inclusive and self-reliant economic growth.

Operational Policy Objective: To support the Government’s development and poverty reduction agenda.

GSGDA II Strategic Pillars:(i) Putting people first; (ii) A strong and resilient economy; (iii) Expanding infrastructure; and (iv) Transparent and accountable governance.

The CSP Strategic Pillars: (i) support for infrastructure development; and (ii) support for improved governance and accountability.

The PFMPSCSP Components: (i) Strengthening fiscal consolidation; (ii) Deepening PFM reforms; and (iii) Enhancing efficiency and competitiveness of the private sector (emphasis on energy and access to credit by SMEs). Table 2: Link between the GSGDA II, MTR-CSP and the PFMPSCSP

Strategic Objective: Leveraging Ghana’s natural resource, agricultural and the human endowments for accelerated economic growth and job creation.

Strategic Objective:To promote inclusive growth that generates economic opportunities

8 4.3 Collaboration and Coordination with other Partners

4.3.1 General budget support operations in Ghana were supported up until 2012 by ten multi-donor budget support (MDBS) partners8. The MDBS was a strong policy dialogue forum, based on a common Performance Assessment Framework (PAF) as the harmonization mechanism. The PAF often included benchmarks and indicators monitored annually and assessed collectively. The MDBS platform was a robust forum comprising various stakeholders: Government, Development Partners, NGOs and CSOs, and had over 15 Sector Working Groups (SWGs). The Ghana Field Office (GHFO) led the Heads of Cooperation (HoC) group in 2013, Co-Chaired the MDBS in 2014, and has also chaired a number of SWGs.

4.3.2 However, this robust MDBS platform has not properly functioned over the past two years owing to failure to agree on a joint PAF and the deterioration of the underlying principles on macroeconomic stability. As a result, the envisaged 2014 PAF, expected to underpin 2014 disbursements and 2015 pledges, was not finalized. This development, combined with the deteriorating macroeconomic situation and protracted negotiations with the IMF, resulted in all budget support DPs rolling over their programmed disbursements for 2014 to 2015.In effect, the traditional mechanism of harmonized disbursements by DPs against a common PAF jointly assessed by the MDBS group broke down, and disbursements became subject to individual DP’s decision. At the same time, however, all MDBS partners continue to put enormous emphasis on the importance of Ghana’s commitment to the Partnership Principle. Assessments against these Principles is still required for non-budget support financial assistance to the country. DPs, therefore, agreed that, in the absence of MDBS, policy dialogue around Macroeconomic Stability and PFM in Sector Working Groups (SWGs) should provide the broad platform for policy dialogue between GOG and DPs on the implementation of Ghana’s reform and development agenda.

4.3.3 In addition to the Bank’s ongoing Ghana Institutional Support Project (GISP), the implementation of the proposed PFMPSCSP will be supported by other ongoing Technical Assistance operations and ISPs on fiscal consolidation and PFM reforms funded by IMF, World Bank, EU, Switzerland, and Germany; on Energy by World Bank, EU, Germany, and France; and on access to credit by Germany, France, Switzerland, EU, and World Bank (see Annex II-B).

4.4 Relationship with Other Bank Operations

4.4.1 The Bank Group portfolio in Ghana as at end October 2015 is composed of 19 operations (13 public sector operations for UA 482.1 million and 6 private sector operations for UA 54.0 million), representing an overall commitment of UA 536.1 million. Transport sector accounted for the largest share of the portfolio (30%), followed by agriculture and rural development (19%), energy (17%), social services (13%), private sector finance (10%), water and sanitation (9%) and multi-sector (2%). In accordance with the Bank Group’s strategic orientation, the portfolio is skewed towards infrastructure (i.e. roads, energy and water sectors) at 56% of total commitments. The performance of the portfolio is rated as satisfactory, with an overall rating of 2.3 (on a scale from 0 to 3). The portfolio has one Problem Project (PP) - Rural Enterprises Project. The overall disbursement ratio as at end October 2015 stood at 50.4%.

8

9

4.4.2 The PFMPSCSP has strong links with ongoing Bank operations in Ghana. It will build on the achievements of the 2012 Poverty Reduction and Business Environment Support Loan (PRBESL) by further contributing to the strengthening of PFM and the business environment. The on-going GISP9 will lend an appropriate framework for the implementation of the proposed operation. Fiscal consolidation policy measures will be complemented by ongoing ISP related activities on domestic resource mobilization and integrity of

public resource

management. Similarly, ISP activities aimed at building capacity for the private sector and competitiveness will create synergies with competitiveness reforms to be implemented in the proposed operation. The PFMPSCSP will also facilitate availability of fiscal space in the

budget for road

maintenance that would benefit Bank Group transport projects. The on-going multinational infrastructure projects will complement the proposed program as they will also contribute to improving competitiveness. Completion reports of past GBS (PRSL I-III, and PRBESP) have rated the overall performance of these operations as satisfactory (Annex V). The key lessons learnt from past operations and how they are incorporated into the design of this operation are presented in Table 3 (above).

4.5 Analytical Works Underpinning

4.5.1 The design of the PFMPSCSP benefitted from a number of analytical works and country reports prepared by the Bank, other partners and the Government, including the Studies on Oil and Gas Downstream Activities in Ghana focussing on value addition; and the study on Improving Linkages between Vocational and Technical Institutes and Community Development produced by the Bank. Other documents consulted include Bank’s Project Completion and Supervision Reports, 2013 PEFA, IMF reports, MDBS reports and minutes, as well as GOG’s budget documents and reports. Major findings and conclusions emanating from these analytical works and reports include the followings: (i) Ghana has achieved a strong growth momentum and has made great strides in reducing poverty but has also been confronted with significant macroeconomic risks related to a weak fiscal position and the dependence on exports of three commodities (cocoa, gold and oil); (ii) there is need to pursue further reforms to strengthen PFM Systems and achieve fiscal consolidation; (iii) more effort is needed to enhance economic competitiveness and promote diversification through improvements in the business environment (in particular for SMEs); and (iv) downstream investments in the Oil and Gas Sector are necessary in order to enhance value addition, employment generation, and inclusive growth.

9

The GISP was approved in September 2012 and effective in July 2013. Delays in effectiveness and in recruitment of the Project Manager and Procurement, M&E, and Accountant Officers have resulted in slow disbursement. As of Mid-October 2015, the disbursement rate is 11.5%. But since July 2015 the Project Team is implementing a fast track Procurement Plan that will bring cumulative commitment and disbursement to 60% and 50%, respectively by December, 2015. The GISP closing date is April 2017.

Lessons Learned Actions taken to integrate lessons into the PAR The need to ensure predictability of donor funds to smoothen resource

flow for government development planning.

The proposed budget support loan of UA 75 million designed as a two-series programmatic operation of UA 40 million in 2015 and UA 35 million in 2016 will contribute to predictability of funds during the period 2015-2016.

Importance of credible and realistic prior actions/triggers to facilitate smooth program implementation.

The selection of prior actions and triggers has been done in close collaboration with GOG; and consultations have been undertaken with DPs.

Need for effective forum for policy dialogue and program coordination Although the MDBS platform in Ghana is not functioning as expected, this operation has been coordinated with the World Bank and discussed with development partners’ resident in Ghana. The GHFO is intensifying efforts, in consultation with other development partners, to re-establish a new and effective policy dialogue platform.

Government commitment and capacity to reforms are critical for effective delivery of reform policy actions.

The recent successful negotiation of a three-year ECF with the IMF after four rounds of negotiation, the approval by the World Bank of a Development Policy Credit (DPC) combined with a Policy-Based Guarantee (June 2015), and the satisfactory outcomes of the First Review of the IMF-ECF (August 2015) attesting that Fiscal Consolidation is on track signal GOG’s renewed commitment to undertake critical reforms.

10

V THE PROPOSED PROGRAMME

5.1 Programme Goal and Purpose

5.1.1 The goal of the proposed operation is to support the implementation of the government medium-term development agenda aimed at building a strong foundation for inclusive and self-reliant economic growth. The operational objective is to strengthen fiscal consolidation and PFM reforms in order to restore macroeconomic stability, and enhance private sector-led competitiveness through improved access to electricity and SMEs’ access to finance.

5.1.2 The proposed operation will build on the achievements of the Bank’s previous Institutional and

Budget Support Operations in Ghana in the areas of PFM and business enabling environment (see Annex V). In this context, the Bank has supported GOG’s efforts in reinstating and enforcing budget commitment controls for all the MDAs; establishing the cash management system; consolidating the revenue agencies (VAT, IRS, and Customs) under a single umbrella organization, the Ghana Revenue Authority (GRA); improving the audit functions; as well as in developing the financial sector strategic plan II and the Private Sector Development Strategy (PSDS II).

5.2 Programme Components

Component 1: Strengthening Fiscal Consolidation

5.2.1 Challenges and Constraints:Large fiscal imbalances in recent years fuelled by revenue shortfall, rising wage bill, and high interest payments due to rapidly rising public debt have placed macroeconomic stability at great risk. The high level of fiscal deficit (since 2012) will require sustained fiscal consolidation efforts. Revenue shortfall results from weak revenue forecasting partly due to external shocks and challenges in tax administration. The tax system is basically sound, but it is undermined by reliance on multiple tax treatments in the form of exemptions, special regimes and tax holidays (amounting to about 6% of GDP) thus constraining revenue mobilization. Weak expenditure control results in expenditure overrun and growing domestic arrears. The 2015 Debt Sustainability Analysis (DSA) shows that the country is facing a high risk of debt distress. With both domestic and external debt steadily increasing over the past decade, rising interest payments have become a significant burden on the budget. The rising wage bill has also been a significant source of fiscal risk. Weak management of Human Resources (HR) and unreliable payroll data, together with negotiating pay rise with labour after the approval of the annual budget, render the control of the wage bill difficult. Thus, employee compensation accounted for a significant high 60% of the total non-interest recurrent expenditure and about 12% of GDP in 2014. This situation is unsustainable.

5.2.2 Recent Government Actions: Government has started implementing a number of medium-term measures to deal with these challenges, and put the economy back on the path of sustainable fiscal consolidation and macroeconomic stability. Recently introduced revenue enhancement measures include: imposition of Special Petroleum Tax of 17.5% to bring Ghana’s petroleum taxes more in line with international practice; a VAT increase from 15% to 17.5%; extending special import levy of 1-2% to 2017; implementing VAT on fee-based financial services; extension of the National Fiscal Stabilization Levy of 5%, a 5% flat VAT rate on real estates; and increase in the withholding tax on Director’s remuneration from 8% to 15% after the expiration of the 10-year tax holiday. Tax exemption regime is also being reviewed starting with increase in the free-zones corporate tax from 10% during tax holiday period to 25% thereafter. The fiscal impact of the new revenue measures is estimated at 2% of GDP10. Revenue efficiency measures introduced also include modernization of the Ghana Revenue Authority (GRA), deployment of the Total Revenue Integrated Processing

10