Asset Pair-Copula Selection with Downside Risk Minimization

Full text

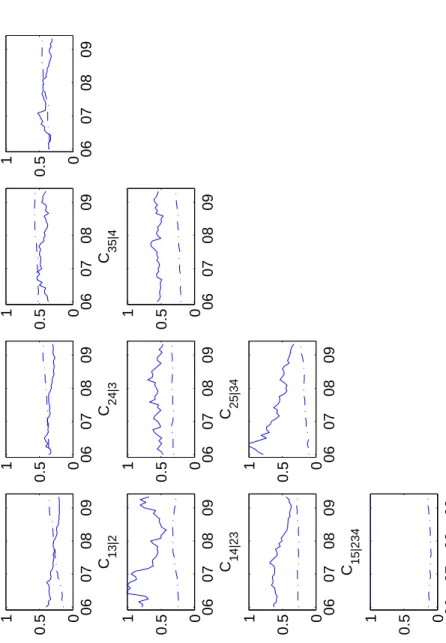

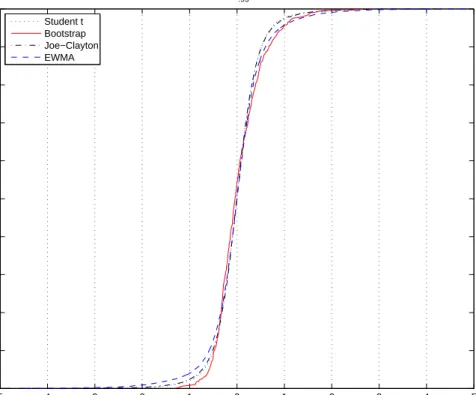

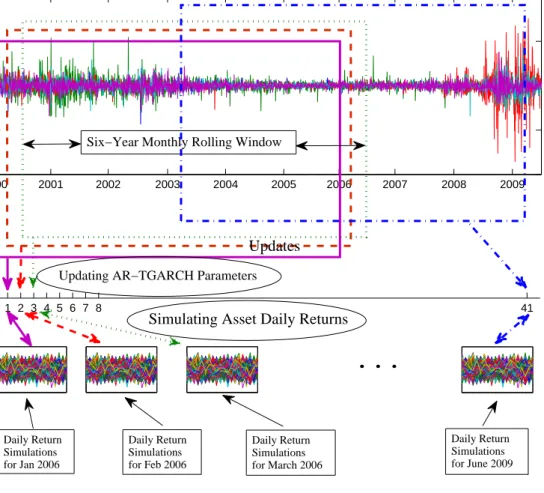

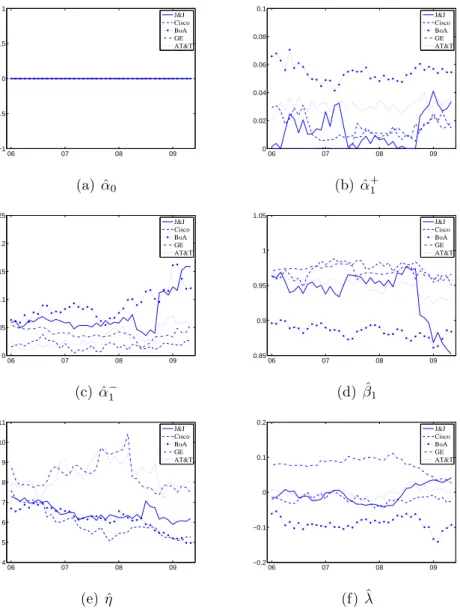

Figure

Related documents

(a) VPD results for copper-rich and silver-rich regions on the braze sample obtained with the three different probe types as seen in Figure 5b VPD results for the same three

One study used the Profile of Mood States test to measure mood levels after listening to the Mozart sonata versus a composition by Philip Glass, “Music with changing parts.”

Quality Control Manager, Genespring NGS, Agilent technologies Targeted Bases with minimum 20X coverage (%) Uniquely aligned bases (%) Bases of reads High QC samples Bases of

Similar evidence has been reported previously (Loesche et al ., 1992 ; Giertsen et al ., 2000) ; nevertheless, the problem that aggregation poses to quantitative culture analyses

The presence of heterogeneous vegetation patterns in constructed wetlands was also analyzed by numerical model to simulate flow, mass transport and contaminant removal in a

During a follow-up meeting with senior management, he presented the BusinessManager Significance Report which showed the bank their net profit from BusinessManager, the percentage of

Since polymorphism is to be applied to HTML documents, CSS files, and JavaScript scripts it was defined that one tool should be crafted to handle each type of file and also