Effect of Corporate Governance on Earnings Management of Commercial Banks in Nigeria

Full text

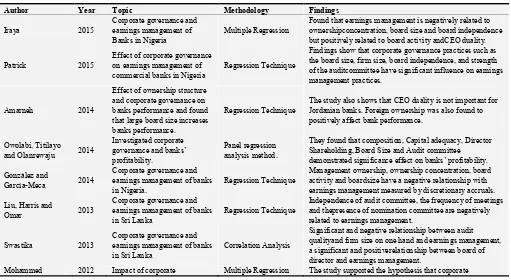

Figure

Related documents

Variable Symbol Mean Median Minimum Maximum St.. Ownership concentration median was also 81%. Ownership concentration minimum and maximumwere respectively 9% and

The findings revealed that, all the variables have significant effect on earnings management of banks except for women directors and board size under the low

a) Determine the extent to which bribery affects the board of directors’ functions in selected area offices of deposit money banks in Enugu State, Nigeria. b) Ascertain the extent

The study shows that the mergers and acquisitions in the banking industry have significantly influenced profitability of commercial banks, earnings per share and

Keywords- Accrual earnings management, board characteristics, corporate governance, Jordan, ownership structure, real earnings management.. Paper type-

Narcissism and education level of CEOs have a positive impact on accrual earnings management, while CEO’s gender and citizenship negatively affect accrual earning

Abstract: This paper aims at investigating the influence of corporate governance mechanisms (board independence, ownership concentration and disclosure) on

Using earnings management and abnormal accruals as indicators of discretionary behavior, our results show that both debt and ownership concentration reduce the managers’