International Journal of Emerging Technology and Advanced Engineering

Website: www.ijetae.com (ISSN 2250-2459,ISO 9001:2008 Certified Journal, Volume 3, Issue 9, September 2013)

187

Economic Impact of Demand-Side Energy Storage System in

Electricity Markets

Rekha Swami

Department of Electrical Engg., Govt. Engg. College Bikaner, Rajasthan, India

Abstract— In the electricity market, market clearing price (MCP) changes depending upon the demand profile. The MCP is high in high-demand time periods and lower during off-peak periods. Due to this volatility of MCP, Load service entities (LSEs) and their customers face a risk of higher cost. Demand-side management (DSM) is an efficient method to reduce MCP at peak periods and is helpful in load leveling. One of the DSM techniques is to use energy storage (ES) systems on demand-side in order to change demand profile. This paper evaluates the influence of demand-side energy storage on MCP when the operating pattern of ES system is governed by LSE with consideration of MCP variations. The market dispatch problem in the pool-based day-ahead electricity market is formulated so as to maximize the social welfare of market participants subject to operational and security constraints. The Proposed methodology is applied on IEEE 30-bus system to demonstrate the effect of energy storage system on MCP.

Keywords— Demand-side management, energy storage

system, market clearing price, social welfare.

I. INTRODUCTION

In the pool-based electricity market, the ISO collects hourly/half-hourly supply and demand bids from generator-serving traders (GSTs) on behalf of gencos and load-serving entities (LSEs) on behalf of pool consumers, respectively. All the supply bids are then aggregated and sorted by price in ascending order to create the aggregate supply curve and the ranking of demand bids are done in decreasing order of price to create the aggregate demand curve. The intersection of these two curves gives the market clearing price (MCP) and the amount of power to be transacted. The MCP is high in high-demand periods because power companies operate extra generators to meet peak demand, and therefore recover the additional costs by increase in prices, and MCP is lower during off-peak periods. Due to this volatility of price LSEs and their customers face a risk of higher cost.

Demand-side management (DSM) is an effective method to protect LSEs and their customers from such variation of market prices and can be helpful to reduce congestion. One of the DSM techniques is to install energy storage (ES) systems on demand-side. Electric energy storage system is capable to store electricity or energy to produce electricity and releasing it for use during other periods when the use or cost is more beneficial.

Various technologies of ES system include redox flow batteries, sodium sulfur batteries, lead acid batteries,

flywheels, pumped hydroelectric storage, and

compressed air energy storage (CAES). The use of conventional lead batteries are avoided due to their short service life and new types of energy storage (NaS batteries, redox flow batteries, etc.) systems are used for this purpose. These new devices have number of advantages over conventional lead batteries, like it is easy to manage them and it is possible to use them longer time than lead batteries even if they are used repeatedly. The installation of energy storage systems on the customer side offers the possibility of load leveling as well as also provides compensation for supply failures. By introducing energy storage on the customer side, an efficient utilization of generators and transmission lines is possible, in addition it also provides cheaper purchasing prices for LSEs. The use of energy storage systems by customers also shifts the electricity demand peak and has an effect on electricity demand in the market overall. This change in electricity demand in the market overall, results a changes in the market price and the market price drops during peak load periods. As a result, cost reductions can be conceived even for LSEs that do not use storage systems.

II. LSE’S BIDDING STRATEGIES

Fig. 1 shows the power market model, in which LSEs make contracts with customers and bid for power in the electricity market at prices determined by their bidding strategies and the customers’ demand. The LSE can increase or decrease demand depending upon the market prices. The LSEs’ bidding strategies can be made more flexible by installing energy storage on the demand side.

[image:1.595.312.544.622.745.2]

Fig.1. Power market model

G

G

G

Electricity Market

LSE

LSE

LSE

Customer

Customer

International Journal of Emerging Technology and Advanced Engineering

Website: www.ijetae.com (ISSN 2250-2459,ISO 9001:2008 Certified Journal, Volume 3, Issue 9, September 2013)

188

The influence of energy storage system on MCP can be examined Using the market model given above the MCP variations is examined under the various bidding strategies of LSE, in which ES system operation may be controlled by LSE:

(1) The LSEs bid for power required by customers

in the market without energy storage,

(2) The LSEs bid for power required by customers

with energy storage installed at customer side, (3) The LSEs control the operation of the energy

storage depending on the MCP, and (4) A mixed pattern of (2) and (3).

(1)

(3)

(4)

(2)

es di P , max , di P e.ESkw Fig.2. Bidding strategies of LSE A. Without Energy storage: In this case a customer has no energy storage and the bid amount is equal to the customer’s demand during each hour of the scheduling period. nt di t n di P P , max , , (1)

B. With Energy storage(fixed operation pattern: ES_FX): In this case it is assumed that a customer has energy storage, and its operation pattern is determined by the customer itself and the bid amount is set to the customer’s demand nt es di

P

,, . t n es di t n di P P ,, , The bid amount in the peak periodt

p

t

and the off-peak periodt

op

t

are described by the following equations kw t n di t n es di P ES P p ,P max , , , (2)kw t n di t n es di P ES P o p ,o p max , , , (3)

Where kw ES (KW) is the energy storage output and

is the inverter efficiency during charging and discharging period. In the peak period fixed amount of energy is discharged through ES system and the energy that is discharged during peak period is restored to the ES system during off-peak periods. C. Energy storage installed (flexible operation pattern1: ES_FL): While in case 2, fixed amount of energy is discharged through ES system during peak periods, here in this case the LSE controls the operation pattern of the customer’s energy storage. The relationship between the bid price and bid amount are shown in (4) and (5). In peak periods, the energy storage in ES system is discharged depending upon the market price ntp MCP , means more energy is released if market price is higher as compared to the periods where prices are lower, whereas in off-peak periods the power discharged during the peak period is restored to ES system. p p p p nt t n i kw t n di t n di MCP b ES P P ,,max , , , (4)nt kw di t n di P ES P o p ,o p max , , (5)

D. Energy storage installed (flexible operation pattern2: ES_FL): In this case like in case 2, the LSE controls the operation pattern of the customer’s energy storage. This strategy is a combination of cases (2) and (3), as indicated by (6) to (9),. In the peak period, the energy storage is discharged independent of the market price until a certain part e

(

1

)

of its capacity is reached. After that ES system discharge power depending upon the price. Thereafter, strategy (2) is used in which ES system discharge fix amount of power. In the off-peak period, the power discharged during the peak period is restored. So during peak period: if n,tp 0 MCP then kw t n di t n di P e ES P p ,p max , , (6)else if p p nt i t n b e MCP , (1 ) , 0 then kw t n t n i kw t n di t n di MCP e ES b ES P P p p p p , , , max , , (7) else if p p ntp i t n t n i MCP b b e) , , , 1 ( kw t n di t n di P ES P p ,p max , , (8)

else kw t n di t n di P ES P o p ,o p max , , (9)

P

ri

ce

(

$

/M

W

h

)

International Journal of Emerging Technology and Advanced Engineering

Website: www.ijetae.com (ISSN 2250-2459,ISO 9001:2008 Certified Journal, Volume 3, Issue 9, September 2013)

189

III. PROBLEM FORMULATION

The objective function for the optimization problem can be expressed as maximize the social welfare i.e. the difference of benefit of consumers and the overall cost of active and reactive power production of suppliers for the complete scheduling period of 24h, subjected to power balance equality constraints, Line flow inequality constraints and limits on variables, in each scheduling sub-interval.

Max Social Welfare =

241 1 1 1

, , , , , , ) ( ) ( ) ( t N n D i G i t n gi t n i t n gi t n i t n RSi t n

i P C P C Q

B

(10)

The benefit function , ( n,t) RSi t n

i P

B of ith DistCo at nth

bus during tth sub-interval can be written as

dint

t n i t n RSi t n

i P b P

B , ( , ) , ,

(11)

Where b d i is the slope of benefit curve of ith DistCo.

The real power generation cost function of each generator is modeled by a quadratic function

where

a

gin,t,b

gin,tandc

gin,t are predetermined coefficients2 , , , , ) ( )

( nt

gi t gi t n gi t gi t gi t n gi t n

i P c b P a P

C (12)

The reactive power cost of generators is also known as opportunity cost. From the capability curve we can see that increase in reactive power output of a generator will reduce its active power generation capability, and the corresponding loss to generator is called as an opportunity cost. From the approximated capability curve, the reactive power cost of each GenCo can be modeled as

, max , max 2 , 2

, , ) ( ) ( ) ( )

( gi gint

t n i gi t n i t n gi t n

i Q kC P C P Q

C

(13)

Where k is the profit rate of active power generation, usually lies between 5 to 10%.

IV. CONSTRAINTS

A. Power Flow Constraints: The power flow equations as determined by the kirchhoff’s law, for all buses during all scheduling sub-intervals are given by

n n n

G

i iD iD p N

np t p t n np t p t n t n RSi t n Ti t n

gi P P VVY

P, , , cos( ) 0

(14)

n n n

G

i i D iD pN

np t p t n np t p t n t n RSi t n Ti t n

gi Q Q VVY

Q, , , sin( ) 0

(15)

B. Constraint on Constant power factor of consumers:

The real and reactive power consumption at any bus

ith DistCo at nth bus during tth sub-interval are tied together by constant power factor.

t i t n RSi t n Ti t n RSi t n

Ti Q P P

Q, , ( , ,)tan (16)

C. Constraint on Energy Consumed during Entire Scheduling Period under PRDS: Energy consumed by the PRDS demand at any ith DistCo during entire scheduling period should be less than the maximum specified value.

T t RSi tRSi t E

P (17)

D. Transmission Line Loading Limit: Transmission line flows are bounded by their thermal limits for short

lines and stability limits for long lines

max ) , , , ( l t q t p t q t p t

l V V S

S (18)

E. Limits on Variables: Real and reactive power of GenCo, price taking and PRDS demand of DistCo and voltage at various buses have their minimum and maximum limits ; max , min gi t n gi gi P P

P

; max , min gi t n gi

gi Q Q

Q

t Ti t n Ti t

Ti P P

Pmin, , max,

; t RSi t n RSi P

P , max,

0

min max

n t n

n V V

V (19)

F. Additional Constraint Due to Capability Curve: The apparent power generated by the GenCo should lie within the boundaries of capability curve and mathematically can be written as

, 2 , 2 max 2

) ( ) ( ) ( gi t n gi t n

gi Q S

P (20)

The proposed market dispatch problem with the objective functions of social welfare maximization and subject to operational and security constraint is a non-linear programming problem and is solved by using Sequential Quadratic Approach in AMPL.

V. RESULT

International Journal of Emerging Technology and Advanced Engineering

Website: www.ijetae.com (ISSN 2250-2459,ISO 9001:2008 Certified Journal, Volume 3, Issue 9, September 2013)

[image:4.595.314.546.146.506.2]190

Table 1

Power flow limits on congested lines

Line 1-3 4-12 28-27

Power flow limit

(MVA) 65 30 17

The maximum real and reactive power demand of DistCos at buses 2, 5, 7, 8, 12, 21 and 30 are varied during the entire scheduling period of 24 hr. Power factor of DistCo during any period is determined from the maximum real and reactive power demands during that period. The benefit bid of a DistCo is the maximum price that disco is willing to pay for its consumption, For this 30-bus system, it is considered that DistCo at all buses are willing to pay 80 $/MWh (at maximum) for its consumption.

The purpose of this study is to examine the price variation with different operation pattern of the demand side energy storage systems, controlled by LSE. When determining the operation patterns, we assumed for simplicity that the output capacity of the energy storage is equal to the 5% of the maximum demand at bus 30, while supporting 12-hour discharge. Since the maximum customer’s demand during entire scheduling period is 10.4 MW so capacity of ES system is equal to 5% of 10.4

MW i.e. 0.52 MW.

[image:4.595.53.276.146.193.2]

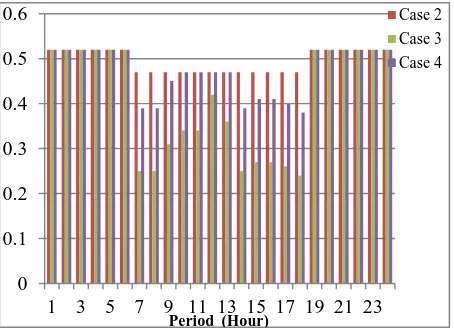

Fig. 3. Charging and Discharging Amount of ES System under three cases

Fig. 3 shows the charging and discharging pattern of ES system. The ES system is charged to its full capacity during off-peak periods (t = 1-6 & 19-24). Therefore, as shown in Fig. 5.4.1, in cases (2), (3) and (4) the charging amount of ES system remain same throughout the off-peak period and during off-peak periods (t = 7-18) the discharged amount of power is high in case (2) and case (4), while the ES system is not always operated at maximum output in case (3).

Table 2

System demand in MW in four cases

period (Hour)

Without ES System

With ES System

With ES (flexible operation pattern 1)

With ES (flexible operation pattern 2)

1 6.2 6.72 6.72 6.72

2 6.6 7.12 7.12 7.12

3 6.9 7.42 7.42 7.42

4 7.5 8.02 8.02 8.02

5 8.2 8.72 8.72 8.72

6 8.9 9.42 9.42 9.42

7 9.2 8.73 8.95 8.81

8 9.5 9.03 9.25 9.11

9 10.2 9.73 9.89 9.75

10 10.3 9.83 9.96 9.83

11 10.2 9.73 9.86 9.73

12 10.4 9.93 9.98 9.93

13 10 9.53 9.64 9.53

14 8.6 8.13 8.35 8.21

15 9.2 8.73 8.93 8.79

16 9.8 9.33 9.53 9.39

17 9.5 9.03 9.24 9.1

18 8.7 8.23 8.46 8.32

19 7.5 8.02 8.02 8.02

20 6.6 7.12 7.12 7.12

21 6.5 7.02 7.02 7.02

22 5.5 6.02 6.02 6.02

23 5.6 6.12 6.12 6.12

24 5.2 5.72 5.72 5.72

From Table 2 it can be concluded that in case (1) without ES system, demand is equal to the maximum demand of the customer in each hour of the scheduling period. In case (2) when ES system is installed on demand-side, then demand is reduced during peak periods due to the discharge of energy stored in ES system, while during off-peak periods demand is increased because the amount of power that is discharged through ES system during peak periods is restored to the ES system in off-peak periods. Similarly in cases (3) and (4) demand is decreased during peak periods and increased in off-peak periods. From the Table 2, it can be concluded that reduction in demand is more in cases (2) and (4) as compared to case (3).

0 0.1 0.2 0.3 0.4 0.5 0.6

1 3 5 7 9 11 13 15 17 19 21 23

Case 2 Case 3 Case 4

[image:4.595.50.277.438.602.2]International Journal of Emerging Technology and Advanced Engineering

Website: www.ijetae.com (ISSN 2250-2459,ISO 9001:2008 Certified Journal, Volume 3, Issue 9, September 2013)

[image:5.595.51.280.129.301.2]191

Fig. 4. LMP of real power at bus 30 under four cases From Fig. 4 it can be seen that in case (1) without ES system market prices are higher in peak periods (t = 7-18) and lower in off-peak periods (t = 1-6 & 19-24). In addition, table indicates that during peak periods market prices are reduced in case (2), (3) and (4) as compared to case (1). This can be explained by the fact that the ES discharge power during peak periods and the power discharged during peak period is stored to ES system in off-peak periods, this will results in balance in load profile and will decrease the market prices in peak periods, while there is little bit increase in market prices in the off-peak periods. Since under case (3) ES system is not always operated at maximum output, therefore decrease in market prices in case (2) and (4) are more as compared to case (3).

VI. CONCLUSION

In this paper, the variations in market clearing price are evaluated when an energy storage system is installed on the demand-side. This paper also proposed several bidding strategies for load service entities, in some of which LSE can control the operating pattern of demand-side energy storage.

From the results it is found that prices in peak-demand periods can be reduced due to the load leveling effect of energy storage and also the variations in the market clearing prices can be reduced by using appropriate bidding strategies.

REFERENCES

[1] Loa Lei Lai, 2012. Published by John Wiley & Sons Ltd , Power System Restructuring and Deregulation.

[2] Shahidehpour M.,Yamin H. and Li Z., 2002, Published by John Wiley & Sons Ltd, Market Operation in Electric Power Systems. [3] Kirschen D.S., May 2003, Demand-side view of electricity

markets. IEEE Trans. Power Syst. , vol. 18, no. 2, pp 520-527. [4] Albadi M.H. and El-Saadany, Nov. 2008. A summary of demand

response in electricity markets. Elect. Power Syst. Res., vol. 78, no. 11, pp. 1989-1996.

[5] Strbac G. and Kirschen D., Feb 1999. Assessing the competitiveness of demand side bidding. IEEE Trans. Power Syst. , vol. 14, no. 1, pp 120-125.

[6] Walawalkar R., Apta Jay, Manicini R. .Economics of electric energy storage and regulation in New York. Carnegie Mellon Electricity Industry Centre Working Paper CEIC-06-04.

[7] Furusawa K. Sugihara H, Tsuji K, Mitani Y. 2005. A study of economic evaluation of demand-side energy storage system in consideration of market clearing price. IEEJ Trans PE, vol. 125, pp. 1147-1158.

[8] Singh K., Padhy, Sharma J.D., Jan 2010. Social welfare maximization considering reactive power and congestion management in the deregulated environment. Elect. Power Comp. Syst., vol. 38, no. 1, pp. 50-71.

[9] Dai Y., Ni Y. X., Wen, Z.X. Han, F.F. Wu, Jan 2001. A study of reactive power marginal price in electricity market. Elect. Power Syst. Res., vol. 57, no. 1, pp. 41-48.

[10] Furusawa K, Sugihara H, Tsuji K, 2009. Economic Evaluation of demand-side energy storage systems by using a multi-agent based electricity market IEEJ Trans PE, vol. 167, pp. 36-44.

[11] Zimmerman R. D., Murillo-Sanchez, 2005. MATPOWER-A MATLAB™ power system simulation package,. [Online]. Available: http://www.pserc.cornell.edu/matpower/.

0 10 20 30 40 50 60 70 80

1 3 5 7 9 11 13 15 17 19 21 23 Case 1 Case 2 Case 3 Case 4

Period (Hour)

L

M

P

o

f

R

ea

l

P

o

w

er

,

$

/M

W