Featuring Insights on ...

Q3 2013

Underwritten in part by

Bank of America Merrill Lynch

U.S. Bank

Purchasing Cards

Working to Simplify the Procure-to-Pay Process

The Increased Use of Purchasing Cards

Purchasing Card Usage by Company Size

Benefits of Purchasing Card Programs

Purchasing Card Road Blocks

Electronic Payment Automation Goals

Purchasing Card Success Factors

Types of Purchasing Cards

Executive Summary ...1

Purchasing Card Market Overview ...2

Benefits of Purchasing Cards ...5

Purchasing Card Road Blocks ...7

Automation Goals Behind Electronic Payments ...10

Purchasing Card Program Incentives ...14

Purchasing Card Management Functional Map ...16

Purchasing Card Success Factors ...19

Different Types of Purchasing Cards ...20

State of Current Purchasing Card Market ...23

Crafting a Purchasing Card Strategy ...26

Bank of America Merrill Lynch ...27

Bank of America Merrill Lynch Case Study ...32

U.S. Bank ...35

U.S. Bank Case Study ...41

Selecting a Purchasing Card Issuer ...43

Final Thoughts ...46

Research Methodology ...46

About PayStream Advisors ...46

© 2013 PayStream Advisors, Inc | www.paystreamadvisors.com | info@paystreamadvisors.com

Executive Summary

PayStream Advisors in conjunction with NAPCP, the Professional Association for the Commercial Card and Payment Industry, is pleased to publish the 2013 Purchasing Card report. This report provides a comprehensive look at the past two years and reveals Purchasing Card (P-Card) trends, as identified by finance and procurement professionals. Consistent with the 2012 Purchasing Card report, the adoption of P-Card programs and spending has continued to increase, as more companies transition away from paper checks in an effort to streamline their purchase-to-pay (P2P) process. Survey respondents reporting they currently use P-Cards increased 5 percent, from 64 percent in 2012 to 69 percent in 2013. Data from RPMG P-Card Benchmarking Survey reveals that annual purchasing card spending in North America has increased from $196 billion in 2011 to $229 billion in 2013.

Key drivers of increased P-Card usage is the convenience of swiping a card over carrying cash and processing a receipt, rebates earned for high volume card use, incentives from P-Card issuers and lower processing costs. In an effort to reduce processing costs, more organizations are migrating away from paper-based check processing to P-Card transactions. When check payments are switched from the traditional purchase order (PO) driven acquisition process to a P-Card, there is a cost savings of $74 per transaction. This can translate to a considerable reduction in processing costs when used to purchase more goods and services. RPMG Purchasing Card Benchmarking Survey reports that P-Card use in North America generates an estimated $44 billion in cost savings per year. A Purchasing Card is a type of commercial card that companies use to simplify the P2P process. A P-Card allows companies to tap into the existing credit card infrastructure and make electronic payments (ePayments) for business expenses. A P-Card is a charge card, similar to a consumer credit card; however, unlike consumer credit cards, companies must pay the card issuer in full each month. P-Cards help companies manage risk and expense and they provide complete control and visibility into purchasing. P-Card programs provide companies with a complete view of how and where procurement dollars are spent, along with the ability to view company-wide spending patterns. This report covers different types of Purchasing Cards, including Corporate Travel Card, One Card, Fleet Card, Ghost Card, Virtual Card, and Single-Use Card. In addition to Purchasing Card products, this report includes P- Card solutions offered by Bank of America and U.S. Bank.

PayStream Advisors and NAPCP have developed this report titled Purchasing Cards: Working to Simplify the Procure-to-Pay Process, for finance professionals who are currently contemplating the adoption of a P-Card program or have a program in place that is currently underperforming. This report is based on the responses of more than 200 finance, treasury, procurement and accounting professionals polled in PayStream’s 2013 Electronic Supplier Payments survey. For more information on this and other research reports available from PayStream Advisors, visit PayStream’s Research Library.

Purchasing Card Market Overview

Purchasing Cards are utilized to simplify the P2P process and improve efficiencies. When compared to traditional PO payment methods, P-Cards generate significant administrative and transactional cost savings, which is currently driving the annual 10 percent P-Card growth rate.

PayStream and NAPCP survey results reveal that P-Card usage continues to increase, up 5 percent from 64 percent in 2012 to 69 percent in 2013. The number of survey respondents reporting they are currently evaluating the implementation of a P-Card program increased from 5 percent in 2012 to 9 percent in 2013, and respondents reporting they do not use P-Cards and have no plans to implement a P-Card program decreased from 31 percent in 2012 to 22 percent in 2013, see Figure 1. The good news is that the trend is moving in the right direction. Companies are writing fewer checks and utilizing P-Cards for small, medium and large transactions.

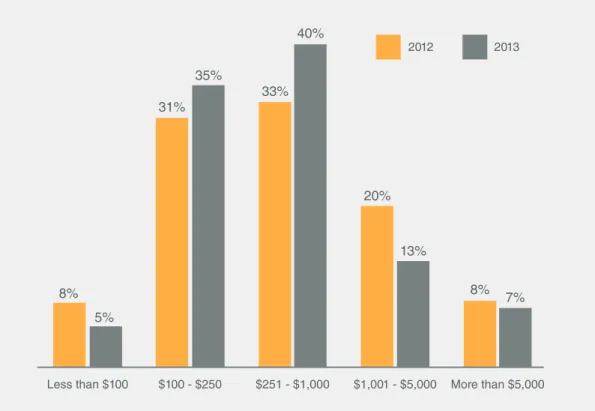

In the past, P-Cards were utilized for small dollar transactions, in an effort to avoid cutting checks for small purchases. However, more companies are now expanding the use of P-Cards. The 2013 Electronic Supplier Payments survey found that 40 percent of survey respondents report that the average value of transactions processed using P-Cards is between $251 - $1000, up from 33 percent in 2012, see Figure 2.

Figure 1 Utilization of Purchasing

Cards

P-Card usage continues to increase.

Evaluating the implementation of a P-Card program

5% 9%

We do not use P-Cards and have no plans to implement one

31% 22%

Currently using P-Cards

64% 69%

© 2013 PayStream Advisors, Inc | www.paystreamadvisors.com | info@paystreamadvisors.com P-Cards provide an efficient, cost-effective method of purchasing and paying for small-dollar as well as high-volume purchases. P-Card programs are used as an alternative to the traditional purchasing process and can result in a significant reduction in the volume of POs, invoices and checks processed. P-Cards can be used whenever a PO, check request, or petty cash would have been processed and with any vendor that accepts credit cards.

P-Card Usage by Company Size

To identify the leaders in P-Card adoption, PayStream analysts classified companies that participated in the survey based on annual revenues. Organizations that had less than $500 million in revenues were classified as small, those with revenues between $500 million and $2.5 billion were classified as medium, and companies with revenues over $2.5 billion were categorized as large.

Fifty percent of survey participants were from small companies, 31 percent were from medium companies, and the remaining 19 percent were from large companies.

Figure 2 Average Value of Transactions Processed Using P-Cards More companies are paying for higher ticket priced items with P-Cards. 8% 5% Less than $100 $100 - $250 31% 35% 33% 40% $251 - $1,000 20% 13% $1,001 - $5,000 8% 7% More than $5,000 2012 2013

Large companies continue to lead the pack in P-Card adoption, with 85 percent of survey respondents from large companies reporting they currently have a P-Card program in place. Nearly three-quarters (73 percent) of medium companies report they have a P-Card program and 62 percent of small companies report the same, see Figure 3. More small and medium enterprises (SMEs) are now utilizing P-Cards in an effort to rein in spending and reap the rewards of P-Card programs, including rebates.

Figure 3 Adoption of Purchasing

Card Programs by Company Size

Large companies continue to lead the pack in P-Card adoption. 85% Over $2.5 Billion (Large) 73% $500 Million - $2.5 Billion (Medium) Less than $500 million

(Small) 62%

© 2013 PayStream Advisors, Inc | www.paystreamadvisors.com | info@paystreamadvisors.com

Benefits of Purchasing Cards

The cost of utilizing a paper-based P2P process that includes a requisition, PO, invoice and paper check payment is the same, whether the purchase is for a pen that costs $1.25 or for a software program that costs $10,000. For low-priced items, the processing cost often exceeds the value of the item being purchased.

The attraction of a P-Card program is the automation and process efficiency it brings to both the buyer and supplier. On the buyer side, the convenience of a P-Card program for small items, where it is difficult to justify the high overhead of using requisitions, POs, approvals, matching and settlement by check through the AP process, is the number one benefit. By simply using a P-Card for small items, companies can shave a lot of overhead from the process and provide the convenience of simply swiping a card. Further increasing the attraction of P-Cards is the rebates that buyers can obtain from the P-Card provider. Rebates are based on the dollar amount spent on the card, and can add up to significant savings. PayStream attributes the increase in the average value of transactions processed using P-Cards to the fact that companies are purchasing higher-priced items with P-Cards to streamline the traditionally paper-laden P2P process, which results in time and cost savings and to reap the rewards of rebates. Additional buyer benefits of P-Card programs include:

» Convenience of purchasing without a PO – reduce cycle time of purchasing transactions

» Increased efficiency through automated payments is a result of utilizing P-cards as a strategic form of payment in AP on high priced items and B2B services

» Increased employee satisfaction and reduced manual labor hours – payment requests, petty cash and personal funds are eliminated » Simplified purchasing and payment process

» Lower overall transaction processing costs per purchase » Increased visibility into spending patterns

» Ability to set and control purchasing dollar limits – restrict maverick spend » Ability to control purchases to specific merchant categories and vendors » Receipt of rebates from the purchasing card provider based on dollar

volume of total purchases » Expedited delivery of goods » Better pricing on goods » Reduction in paperwork

Purchasing cards also benefit suppliers that accept P-Cards for payment. P-Card benefits to suppliers include:

» Cost reductions, including the elimination of invoice creation, invoice handling and mailing costs, depositing payments and invoice collection activities

» Lower risk of non-payment

» Expedited payments through electronically deposited funds » Improved cash flow through faster receipt of payments » Customer satisfaction

Survey results reveal that the number one benefit of P-Card programs remains increased convenience for employees at 75 percent, up from 72 percent in 2012. Rebates and incentives from P-Card issuers ranked second at 63 percent, see Figure 4. It’s interesting to note the change in the number of respondents reporting the reduction in procure-to-pay cycle time – up to 45 percent in 2013, from 37 percent in 2012. This 8 percent increase reveals that more P-Card users are witnessing the benefits of reducing the procure-to-pay cycle time, resulting in more on-time payments and rebates.

Figure 4

Benefits of Purchasing

Card Programs

Convenience ranks as the

number one benefit of

P-Card programs for the second consecutive year.

Float / ability to increase days payable outstanding (DPO)

34% 25%

Rebates and incentives from p-card issuers

67% 63%

12% 7%

Improved compliance with contracts / purchasing policies etc.

Lower processing costs 56%

50% Reduction in procure-to-pay cycle time 37% 45% Increased convenience for employees 72% 75%

Reduction in maverick spend 10%

7% 6% 3%

Ability to negotiate better pricing with vendors

© 2013 PayStream Advisors, Inc | www.paystreamadvisors.com | info@paystreamadvisors.com

Purchasing Card Road Blocks

The primary reasons 22 percent of survey respondents do not have a Purchasing Card program in place include:

1. Internal Resistance to Change – The 2013 survey results reveal that internal resistance to change (26 percent), down from 27 percent in 2012 is the primary reason companies have not implemented a P-Card program, see Figure 5. In an effort to break down the barrier of internal resistance to change, change management champions must clearly identify the tangible benefits of P-Card programs and communicate them efficiently.

2. Security Concerns – This road block tied for second place at 21 percent. P-Card security concerns can be easily alleviated by establishing and maintaining a P-Card program that is carefully designed to prevent fraud and misuse. This includes approval levels, reporting requirements and internal audits, see Figure 6. Rigorous controls can be pre-set by companies to prohibit rogue spending and to steer buyers to preferred suppliers to maximize discounts and rebates. Cards can be subject to a wide variety of controls, including:

» A limit on transaction size – e.g., no more than $100 can be spent on any one transaction.

» A limit on daily, weekly or monthly transactions – e.g., no more than three card transactions will be per permitted in one day.

» A limit on the value that can be charged in a given day, week or month – e.g., no more than $250 per day can be charged to certain employee cards.

Figure 5 Primary Reason Organizations Do Not Use Purchasing Cards

Internal resistance to change ranks as the number one road block to P-Card adoption.

26% Internal resistance to change

21% Concerned about security

16% Suppliers do not accept cards

21% Difficult to integrate with

AP systems

16% Other, please specify

» Blocking certain merchant categories where the card should never be used – e.g., no charges will be accepted for purchases at jewelry stores or casinos.

If an employee presents a P-Card for a transaction that violates any

pre-determined restrictions the transaction is denied and the company can be notified of card misuse. Since the transaction is denied there is no sale and no abuse. Various employees throughout a company will be expected to make different kinds of purchases and charge different amounts. For example, a buyer in a procurement department can have high limits on their P-Card, while a clerk in the mail room can have low limits. Card restrictions can be adjusted for each card holder by card number. A company administrator can easily add, remove or adjust card restrictions online.

3. Difficult to integrate with AP systems – Nearly one-quarter (21 percent) of 2013 survey respondents report this stumbling block has prevented them from adopting a P-Card program. They are concerned about the issue of charging purchases to the correct department, project or other accounting category. There are a number of techniques that companies can implement to ensure the purchased products are coded correctly.

Figure 6 Mechanisms Organizations

Employ to Protect Against Purchasing Card Fraud and Misuse

Requiring receipts for purchases ranks as the top tool used to prevent fraud and misuse.

81% Define card spending limit and

/ or individual transaction limit

64% Have a commercial card administrator

for training and monitoring usage

66% Card holder agreements

that employee signs

83% Require receipts for purchases

75% Conduct audits of compliance with

card usage policies and procedures

68% Merchant Category Code

(MCC) blocking

27% Blocking specific vendors by using

preferred supplier lists (PSL) 0% We don’t use any controls

© 2013 PayStream Advisors, Inc | www.paystreamadvisors.com | info@paystreamadvisors.com Employee cards can be assigned a particular accounting category for which

that employee is most likely to buy. On the off chance the employee purchases a product outside that category, the employee can manually override the default accounting code and easily enter a different accounting code. This can quickly be done online. The system then automatically applies all that cardholder’s purchases for that month to the correct accounting categories. Companies can also issue multiple cards to persons who would buy for multiple accounting categories. The card used would depend on the accounting category that the purchase would fall under.

Another option is for companies to utilize ghost cards. A ghost card is assigned to a particular vendor, rather than to an employee. When an employee needs to purchase something from that vendor, they would simply make the purchase online, call, email or visit the vendor in person. If the vendor sells for different accounting codes, the vendor would collect the correct accounting information at the time of the sale and attach it to the record that would be reported back through the card network and the issuing bank, and it would be applied automatically to the correct accounting category.

Automation Goals Behind Electronic

Payments

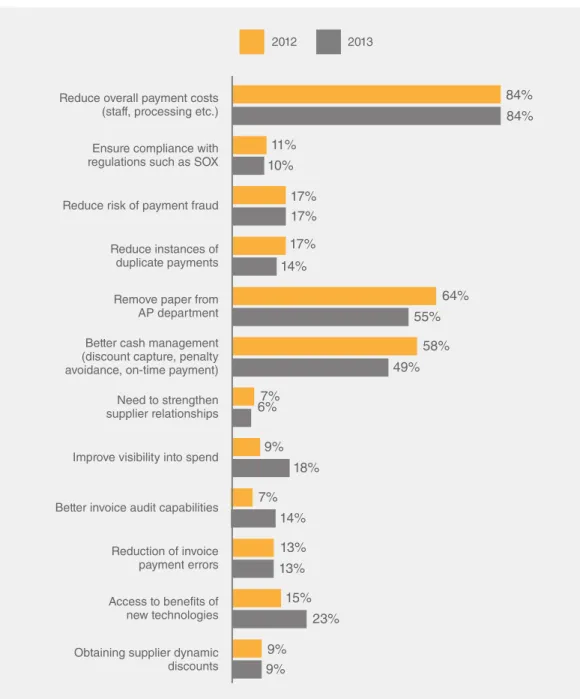

In an effort to overcome challenges in the payment process such as high processing costs, missed discounts and late payments, see Figure 7, demand for electronic payments (ePayments) continues to increase.

In 2013, 72 percent of finance professionals surveyed by PayStream reported they are actively seeking to increase their company’s use of electronic supplier payments, including P-Card payments to streamline the P2P process. In 2013, 73 percent of those polled reported they were writing fewer checks – up from 68 percent in 2012. In addition, 53 percent reported an increase in P-Card transactions in 2013, up from 48 percent in 2012, see Figure 8.

Figure 7 Challenges Faced in the

Payment Management Process High processing costs

ranks as the top challenge.

54% High processing costs

49% Missed discounts

41% Late payments

24% Lack of payment visibility

23% Duplicate payments

5% Loss from fraud

© 2013 PayStream Advisors, Inc | www.paystreamadvisors.com | info@paystreamadvisors.com Key drivers leading to the increased demand for electronic payments are a desire to reduce P2P transaction costs, a push to eliminate paper, and a desire for better cash management, see Figure 9.

Figure 8 Electronic Payments Continue to Increase Survey respondents report P-Card transactions increased 53 percent.

Increased Stayed the Same Decreased

5% 23% 73% 73% 24% 3% 18% 74% 8% 53% 41% 6%

Electronic payment methods are faster, cheaper, and more convenient than paper based checks, so it should come as no surprise that that electronic payments are on the rise as the use of paper checks is declining. While Automated Clearing House (ACH) payments are the preferred electronic payment method across payment attributes, P-Card payments rank a close second, see Figure 10.

Figure 9 Factors Driving Enterprises to Focus on Electronic Payments

Reducing payments costs remains the number on focus.

Reduce overall payment costs (staff, processing etc.)

84% 84%

Reduce risk of payment fraud 17%

17%

Ensure compliance with regulations such as SOX

11% 10% Need to strengthen supplier relationships 7% 6%

Better cash management (discount capture, penalty avoidance, on-time payment)

58% 49% Reduce instances of duplicate payments 17% 14% 9% 18%

Improve visibility into spend

7% 14%

Better invoice audit capabilities

13% 13% Reduction of invoice payment errors 15% 23% Access to benefits of new technologies 9% 9%

Obtaining supplier dynamic discounts

64% 55%

Remove paper from AP department

© 2013 PayStream Advisors, Inc | www.paystreamadvisors.com | info@paystreamadvisors.com

Figure 10 Preferred Electronic Payment Methods Across Payment Attributes

P-Card payments continue to inch closer to ACH payments. ACH P-Card Wire 34% 4% 62% Less costly 51% 44% 5% Convenience; ease of use 63% 23% 14%

Better data security

64% 30% 6% Supplier acceptance 72% 20% 8% Better/complete remittance information 79% 14% 7% Ease of integration with AP system 50% 45% 5% Better working capital management 73% 18% 9%

Duplicate payment avoidance

62% 24%

14%

Better fraud protection ability

23% 9%

68%

Purchasing Card Program Incentives

PayStream analysts believe that companies choose to enroll in a P-Card program for three primary reasons.

1. Lower Processing Costs – Organizations want to automate and reduce overhead in the purchasing process and P-Cards provide an effective way of realizing significant cost savings. Whether a company is purchasing a million dollar piece of equipment or a five dollar tape dispenser, most companies use identical processes for these transactions. Cost studies have shown that the typical cost to process a single transaction can be over $15. Obviously, cost-conscious purchasing operations don’t want to spend over $15 to purchase something that is worth about $10. By utilizing P-Cards, most of the overhead can be eliminated by cutting out requisitions, approvals, POs, purchasing channels, receipts and follow up to be sure the item is charged to the correct department. Such an elaborate, carefully controlled process may be justified for large purchases; however, fewer stewards think such an expensive process is justified for small purchases. By eliminating the typical purchasing route, the purchasing process is streamlined by removing the traditional PO steps and approvals. Predetermined spending controls and requirements such as spending limits are able to be channeled via more cost effective routes.

2. Transaction Control – Companies want to control where purchases are made. Most companies make an effort to consolidate the number of suppliers they use, in an effort to channel more business to fewer providers to increase purchasing volume and negotiate price discounts. The more often employees are permitted to engage in “rogue buying” – going anywhere they want to purchase company goods – the more the buying company’s negotiating leverage is diluted. On the opposite side, the more employees purchase through preferred providers, the greater the price discounts the company can negotiate. Thus, a successful P-Card program is the key to reduced overhead and discounted or lower prices for items purchased.

In an effort to rein in rogue buying, a company can issue P-Cards to employees, instruct them to purchase what they need and charge it to the card and block usage of the card at any merchant in a merchant category that does not have preferred status. For example, a company can contract to purchase office supplies at Staples for a 3 percent discount and block P-Card transactions with all vendors in the office supply category except Staples. Such a policy provides better control over letting employees purchase needed items with their own funds or cash advances and then turn in expense reports for such purchases.

In an effort to help control transactions, card providers have identified three levels of data capture and reporting for card transactions. Level-3 is the highest level of processing and defines what is being purchased and combines that information with the payment transaction and delivers it electronically to customers. Level-3 line item detail provides specific purchase information, detailed merchant

© 2013 PayStream Advisors, Inc | www.paystreamadvisors.com | info@paystreamadvisors.com establishment information and cardholder information. Level-3 information is useful to P-Card customers to help streamline accounting, merge purchase data with eProcurement systems and accurately manage transactions with the least amount of costly manual intervention.

3. Attractive Rebates – Organizations want to collect rebates based on their purchasing volume. P-Cards are a lucrative product of the banks that issue them; therefore, the marketplace has become very competitive. Large volume programs can earn a significant amount in rebates. With the right P-Card provider, a company can save money on overhead, obtain lower prices for goods and services purchased and get cash back from the card issuer. It’s no surprise why P-Card usage is on the rise and why small and medium size companies want to get in on the savings.

Purchasing Card Management Functional

Map

P-Card solutions streamline the purchasing process by giving end users a highly automated self-service option. They can also be structured to steer buyers to preferred suppliers that are under contract to provide price discounts and earn the buying company attractive rebate checks. Each of the P-Card solution providers profiled in this PayStream Advisors report has effective tools and automation packages that reduce overhead costs, lower the cost of goods and services purchased and bring back a premium for program success in the form of rebates. A successful P-Card program can be broken down into six specific parts, including:

1. Cardholder Administration – P-Card programs require a person to oversee the operation; issue new cards, terminate cards when an employee leaves or is reassigned; monitor activity, including times when a transaction is refused; generate reports to management and communicate with the issuer. Typically, one person does this as a full time job, but a small program might have a part-time administrator and a large one might have a staff of two. Most of the features in issuers’ reporting and management software have been designed with the program administrator in mind, including tools to turn cards off and on, adjust credit limits and receive a host of reports.

2. Supplier Management – Card acceptance is critical to the success of a P-Card program. If the majority of a company’s suppliers do not accept card payments, the program will stall. Therefore, enrollment of suppliers is a key component to any good program. Much of that effort consists of notifying suppliers that do not accept card payments that the buying company would like them to start accepting. Many P-Card providers have supplier onboarding programs to help with this step in the process. Such programs should be taken into consideration when evaluating the right P-Card solution for your company. Beyond enrolling suppliers, supplier management involves tracking spending with particular suppliers and using this data to show the supplier how much business you bring them. This documented volume can be used to try to negotiate supplier discounts. P-Card providers are able to differentiate card spend by merchant, which is a useful tool for negotiating supplier discounts. 3. Transaction Control and Integration – Restrictions such as transaction limits

whether they are daily, weekly or monthly limits can quickly and easily be put into place and work to prohibit unsanctioned card usage. PayStream research shows that creating card spend limits is a useful tool companies deploy to prevent card misuse, see Figure 6. In addition, unauthorized merchants can be blocked by Merchant Category Code (MCC). This forces buyers to purchase from preferred suppliers that are under contract to rationalize and consolidate spending with suppliers, and provide negotiated discounts. Different limits and restrictions can be built into company card programs for different card holder accounts – e.g., a CFO may have fewer restrictions on his/her account than a new hire middle manager.

© 2013 PayStream Advisors, Inc | www.paystreamadvisors.com | info@paystreamadvisors.com The customized controls or restrictions placed on the card protect the buying company against fraud and misuse.

4. Transaction Accounting – P-Card programs seamlessly integrate with accounting systems and provide accuracy and efficiency. Card purchases are matched to transaction statements and card transactions are allocated to the appropriate General Ledger (GL) and Cost Center codes. Purchases can easily be split and administrators have the ability to override default codes and redirect purchases to other accounts based on the GL codes. This automated process reduces errors and processing time, allowing for timely payment and control.

5. Payment Management – Paper checks are waning as more efficient payment processes gain in popularity – such as P-Card programs. Suppliers are happy because they get paid promptly with the bank’s money and with no action required on the part of the buying company. The bank provides credit to the buyer and the bank pays the supplier. As a result, the supplier takes a discount due to the early payment. Since there is a benefit to early payment, the bank and buyer negotiate a payment date. Most often payments are paid monthly but there can be additional rebates or lower program fees when payments are made bi-monthly, weekly or daily. Payment schedules can be negotiated by the buyer and bank.

Figure 11 Purchasing Card Management Universe

P-card programs work to streamline the

purchase-to-pay process

Cardholder

Administration

Monitoring

& Analytics

Payment

Management

Transaction

Accounting

Transaction

Control &

Management

Supplier

Management

6. Program Monitoring & Analytics – With P-Cards come powerful reporting functionality that allows program administrators and procurement, financial and accounting executives to precisely track how the cards are being utilized. The high level reporting capabilities provide detailed data for spend analysis and financial decision making. Visibility into spend patterns and spend activity is another added benefit of P-Card programs. P-Card solution providers offer a wide range of standard and ad hoc reporting capabilities. Reports can be scheduled for certain days each week or month, to meet a company’s specific needs.

© 2013 PayStream Advisors, Inc | www.paystreamadvisors.com | info@paystreamadvisors.com

Purchasing Card Success Factors

The advantages to streamlining the P2P process through P-Card programs far outweigh the disadvantages to such programs. A variety of factors contribute to the success of a P-Card program or its stagnation. PayStream has identified some of the key factors that will lead to a successful P-Card program.

1. Implementation of a good program administrator – An effective Purchasing Card administrator who knows the P-Card industry and best practices is key to the success of a company’s program.

2. Solid partnership with card issuer – Be sure to choose a program that best fits your company’s needs and expectations. Discuss roles and responsibilities with your card issuer to be sure both sides are clear about set expectations.

3. Strong internal communication and supplier communication – A good communication plan is key to getting internal employees to embrace the P-Card implementation. In addition, P-Card requirements will need to be conveyed to suppliers. Early supplier education and onboarding are key factors to the success of the program.

4. Set program goals and benchmarking – Goals need to be clearly defined for policies and procedures to be developed. Benchmarking needs to be completed to measure progress and success against goals. Benchmarking can also be used to identify improvement opportunities.

5. Proper training – Be sure the card issuer you choose to partner with provides a mandated training program.

6. Policies and procedures – Documented policies and procedures need to be aligned with program goals and be updated as the program evolves and grows. 7. Strike a control balance – Companies don’t want to under control or over

control a P-Card program. Striking the right balance of controls is more important that the sheer number of controls. Auditing each and every transaction for every cardholder in every period reduces the process savings inherent to P-Cards. A long term approach is for companies to review the cost versus benefit and consider its level of risk tolerance.

8. Effective card distribution – Put cards in the right hands by determining which employees initiate purchases or requisitions.

Different Types of Purchasing Cards

P-Cards are not limited to plastic cards; they can also utilize non-plastic account

numbers. The term “card” is used when describing any type of commercial card product, regardless of whether or not a plastic card is issued. Other types of P-Cards include Corporate Travel Cards, One Cards, Fleet Cards, Ghost Cards, Virtual Cards and Single Use Cards – each card is used to handle different types of purchases and/or spend categories.

Corporate Travel Card

The Corporate Travel Card is generally used by organizations for employee travel and entertainment related expenses. The card allows employees to use the card for payment of travel expenses and provides essential data to the employer. Employees are provided the Corporate Card for payment of approved, business-related expenses that are most often travel-related as designated by the employer. The card is issued in the company’s name with the name of the individual employee displayed on the card. The company’s credit is considered when applying for the card.

Corporate Cards are divided into two groups, individual payment cards and company payment cards. If an employee is given an individual payment card, the employee is responsible for submitting their own expense reports. Company policies must be followed and the card issuer is paid directly for charges incurred. If an employee utilizes a company payment card, the employer pays all company charges. If there are unapproved or personal charges, the employee pays the card issuer directly.

One Card

The One Card is a type of commercial card that simplifies card administration and reporting without compromising control or convenience from payment to vendor negotiations. Processes are streamlined through eliminating steps such as vendor set up and PO data entry. The card leads to increased productivity and employee convenience because it is a single payment solution. The One Card offers better management of expenditures, such as business supplies, maintenance, repair, operational, travel and fleet expenses through spending controls and point of sale restrictions. The single payment solution integrates data with a company’s general ledger, ERP and other existing systems to reduce manual data entry and create a single monthly payment for all transactions. The result is a complete view of the corporate spending pattern.

The One Card provides flexibility and convenience through managing procurement, travel, and fleet expenses. The One Card is the payment tool of choice for many organizations based on the cards versatile controls and online approval process for transactions.

© 2013 PayStream Advisors, Inc | www.paystreamadvisors.com | info@paystreamadvisors.com

Fleet Card

A Fleet Card or Fuel Card is a product used by organizations to pay for fuel and related expenses on company vehicles. The card is used as a payment card that is commonly utilized for fuel purchases such as gasoline, diesel, and other fuels at gas stations. The fleet cards may be used to pay for vehicle expenses and maintenance if allowed by a fleet owner or manager. The benefit of a fleet card is increased security for cardholders, or the fleet drivers that no longer need to carry money.

With the use of fleet cards, the fleet owners or managers receive real-time reports that reveal transactions. The fleet owners or managers can set purchase controls that provide detailed use of business related expenses. The fleet card provides convenient and comprehensive reports of business transactions.

Ghost Cards

Ghost Cards are card accounts issued to a specific supplier to process all the

organization’s transactions. Companies can use Ghost Cards as another payment option instead of providing a credit card to each employee. The Ghost Card provides a single account for organizations to pay employee charges.

Companies can provide a single Ghost Card number to more than one employee. For example, everyone in the IT department can be given the same single Ghost Card number. The single card number helps a company to organize and track departmental expenses.

A company can also assign their vendors with a single Ghost Card number. When several employees buy office supplies from the same company, the single card number provides an easier method to track a receipt for all of the supplies purchased from the vendor. It would be more tedious for a company to track each individual receipt for each employee.

Virtual Cards/ Single-Use Cards

Virtual Cards are non-plastic accounts with multiple security and control features. Virtual Card account numbers are “dormant” until the payment is sent, specifying the authorized payment amount, payment date range and supplier. Suppliers cannot authorize payment until they receive notification from the buyer that the account limit has been raised to the approved payment amount.

Single-Use Cards add another layer of security and control by locking down use of the account to only a specific supplier, for a specific down-to-the penny amount and within a certain time frame. Since a one-time-use account is assigned per payment, buyers also benefit from improved reconciliation – each payment is automatically matched to the transaction.

Virtual Cards and Single-Use Cards are well suited for making more strategic, higher value payments, which are traditionally made by check.

State of Current Purchasing Card Market

As stated earlier, annual P-Card spending in North America continues to increase. PayStream analysts attribute this continued increase to three main factors:1. Increased Number of Employees Issued a P-Card – More cards and more employees with access to P-Cards has been a primary reason for the growth in P-Card spend.

2. Improved Internal Education – P-Cards can greatly improve the efficiency of an organization’s spending volume and reduce processing costs; however, these changes will only occur if employees change the purchasing process. A Best Practice to a successful P-Card program is a well-planned implementation that consists of an internal education plan. Companies are doing a better job at educating their employees on spending policies.

3. Purchase of Higher Priced Items – Companies are doing a better job at shifting their focus from low-priced items to putting higher-priced items on P-Cards. Key growth categories for P-Card use includes capital assets,

printing and duplicating services, transportation and delivery services, utilities and lease or rental payments and telecommunication services.

The lure of P-Card programs is expanding among organizations of all sizes and in virtually every industry. Companies are taking strategic steps to increase the usage of P-Cards, including providing better internal education (37 percent), increasing spending limits for the purchase of higher-priced items (22 percent, up from 11 percent in 2012), and expand P-Card use to more spend categories (27 percent), see Figure 12.

© 2013 PayStream Advisors, Inc | www.paystreamadvisors.com | info@paystreamadvisors.com Moving forward, predicted P-Card growth is about a 10 percent per year average over the next five years, according to RPMG Research Corporation. Annual P- Card spending is expected to increase to $247 billion by 2014, and $290 billion by 2016. Corporate respondents project an annual average P- Card spending growth rate over the next five years (11.2 percent) that is higher than that projected by Government and Not-for-Profit respondents (6.4 percent).

Companies implementing successful P-Card programs are reaping the rewards and turning their accounts payable and P2P initiatives into a profit center by cashing in on rebates and early payment discounts. The visibility that P-Card transactions provide also puts companies in a much stronger position when renegotiating supplier contracts, which can also be a tremendous opportunity for savings.

With considerable savings and efficiency, the importance of increasing P-Card usage is evident. According to PayStream survey results, 88 percent of companies (up from 84 percent in 2012), reported they used P-Cards to process transactions ranging from $100 - $5000, with the largest percent (40) utilizing P-Cards for transactions ranging from $251-$1,000, see Figure 2.

Figure 12 Steps Taken to Increase Use of Purchasing Cards

Improved internal education is the number one method used to increase P-Card use

We are not planning to increase usage of cards

38% 37%

Mandate usage of cards where accepted

17%

25%

Provide more / better internal education

39% 37%

Expand use to more spend categories

32% 27%

Increase the number of employees given a card

26% 24%

Increase in spending limits 11%

22%

Supplier outreach and education 19%

24%

Build a strong Intranet presence to promote card usage

5% 8%

Survey results also reported the maximum limit range per transaction made on P-Cards. While 18 percent (up from 15 percent in 2012) of respondents reported they do not limit transactions on P-Cards, the highest (38 percent) reported the maximum limit range per transaction on a P-Card was between $1000 and $5000, see Figure 13.

Figure 13 Maximum Limit Range

per Transaction made on Purchasing Cards Nearly forty percent of companies reported the maximum limit range per transaction on a P-Card was between $1000 and $5000. 15% 18% We do not limit transactions on p-cards Less than $500 1% 3% 13% 13% $500 - $1,000 35% 38% $1,000 -$5,000 15% 12% $5,000 -$10,000 21% 15% More than $10,000 2012 2013

© 2013 PayStream Advisors, Inc | www.paystreamadvisors.com | info@paystreamadvisors.com

Crafting a Purchasing Card Strategy

A strategy must be formulated prior to implementing a P-Card program. The overall success of the program will largely depend on the important decisions made prior to implementation and should include:

Which purchases to put on the card?

Most companies make a large number of small purchases or low dollar value purchases, and these purchases are a logical starting place for P-Card purchases. Some companies draw a line between small purchases from suppliers used often and small purchases from suppliers used only occasionally. Adopting a policy of using the P-Card to charge all small dollar purchases from infrequently used suppliers is a quick way to cut overhead with minimal financial risk. The small purchases from suppliers used frequently justify more planning. Talk with your issuer about the relative merits of opening a ghost card account for frequently used suppliers versus the merits of having individuals purchase from that supplier using their individual cards. The usual strategy is to start with small purchases and then work up to higher value transactions.

Who should get cards?

The usual complaint is that companies are too suspicious and security conscious, resulting in the restriction of cards to only a handful of trusted employees. This undercuts the premise and value of the program. Each company will have to make its own choices on exactly who gets cards. Some companies issue cards to procurement professionals and continue to channel small purchases through them, but the

consensus among companies with successful P-Card programs is that the greatest gains in process efficiency come from putting the cards in the hands of end-users and letting them buy what they need, when they need it – with predetermined restrictions and controls set to prevent misuse.

How controls should be set?

Research shows that too many controls can stifle purchasing card programs and limit savings. Many companies start with strict controls and gradually relax them over time. To kick a P-Card program off, it’s wise to use controls that are absolutely necessary. Program administrators can easily log in to the program online and make adjustments to controls as necessary.

How to Grow a Successful P-Card Program

As organizations realize the benefits of using P-Cards to reduce costs and control expenses, many forward-thinking companies are exploring ways to expand their program’s reach. The advent of robust controls and security measures that card issuers have implemented to prevent unauthorized charges or employee misuse provides companies with the comfort to convert higher dollar, low volume payments to cards.

Utilizing virtual cards allows companies to lock down purchase controls as they see fit. Each virtual card is tied to an underlying billing account that is not shared with suppliers, which prevents the chances of unauthorized spending or fraudulent activity. When virtual cards are combined with a successful P-Card program, it can help organizations derive greater financial benefits and process improvements.

Issuers of P-Cards can help companies grow their programs through supplier on-boarding initiatives. Ongoing support and communications programs to targeted suppliers can help educate suppliers on the benefits of P-Card acceptance.

Rebates

More and more companies are cashing in on P-Card rebates to drive savings. Rebates which provide cash back to an organization are based on annual purchase volume; therefore, companies with large volumes reap the most rewards from rebates. With a rebate program, the card issuer pays back to your organization a negotiated portion of the volume of purchases made with the cards. Rebates typically are paid annually and generally are made available to organizations that meet an established card volume threshold.

Rebates can be ideal for situations in which P-Card use can be mandated. If a company can develop and enforce a policy that all employees participate in the card program, companies will capture more spend and maximize rebates. The more a company spends, and the faster the card issuer is paid, the greater the rebate is likely to be.

© 2013 PayStream Advisors, Inc | www.paystreamadvisors.com | info@paystreamadvisors.com

Bank of America Merrill Lynch

Founded in 1784, Bank of America Corporation is one of the world’s largest financial service companies. It is also one of the oldest financial institutions, with roots back to Massachusetts Bank, the first nationally chartered back in the United States.

Bank of America Merrill Lynch (BofA Merrill), the global banking and global markets businesses of Bank of America Corporation, assists thousands of clients across many industries, and in all regions of the world, in making the transition from paper to electronic payments. According to the 2012 Nilson ratings, BofA Merrill is ranked as one of the top issuers of purchasing cards in the U.S. with the fastest year over year growth rate of U.S. purchasing card providers out of the top three players. BofA Merrill offers a leading solution in all regions of the world, continuously expanding its footprint to meet client needs.

Website www.baml.com

Founded 1784

Ticker (NYSE) BAC

Headquarters Charlotte, NC

Other Locations Locations worldwide Number of Employees 280,000+

Number of Commercial

Card Programs 15,000+

Number of Cards Issued 1.5mm+

Target Verticals Varied, including healthcare, government, entertainment, utilities, service organizations, consumer product retailers, financial services, agribusiness, industrial, computer, newspaper, automotive, telecommunications and

manufacturing. Partners / Resellers MasterCard and Visa

Solution Name Bank of America Merrill Lynch Purchase Card Program

Frequency of Upgrades 4-6 upgrades annually

Solution Functionality

Bank of America Merrill Lynch’s commercial card program helps organizations around the globe design integrated payment solutions that unlock working capital while increasing efficiency, visibility and control. The BofA Merrill Corporate Purchasing Card is an all-in-one solution that can help organizations increase purchasing power, reduce costs associated with routine business purchases and streamline reporting on accounts payable activities.

BofA Merrill offers a Visa® or MasterCard® branded Purchasing Card program that provides cardholders with access to more than 36 million merchants and ATMs worldwide. Cards can be Chip and PIN enabled to enhance acceptance for employees travelling internationally where Chip terminals are prevalent. Purchasing Card clients have access to industry leading fraud detection and comprehensive card controls to help prevent unauthorized spending. Javelin Solutions & Research recently awarded BofA Merrill “Best in Class Fraud Detection/Prevention, Servicing and Claims resolution” for the 8th straight year. BofA Merrill continually invests in and enhances their

product offerings to bring clients the most advanced card solutions available in the market. The development of new services is based on industry best practices, client need and overall product strategy in the pursuit of new tools, changes in regulatory environments and enhanced usability.

For clients within the U.S. and Canada, BofA Merrill Lynch provides an online commercial card management tool called Works®. The Works® platform helps companies manage all aspects of their card program – from individual card account setup, spending controls, account approvals and reconciliation to organization-wide expense reporting. The Works® platform supports card programs including Purchasing Cards, Travel & Entertainment Cards as well as the bank’s accounts payable online tool, ePayables. BofA Merrill launched a new user interface (UI) for Works® in the second quarter of 2013 that further enhances the user experience by streamlining workflows, data presentation and user navigation. The redesigned UI provides a clean and intuitive navigation and promotes seamless usability for commercial card users. It also provides additional search and filter capabilities that allow users to easily drill down into transactions. In addition, expanded rows, hyperlinks and multi-select buttons allow users to process transactions even faster.

Works® allows administrators and card users to effectively manage their BofA Merrill card programs. Administrators have the ability to modify spending limits, adjust cardholder profiles and monitor policy compliance. Cardholders can review and dispute transactions and quickly access transactional details. This easy to use platform simplifies each step in the payment process by enabling workflow enhancements, automating traditional purchasing tasks and eliminating the time consuming paperwork before and after a purchase. Works® provides internal spending and administrative controls that meet and exceed the needs of cardholders, managers and administrators. BofA Merrill recently launched Works® Online Account Request, further simplifying the card application process. Online Account Request provides an electronic means to request a card and reduce new card application processing time by as much as 50 percent. This new functionality allows cardholders to input their information directly, which significantly reduces the potential for errors, while saving program administrators valuable time.

Works® features a patented technology called Active Card Control® that allows clients to manage their card program with optimum control tailored to their specific organizational needs. Through a configurable hierarchy of access, a desired set

© 2013 PayStream Advisors, Inc | www.paystreamadvisors.com | info@paystreamadvisors.com of controls are mapped in the application for maximum efficiency. Highlights of the control features in Works® include:

» Funds Pre-Approval Process » Purchase Request Process » Declining Balance Cards Issuance

» Merchant Category Code (MCC) Restrictions » Transaction Limits

» Flexible and Customizable Reporting

» Transaction Level Data, Including Level I, Level II and Level III Data Capture The system also enables users to upload receipt images directly from their

desktop, which allows users to attach receipts directly to a transaction or expense report.

Integration

Works® integrates quickly with a company’s GL, ERP and other existing systems, allowing up to the minute spending data to be easily accessed. The application integrates with ERP systems in three key areas:

1. Exporting transaction data with GL information into an AP or GL module; 2. Exporting data from pre-defined Works® reports into ERP a client’s ERP or

reporting systems;

3. Importing invoice payment information through ePayables, driven by patented Active Card Control® technology.

In addition to auto-mapping of GL coding, the application also provides the “GL Assistant” functionality that allows cardholders to select from a drop down menu of authorized values. This can be tailored to the cardholder individually or to the department or organizational group level.

Security Features

Advanced fraud detection and security monitoring make BofA Merrill cards some of the safest cards available on the market. Based upon historic corporate card spending data, BofA Merrill sets specific spending parameters at the card level. Their fraud group monitors transactions that fall outside of the parameters. Over time, each account develops customary spending patterns and any time a transaction falls outside the normal pattern, BofA Merrill’s security group reviews the transaction and makes a determination to refer it to a user’s program administrator.

Extensive security measures are in place to minimize a client’s overall exposure to fraud and card abuse, including a multi-layered defense approach involving firewalls, intrusion detection monitoring, spyware identification and removal, anti-virus software, patch management and various encryption products to secure internal and DMZ network segments and devices.

Workflow and Dispute Management

Workflow management is a critical component of the card management tool. Workflow can quickly be updated by card administrators to meet a company’s specific needs and requirements. Through the Works tool, cardholders have the ability to review transactions, report lost or stolen cards, apply accounting codes to transactions and submit card disputes.

Reporting and Analytics

Flexible and customizable reports generated by the application are available 24/7, at no cost and are easy to use and access. Transactions are updated nightly, so all data up until the current day’s transactions are available for reporting. The configurable reports feature allows users to quickly create new templates at any time by selecting from over 650 fields of data to determine the content and layout of reports based on their organization’s needs. Scores of new filters can be used to narrow the results in a report, and nearly every field can be filtered allowing for true ad hoc reporting.

Some report templates are predefined and available to customers to use or customize. Report templates can be created, stored and scheduled for future use. In addition, Works® reporting allows administrators to share report templates with other users in the system. Reports can be viewed online, printed or downloaded as Adobe PDF files, Microsoft® Excel® files or text files that can be exported into standard reporting packages or commonly used applications like Microsoft Access®.

Implementation and Support

BofA Merrill has an expert team of card implementation resources, spread geographically around the U.S., with vast experience in implementing large, complex card programs. Each member of our implementation staff is extremely qualified and has several years of project management experience. The

implementation process focuses on deploying an application configuration that meets the clients overall business needs and empowers them to use and maintain the application.

Once Implemented, clients’ will have access to a 24/7 customer support team. BofA Merrill’s Customer Service Centers are certified by J.D. Power and Associates for

delivering exemplary client satisfaction excellence. The Customer Call Center, Technical Help Desk and Client Level Support teams fully support a client’s account manager and

© 2013 PayStream Advisors, Inc | www.paystreamadvisors.com | info@paystreamadvisors.com Through the Works application, users are alerted of new functionality, training and support sessions. There is also a full list of support materials that can be accessed from the home screen that includes training guides, videos, tutorials and live training sessions. BofA Merrill may assign a card account manager to work jointly with clients to analyze an organization’s program and work closely to design and develop the tactics needed to accomplish an organization’s specific goals. This is an ongoing process that BofA Merrill provides that continues throughout the life of an organization’s card program. The card account manager functions as a consultative resource, keeping clients updated on BofA Merrill’s most recent product innovations, as well as new trends and best practices within the card industry, networking and benchmarking with similar types of accounts.

Virtual Cards

BofA Merrill provides virtual cards or ghost cards for clients through their ePayables service. The virtual card accounts have zero dollars in available funds until a request is received from a client to initiate payment to a vendor. The vendor then receives a notification with remittance information to process the transaction, which greatly decreases the potential for fraud and end of month reconciliation issues.

In addition to ghost cards and ePayables (virtual cards), BofA Merrill clients can leverage the Works® Card Shuffler capability to facilitate one-time payments to specified vendors The Works® Card Shuffler is the only solution that allows organizations to instantly adjust the available credit on individual purchasing cards based on the payer’s needs while adhering to internal purchasing policies.

General Disclaimer for Bank of America Merrill Lynch

“Bank of America Merrill Lynch” is the marketing name for the global banking and global markets businesses of Bank of America Corporation. Lending, derivatives and other commercial banking activities are performed globally by banking affiliates of Bank of America Corporation, including Bank of America, N.A., member FDIC. Securities, strategic advisory, and other investment banking activities are performed globally by investment banking affiliates of Bank of America Corporation (“Investment Banking Affiliates”), including, in the United States, Merrill Lynch, Pierce, Fenner & Smith Incorporated and Merrill Lynch Professional Clearing Corp., both of which are registered as broker-dealers and members of FINRA and SIPC, and, in other jurisdictions, by locally registered entities. Merrill Lynch, Pierce, Fenner & Smith Incorporated and Merrill Lynch Professional Clearing Corp. are registered as futures commission merchants with the CFTC and are members of the NFA. Retirement Services discussed are provided through Bank of America Merrill Lynch, which is a marketing name. Banking activities may be performed by wholly owned banking affiliates of Bank of America

Corporation (“BAC”), including Bank of America, N.A. Brokerage services may be performed by wholly owned brokerage affiliates of BAC, including Merrill Lynch, Pierce, Fenner & Smith Incorporated.

Investment products offered by Investment Banking Affiliates: Are Not FDIC Insured * May Lose Value * Are Not Bank Guaranteed. © 2013 Bank of America Corporation.

Bank of America Merrill Lynch Case Study

Building Profitability with Innovative Payment Solutions

Executive Summary

For Oldcastle, North America’s largest manufacturer of building products and materials, taking a fresh look at its recurring, lower-value payment processes has resulted in wide-ranging benefits. With an eye on leveraging recent innovations in technology, several Oldcastle product groups adopted ePayables and the Corporate Purchasing Card from Bank of America Merrill Lynch. These solutions helped Oldcastle convert paper payments to electronic transactions—expanding purchasing power, delivering real-time visibility, increasing leverage with vendors and improving bottom-line results.

Innovation in Accounts Payable

Oldcastle is the North American arm of CRH, one of the world’s largest manufacturers of building materials. Headquartered in Atlanta, Georgia, the company has more than 30,000 employees, operations in all 50 states, and leadership positions across the concrete masonry, building enclosure, asphalt and paving services sectors. Oldcastle manages these diverse businesses through a decentralized structure, which gives its product groups a high level of autonomy and the flexibility to adopt banking solutions that meet their specific needs.

The Central West division of Oldcastle Materials went live with the Corporate Purchasing Card in 2011. In addition to expanding purchasing power—the card is accepted at 36 million locations worldwide—Central West began taking advantage of robust reporting tools, tighter spending controls and tailored options for billing cycles and payments.

The Corporate Purchasing Card is designed to eliminate purchase orders— especially for lower-value, recurring purchases—and help companies centralize purchasing, consolidate reporting and negotiate discounts with vendors. With operations in 12 states and $1B in revenue, Central West has had more than $18MM in annual spend on card since implementing the program. Converting this spend from paper checks has helped the company realize significant cost and efficiency benefits. An estimated $325MM in combined rebates and cost savings has helped Central West boost its bottom line, enhancing its ability to deliver for clients.

© 2013 PayStream Advisors, Inc | www.paystreamadvisors.com | info@paystreamadvisors.com In addition to wider payment acceptance, the bank’s Works® solution for

card program management began yielding immediate dividends. “What really impressed us is the ability to see, approve and code transactions before the bills are processed,” says Jennifer Franklin, assistant controller at Central West. “Those are things we couldn’t do with our old card program. With the Corporate Purchasing Card, we’ve eliminated the back-end re-classes that used to require extra attention after the invoices posted to our accounting system.”

Franklin also loads Central West’s project codes directly into Works, which enables the system to quickly assign each card purchase to a specific construction job. These project codes change frequently due to the fluid nature of the construction industry, and Works has helped Central West adapt by automating the upload process. “We send code changes straight from our ERP system, and the updates are reflected in Works,” Franklin notes.

In 2009, Allied Building Products—Oldcastle’s arm for distributing materials to residential and commercial builders—began seeking ways to convert paper payments to electronic transactions. After evaluating options from several banks, Allied adopted Bank of America Merrill Lynch ePayables in 2012. The ePayables program is designed to help companies replace non-payroll checks with electronic, card-based payments—which can reduce bank fees and processing costs while creating working capital efficiencies.

A Strategic Approach to Treasury

With many companies taking a more strategic approach to treasury in recent years, CFOs and other financial executives are focusing on making their businesses leaner, driving down costs and leveraging new technology to replace manual processes. Finding newer, predictable revenue streams has become especially important to Oldcastle as it seeks to offset the inherent volatility of the construction industry and its reliance upon public sector clients. With the Corporate Purchasing Card and ePayables programs from Bank of America Merrill Lynch, the treasury teams at Central West and Allied have quickly begun meeting these objectives and demonstrating the benefits to senior management. “With ePayables, we’ve transformed a department known for its notorious overhead into a source of new revenue. And we’ve done it in a way that lets me show senior management that accounts payable can be a strategic, value-added function instead of a fixed cost,” says O’Bryant.

For Central West, Franklin says that switching to the Corporate Purchasing Card and its Works card program management solution has yielded similar results. “Works gives me instant visibility and more information on spend, which increases my team’s value to the organization and makes us a crucial partner going forward.”

© 2013 PayStream Advisors, Inc | www.paystreamadvisors.com | info@paystreamadvisors.com

U.S. Bank

As the first commercial bank card issuer, U.S. Bank helped pioneer electronic payment products and continues to be a market leader with a legacy of innovation—developing cutting-edge solutions that support overall procurement and payment practices. As the fifth largest bank in the United States, U.S. Bank provides a wide array of payment solutions, including fleet, freight, healthcare, corporate travel, purchasing and electronic accounts payable, including single-use accounts, straight-through processing and more.

Beginning with the first purchasing card in 1986, U.S. Bank has been a payments innovator ever since—processing over 110 million commercial card transactions annually. U.S. Bank was also one of the first companies to develop cardless (“virtual”) payment accounts (e.g., single-use accounts or buyer-initiated payments), and industry leading compliance management and business intelligence tools.

U.S. Bank is uniquely positioned as a strategic partner as they view check, card and electronic payment spend holistically, and recommend solutions based on enhancing the entire, tiered payables process. U.S. Bank analyzes clients’ accounts payable (AP) data and supplier profiles to map a complete payment model to optimize cash flow, working capital and payables management. U.S. Bank’s evaluation is based on the clients’ unique business needs, so their recommendations specifically address what changes organizations can make to achieve bottom line results. With the ongoing development of innovative and emerging technologies, U.S. Bank meets client needs today while anticipating what they might be tomorrow.

U.S. Bank Corporate Payment Systems, a business unit of U.S. Bancorp, provides a comprehensive array of business-to-business (B2B) payment solutions across all market segments, program sizes and geographies. Corporate Payment Systems (CPS) is a trusted, dependable partner, proven by their high customer satisfaction and retention rates.

Website www.usbpayment.com

Headquarters Minneapolis, MN

Other Locations CPS: North America and Europe (U.S. Bank: global)

Ticker (NYSE) USB

Number of Employees CPS: 850 U.S. Bank: 60,000 Number of Customers CPS: 10,000

U.S. Bank: 17.6 million

Number of End Users 3 million commercial card accounts

Target Verticals Public sector (federal/state/municipal), commercial real estate, education & nonprofit, energy, healthcare & pharmaceutical, insurance, manufacturing, oil & gas, retail & apparel, services, telecom & utilities, transportation, among others.

Partners / Resellers Other financial institutions through agent/referral relationships.

Transactions Processed

Annually 110 million transactions

Awards / Recognitions #1 Online Overall Customer Experience among credit card websites (Keynote Systems, 2012 and 2013); one of the “Best Banks in America” (Money Magazine, 2012); Most Admired Superregional Bank (Fortune, 2011, 2012 and 2013); one of “America’s Greenest Banks” (Bank Technology News, 2011 and 2012); Most Reputable Companies (Forbes, 2010, 2011 and 2012); #1 most trusted bank in consumer protection (Ponemon Institute, 2011 and 2012); one of the World’s Safest Banks (Global Finance, 2012 and 2013); #3 Overall Customer Service in the banking industry (Temkin Customer Service Ratings, 2013)

Solution Name(s) U.S. Bank Purchasing Card, Access® Online Payment Plus, Access® Online and Payment Analytics

Frequency of Upgrades Three per year

Solution Functionality

U.S. Bank offers several payables solutions that include: U.S. Bank Purchasing Card, Access® Online Payment Plus, Access® Online and Payment Analytics. U.S. Bank has led the way in developing commercial card best practices that today are standard throughout the public and private sectors. The organization is a leader in providing enterprise card programs across all market segments and is among a select group of issuers that have experience with organizations and card programs of all sizes, from those spending in excess of $1 billion to smaller, middle market businesses and municipalities.

U.S. Bank continues its legacy of innovation, developing cutting-edge solutions that support overall procurement and payment practices. The company continually adds additional features and functionalities to their payables solutions that help facilitate payments and drive efficiency, such as their new card program management home page. The enhanced system home page is highly customizable and features quick links and instant access to key cardholder information such as: statements, current balance, credit limit, available credit, last 10 transactions, and the message center that displays important communications to cardholders.

The U.S. Bank Purchasing Card addresses the needs of organizations of all sizes, geographies and industries. It is intended for organizations that are looking to

streamline their company’s procurement and payment processes and/or streamline the payment of large-value, strategic purchases. The U.S. Bank Purchasing Card simplifies and enhances all aspects of the purchasing process, including policy compliance, vendor negotiations, transaction monitoring, security, reporting and payment.