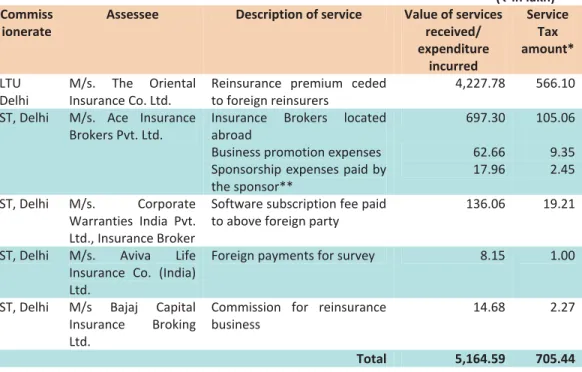

Chapter II Service Tax liability in Insurance sector

Full text

Figure

Related documents

We document a significant increase in the magnitude of put-call parity violations in the direction of short sale constraints during the 2008 short sale ban period relative to both

Classifiers simply use classification results embedded by collaborators. The decision of directly using actions obviates any additional state requirements in classifiers. Lattice

At least until the annals of Thutmose III and probably thereafter, annal inscriptions did not focus either around specific episodes, as is the norm among royal inscriptions, or

In recent Dutch surveys and monitoring studies edible wild fish species such as eel, herring, mussels, shrimp, cod, plaice, tuna, pike-perch and sole and

1 The proposed Bayesian model and estimation algorithm are evaluated using synthetic and real echoes acquired during the Jason-2 and CryoSat-2 missions.. The obtained results are

Users of works protected by copyright (books, musical recordings, films, video games, computer programs) have rights to those works through various means: the personal property in

Rensch ’s rule states that SSD increases with overall body size in species where males are the larger sex, while decreasing with body size when females are larger.. To test this

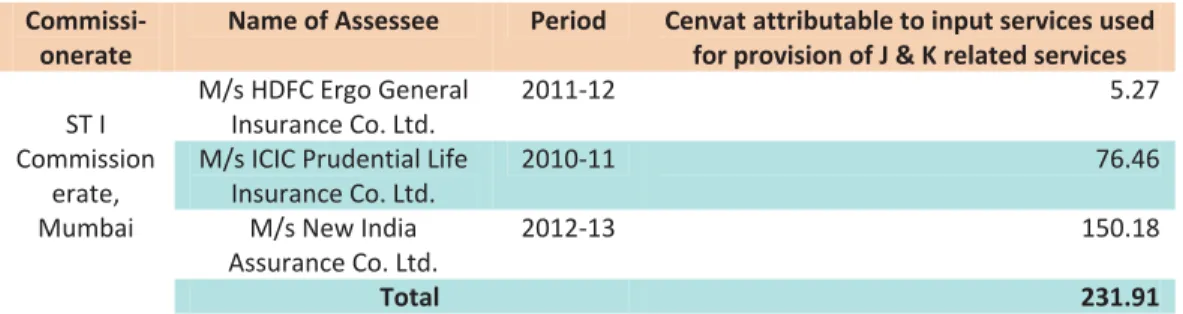

Rule 2(l) of the Cenvat Credit Rules, 2004, stipulates that inputs service means any service, (i) used by a provider of taxable service for providing an output service; or (ii)