By: Justin Owens, FSA, EA, Asset Allocation and Risk Management Analyst JUNE 2013

UPDATE:

Risk transfer options for defined

benefit plan sponsors

Issue:

Defined benefit pension risk transfer is becoming increasingly common. With Ford, GM and Verizon leading the way, many plan sponsors have regrouped to determine whether transferring pension risk can meet their corporations’ needs. What options are available to sponsors? And what should they consider while pursuing risk transfer for their pension plans?Response:

Pension risk transfer gained significant market awareness in 2012. Increased balance sheet volatility, favorable lump sum interest rate rules and a desire to reduce expenses are just a few of the reasons why some sponsors have chosen to pursue risk transfer options. These options can actually trim the plan’s financial footprint on the corporation by shifting certain risks to plan participants or to insurance companies.In general, only two risk transfer options exist: lump sum cash-outs and annuity purchases. Complete risk transfer is plan termination, the process of which includes a combination of lump sum payouts and annuity purchases. Sponsors more

commonly choose to remove only a certain group of participants from a plan. Risk transfer carries potential advantages for plan sponsors, including reductions in administrative costs and balance-sheet volatility. That said, transferring risk can be expensive. This is particularly true in the present economic environment of

historically low interest rates and recent asset losses. The introduction of MAP-211

funding relief has, in some ways, improved the attractiveness and availability of risk transfer options.

1

Moving Ahead for Progress in the 21st Century Act

Risk transfer carries

potential

advantages for plan

sponsors, including

reductions in

administrative costs

and balance-sheet

volatility.

Background

While plan termination has become the end-game strategy for some sponsoring

companies, most do not plan to undertake the step in the near future. In fact, as of 2011, about 68% of all single-employer DB plans continued to maintain ongoing pension benefit accruals for participants. Given that a full plan freeze is one of the first steps toward a plan termination, it is safe to say that DB plans will be around for years to come. Moreover, the rate of standard plan terminations has been relatively constant over the last 10 years, with no consistent trend up or down.2

DB plan sponsors have historically been confronted with several types of considerable risk. The risks typically center on the volatility of a plan’s funded status, contribution requirements and pension expense. Uncertainty in these key measurements is typically driven by interest rate environments, equity returns and plan participants’ longevity outlooks. For DB plan sponsors looking to mitigate these risks, transfer options remove pension plan liabilities and assets from the corporate balance sheet and shift to others – individuals or insurance companies – the tasks of managing assets and risks.

Risk transfer options

We will discuss the two major risk transfer options available to plan sponsors, then briefly discuss considerations for plan termination, which is the result of implementing these two options for the entire plan.

1. LUMP SUM CASH-OUTS: TRANSFER RISK TO PARTICIPANTS

In accordance with U.S. statutes, qualified defined benefit plans must offer a life annuity option to all plan participants. Offering a lump sum payment is optional. Since longevity risk to the plan is inherent in any life annuity, lump sum payments will reduce the plan’s

longevity risk.3 While sponsors can provide lump sum payments to nearly any participant

group, terminated vested participants (TVs) are often the most logical group on which to focus.4

Sponsoring companies typically maintain pension plans to attract, retain and reward employees. More specifically: employers seek to attract candidates for employment and to retain active employees, then to reward retired employees who have retired directly from the company.

When a TV’s employment ends, however, at either the employer’s or the employee’s discretion, the attract/retain/reward considerations change. Yet most sponsors continue to pay expenses for the investment, administration and insurance (through the PBGC) of TVs’ benefits. For many sponsors, this benefit doesn’t seem to align with the reasons for having offered a retirement plan, and thus transferring risks for the TV group can be a particularly attractive option.

TVs often represent a large percentage of plan participant counts, but a smaller part of participant liabilities. Chart 1, below, demonstrates this inconsistency.

2 Based on the 2011 PBGC pension insurance data tables. Note that a significant majority of the plan terminations over the last 10 years were for plans with fewer than 1,000 participants. The plan termination trend could shift either way at any time.

3

Longevity risk is the risk of participants living longer than expected. Retirees who live beyond actuarial life expectancy cost the plan more, due to longer-term benefit payments.

4

Ford and GM are notable exceptions to this statement. In 2012, they announced plans to offer lump sums to retirees. While still achieving some of the risk-reduction objectives explained in this paper, cashing out current retirees is a more complex process than cashing out TVs and involves some considerations not covered in this paper. As an example, both Ford and GM attained private letter rulings from the IRS before implementing this strategy.

DB plan sponsors

have historically

been confronted

with several types

of considerable

risk.

TVs often

represent a large

percentage of plan

participant counts,

but a smaller part

of participant

liabilities.

Chart 1 – Comparison of participant counts and funding target for single-employer DB plans

5Terminated vested participants represent less than a sixth of total plan liability in single-employer pension plans, but nearly a third of total participant counts. This disconnect can be a disproportionate drag on ongoing plan administration expenses. For example, each year, DB plan sponsors must pay a PBGC insurance premium for each plan participant, regardless of that participant’s current employment status and associated liability. MAP-21, new legislation passed in 2012, increased the flat-rate premiums from $35/year per particpant to $42/year in 2013, then $49 in 2014, with inflation-adjusted increases thereafter. These increases may further strengthen the case for lump sum cash-outs as cashing out participants reduces counts that affect PBGC flat rate premiums.

In addition, other ongoing costs for TVs can be vexing, given that TVs are often more difficult to locate than active employees or plan retirees. Determining final benefit amounts may require more detective work as well, as historical records become less accessible. As time passes, these challenges intensify while administrative expenses continue to accrete.

In addition to reducing costs, cashing out TVs could provide the DB plan sponsor with a straightforward means of reducing the plan’s interest rate risk by possibly shortening the duration of plan liabilities. TV liabilities will tend to be of greater duration than other plan liabilities, owing to TVs’ typically being younger than retirees. Thus, as the plan matures, removal of TV liability could make the plan less sensitive to changes in interest rates and less subject to interest rate risk.6

To help contain and predict costs, sponsors could offer lump sums to only a select group of TVs, based on criteria such as:

Termination date – Sponsors may cash out only those whose employment terminated prior to a certain date. A reasonable cutoff date could be when a major plan design change or merger occurred. These criteria may help reduce plan complexity.

Lump sum values – Sponsors could allow cash-outs for any group of TVs where the lump sums would be below a certain dollar amount (for example, $20,000). Given that plan participants within this category would typically have small annuity benefits, the lump sum option would probably be much more attractive to TVs than an annuity. Likewise, cash-outs for this group could significantly reduce plan counts,

5

Based on Form 5500 filings of single-employer plans, with plan years beginning January 1, 2011, over 100 participants, and over $10 million in assets (around 5,000 plans included).

6 The change in plan duration from a TV cash-out will depend on the “maturity” of the plan. Less mature plans with a small proportion of retirees may see an increase in duration with a TV cash-out. However, more mature plans with a heavier proportion of liabilities due to retirees will likely experience a decrease in duration.

39%

37%

31%

16%

30%

48%

0%

20%

40%

60%

80%

100%

Portion of Plan Count

Portion of Funding Target

Liability

Actives Terminated Vested Retirees

To help contain

and predict costs,

sponsors could

offer lump sums to

only a select

group of TVs.

at relatively low cost. If the sponsor is primarily interested in reducing participant head counts (which will reduce the PBGC flat rate premiums) and controlling the risk of a plan accounting settlement, this may be the best condition to use.7 Location or line of business – Some firms that have shut down plants or sold

certain lines of business are still obligated to pay pension benefits for the terminated vested participants. Workers whose employment terminates with the shutdown of a facility or business line may be a logical focus for cash-outs, since their ongoing inclusion in the plan can complicate the administration process.

Cash-out strategies are most effective when coupled with an effective communication campaign and election window. For example, the plan could allow cash-outs for

participants only during a specified 60-day period. Setting time frames instills a sense of urgency in participants, and empowers sponsors to better control and predict costs. As lump sum interest rates are often fixed for the entire plan year, a temporary window will

enable the sponsor to better predict payout amounts.8

When offered a choice, many TVs will readily choose a lump sum, particularly if the election process is simple. To further simplify the process, sponsors may consider offering direct rollovers to employer-sponsored defined contribution (e.g., 401k) plans. Moreover, plan participants are permitted to roll over cash-outs from their qualified defined benefit plan to a qualified IRA without tax penalty. Sponsors concerned about retirement adequacy for these participants should advocate such rollovers.

Sponsors would typically be required to pay large one-time administrative and legal costs associated with this type of initiative. However, they may realize that the long-term benefits, cost savings and risk reductions outweigh these initial costs. Furthermore, a cash-out initiative could greatly reduce the time and resource burden down the road, if plan termination is the ultimate goal.

Alternatively (or in addition), sponsors may gradually reduce risk by offering lump sums as a standard form of payment in the plan. Note, however, that lump sum options without election windows cannot be removed from a plan, and will add to future volatility in cash flows.9

2. ANNUITY PURCHASES: TRANSFER RISK TO AN INSURANCE COMPANY

As we have mentioned, qualified U.S. DB plans must offer a life annuity option to all plan participants, regardless of the benefit formula. However, the annuity does not

necessarily need to be paid through the plan’s trust. Under certain conditions, sponsors may purchase annuity contracts from an insurance company to cover future annuity payments. Annuity contracts can be more expensive over the long term, since sponsors are effectively hiring the insurance company to take on the firm’s administrative role and assume all the associated risks. But the advantage to plan sponsors is that they shed the longevity risk represented by a number of their plan participants.

In general, there are two options for purchasing annuity contracts:

Buy-out – The purchase of annuity contracts from an insurance company to pay all future annuity payments for select participants. This arrangement includes full

7 An accounting settlement is explained in the “Settlement accounting” section below, but in short: a settlement is triggered when the lump sum or annuity purchase payout exceeds the plan’s interest cost plus service cost for the fiscal year. Cashing out only small lump sums may keep the settlement amount below this level.

8 Plan sponsors choose a “stability period,” ranging from one month to one year, to specify how long actuarially equivalent lump sum rates will be effective. They also choose a “lookback month” of up to five months prior to the beginning of the stability period. The lookback month allows sponsors to know well in advance what the effective rate for the year will be.

9

IRC § 411(d)(6) restricts plan sponsors from amending the plan to remove optional forms of payment (except de minimis changes).

To further simplify

the process,

sponsors may

consider offering

direct rollovers to

employer-sponsored defined

contribution (e.g.,

401k) plans.

Sponsors may

purchase annuity

contracts from an

insurance

company to cover

future annuity

payments.

administration by a third party and removes from the plan sponsor any future pension obligations to the plan participants.

Buy-in – Similar to a buy-out option, except that the sponsor maintains the assets and liabilities on the corporate balance sheet. The insurance company reimburses the sponsor for annuity payments made. This solution has experienced more success internationally than in the U.S. in recent years.

Annuity contracts can be pricey, depending on several factors, including:

Current interest rates – Lower bond rates generally mean higher annuity costs. The size of the purchase – Larger purchases typically allow for lower costs per

participant, due to economies of scale.

Plan complexity – Having many payment form options increases costs, for example, due to increased administrative complexity and less predictable risks. Insurance market factors – Profit margin targets, administrative capacity, supply

and demand for business, etc., can all affect the annuity cost, and are challenging to predict.

Profiles of plan participants – Annuities for women are more expensive than annuities for men, due to longer expected female lifetimes10; the type of industry can impact longevity (for example, physical laborers have shorter expected lifetimes); and participant status (active vs. retired) can impact annuity contract costs. Expenses – Plan liabilities do not normally account for future plan expenses, but

annuity contracts will have this built into the purchase price.

Mortality – Insurance companies generally use more conservative mortality

assumptions than those used for funding and accounting actuarial valuations.11

While sponsors can purchase annuity contracts for any group of participants within the plan, retirees are the most efficient group on which to focus. This is due to the typically shorter time horizon and higher certainty of the benefits being paid. This creates for more favorable pricing.

A potential disadvantage to purchasing annuities for retirees is the associated increase in liability duration. Retirees’ liabilities are shorter in duration than those of any other participants.12 Removing retiree obligations from the plan will probably increase duration and interest rate risk, which may necessitate an updated strategic asset allocation review.13

3. PLAN TERMINATION: SHIFT ALL RISK TO OTHERS

Plan termination is typically a combination of lump sum cash-outs and annuity purchases. For cost efficiency, sponsors will seek to cash out as many participants as possible, then purchase annuities for the rest.

10 As an interesting side note, rates used for lump sum calculations are based on unisex mortality rates (50% male/50% female), whereas annuity contracts are based on sex-distinct mortality tables. All else being equal (which is quite a stretch), sponsors would benefit from female participants electing lump sums and males electing annuities. However, this would obviously be unreasonable to anticipate or influence in practice.

11

This is true with current RP-2000 mortality tables (including associated projections). As of this writing, the Society of Actuaries (SOA) is developing new mortality tables that will generally increase liabilities and bring valuation and annuity purchase pricing more into line with one another.

12

A possible exception to this would be with plans that pay lump sums to new terminations but still have significant numbers of legacy retirees receiving annuities.

13 For more information, refer to the forthcoming note “Investment Strategy Implications of Risk Transfer” by James Gannon.

A potential

disadvantage to

purchasing

annuities for

retirees is the

associated

increase in

liability duration.

Sponsors may choose to terminate their plans at any time, assuming they are sufficiently

funded.14 Sponsors pursuing “voluntary” terminations must follow a rigorous, lengthy and

often pricey process. When the process is complete, the sponsor is free of all funding,

accounting and administrative requirements related to the plan.15

Many plan sponsors have no immediate need or desire to terminate their plans. Others choose to delay the plan termination process for a variety of reasons, including:

The sponsor values the plan as an employee attraction and retention tool;

The plan includes collectively bargained agreements that restrict any plan freeze or

termination measures;

The plan is underfunded, and the sponsor cannot (or chooses not to) fully fund it;

Current interest rates may require a high premium that would prevent or dissuade

the sponsor from terminating the plan;

The sponsor does not have the internal resources needed to navigate the plan

termination process;

The complexity of the plan or the quality of historical data may impede a termination

process;

The sponsor may not be able to justify the required cost or effort.

Some of these factors, such as interest rates or funded status, are likely to change with time. Others, such as collectively bargained agreements, tend to be more permanent, and may delay a plan termination process indefinitely.

Considerations

While any of these solutions – lump sum cashouts, annuity purchases or plan termination - can reduce ongoing administrative expenses and overall company risk, sponsors should carefully consider the appropriate timing of any transaction. Interest rates still hover near historical lows, contributing to high annuity purchase prices, large lump sum values, and low funded status in plans. Moreover, poor funding ratios may disallow any risk transfer transactions unless the ratios improve. In addition, these solutions may trigger settlement accounting, which is likely to increase current pension expense.

1. INTEREST RATE TIMING

We observed significant market activity for lump sum cash-outs during 2012. This was due in part to the five-year phase-in to corporate bond rates as the underlying basis for

lump sums having been completed.16 In addition, many sponsors were able to use

relatively high corporate bond rates from fall 2011 for cash-outs in 2012.

Chart 2, below, demonstrates that even with the phase-in (which we would expect to increase rates), lump sum rates since 2008 have stayed relatively flat, even decreasing to their lowest values during 2012. For comparison, in the chart we show the 30-year Treasury rates, the underlying corporate bond rates (now equivalent to the lump sum rates) and the funding liability rates. Until 2012, funding liabilities are calculated based on the 24-month average of the same corporate bond rates used for lump sum

14 In some limited cases, where a company is not financially capable of funding pension benefits, the PBGC may initiate a “distressed termination.” For every 12 standard terminations since 2000, there was about one distressed termination, based on the 2011 PBGC pension insurance data tables.

15

See the Appendix for a description of standard termination requirements. 16

Prior to PPA (Pension Protection Act), lump sum rates were based on Treasury rates. Between 2008 and 2011, lump sum rates were a mixture of Treasury and corporate rates.

Sponsors pursuing

“voluntary”

terminations must

follow a rigorous,

lengthy and often

pricey process.

We observed

significant market

activity for lump

sum cash-outs

during 2012.

purposes. In 2012, due to MAP-21, rates are limited to a corridor centered on the 25-year average of the 24-month average. For simplicity, we have shown just the

second-segment rates.17 We observe similar results with rate segments 1 and 3.

Chart 2 – Phase-in of segment 2 lump sum rates since PPA

Source: Internal Revenue Service, September 2007–May 2013

Lump sum values are inversely related to discount rates – meaning that, as rates fall, lump sums become more attractive to participants. Inasmuch as the rates used to calculate the lump sums are higher than the rates used to value liabilities, sponsors may find lump sums more attractive as well. Both conditions occurred in 2012.

How do interest rates affect the cost of lump sum cash-outs? The answer will depend on the basis being considered. Three common viewpoints:

Economic basis – From an economic value perspective, lump sum benefits are currently more expensive than they have been at nearly any time in recent years. Despite the five-year phase-in, rates have fallen so dramatically that the benefits of the completed phase-in have been largely eclipsed. Lump sum rates in 2008, mostly based on Treasury rates, were around 5%. In 2013, rates are below 4%, based exclusively on corporate bond rates.

However, lump sums typically come directly from the pension trust, not from the company’s checking account. Therefore, the following two points of view are probably more consequential.

Funding (PPA/MAP-21) basis – From a funding standpoint, we consider cash-outs on the basis of whether they result in a plan gain or a plan loss. If the lump sum paid is greater than the associated liability that is being removed, the plan experiences a loss. The opposite is true for gains. Losses typically increase funding requirements;

gains decrease them.18

Due to MAP-21, if lump sum rates stay near their current levels, lump sum payouts will almost definitely create losses on a funding basis. This will probably change over time as the effects of MAP-21 phase out, and if rates rise. In the unlikely event

17 For lump sum purposes, PPA interest rates are defined as 3 “segment rates”, which represent the average of rates from years 1-5, 6-20, and above 20 for segments 1, 2, and 3, respectively.

18

Gains and losses are determined on the valuation date in the year following a distribution. Note that a gain would not necessarily mean that funded status has improved. In fact, a gain may lead to a lower funded status if the plan was underfunded to begin with.

0%

2%

4%

6%

8%

10%

Lump Sum Rate … 30-year Treasury Rate Corporate Bond Rates … Funding Rates …

Lump sum values

are inversely

related to discount

rates.

that rates rise above the MAP-21 upper corridor in the near term, lump sum

cash-outs would become particularly attractive from a funding standpoint.19

Accounting (PBO) basis – Unlike funding liabilities, which are based on 24-month smoothed rates, accounting liabilities are calculated by use of market rates as of the end of the fiscal year, or the date of re-measurement. As lump sum rates are typically fixed for a year, there may be a disconnect between the lump sum rate paid and the discount rate used to re-measure liabilities after the settlement.

Both the lump sum values and the accounting discount rates are based on a mix of high-quality corporate bonds. Because the underlying rates are not identical

(particularly when selective bond models are used to measure accounting liabilities), the lump sum values and accounting discount rates will not match perfectly.

Accounting discount rates have no prescribed yield curve, and the range of rates used at any measurement date may vary widely.

Trying to tactically time a lump sum cash-out opportunity can be challenging, and choosing the right time may depend on other factors not considered here. Still, prudent sponsors will want to be aware of how the current environment influences the cost of any risk transfer option.

Annuity contract timing is quite different from lump sum options. Unlike lump sums, which can have fixed rates for up to one year, annuities are priced (by the issuing insurance companies) on the basis of the rates effective at the date of settlement – which can change frequently, exposing the plan sponsor to the risk of falling rates during the planning and preparation phase.

2. FUNDED STATUS PERCENTAGE AND CASH DEMANDS

Many firms closely follow their adjusted funding target attainment percentage (AFTAP) and may wonder how risk transfer options affect this measure. Sponsors must meet certain AFTAP thresholds in order to pursue risk transfer options, and the AFTAP is likely to change after the risk transfer takes place.

Sponsors with an AFTAP below 80% cannot offer certain accelerated forms of payment to participants, including full lump sums and annuity purchases.20 Therefore, plans in this category must either wait for the AFTAP to rise above 80% or contribute the necessary additional cash before considering one of those risk transfer options.21

For plans with an AFTAP below 80% before 2012, MAP-21 may have created a window of opportunity wherein the AFTAP temporarily increased by as much as 20%. This opened the door for some sponsors to pursue risk transfer when it may not have been a permissible option before. Note, however, that MAP-21 is not a market-based measure of liability, and while risk transfer may technically be allowed, sponsors should consider the long-term effects of risk transfer on their plans, particularly if they are severely underfunded.

Sponsors should note that transferring plan liabilities could lead to reductions in overall funded status. In general, if a plan experiences a loss due to risk transfer, the funded deficit (if any) will likely increase. More severely underfunded plans will see a relatively larger dip in funded percentage after a risk transfer event.It is particularly important that sponsors recognize this, given that plan funded status determines minimum contribution

19

In this scenario, it is possible that lawmakers would eliminate the use of the corridor altogether, which would negate this argument. 20

There are a few exceptions to this rule, such as de minimis lump sums and level income options. 21

Due to investment returns, favorable increases in discount rates, minimum required contributions and some combination of these. See the appendix for AFTAP ranges and corresponding consequences.

Accounting

discount rates

have no

prescribed yield

curve, and the

range of rates

used at any

measurement date

may vary widely.

Sponsors should

consider the

long-term effects of risk

transfer on their

plans, particularly

if they are severely

underfunded.

requirements, quarterly contribution requirements, benefit restrictions, the use of carryover/pre-funding balances and a host of other results.

3. SETTLEMENT ACCOUNTING

Plan sponsors considering risk transfer through annuitization or cash-outs should understand the accounting implications. Due to accelerated recognition of gains or losses (but mostly losses, as of this writing), the effects of settlement accounting on pension expense can be significant.

Under U.S. accounting standards, plan settlements are among the few infrequent events

that can trigger special pension expense treatment.22 To be considered a settlement, the

arrangement must:

be “an irrevocable action,”

“relieve the employer (or the plan) of primary responsibility for a pension obligation,” and

“eliminate significant risk related to the obligation and the assets used to effect the settlement.”23

Settlements usually follow large lump sum payouts or buy-out annuity contract purchases. Because buy-in annuity purchases are revocable and the employer maintains primary responsibility for the obligation, they probably will not trigger settlement accounting. This is one of the key advantages to annuity buy-ins. When a settlement occurs, the firm must recognize a portion of the pension plan’s

unrecognized gain or loss.24 It would otherwise amortize the unrecognized gain or loss

over a longer period. The settlement amount recognized in pension expense is the unrecognized gain or loss, prorated on the basis of the cash-out/annuity purchase size relative to the DB plan’s total liability.

Recent liability losses driven by declining discount rates, coupled with asset losses, have led to unusually large accumulated pension losses, making the accounting costs of plan settlements more severe in recent years than in the past.

Settlement accounting is required only when the settlement cost exceeds interest cost plus service cost.25 Consequently, fully frozen plans are more likely to trigger a settlement, as they have minimal service cost. The increased likelihood of settlement accounting for frozen plans, along with the recent large pension losses, have

exacerbated the pension expense impact of certain risk transfer options.

We advise DB plan sponsors to pay careful attention to these and the other matters we’ve discussed in this paper, as they seek to determine whether risk transfer solutions are right for their organizations. When planned and carried out effectively, risk transfer can hold many advantages and fit well within a sponsor’s long-term pension plan risk-management goals.

22

The other accounting events that trigger special treatment are special termination benefits and curtailment. 23

Paragraph 3, Statement of Accounting Standards No. 88 (now ASC 715). 24

A portion of the transition obligation/asset would also be immediately recognized, but this is now zero for most plans. 25

Service cost and interest cost are two components of pension expense.

Plan sponsors

considering risk

transfer through

annuitization or

cash-outs should

understand the

accounting

implications.

We advise DB

plan sponsors to

pay careful

attention to these

matters.

Appendix

Risk transfer statistics during 2012

The following table details some of the risk transfer transactions known through public information. With the exception of Verizon, GM, Ford and Pep Boys, these were all cash-out settlements to terminated vested participants.

Table 1

COMPANY

SETTLEM ENT ($M)

PBO (BOY, $M)

% PBO

SETTLED COMMENTS

Pep Boys 58 54 100% 7.5% premium implied to terminate

Verizon Communications 9,138 30,582 30% Includes annuity purchase

General Motors 30,937 108,562 28% Includes annuity purchase & retiree lump sum offer

TRW Automotive Holdings 311 1,284 24% 50% acceptance rate

Sears Holdings 1,405 6,109 23% 75% acceptance rate

Visteon 301 1,480 20% 70% acceptance rate

Yum! Brands 278 1,381 20%

Energy Future Holdings 513 3,331 15%

Thomson Reuters 245 1,800 14%

OfficeMax 190 1,365 14% 57% acceptance rate

Diebold 78 636 12%

Equifax 77 746 10% 64% acceptance rate

J.C. Penney Company 439 5,297 8% 72% acceptance rate, future terms will have lump sum option

Baxter International 387 4,944 8% 50% acceptance rate

Mead Johnson Nutrition 31 403 8%

Archer Daniels Midland 204 3,095 7%

NCR 240 4,027 6%

New York Times 112 1,987 6%

PepsiCo 633 11,901 5%

Kaydon 7 143 5%

A.H. Belo 15 421 3% 62% acceptance rate

Ford Motor 1,123 48,816 2% Retiree lump sum offer

Kimberly-Clark 95 5,920 2%

Lockheed-Martin 375 40,616 1% Did not trigger settlement accounting

Summary of plan termination steps

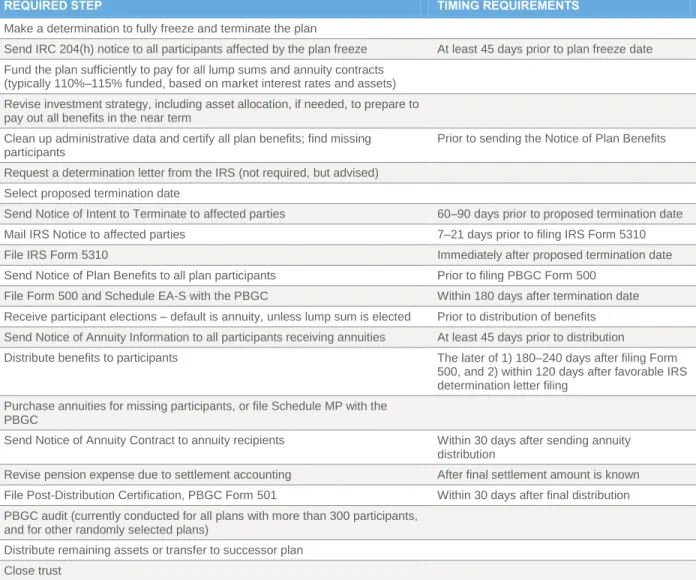

The plan termination process is complex. Appropriate timing and communication are critical. Sponsors must communicate with the IRS, the PBGC, plan participants

(including beneficiaries and alternate payees), and any other affected parties (e.g., labor unions). While not necessarily comprehensive, Table 2 below covers the major steps plan sponsors must complete during a standard plan termination process.

Table 2 – Summary of plan termination steps

REQUIRED STEP TIMING REQUIREMENTS

Make a determination to fully freeze and terminate the plan

Send IRC 204(h) notice to all participants affected by the plan freeze At least 45 days prior to plan freeze date Fund the plan sufficiently to pay for all lump sums and annuity contracts

(typically 110%–115% funded, based on market interest rates and assets) Revise investment strategy, including asset allocation, if needed, to prepare to pay out all benefits in the near term

Clean up administrative data and certify all plan benefits; find missing participants

Prior to sending the Notice of Plan Benefits Request a determination letter from the IRS (not required, but advised)

Select proposed termination date

Send Notice of Intent to Terminate to affected parties 60–90 days prior to proposed termination date Mail IRS Notice to affected parties 7–21 days prior to filing IRS Form 5310 File IRS Form 5310 Immediately after proposed termination date Send Notice of Plan Benefits to all plan participants Prior to filing PBGC Form 500

File Form 500 and Schedule EA-S with the PBGC Within 180 days after termination date Receive participant elections – default is annuity, unless lump sum is elected Prior to distribution of benefits Send Notice of Annuity Information to all participants receiving annuities At least 45 days prior to distribution

Distribute benefits to participants The later of 1) 180–240 days after filing Form 500, and 2) within 120 days after favorable IRS determination letter filing

Purchase annuities for missing participants, or file Schedule MP with the PBGC

Send Notice of Annuity Contract to annuity recipients Within 30 days after sending annuity distribution

Revise pension expense due to settlement accounting After final settlement amount is known File Post-Distribution Certification, PBGC Form 501 Within 30 days after final distribution PBGC audit (currently conducted for all plans with more than 300 participants,

and for other randomly selected plans)

Distribute remaining assets or transfer to successor plan Close trust

AFTAP ranges and Implications26

PPA imposed restrictions on underfunded plans, as determined by the adjusted funding target attainment percentage (AFTAP). The AFTAP is the plan’s actuarial value of assets (smoothed up to two years), minus any credit balance, all divided by the plan’s funding target. This ratio is then adjusted for annuity purchases made for non–highly compensated employees in the prior 24 months.

The plan’s actuary must certify the AFTAP each year, typically by the last day of the ninth month. Table 3 below summarizes the key restrictions.

Table 3 – AFTAP ranges and restrictions

Source: Internal Revenue Code Section 436

Comparison of risk transfer options

Plan sponsors ought to consider many different factors when deciding which risk transfer option will most effectively meet their objectives. Table 4 summarizes the key

considerations for the risk transfer options discussed in this paper.

Table 4 – Comparison of risk transfer options

ANNUITIZATION BUY-IN30

ANNUITIZATION BUY-OUT

TV LUMP SUM CASH-OUT

Avoid Settlement Accounting Yes Possible Possible

Revocable Yes No No

Allowed if AFTAP < 80% No No No31

Fixed Stability Rate Period No No Yes

Avoid Annuity Contract Premium No No Yes

Reduced Interest Rate Risk No No Yes

Reduced PBGC Premium No Yes Yes

Reduced Ongoing Admin Expenses Possible Yes Yes

Reduced Investment Expenses Possible Yes Yes

Reduced Longevity Risk Yes Yes Yes

26

Note that plans fully frozen prior to September 1, 2005, may not be subject to the same restrictions.

27 Plans in the termination process may be allowed to purchase annuities and offer lump sums. Also, annuity “buy-in” purchases may not be restricted, as they can be viewed as investment tools rather than irrevocable transfers to insurance companies.

28

Defined as any benefit greater than a single life annuity plus social security supplement. 29

The same restrictions would apply if the plan sponsor is in Chapter 11 bankruptcy. 30

Assumes that buy-in option is considered a revocable investment product. 31

Except for small lump sums (i.e., less than $5,000). FULL LUMP SUM PAYMENTS

ANNUITY PURCHASES27

ACCELERATED FORMS OF PAYMENT 28

ONGOING BENEFIT ACCRUALS

LIFE ANNUITIES

AFTAP ≥ 80% Allowed Allowed Allowed Allowed Allowed

60% ≤ AFTAP < 80% Restricted Restricted Partially Restricted Allowed Allowed

For more information:

Call Russell at 800-426-8506 or visit www.russell.com/institutional Important information

Nothing contained in this material is intended to constitute legal, tax, securities or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type. The general information contained in this publication should not be acted upon without obtaining specific legal, tax and investment advice from a licensed professional.

Please remember that all investments carry some level of risk. Although steps can be taken to help reduce risk, it cannot be completely removed.

Russell Investments is a trade name and registered trademark of Frank Russell Company, a Washington USA corporation, which operates through subsidiaries worldwide and is part of London Stock Exchange Group.

The Russell logo is a trademark and service mark of Russell Investments.

Copyright © Russell Investments 2012, 2013. All rights reserved. This material is proprietary and may not be reproduced, transferred or distributed in any form without prior written permission from Russell Investments. It is delivered on an "as is" basis without warranty. First used: May 2012. Revised June 2013 (Disclosure revision: December 2014)