An Authorised Financial Services Provider Item No: 992283 Feb06

TH

E

LIV

IN

G F

AC

ILIT

Y

FN

B

Life insurance for the

living!

TH

E

LIV

IN

G F

AC

ILIT

Y

FN

B

With the FNB Living Facility, you don't have to die to benefit -

You can choose to

! of the premiums you have paid every three years;

OR

! you have paid

over the term; OR

! if you

are alive at the end of the term. In the past you could never reap the benefit of the premiums that you paid, because you had to die before the money could be paid out!

How are you currently

insuring your life?

! A that only

pays out at your death

! Expensive

! A with no

guarantees and no value in the short term

! You have

That's not good enough!

we will reward you for living!

get back -10%

all the premiums

the whole insured amount,

life insurance policy credit life cover universal life policy

TH

E

LIV

IN

G F

AC

ILIT

Y

FN

B

With the FNB Living Facility, you have an innovative life insurance policy that:

! your benefits and your

premium for life, and

!

You choose to get back: 1.

every three years – the Living Bonus Facility.

OR

2. you have paid at

the end of the term – it is free life cover with the Living Premium Facility

OR 3. the

(e.g. R1,5 million), if you are alive at the end of the term – the Living Future Benefit

you to undergo lengthy and time consuming

We will phone you to get the medical information we need from you.

guarantees

rewards you for living

10% of the premiums you paid, tax-free

all the premiums

whole insured amount tax-free

will not expect

medical examinations.

What makes the FNB

Living Facility better?

TH

E

LIV

IN

G F

AC

ILIT

Y

FN

B

The Living Facility will pay a lump sum on your death. But you also by getting if you stay alive you can choose to get either

every three

years or the if

you are alive at the end of the term!

The protects you

against incapacity. Many people don't realise that becoming incapacitated will seriously jeopardise their financial situation - not only will their income cease because they are unable to work, but they will also have additional expenses, such as medical bills. It is therefore wise to cover yourself against this unforeseen eventuality.

The is

automatically included in your Living Facility and allows you to increase your cover and cash back benefits without evidence of health.

The can

be included if you would like us to pay your future contributions in case you become incapacitated. We will also pay your premiums for three months if you are retrenched.

benefit money back

10% of your premiums back

whole insured amount

Inability Benefit

Cover Top-up Benefit

Facility Protection Benefit

A practical guide to your

insurance needs

Cash back

Fac fit

e

ility en

B Protection

r e v o C e fi L Inab ility B

en e fit R e tre n ch m ent B

enefit p u-p o T r e v o C

TH

E

LIV

IN

G F

AC

ILIT

Y

FN

B

2. The Living Premium

Facility

You get back

during the term of the policy, which effectively means that you get life cover for free! This amount will be paid to you

OR

3. The Living Future Facility

You can insure your life for an amount of, for example R1.5 million, and you

get the back

at the end of your chosen term - For example, if you are now 30 years old, need R1.5 million life cover for 20 years and you choose this option, we will pay you the R1,5million if you die or if you live to your 50th birthday - guaranteed!

all the premiums you have paid

tax-free!

whole insured amount tax-free.

How does the FNB Living

Facility work?

How do I get cash back?

You have three options:

1. The Living Bonus Facility

You can get

back for as long as the Facility remains in force. For example, if your monthly premium at the start of a three-year cycle is R350, you will receive R1 324 back in three years' time -

OR

10% of your premiums every three years,

TH

E

LIV

IN

G F

AC

ILIT

Y

FN

B

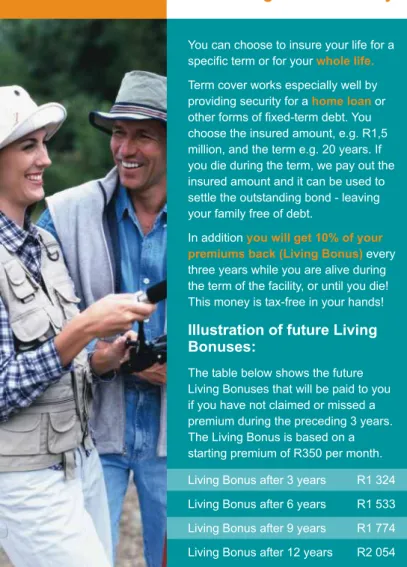

You can choose to insure your life for a specific term or for your

Term cover works especially well by providing security for a or other forms of fixed-term debt. You choose the insured amount, e.g. R1,5 million, and the term e.g. 20 years. If you die during the term, we pay out the insured amount and it can be used to settle the outstanding bond - leaving your family free of debt.

In addition

every three years while you are alive during the term of the facility, or until you die! This money is tax-free in your hands!

Illustration of future Living

Bonuses:

The table below shows the future Living Bonuses that will be paid to you if you have not claimed or missed a premium during the preceding 3 years. The Living Bonus is based on a starting premium of R350 per month. Living Bonus after 3 years R1 324 Living Bonus after 6 years R1 533 Living Bonus after 9 years R1 774 Living Bonus after 12 years R2 054

whole life.

home loan

you will get 10% of your premiums back (Living Bonus)

The Living Bonus Facility

TH

E

LIV

IN

G F

AC

ILIT

Y

FN

B

With the Living Premium Facility you choose the term of your Facility. The Living Premium Facility will

you have paid during this term. This means that you have been

Example

You insure your life for R500 000 and pay R115 000* in premiums during the 20 year term. If you are alive at the end of this 20 year term, you will receive the amount of R115 000 – tax free.

But if something should happen to you and you die or become disabled, your dependants will still receive the insured amount of R500 000 – you can’t lose! It is free life cover!

* Each person’s premium will differ

according to his or her risk profile.

repay all the premiums

covered for free!

The Living Premium

Facility

TH

E

LIV

IN

G F

AC

ILIT

Y

FN

B

If you survive your selected term, you will receive the

that you selected at the beginning of the term. This is called the Living Future Benefit. The Living Future Benefit is in your hands and you can

You can buy a car, travel or even buy a house! You can even use this money to supplement your retirement funds.

Example:

You have just been granted a single credit facility, registered for R1,5 million over a 20 year term. You protect your family in case of your death or inability by taking out a Living Future Facility. This means that they will be able to pay off the outstanding debt if you die or become incapacitated. If you live for the next 20 years and there is still an amount owing on the single credit facility, you can use your Living Future Benefit to settle the debt.

You now have a facility that:

! will out the

which means that your family is looked after -

! will out the

if you don't die but to the end of the term -

whole insured amount

tax-free

use the money for anything.

pay whole insured

amount if you die,

tax-free!

pay whole insured

amount live

tax-free!

The Living Future

Facility

The FNB Living Future Benefit is truly “Life Cover for the Living”.

You choose the term of your Facility. The Living Future Facility will pay the

if you die during this term.

TH

E

LIV

IN

G F

AC

ILIT

Y

FN

B

The Inability Benefit pays you a if you become incapacitated during the term of the Facility. You choose the size of your inability cover at the start of your facility.

The benefit will be paid on any of the following events:

! Loss of hearing

! Loss of vision

! Loss of speech

! Cancer

! Loss of limbs

! Paraplegia

! Muscular dystrophy

! Heart bypasses

! Surgery to the aorta

! Heart failure

! Kidney failure

! Respiratory failure

! Organ transplants

! Stroke

! Permanent confinement to a wheel chair, or becoming bedridden

! Terminal illness

lump sum

TH

E

LIV

IN

G F

AC

ILIT

Y

FN

B

Cover Top-up Benefit

Your FNB Living Facility has a built-in Cover Top-up Benefit. This allows youto your level of every

year having to undergo any or answer any medical questions. Both your life cover and your inability cover (if selected) will increase by your chosen percentage each year.

Facility Protection

Benefit

The Facility Protection Benefit will

your if:

! you become incapacitated, or

! you are retrenched

If you become during

the term of your Facility, the Facility Protection Benefit will continue to

for the remainder of your chosen term.

increase cover

without

medical examinations

pay future premiums

incapacitated pay your premiums

Retrenchment Benefit

If you are we will pay your premiums for After the three months you will have to resume premium payments in order to keep your benefits intact. You will not lose any Living Bonuses and your Living Future Benefit will remain unaffected under the Living Future Facility Benefitretrenched, three months.

TH

E

LIV

IN

G F

AC

ILIT

Y

FN

B

Do I have to go for

medical tests?

The FNB Living Facilityyou to go for extensive In most cases we will ask you a few medical questions over the telephone and make the underwriting decision based on this information.

does not require

medical examinations.

If you currently have a fully

underwritten, standard rates policy with another insurer that is less than two years old, and your health has not changed since then, you are guaranteed acceptance under the Living Facility, for up to double the life cover qualifying policy.

When does my cover

start?

Your life cover will start when we receive the first premium.

Are any benefits

guaranteed?

Yes, all our benefits areIn order to keep the starting premium as low as possible, the

by each year.

If you aspire to provide yourself with peace of mind and don't wait a minute longer to find out how you can benefit from the FNB Living Facility. Just send a blank to

and we will phone you back.

guaranteed for life.

premium will increase 5%

money back,

SMS 31091