41428

Public Disclosure Authorized

Public Disclosure Authorized

Public Disclosure Authorized

MALDIVES

PUBLIC SECTOR ACCOUNTING AND

AUDITING

A Comparison to International

Standards

Country Report

Government of Maldives

South Asia Region Financial Management Unit June, 2007

ABBREVIATIONS AND ACRONYMS

AG Auditor General

CFO Chief Financial Offi cer

CIPFA Chartered Institute of Public Finance and Accountancy, United Kingdom GoM Government of Maldives

IAASB International Auditing and Assurance Standards Board IAS International Accounting Standard

IDF Institutional Development Fund

IES International Education Standards for Professional Accountants IFAC International Federation of Accountants

IFRS International Financial Reporting Standard

INTOSAI International Organization of Supreme Audit Institutions IPSAS International Public Sector Accounting Standards (of IFAC) IPSASB International Public Sector Accounting Standards Board ISA International Standard for Auditing

MoFT Ministry of Finance & Treasury NAO UK National Audit Offi ce PAS Public Accounting System

PEFA Public Expenditure and Financial Accountability PFM Public Financial Management

PSC Public Service Commission PSTI Public Service Training Institute SAI Supreme Audit Institution SOE State-Owned Enterprise

ACKNOWLEDGMENTS

This assessment of accounting and auditing standards and practices in the public sector was carried out in active collaboration with the Government and various stakeholders, particularly the Auditor General and his staff; and the Ministry of Finance and Treasury.

The review was conducted through a participatory process that involved these stakeholders whose responses to issues raised in the diagnostic questionnaires were especially useful. The team of advisors and development partners also contributed greatly to the early stages of the concept note and framework development, as well as drafting of earlier reports for this study which ultimately covers the countries of the South Asia Region: Afghanistan, Bangladesh, Bhutan, India, Maldives, Nepal, Pakistan, and Sri Lanka.

The following World Bank Task Team was responsible for this report with general guidance from the advisors on this review program and the development partners who collaborated in this program. The Maldives report benefi ted from the comments of its peer reviewers, M. Mozammal Hoque, Senior Financial Management Specialist and Christian Eigen-Zucchi, Economist in the World Bank. The fi nal report was developed after a consultative workshop held in Male on January 14, 2007 and was provided to the Government for comment. Subsequent to the workshop, the Audit Bill (2002) has also recently been enacted as an Audit Act on March 13, 2007 and accordingly, revisions have been made in the report.

Task Team

P. K. Subramanian, Lead Financial Management Specialist Manoj Jain, Senior Financial Management Specialist Ronald Points, Lead Consultant, Accounting Michael Jacobs, Lead Consultant, Auditing

Review Program Advisors

Simon Bradbury, Loans Department, World Bank

David Goldsworthy, International Technical Cooperation Program, UK National Audit Offi ce Noel Hepworth, Chartered Institute of Public Finance and Accountancy, London

Abdul Mudabbir Khan, Fiscal Affairs Department, International Monetary Fund Ian Mackintosh, Chairman, UK Accounting Standards Board

Paul Sutcliffe, International Public Sector Accounting Standards Board, International Federation of Accountants

Development Partner Collaborators on the Review Program

David Biggs, Financial Management Advisor, UK Department for International Development Kathleen Moktan, Asian Development Bank

CONTENTS

Executive Summary ix

I. INTRODUCTION 1

II. PUBLIC SECTOR ACCOUNTING 2

A. Institutional Framework for Public Sector Accounting 2

(1) Accounting Laws and Regulations 2

(2) Education and Training 2

(3) Code of Ethics 3

(4) Public Sector Accountant Arrangements 3

B. Accounting Standards as Practiced 4

(1) Setting Public Sector Accounting Standards 4

(2) Presenting Financial Reports 4

III. PUBLIC SECTOR AUDITING 6

A. Institutional Framework for Public Sector Auditing 6

(1) Institutional Framework 6

(2) Setting Auditing Standards 7

(3) Code of Ethics 7

(4) Accountability in the Supreme Audit Institution 8

(5) Independence 8

(6) Qualifi cations and Skills for the Auditors 8

(7) Training 8

(8) Audit Competence 9

(9) Quality Assurance 9

B. Auditing Standards as Practiced 9

(1) Audit Planning 9

(2) Audit Supervision 9

(3) Reviewing Internal Controls 10

(4) Reviewing Compliance 10

(5) Analyzing the Financial Statements 10

P U B L I C S E C T O R A C C O U N T I N G A N D A U D I T I N G

Annex A: Methodology of the Assessment 14

Annex B: Accounting And Auditing Standards 16

International Public Sector Accounting and Education Standards 17 International Financial Reporting Standards and International Accounting Standards 18

INTOSAI Code of Ethics and Auditing Standards 19

International Standards on Auditing 22

Annex C: National Accounting Legislation 23

Annex D: National Audit Legislation 25

Annex E: Benefi ts of Accrual Basis of Accounting 32

1. This assessment of public sector accounting and auditing standards is generally meant to assist with the implementation of more effective public fi nancial management (PFM) through better quality accounting and public audit processes in Maldives. It is intended to provide greater stimulus for more cost-effective outcomes of government spending. The specifi c objectives are (a) to provide the country’s accounting and audit authorities and other interested stakeholders with a common well-based knowledge as to where local practices stand in comparison with internationally developed standards of fi nancial reporting and audit; (b) to assess the causes of the prevailing variances; (c) to chart paths to reduce the variances; and (d) to provide a continuing basis for measuring improvements. The World Bank is supporting initiatives to develop local systems so that donors can increase their use of country systems for their own grants and loans. Other donors are cooperating with the Bank in this approach.

2. Adoption of international standards for accounting and auditing provides the basis for competent fi nancial reporting and transparency. The International Public Sector Accounting Standards Board (IPSASB) of the International Federation of Accountants (IFAC) has developed a core set of International Public Sector Accounting Standards (IPSAS) for accrual-based systems, as well as one for cash basis of accounting. These establish an authoritative set of independent international fi nancial reporting standards for governments and others in public sector organizations. Application of IPSAS will support developments in public sector fi nancial reporting directed at improving decision-making, fi nancial management, and accountability; and it will be an integral element of reforms meant for promoting social and economic development. The IPSASB has also developed guidelines for the migration from cash basis to accrual-based fi nancial reporting.1 The traditional emphasis on cash basis of accounting has been found inadequate because of its failure to recognize true costs, and all assets and liabilities. Cash basis of accounting can too easily neglect asset management, accumulating arrears, future liabilities (e.g., pensions), and contingent liabilities (e.g., guarantees).

3. The International Organization of Supreme Audit Institutions (INTOSAI) supports the development of auditing standards developed by the International Auditing and Assurance Standards Board (IAASB). The INTOSAI Auditing Standards, which are supported by the detailed IAASB International Standards on Auditing (ISA) underpin a modern audit process. The IAASB is progressively rolling out international auditing standards in order to appropriately refl ect the interests of the international public sector audit community.

1 Transition to the Accrual Basis of Accounting: Guidance for Governments and Government Entities, Study 14, IFAC Public Sector

P U B L I C S E C T O R A C C O U N T I N G A N D A U D I T I N G

TABLE ES1. SUMMARY OF ACCOUNTING STANDARDS ISSUES IN THE MALDIVES

4. Annex A explains the methodology used for the study. Annex B provides a summary of international accounting and auditing standards referred to in this study. Annex C and D provide country accounting and auditing legislation, respectively. Lastly, Annex E includes a description of the benefi ts of accrual accounting. The desired actions indicated by this assessment are summarized below.

5. Build on the current cash basis of fi nancial reporting under the Cash Basis IPSAS and

chart a path to subsequent implementation of the Accrual Basis of Accounting. The IPSASB encourages governments to progress to the Accrual Basis of accounting and to harmonize national requirements with the IPSAS. Immediate reporting in the format of the Cash Basis IPSAS, and then progressive adoption of Accrual Basis reporting is needed to meet the requirement of the Public Finance Act.

6. A Supplementary Table of Standards and Gaps of this report provides a matrix detailing the accounting standards, the present position, and options for improvement. A summary of these accounting issues is shown in Table ES1.

7. Adopt the IFAC-issued International Standards on Auditing to the more specifi c

INTOSAI Auditing Standards, as well as to existing audit manuals and procedures. The new, amended Audit Act mandates the adoption of international standards. The Auditor General currently uses an Audit Manual which follows the prescriptions of the INTOSAI Auditing Standards but they have not been formally adopted. The implementation of the new Audit Act and the implementation of an Institutional Development Plan for the Offi ce of the Auditor General should introduce modern audit reporting and a modern audit organization.2 Audit recommendations and observations should be made public.

2 This is proposed to be completed under an IDF grant fi nanced by the World Bank for institutional development and capacity

building of the audit offi ce of Maldives.

Standard Current status Action to move towards international

standards 1.Does the Public Sector

Accounting Law adopt IPSAS?

No The Auditor General would prescribe the adoption

of IPSAS for Maldives (to be confi rmed and communicated by GoM by March, 2007).

2.Does education and

training of accountants accord with IES?

No Distance learning education arrangements are

needed. A proposal is required to be drafted jointly by Ministry of Higher Education, Public Service Training Institute (PSTI), Public Service Commission (PSC), Ministry of Finance and Treasury (MoFT) and the AG by June, 2007 (led by MoFT)

3.Does the Code of Ethics match international standards?

No There is a need to develop a Code. The MoFT

is to develop a Code of Ethics for public sector accountants – by December, 2007.

4.Is there a body to prescribe public sector accounting standards?

The Auditor General has this responsibility under the proposed Audit Act.

MoFT will be issuing implementation guidelines as per the principles and standards prescribed by the AG.

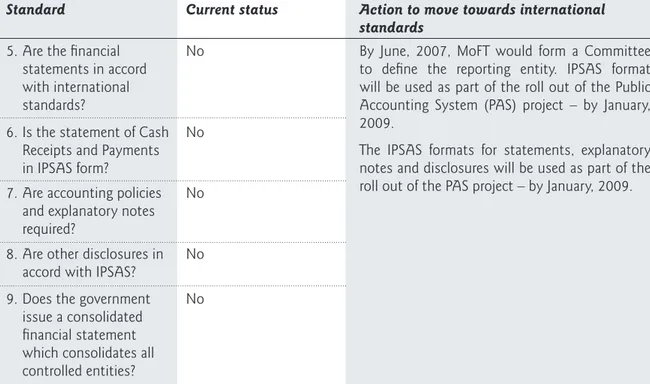

TABLE ES2. SUMMARY OF AUDITING STANDARDS ISSUES IN THE MALDIVES

8. A Supplementary Table of Standards and Gaps of this report provides a matrix detailing the current standards, present position, and options for improvement. A summary of these auditing issues are shown in Table ES2.

Standard Current status Action to move towards international

standards 5.Are the fi nancial

statements in accord with international standards?

No By June, 2007, MoFT would form a Committee

to defi ne the reporting entity. IPSAS format will be used as part of the roll out of the Public Accounting System (PAS) project – by January, 2009.

The IPSAS formats for statements, explanatory notes and disclosures will be used as part of the roll out of the PAS project – by January, 2009. 6.Is the statement of Cash

Receipts and Payments in IPSAS form?

No 7.Are accounting policies

and explanatory notes required?

No 8.Are other disclosures in

accord with IPSAS? No

9.Does the government

issue a consolidated fi nancial statement which consolidates all controlled entities?

No

Standard Current status Action to move towards international

standards 1. Is the SAI statutory

framework in accord with the needs of the INTOSAI Auditing Standards?

Yes3 The Republic of Maldives has recently enacted the

Audit Act (included in Annex D) following the workshop in January 2007, which provides an adequate statutory framework. The effectiveness of the implementation of the new Audit Act is yet to be seen

2. Is there a body to prescribe public sector auditing standards?

Yes4 The Audit Act needs to prescribe the AG as the

responsible body and S. 5 of the recently enacted Audit Act (included in Annex D) provides this. The AG could work jointly with the proposed professional body to develop implementation guidelines.

3. Have INTOSAI and IFAC

audit standards been adopted?

The Audit Manual is based on them.

3 Current status has recently changed due to enactment of the Audit Act on March 13, 2007 4 Current status has recently changed due to enactment of the Audit Act on March 13, 2007

P U B L I C S E C T O R A C C O U N T I N G A N D A U D I T I N G

Standard Current status Action to move towards international

standards 4. Has a code of ethics

equivalent to the INTOSAI standards been adopted?

No A code will be developed as part of the ongoing

IDF grant and it needs to be adopted by the AG. (by Jan.2008)

5. Is the accountability process in the SAI in accord with INTOSAI Auditing Standards?

No An annual report is required by 2007.

6. Does the SAI legal framework meet the INTOSAI standards for independence and powers?

No The new Audit Act at Annex D provides for these

and satisfactorily adopts the recommendations made by the UK National Audit Offi ce (NAO) team and the Task Team (World Bank)) on the draft Audit Bill examined during this study.

7. Does education and

training of auditors accord with INTOSAI and IES standards?

No A needs analysis is being carried out by

the NAO institutional strengthening team. Formation of the proposed professional body and opportunities like overseas practical experience or secondment and joint audits with other SAIs and/or professional fi rms could help. A proposal is to be drafted jointly by Ministry of Higher Education, PSTI, PSC, MoFT and the AG by June, 2007 (led by MoFT) for creating institutional education and training facilities in Maldives supported, if need be, by distance learning syllabi from academic and professional bodies overseas.

8. Is the SAI equipped with the audit methods and technologies to meet the INTOSAI Auditing Standards?

No The ongoing IDF grant will give assistance

for developing this, but additional computer software and hardware are needed by 2008 for certifi cation auditing.

9. Does the SAI have

the quality assurance programs to meet international standards?

No The ongoing technical assistance through IDF

will introduce this program by Sep.2008. 10. Does the process to

plan the audits meet international standards?

Yes 11. Does the process to

supervise the audits meet international standards?

Yes

12. Does the process to evaluate the reliability of internal controls meet international standards?

9. Improve public fi nancial management through a more effective chief fi nancial offi cer

arrangement.5 The Public Finance Act relies on a comprehensive and timely accounting and fi nancial

reporting system that is supported by competent assurance from a professional audit function that the 5 A fi nancial controller for the Government was appointed in March 2006, as required under the recently enacted Public Finance

Act 2005.

Standard Current status Action to move towards international

standards 13. Does the process used

in audits to assess compliance with laws meet international standards?

Yes

14. Does the audit process used to obtain evidence to support conclusions meet international standards?

Yes

15. Does the audit analyze the fi nancial statements to establish whether acceptable accounting standards for fi nancial reporting and disclosure are complied with?

No Certifi cation audits from 2009 will need this

capacity and the technical assistance will provide it.

16. Does the auditor prepare an audit opinion on the fi nancial statements in a form that accords with international standards?

Yes for the SOEs Certifi cation audits from 2009 will need this

capacity and the technical assistance will provide it.

17. Does the consideration of fraud and error in an audit of fi nancial statements accord with international standards?

Yes

18. Is the process for taking action on audit recommendations suffi ciently effective to meet international standards?

No, because the audit reports are not made public

The recently enacted Audit Act allows public reporting. Its implementation and effectiveness needs to be examined

19. Is the process for taking action on audit recommendations suffi ciently effective to meet international standards?

No The IDF grant TA will cover the preparation of

P U B L I C S E C T O R A C C O U N T I N G A N D A U D I T I N G

system is working properly and that the information is reliable. The accountable offi cers required for the new public fi nance system should undertake the functions of maintaining systems of internal fi nancial controls that manage risks, and for preparing the accounts for signature. There should be a requirement for all government bodies including state-owned enterprises to make their audited accounts public. 10. Improve accounting and auditing skills. Improved compliance with international standards requires properly trained staff. Basic accounting and auditing skills need to be enhanced. Distance learning education arrangements with foreign accounting institutions could be used to strengthen public sector accounting and auditing skills.

11. Improve audit impact. Prepare a PFM indicators survey to provide the basis for monitoring progress in adopting and applying international standards. Improvement of audit impact should be monitored through the progress of the Institutional Development Plan proposed to strengthen the Offi ce of the Auditor General over the next few years.

1. This assessment of public sector accounting and auditing is to facilitate more effi cient implementation of Public Financial Management (PFM) in Maldives through better quality accounting and public audit processes. It is intended to provide greater stimulus for more cost-effective outcomes of government spending. The specifi c objectives are (a) to provide the country’s accounting and audit authorities and other interested stakeholders with a common well-founded knowledge as to where local practices stand in comparison with internationally developed standards of fi nancial reporting and audit; (b) to assess the prevailing variances; (c) to chart paths to reduce the variances; and (d) to provide a continuing basis for measuring improvements.

2. In conducting this assessment of the Maldives, information on national standards and practices for accounting, fi nancial reporting, and auditing in the government budget sector and in the state-owned enterprise sector were collected from diagnostic questionnaires that were completed in cooperation with country authorities. The diagnostic questionnaires incorporated the principles contained in the public sector accounting and auditing standards promulgated by International Organization of Supreme Audit Institutions (INTOSAI) and International Federation of Accountants (IFAC). The responses to these questionnaires were further explored through discussions conducted by a World Bank team with the country authorities. These discussions included examination of accounts and audit reports and working papers, to explore the quality of the processes and the products. Annex A further explains the methodology used for the assessment. 3. The analysis in this report has been conducted in the light of PFM reform plans that the Government of the Maldives has been implementing. A Public Finance Act was enacted in 2005. In response to the Act, the Ministry of Finance and Treasury is engaged in implementing an accounting system to support annual accounts for each ministry and for the State. The legislature is in the process of approving a new National Audit Act. The Auditor General has been invited to form a committee that will provide comments on the proposed law. The legislation of a new National Audit Act and the implementation of an Institutional Development Plan for the Offi ce of the Auditor General should introduce modern audit reporting and a modern audit organization. A program for provision of technical assistance to the Offi ce of the Auditor General is under implementation through an Institutional Development Fund (IDF) grant provided by the World Bank.

4. Annex B provides a summary of international accounting and auditing standards referred to in this study. Annex C and D provide country accounting and auditing legislation, respectively. Annex E includes a description of the benefi ts of accrual basis of accounting. The report is accompanied by a Supplemental Table of Standards and Gaps, which summarizes for each component of current accounting and auditing standards, the present position, and the options for improvements that would bring Maldives into closer conformance with the international standards.

A. Institutional Framework for Public Sector Accounting

5. The institutional framework should include adherence to IFAC-issued International Accounting Standards. And it should support the groundwork for qualifi ed accounting staff to provide the timely, relevant, and reliable fi nancial information needed to support all fi scal and budget management, decision-making, and reporting processes. The diagnostic questionnaires that were used in this assessment collected information on the current arrangements and the apparent gaps in Maldives for accounting laws and regulations; education and training of public sector accountants; application of a code of conduct; and numbers and characteristics of public sector accountants.

(1) Accounting Laws and Regulations

6. The Public Finance Act and the Financial Regulations are prescriptive about the

maintenance and compilation of accounts but make no mention of International Accounting Standards. The Public Finance Act (see Annex C) should require conformance with International Public Sector Accounting Standards (IPSAS). However, under the Public Finance Act, there are proposed rules that would promulgate the allowance of IPSAS to be followed. The future accounts should be based on Cash Basis IPSAS with notes providing other information on assets, liabilities, and contingent liabilities as required by the Public Finance Act. Progression to accrual-based statements would occur as adequate computerized accounting systems are rolled out.

7. A modern fi nancial reporting framework is required for better accountability. The

accounting function has been located in the Treasury. However, this has not provided a good separation of duties among departments. As new computerized public accounting systems are implemented, more suitable accounting units must be established, preferably in the ministries. Producing annual audited accounts within each government department will hold senior departmental managers accountable for their operations and use of budget funds. Development of the computerized accounting system has a tight timeline requiring intensive efforts for meeting the targets. The World Bank will provide the Ministry of Finance and Treasury with technical advice on the progressive design and implementation of the computerized public accounting system.

(2) Education and Training

8. Better opportunities for educating and training government accountants should be

developed. Government accountants are recruited with limited accounting knowledge due to the lack

PUBLIC SECTOR ACCOUNTING

of proper curricula in universities. Government accountants need exposure and training in international accounting standards from professional institutions. Many training institutions provide a foundation for public sector accountancy qualifi cations of international standards, on an outreach basis. There is no comprehensive local training institution in Maldives, but the professional certifi cation offered by the UK Association of Chartered Certifi ed Accountants is available locally up to Stage 2. These professional accounting outreach programs will provide the core competencies needed for public sector accounting and reporting.

9. A training program that meets the IFAC-issued International Education Standards (IES)

for Professional Accountants is needed for the public sector accountants and auditors. Consideration should be given in due course to adopting the public sector program of institutes like the Chartered Institute of Public Finance and Accountancy (CIPFA) in United Kingdom. This course can be adapted for local conditions and would provide a path for sustained, improved training. The advantage of this is that the CIPFA learning materials take into account international audit and accounting standards as required for adoption by public sector organizations. Among the CIPFA learning materials are modules covering fi nancial reporting, accounting for decision-making, fi nancial management, law and taxation, and information systems management.

10. The Ministry of Finance and Treasury needs to develop training plans. There is a need for constant upgrading of training for government accountants in the requirements of the Public Finance Act and the Public Financial Regulations and in the standards for preparing fi nancial statements.

(3) Code of Ethics

11. A code of ethics is needed to improve fi nancial compliance and build the professionalism of the government accounting staff. The current code in practice is part of the government employment contract and relates to public service behaviour. It has little relevance to the IFAC Code of Ethics for Professional Accountants. A strongly directed code of ethics could help build public support that would aid in improving the state of public fi nancial management in the country. The IFAC Code of Ethics should be the model used in preparing the national code.

12. The training programs should include ethics training and how the code ensures proper behaviour. With certifi cation under the professional qualifi cations outreach programs, accounting staff will be required to follow a code of ethics and conduct. For example government accountants who are accepted into membership of professional institutes — whether as affi liates (for the Diploma holders) or as qualifi ed accountants (for those who complete the full professional qualifi cation) — would be required to abide by the code of ethical standards of the respective institute, which is based on the IFAC Code.

(4) Public Sector Accountant Arrangements

13. The preparation of fi nancial statements for each ministry requires a system of internal control. For each public sector body that prepares annual accounts, there should be a professionally qualifi ed chief fi nancial offi cer function.6 The person in this position would be responsible for maintaining 6 A fi nancial controller for the Government was appointed in March 2006, as required under the recently enacted Public Finance

P U B L I C S E C T O R A C C O U N T I N G A N D A U D I T I N G

systems of internal fi nancial controls that manage risks, and for preparing the accounts for signature by the chief accounting offi cer. The need to produce fi nancial statements for each ministry would require well-working systems of internal fi nancial controls. At the present time audit results are not being translated suffi ciently into remedial action. The Public Finance Act provides for an accountable offi cer (with the functions of a chief fi nancial offi cer) for each ministry. The duties of the accountable offi cer are yet to be defi ned in the Public Finance Instructions, but they should include the following functions:

■ maintain systems of internal fi nancial controls that manage risks,

■ ensure that accounting and fi nancial approval duties are properly carried out,

■ ensure that the staff perform their duties in accordance with the Public Finance Instructions, ■ prepare regular fi nancial accounts,

■ maintain the chart of accounts,

■ ensure the most appropriate technological support for fi nancial management practices, ■ manage training and education needs for fi nancial management,

■ report on key performance indicators, and

■ assist program managers in developing an effective fi nancial approach to the delivery of expected

outcomes.

B. Accounting Standards as Practiced

14. The diagnostic questionnaires have collected information on the current arrangements and the apparent gaps for setting public sector accounting standards and for presenting fi nancial reports. Out of this exercise came recommended activities that will help bring local standards in line with international standards.

(1) Setting Public Sector Accounting Standards

15. More formal administrative actions should be taken by the Auditor General to set public sector accounting standards. Under the Constitution, the accounts of the State are kept and maintained in such form and manner as prescribed by the Auditor General in consultation with the President of Maldives. The Public Finance Act sets the form of the annual accounts but does not specify the accounting standards required in preparing fi nancial statements. The Auditor General should advise the President that Cash Basis IPSAS should be used as the international accounting standard in preparing fi nancial statements with a road map to move to full accrual-based reporting over a period of time.

(2) Presenting Financial Reports

16. Annual fi nancial statements should be prepared in accordance with Cash Basis IPSAS, with some early planning for effecting a transition to adopt accrual-based IPSAS. The current annual reporting statements do not accord with the format of the Cash Basis IPSAS but steps should be taken that allow them to do so in the future. The Auditor General should hold discussions with the Ministry of Finance and Treasury to arrange for the setting of standards in a formal manner and to reach an agreement that future accounts be presented in the format of Cash Basis IPSAS. Also

consolidation of controlled entities into the cash basis statements as per 1.6.5 of the Cash Basis IPSAS (e.g. public enterprises) should be considered.

17. State-owned enterprises should comply with new governance requirements established by the Public Enterprise Monitoring Board. State-owned enterprises follow International Financial Reporting Standards (IFRS), as issued by the International Accounting Standards Board (IASB) which require that the fi nancial accounts should be produced annually within three months of the year-end, in accordance with good accounting practice, and should include the following:

■ Profi t and loss accounts for the year. ■ Cash fl ow statements for the year.

■ Balance sheet showing the position at year end.

■ Notes to support the fi nancial accounts that set out the company’s accounting policies and the

main components of the accounts as required by good practice. The fi nancial accounts should also be accompanied by a director’s report that details fi nancial activities of the company in the past and future.

18. All government bodies should be required to make all audited accounts available to the public. At present few accounts are available publicly, and governance requirements about the public availability and transparency requirements for these annual accounts should be made clearer.

19. The Auditor General should arrange consultations with the accountancy professions in the neighboring countries to consider ways of establishing similar professional accountancy arrangements in the Maldives. The Public Enterprise Monitoring, which receives the audited accounts of state-owned enterprises, notes that in a few cases there have been audit qualifi cations to the accounts that have mainly been related to assets issues. This is one example of accounting problems that exist in the Maldives. The country does not have a professional accountancy body to help regulate and support the profession. Other countries in the Region have larger numbers of professionals and operate professional bodies to regulate and support the accountants. The level of professionalism in the Maldives may be improved by regional consultations and cooperation to develop similar arrangements in the country.

A. Institutional Framework for Public Sector Auditing

20. Effective scrutiny by the legislature through comprehensive, competent external audit underpinned by international standards on auditing enables accountability for the implementation of fi scal and expenditure policies. The environment for an effective Supreme Audit Institution (SAI) requires a comprehensive approach to public fi nancial management. Supreme Audit Institutions are not stand-alone institutions; they are part of a PFM architecture that also includes budgeting, accounting, internal control, audit and legislative oversight, and government response. Improving the way the Maldives Supreme Audit Institution functions is integral to providing information for improving the overall PFM system, but the action must be within the executive branch under the watchful eyes of the legislature and the public. A strong demand for good public sector external auditing is necessary for the Supreme Audit Institution to have any impact. This requires willingness of the executive branch to accept and respond to external scrutiny over its management of funds and to ensure that reform action is taken. It also requires public disclosure of the audit reports in order to ensure public support for effective action.

21. The diagnostic questionnaires used in this assessment collected information describing the current audit arrangements in Maldives and the apparent gaps in the following areas:

■ Institutional framework for the Supreme Audit Institution, ■ Process for setting auditing standards,

■ Use of code of ethics or codes of conduct,

■ Arrangements to ensure accountability in the Supreme Audit Institution, ■ Arrangements to ensure independence,

■ Arrangements to ensure adequate skills and qualifi cations for the auditors, ■ Arrangements for providing training,

■ Arrangements to ensure a desired level of competence for the auditors, and ■ Arrangements for quality assurance.

(1) Institutional Framework

22. The appointment and powers of the Auditor General need to be adequately covered in

the Audit Act. The Constitution and relevant laws provide for the President to appoint the Auditor

General with a mandate to audit all government bodies, but does not require that audit reports be published. Commercial state-owned enterprises are audited by accounting fi rms and can be also reviewed by the Auditor General. The new National Audit Act which was a draft at the time of the study workshop in January 2007 was legislated soon after. Discussions during the workshop also included some desirable changes to improve the effectiveness of the Audit function. Some revisions have now been made to the fi nal Act, and these revisions do provide additional value to the fi nal legislation, which now provides for a better institutional framework.

(2) Setting Auditing Standards

23. The Audit Act empowers the Auditor General to set auditing standards. The Auditor General should formally adopt INTOSAI Auditing Standards and International Standards on Auditing promulgated by the International Auditing and Assurance Standards Board (IAASB) of the IFAC. The Australian National Auditing Offi ce Auditing Standards provide a model that incorporates the relevant professional standards and adds some specifi c public sector standards. 7 The INTOSAI Auditing Standards supported by the detailed IAASB International Standards on Auditing underpin a modern audit process. The IAASB is progressively rolling out International Standards on Auditing. INTOSAI supports the IAASB’s development of auditing standards. This is being done in particular so that the IAASB International Standards on Auditing appropriately refl ect the interests of the international public sector audit community.

24. The IAASB International Standards on Auditing represent the best international practices for the auditing profession, particularly in such areas of fundamental auditing practice as the following:

■ audit evidence, ■ documentation, ■ audit materiality, ■ fraud, ■ audit errors, ■ audit opinions, ■ audit planning,

■ control environment assessments, and ■ supervision of the work of audit staff.

(3) Code of Ethics

25. The Auditor General should adopt the INTOSAI Code of Ethics. Along with INTOSAI’s Lima Declaration of Guidelines on auditing precepts,8 the INTOSAI Code of Ethics is considered an essential complement to the INTOSAI Auditing Standards. A code of ethics is a statement of values and principles guiding the daily work of the auditors. The Supreme Audit Institution has adopted neither the IFAC-issued Code of Ethics for Professional Accountants nor the INTOSAI Code of Ethics.

7 Notifi ed in the Australian Commonwealth Gazette No. GN45, November 16, 2005 8 Lima Declaration of Guidelines on Auditing Precepts, October 1977, INTOSAI

P U B L I C S E C T O R A C C O U N T I N G A N D A U D I T I N G

(4) Accountability in the Supreme Audit Institution

26. The Institutional Development Plan in strengthening the Offi ce of the Auditor General

should assist in the design of the annual report required by the Public Finance Act. An

Institutional Development Plan and capacity-building technical assistance are under implementation at the time of this assessment. The technical assistance should give aid to the advisement on the development of an annual report on operations and performance. This report would provide an objective, balanced, and understandable account of activities and achievements and provide transparency in the accountability process.

(5) Independence

27. The National Audit Act should provide effective independence to the Auditor General.

Five of the eight core principles of SAI independence that were set out by INTOSAI were only partially, if at all, met by the legislative and administrative framework prevalent at the time of the study workshop in January 2007. These are:

■ The independence of the SAI Heads including security of tenure and legal immunity in the normal

discharge of their duties.

■ The obligation to report.

■ The freedom to decide on the content and timing of SAI reports and to publish and disseminate

them.

■ The existence of effective follow-up mechanisms on SAI recommendations.

■ Financial and managerial autonomy and the availability of appropriate human, material, and monetary

resources.

The recently enacted Audit Act now satisfactorily resolves some of these concerns but some concerns still remain. They are (i) specifi c term of appointment for the Auditor General is still not set, (ii) reporting requirements are still fairly minimal, (iii) there is no statement of legal immunity, and (iv) there is little to guarantee follow up of the audit reports that are made,

(6) Qualifi cations and Skills for the Auditors

28. Improved distance learning education is needed to establish the necessary standards for

training and education. The quality of accounting and auditing educational and training arrangements

in the Maldives does not meet the needs of modern accounting and fi nancial management. The ongoing technical assistance from the World Bank will look at training and certifi cation needs, and provide a long-term human resource plan.

(7) Training

29. An in-house training unit for government auditors should be introduced. At present training is achieved through overseas courses. The technical assistance from the World Bank includes building an in-house training capacity.

30. A skills analysis program based on international standards for competencies should be

development. A proper needs-based approach is required that will support the introduction of an audit methodology, and international accounting and auditing standards. The Institutional Development Plan would be used to re-assess these needs.

(8) Audit Competence

31. The roll-out of a computerized accounting system is likely to take some years and at that stage the Auditor General will require additional hardware and software support. The technical assistance from the World Bank will develop training toolkits covering audit methodology, reporting, and quality control for fi nancial and computerized audit.

(9) Quality Assurance

32. There is a need to introduce a system of quality assurance. This requirement is included in

the ongoing technical assistance from the World Bank.

B. Auditing Standards as Practiced

33. The diagnostic questionnaires have been used to collect information about the current arrangements for the audit methodology and the apparent gaps in the country for:

■ audit planning ■ audit supervision

■ reviewing internal controls ■ reviewing compliance with laws

■ ensuring that adequate audit evidence is collected

■ analyzing whether the fi nancial statements accord with accounting standards ■ preparing audit opinions

■ reporting on fraud, and ■ reporting on compliance.

Out of this exercise came recommended activities that will help bring local standards in line with international standards.

(1) Audit Planning

34. The updated Audit Manual would provide a sound basis for audit planning and thus

needs to be implemented. Improvements in implementation will occur as training is provided in

certifi cation audit under the technical assistance.

(2) Audit Supervision

35. A more rigorously applied working paper system is needed to ensure proper supervision. Current supervision is hampered by incomplete working papers. Quality assurance as required by the Audit Manual will help to ensure that supervision takes place properly.

P U B L I C S E C T O R A C C O U N T I N G A N D A U D I T I N G

(3) Reviewing Internal Controls

36. An update of the Audit Manual will support the review of internal controls. The general budget sector audits examine transactions in accordance with the rules established by the Financial Regulations. They therefore report on where controls have not been applied. They approach the audit from the perspective of material misstatement of an accounting fi gure. INTOSAI has issued a paper on internal control standards that provides a good international benchmark for assessing internal controls.9 The technical assistance will provide the basis to provide any necessary updates to the Audit Manual.

(4) Reviewing Compliance

37. Necessary steps need to be taken in order to maintain compliance of audit work. Publishing audit reports, monitoring the implementation of the recommendations, and reporting on the process in the annual performance report are all necessary. The Offi ce of the Auditor General uses much of its resources for the compliance type of audit work. An important issue is whether the audits are effective in dealing with instances of noncompliance. In the absence of published audit reports, there is little opportunity to press for response effectively.

(5) Analyzing the Financial Statements

38. The Public Finance Act requires certifi cation of ministry and government fi nancial statements. The technical assistance from the World Bank will help develop effective analytical tools. A revised audit methodology will improve the way the Offi ce of the Auditor General analyzes fi nancial statements.

9 Guidelines for Internal Control Standards, Internal Control Standards Committee, International Organization of Supreme Audit

Accounting Standards

Issue Current status Action to be taken to move towards international standards 1. Has the Public Sector

Accounting Law adopted IPSAS?

No The Auditor General (AG) would prescribe

the adoption of IPSAS for Maldives (to be confi rmed and communicated by GoM by March, 2007).

2. Does the education and

training of accountants’ accord with IES?

No A proposal is required to be drafted jointly by

Ministry of Higher Education, Public Service Training Institute (PSTI), Public Service Commission (PSC), Ministry of Finance and Treasury (MoFT) and the AG by June, 2007 (led by MoFT)

3. Does the ICAB Code

of Ethics match international standards?

No The MoFT is to develop a Code of Ethics for

public sector accountants – by December, 2007.

4. Is there a body to prescribe public sector accounting standards?

The Auditor General has this responsibility under the Constitution

MoFT will be issuing implementation guidelines as per the principles and standards prescribed by the AG.

5. Are the fi nancial statements in accord with the IPSAS standard?

No By June, 2007, MoFT would form a

Committee to defi ne the reporting entity. IPSAS format will be used as part of the roll out of the accounting system project – by January, 2009.

The IPSAS formats for statements, explanatory notes and disclosures will be used as part of the roll out of the PAS project – by January, 2009.

6. Is the statement of cash receipts and payments in IPSAS format?

No 7. Are accounting policies

and explanatory notes required?

No 8. Are other disclosures in

accord with IPSAS? No

9. Does the government

issue a consolidated fi nancial statement which consolidates all controlled entities?

P U B L I C S E C T O R A C C O U N T I N G A N D A U D I T I N G

Auditing

Standards Issue Current status Action to be taken to move towards international standards 1. Is the SAI statutory framework

in accord with the needs of the INTOSAI Auditing Standards?

Yes10 The Republic of Maldives has recently

enacted the Audit Act (included in Annex D) following the workshop in January 2007 and provides an adequate statutory framework. The effectiveness of the implementation of the new Audit Act is yet to be seen 2. Is there a body to prescribe

public sector auditing standards?

Yes11 The Audit Act needs to prescribe the AG as

the responsible body and S. 5 of the recently enacted Audit Act (included in Annex D) does this. The AG could work jointly with the proposed professional body to develop implementation guidelines.

3. Have INTOSAI and IFAC audit

standards been adopted? Yes. The Audit Manual is based on them. 4. Has a code of ethics

equivalent to the INTOSAI Auditing Standards been adopted?

Not for the core public sector. Most SOEs are audited by the private sector auditors.

A code will be developed as part of the IDF grant and it needs to be adopted by the AG. (by Jan.2008)

5. Is the accountability process in the SAI in accord with INTOSAI Auditing Standards?

No An annual report is required by 2007.

6. Does the SAI legal framework

meet the INTOSAI Auditing Standards for independence and powers?

No The new Audit Act at Annex D provides

for these and satisfactorily adopts the recommendations made by the UK National Audit Offi ce (NAO) team and the Task Team (World Bank)) on the draft Audit Bill examined during this study .

7. Does the education and

training of auditors accord with INTOSAI and IES?

No A needs analysis is being carried out by

the NAO team. Formation of the proposed professional body and opportunities like overseas practical experience or secondment and joint audits with other SAIs and/or professional fi rms could help. A proposal to be drafted jointly by Ministry of Higher Education, PSTI, PSC, MoFT and the AG by June, 2007 (led by MoFT) for institutional education and training facilities in Maldives supported as necessary by distance learning syllabi from academic and professional bodies overseas.

8. Is the SAI equipped with the audit methods and technologies to meet the INTOSAI Auditing Standards?

No The ongoing IDF grant will give assistance

for developing this, but additional computer software and hardware are needed by 2008 for certifi cation auditing.

10 Current status has recently changed due to enactment of the Audit Act on March 13, 2007 11 Current status has recently changed due to enactment of the Audit Act on March 13, 2007

Auditing

Standards Issue Current status Action to be taken to move towards international standards 9. Does the SAI have the quality

assurance programs to meet the international standards?

No The ongoing technical assistance through

IDF will introduce this program by Sep.2008.

10.Does the process to plan the audits meet international standards?

Yes The development plan will address variations

in planning requirements caused by the Public Finance Act.

11.Does the process to supervise the audits meet international standards?

Yes 12.Does the process to evaluate

the reliability of internal control meet international standards?

Yes 13.Does the process used in

audits to assess compliance with laws meet international standards?

Yes

14.Does the audit process used to obtain evidence to support conclusions meet international standards?

Yes

15.Does the audit analyze the fi nancial statements to establish whether acceptable accounting standards for fi nancial reporting and disclosure are complied with?

No Certifi cation audits from 2009 will need

this capacity and the technical assistance will provide it.

16.Does the auditor prepare an audit opinion on the fi nancial statements in a form that accords with international standards?

For SOEs commercial sector auditors use international standards. For the govern- ment no certifi ed accounts are produced at present.

Certifi cation audits from 2009 will need this capacity and the technical assistance will provide it.

17.Does the consideration of fraud and error in an audit of fi nancial statements accord with international standard?

Yes

18. Are the Auditor General’s

reports made public? No The new Audit Act includes public reporting of the audit report on the annual fi nancial statements of the Government. It will be important for reports on all audits done to be made public as well as be included in the quarterly reports to the Parliamentary Committee.

19. Is the process for taking action on audit recommendations suffi ciently effective to meet international standards?

No The IDF grant will cover the preparation

of recommendations for this. The Audit Act specifi es that the Auditor General will submit quarterly reports on work undertaken by his Offi ce to a Parliamentary Committee acting in the capacity of a Public Accounts Committee.

As part of the general support program in South Asia for the assessment and improvement of public sector accounting and auditing against international standards, the World Bank is conducting the Review of Public Sector Accounting and Auditing Practices in member countries, with the cooperation of member governments. The development of the Public Financial Management (PFM) Performance Measurement Framework12 by the Public Expenditure and Financial Accountability (PEFA) Program13 has opened the way for a diagnostic tool to be developed that is referenced to the accounting and auditing standards of International Federation of Accountants (IFAC) and International Organization of Supreme Audit Institutions (INTOSAI), and other relevant international benchmarks. This exercise provides substantial insight into country performance in regard to the external auditing and fi nancial statement reporting FM indicators.

A set of 6 questionnaires are used to collect relevant information on country practices:

■ The public sector accounting environment collecting basic information about fi nancial laws

and standards-setting arrangements, educational requirements for accountants compared with IFAC International Education Standards, and ethical requirements compared with the IFAC Code of Ethics for Professional Accountants.

■ Public sector accounting practices for the general budget sector if using the cash basis

of accounting compared with the requirements of the Cash Basis International Public Sector

Accounting Standards (IPSAS).

■ Public sector accounting practices for the general budget sector if using the accrual

basis of accounting compared with the IPSAS requirements that govern accrual reporting for the public sector.

■ Public sector auditing environment compared with the provisions of the INTOSAI Code of

Ethics and the INTOSAI general standards.

12 The PFM Performance Measurement Framework has been developed as a contribution to the collective efforts of many stakeholders

to assess and develop essential PFM systems, by providing a common pool of information for measurement and monitoring of PFM performance progress, and creating a common platform for dialogue.

13 The PEFA Program is a partnership among the World Bank, the European Commission, the UK Department for International

Development, the Swiss State Secretariat for Economic Affairs, the French Ministry of Foreign Affairs, the Royal Norwegian Ministry of Foreign Affairs, the International Monetary Fund and the Strategic Partnership with Africa. A Steering Committee, comprising members of these agencies, manages the program. A Secretariat is located in the World Bank in Washington, DC.

Annex - A

METHODOLOGY OF THE

ASSESSMENT

■ Public sector auditing practices compared to the requirements of the INTOSAI fi eld standards

and reporting standards, and the IFAC International Standards on Auditing.

■ Accounting and auditing practices for state-owned enterprises�compared with the

requirements of the International Financial Reporting Standards (IFRS) and International Standards on Auditing that govern commercial reporting.

The responses to the diagnostic questionnaires, prepared by the relevant authorities of the country, with the help, as necessary, of in-country experts retained by the World Bank, are supplemented by a due diligence review conducted by members of a World Bank task team from the country.

Various documents are examined as part of the review, including relevant laws, codes of conduct, national accounting and auditing standards, accountant selection and promotion processes, training needs assessments, accountancy training course outlines, curricula and accreditation methods, sample accounts, and sample audit reports and working paper sets.

A country report on the assessment is prepared for each country and reviewed by an expert panel of advisors before examination by the World Bank country team. The draft is then shared with the Government for response before fi nalization.

This section contains a summary of the frameworks that have been used for the public sector accounting and auditing assessment.

These have been compiled by the International Accounting Standards Board (IASB), the International Federation of Accountants (IFAC) and the International Organization of Supreme Audit Institutions (INTOSAI), which are cooperating in setting international standards for accounting and auditing. The IASB is an independent, privately funded accounting standard-setter based in London, UK. The Board members come from nine countries and have a variety of functional backgrounds. In the public interest, IASB is committed to developing a set of high quality, understandable, and enforceable global accounting standards that require transparent and comparable information in general purpose fi nancial statements. In addition, the IASB cooperates with national accounting standard-setters to achieve convergence in accounting standards around the world. The IASB issued International Accounting Standards (IAS) from 1973 to 2000. Since 2000, they have issued International Financial Reporting Standards (IFRS).

IFAC has its headquarters in New York, USA and is comprised of 163 member bodies, mainly the national professional accountancy bodies of most countries around the world. The IFAC Board established the International Public Sector Accounting Standards Board (IPSASB) to develop high quality accounting standards for use by public sector entities around the world in the preparation of general purpose fi nancial statements. These are the International Public Sector Accounting Standards (IPSAS). The full text of Standards and Exposure Drafts currently on issue is available at http://www.ifac.org/publicsector.

The fi rst 20 IPSAS are based on IAS to the extent appropriate for the public sector. IFAC also has established the International Auditing and Assurance Standards Board (IAASB) to prepare and promulgate International Standards on Auditing (ISA) and is now working in cooperation with INTOSAI on preparing public sector guidance on the use of ISA.

INTOSAI includes the Auditors General from almost all national government audit departments around the world and has its Secretariat in the Vienna offi ces of the Auditor General of Austria. Its Auditing Standards Committee, chaired by the Auditor General of Sweden, produces the INTOSAI Code of Ethics and Auditing Standards, a set of standards at a higher and more generic level than the IFAC-issued ISA. The Auditing Standards Committee is working with the IAASB to prepare practice notes explaining the application of each ISA in the public sector.14

The various standards are listed on the following pages.

14 Working Group on Financial Audit Guidelines, INTOSAI Auditing Standards Committee, Swedish National Audit Offi ce, 2004.

Annex - B

ACCOUNTING AND AUDITING

STANDARDS

International Public Sector Accounting and Education Standards

International Public Sector Accounting Standards

IPSAS 1, Presentation of Financial StatementsIPSAS 2, Cash Flow Statements

IPSAS 3, Net Surplus or Defi cit for the Period, Fundamental Errors and Changes in Accounting Policies

IPSAS 4, The Effects of Changes in Foreign Exchange Rates

IPSAS 5, Borrowing Costs

IPSAS 6, Consolidated Financial Statements and Accounting for Controlled Entities

IPSAS 7, Accounting for Investments in Associates

IPSAS 8, Financial Reporting of Interests in Joint Ventures

IPSAS 9, Revenue from Exchange Transactions

IPSAS 10, Financial Reporting in Hyperinfl ationary Economies

IPSAS 11, Construction Contracts

IPSAS 12, Inventories

IPSAS 13, Leases

IPSAS 14, Events after the Reporting Date

IPSAS 15, Financial Instruments: Disclosure and Presentation

IPSAS 16, Investment Property

IPSAS 17, Property, Plant and Equipment

IPSAS 18, Segment Reporting

IPSAS 19, Provisions, Contingent Liabilities and Assets

IPSAS 20, Related Party Disclosures

IPSAS 21, Impairment of Non-cash Generating Assets

Cash Basis IPSAS, Financial Reporting under the Cash Basis of Accounting

International Education Standards

IES 1, Entry requirements to a program of professional accounting education

IES 2, Content of professional accounting education programs

IES 3, Professional skills

IES 4, Professional values ethics and attitudes

IES 5, Practical experience requirements

IES 6, Assessment of professional capabilities and competence

IES 7, Continuing professional development

P U B L I C S E C T O R A C C O U N T I N G A N D A U D I T I N G

International Financial Reporting Standards and International Accounting

Standards

IFRS 1, First-time Adoption of International Financial Reporting Standards

IFRS 2, Share-based Payment

IFRS 3, Business Combinations

IFRS 4, Insurance Contracts

IFRS 5, Non-current Assets Held for Sale and Discontinued Operations

IAS 1, Presentation of Financial Statements

IAS 2, Inventories

IAS 7, Cash Flow Statements

IAS 8, Accounting Policies, Changes in Accounting Estimates and Errors

IAS 10, Events after the Balance Sheet Date

IAS 11, Construction Contracts

IAS 12, Income Taxes

IAS 14, Segment Reporting

IAS 16, Property, Plant and Equipment

IAS 17, Leases

IAS 18, Revenue

IAS 19, Employee Benefi ts

IAS 20, Accounting for Government Grants and Disclosure of Government Assistance

IAS 21, The Effects of Changes in Foreign Exchange Rates

IAS 23, Borrowing Costs

IAS 24, Related Party Disclosures

IAS 26, Accounting and Reporting by Retirement Benefi t Plans

IAS 27, Consolidated and Separate Financial Statements

IAS 28, Investments in Associates

IAS 29, Financial Reporting in Hyperinfl ationary Economies

IAS 30, Disclosures in the Financial Statements of Banks and Similar Financial Institutions

IAS 31, Interests in Joint Ventures

IAS 32, Financial Instruments: Disclosure and Presentation see also: See also Financial Instruments - other issues

IAS 34, Interim Financial Reporting

IAS 36, Impairment of Assets

IAS 37, Provisions, Contingent Liabilities and Contingent Assets

IAS 38, Intangible Assets

IAS 39, Financial Instruments: Recognition and Measurement see also: See also Financial Instruments - other issues

IAS 40, Investment Property

IAS 41, Agriculture

INTOSAI Code of Ethics and Auditing Standards

Code of ethics

Integrity.Auditors have a duty to adhere to high standards of behaviour (e.g. honesty and candidness)

in the course of their work and in their relationships with the staff of audited entities.

Independence, objectivity and impartiality. The independence of auditors should not be impaired

by personal or external interests. There is a need for objectivity and impartiality in the work and the reports, which should be accurate and objective. Conclusions in opinions and reports should be based exclusively on evidence obtained and assembled in accordance with the SAI auditing standards.

Professional secrecy.Auditors should not disclose information obtained in the auditing process to

third parties except for the purposes of meeting the SAI statutory responsibilities.

Competence.Auditors must not undertake work for which they are not competent to perform.

Basic postulates for the auditing standards

(a) The SAI should consider compliance with the INTOSAI auditing standards in all matters that are deemed material. Certain standards may not be applicable to some of the work done by SAIs, including those organized as Courts of Account, nor to the non-audit work conducted by the SAI. The SAI should determine the applicable standards for such work to ensure that it is of consistently high quality.

(b) The SAI should apply its own judgment to the diverse situations that arise in the course of government auditing.

(c) With increased public consciousness, the demand for public accountability of persons or entities managing public resources has become increasingly evident so that there is a need for the accountability process to be in place and operating effectively.

(d) Development of adequate information, control, evaluation and reporting systems within the government will facilitate the accountability process. Management is responsible for correctness and suffi ciency of the form and content of the fi nancial reports and other information.

(e) Appropriate authorities should ensure the promulgation of acceptable accounting standards for fi nancial reporting and disclosure relevant to the needs of the government, and audited entities should develop specifi c and measurable objectives and performance targets.

P U B L I C S E C T O R A C C O U N T I N G A N D A U D I T I N G

(f) Consistent application of acceptable accounting standards should result in the fair presentation of the fi nancial position and the results of operations.

(g) The existence of an adequate system of internal control minimizes the risk of errors and irregularities. It is the responsibility of the audited entity to develop adequate internal control systems to protect its resources. It is also the obligation of the audited entity to ensure that controls are in place and functioning to help ensure that applicable statutes and regulations are complied with, and that probity and propriety are observed in decision-making. The auditor should submit proposals and recommendations where controls are found to be inadequate or missing.

(h) Legislative enactments would facilitate the co-operation of audited entities in maintaining and providing access to all relevant data necessary for a comprehensive assessment of the activities under audit.

(i) All audit activities should be within the SAI audit mandate.*

(j) Legislative enactments would facilitate the co-operation of audited entities in maintaining and providing access to all relevant data necessary for a comprehensive assessment of the activities under audit.

(k) SAIs should work toward improving techniques for auditing the validity of performance measures. (l) SAIs should avoid confl ict of interest between the auditor and the audited entity.

* The full scope of government auditing includes regularity and performance audit.

Regularity audit embraces:

i. Attestation of fi nancial accountability of accountable entities, involving examination and evaluation of fi nancial records and expression of opinions on fi nancial statements;

ii. Attestation of fi nancial accountability of the government administration as a whole;

iii. Audit of fi nancial systems and transactions including an evaluation of compliance with applicable statutes and regulations;

iv. Audit of internal control and internal audit functions;

v. Audit of the probity and propriety of administrative decisions taken within the audited entity; and vi. Reporting of any other matters arising from, or relating to, the audit that the SAI considers should

be disclosed.

Performance audit is concerned with the audit of economy, effi ciency and effectiveness, and embraces:

vii. Audit of the economy of administrative activities in accordance with sound administrative principles and practices, and management policies;

viii. Audit of the effi ciency of utilization of human, fi nancial and other resources, including examination of information systems, performance measures and monitoring arrangements, and procedures followed by audited entities for remedying identifi ed defi ciencies; and

ix. Audit of the effectiveness of performance in relation to the achievement of the objectives of the audited entity, and audit of the actual impact of activities compared with the intended impact.