Abstract

Microfinance sector has traversed a long journey from micro savings to micro credit and then to micro enterprises and now entered in the field of micro insurance, micro remittance and micro pension. This gradual and evolutionary growth process has given a great opportunity to the rural poor in India to attain reasonable economic, social and cultural empowerment, leading to better living standard and quality of life for participating households. Financial institutions in the country continued to play a leading role in the microfinance programme for nearly two decades now. They have joined hands proactively with informal delivery channels to give microfinance sector the necessary momentum. During the current year too, microfinance has registered an impressive expansion at the grass root level. This paper tries to find out the contribution of commercial banks, regional rural banks and cooperative banks in strengthening microfinance sector by participating in Self Help Group bank linkage programme. Researcher tried to establish the relation between spread of non-government organizations and growth in microfinance sector in Himachal Pradesh.

Keywords : Microfinance, Self-help group, Bank linkage programme, Growth.

Introduction

India is a developing country where banking plays a vital role in the economic development. On 19th July, 1969, fourteen major commercial banks were nationalized by RBI for strengthening the financial structure so that country can have balanced regional development. RBI has also focussed on priority sector. After this focused strategy the banking sector witnessed an expansion stage all over the country by reaching to rural population. Credit needs of the people is very small in rural India and it involve high

* Research Scholar, Department of Marketing & Supply Chain Management, School of Business & Management Studies, Central University of Himachal Pradesh, Dharamshala. Email-id:rishikant111@gmail.com,

** Research Scholar (Fellow-U.G.C.), Department of Management Studies, School of Law, Governance, Public Policy and Management ,Central University of Haryana, Mahendergarh. Email-id: suyashmba1234@gmail.com *** Research Scholar, Department of Accounting and Finance, School of Business & Management, Central University

of Himachal Pradesh, Dharamshala. E-mail id: swatidogra6317@gmail.com

Microfinance: A Tool of Poverty Alleviation with Bank

Linkage Programme in Himachal Pradesh

risk and high transaction cost for the banks. It creates hurdle in smooth flow of credit to needy people. Loan disbursement involves lengthy documentation process which is problem for the rural public. Due to such problems involved in formal banking, it has forced the poor and needy to borrow money from informal lenders and be a part of vicious cycle of poverty. Poor have inadequate supply of money. They need money in the form of credit but due to the lack of it, they are unable to raise their income levels and standards of living. That is why weaker section of the society remains poor in the country like India. There are certain main reasons because of that poor are unable to access these services as people do not have collaterals to mortgage. Even the banks found the cost of screening and monitoring of these loans is very high in order to make this loan profitable to borrowers. This showed that efforts of the banks were insufficient and unsuitable for fulfilling the expectations and needs of the poor clients. Thus government of India has made many efforts for providing formal financial services to the rural people by setting up NABARD (National Agriculture Bank for Rural Development) and Regional Rural Banks. Government of India has made a remarkable effort by setting up NABARD. These banks have helped to provide credit at low interest rate as compared to interest rate charged by informal lenders. These efforts of government have led to growth and emergence of microfinance. Microfinance is considered as a poverty alleviation tool for the poor. It is not only the provider of credit but also other financial and non-financial services like saving, insurance, technical assistance and training facility. Commercial banks, RRBs and NGOs are making a great contribution in this field. Most of the NGOs are involved in formation Self Help Group (SHG) which is linked to banks for providing financial help to poor. Microfinance institutes are the mainstream institute for providing microfinance. Some of the MFIs have organised as non-banking finance companies are also making contribution. But these MFIs need collateral and high documentation procedure like that of banks in which lot of time is consumed during the processing of loan. Due to certain limitation banks can never fill the gap thus microfinance plays strong and vital role. Poor are thrown into the vicious cycle of poverty by informal financial institutions. So microfinance is a way to get rid of that. It acts as an intermediary for bridging the gap by providing the facility of saving and getting credit so as to become socially and economically independent. In order to get the poor household free from the shackles of informal credit system microfinance has contributed a lot. Micro financing through SHG is one of the best methods followed by government. Not only the government but also the NGOs are doing their part by formulation of self-help groups.

Microfinance and its Growth in India

of SHG and promotion of linkage of SHGs with banks. Thus SHG bank linkage programme was launched as a pilot project in 1992. SHG bank linkage program is dominating the microfinance sector with the help of NGOs and banks. It is one of the cost effective tool of providing subsidised and concessional financial services. According to NABARD, there are only two models of microfinance in India i.e. SHG bank linkage model and MFI bank linkage model. The self-help group are linked to banks like commercial banks, regional rural banks and cooperative banks in SHG bank linkage model. These groups pool resources in monetary form and deposit these resources in bank by opening account in these banks and loan is granted as per need of group. Under MFI bank linkage model, mainstream MFI are linked to banks. Banks provide financial assistance to MFI so that these MFIs can further provide financial assistance to SHG and other marginal borrowers.

Review of Literature

that 74 per cent of MFIs had the employed as clients, 17 per cent had mainly self-employed in their patrons and just 9 per cent had only a minority of self-self-employed amongst their clients. This survey has cleared the picture of different countries. Mishra et al. (2001) deliberated the effect of rural SHGs on income among the beneficiaries identified the major problems faced by the SHGs and suggested measures for overcoming these problems in Faizabad district of Uttar Pradesh which is close to the capital of U.P .i.e. Lucknow. The results of the survey showed that SHGs have helped to increase the income of the participants by 10 to 15 percent. The foremost problems that the SHGs faced were need of training facility. It was suggested by the researchers to involve Commercial Banks, RRBs and agricultural co-operative societies to provide liberal credit at cheaper interest rate through SHGs in this study.

Objectives of the Study

• To study the status of self-help group bank linkage programme in Himachal Pradesh.

• To find out the role of self-help group bank linkage programme in growth and development of microfinance sector in the state of Himachal Pradesh.

Methodology

Secondary data published by NABARD has been taken regarding the status of microfinance in Himachal Pradesh. Statistical and econometric tools like mean, coefficient of variance etc. are applied. The period for study is five years i.e. 2007-2008 to 2011-2012. Growth rate is calculated to see the growth of self-help group bank linkage programme in Himachal Pradesh.

Status from Himachal Pradesh

Progress under Microfinance Savings of SHG with Bank in Himachal Pradesh

Table 1 : Status of Microfinance Saving of SHGs with Commercial banks (Amount in lakh in Indian rupees)

Commercial Bank

Year

No of SHG

Saving Amount

Growth rate of SHG

Growth rate of Saving Amt.

2007-08 26762 2213.32 0 0

2008-09 28658 2104.89 7.08 -0.49

2009-10 26908 2000.36 -6.11 -0.5

2010-11 28571 1881.9 6.18 -0.59

2011-12 29621 1362.48 3.68 -2.76

Source : Status of microfinance in India 2007-2008 to 2011-2012 from www.nabard.org

Table 2 : Status of Microfinance Saving of SHGs with Regional Rural banks (Amount in lakh in Indian rupees)

Regional Rural Bank

Year

No of SHG

Saving Amount

Growth rate of SHG

Growth rate of Saving Amt.

2007-08 4369 401.28 0 0

2008-09 4616 578.4 5.65 44.14

2009-10 6660 849.28 44.28 46.83

2010-11 5955 852.19 -10.59 0.34

2011-12 7101 868.17 19.24 1.88

Source : Status of microfinance in India 2007-2008 to 2011-2012 from www.nabard.org

Table 3: Status of Microfinance Saving of SHGs with Co-operative banks (Amount in lakh in Indian rupees)

Co-operative Bank Year No of SHG Saving Amount

Growth rate of SHG

Growth rate of Saving Amt.

2007-08 7460 207.61 0 0

2008-09 8470 305.6 13.54 47.20

2009-10 16614 641.26 96.15 109.84

2010-11 18587 974.41 11.88 51.95

2011-12 28919 1057.97 55.59 8.58

Table 4: Combined Status of Microfinance Saving of SHGs with Commercial banks, Regional Rural Banks and Co-operative Banks (Amount in lakh in Indian rupees)

Total

Year No of

SHG

Saving Amount

Growth rate of SHG

Growth rate of Saving Amount

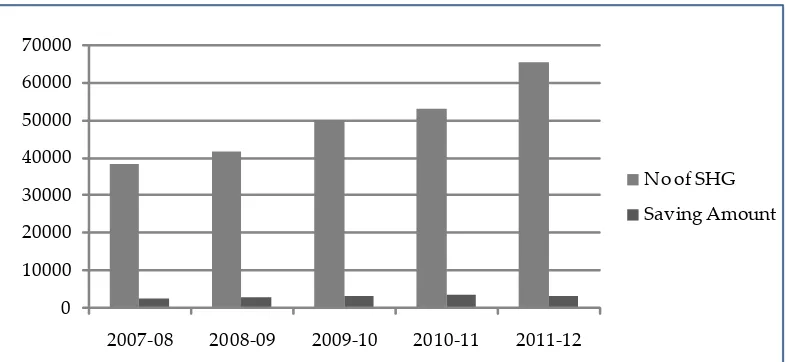

2007-08 38591 2822.21 0 0

2008-09 41744 2988.89 8.17 5.91

2009-10 50182 3490.9 20.21 16.80

2010-11 53113 3708.5 5.84 6.23

2011-12 65641 3288.62 23.59 -11.32

Average 49854.2 3259.82 11.56 3.52

Coefficient of variance 0.21 0.11 0.86 2.91

Source : Status of microfinance in India 2007-2008 to 2011-2012 from www.nabard.org

Graph 1: Combined Status of Microfinance Saving of SHGs with Commercial Banks, Regional Rural Banks and Co-operative Banks (Saving amount in lakh in Indian rupees)

0 10000 20000 30000 40000 50000 60000 70000

2007-08 2008-09 2009-10 2010-11 2011-12

Graph 2: Combined Status of Growth Rate of SHGs and Saving Amounts

-15 -10 -5 0 5 10 15 20 25 30

2007-08 2008-09 2009-10 2010-11 2011-12

Growth rate of SHG

Growth rate of Saving Amount.

Progress under Microfinance Bank Loan Disbursed to SHGS in Himachal Pradesh

Table 5: Status of Microfinance Loan Distribution by Commercial Banks (Amount in lakh in Indian rupees)

Commercial Bank

Year No of SHG Bank Loan Growth rate of SHG

Growth rate of Bank Loan

2007-08 2532 2382.86 0 0

2008-09 2952 2204.04 16.59 -7.50

2009-10 1892 1948.48 -35.91 -11.60

2010-11 1801 2475.7 -4.81 27.06

2011-12 1274 1651.26 -29.26 -33.30

Source : Status of microfinance in India 2007-2008 to 2011-2012 from www.nabard.org

Table 6 : Status of Microfinance Loan Distribution by Regional Rural Banks (Amount in lakh in Indian rupees)

Regional Rural Bank

Year No of SHG Bank Loan Growth rate of SHG

Growth rate of Bank Loan

2007-08 1138 1188.13 0 0

2008-09 981 1219.65 -13.80 2.65

2009-10 255 289.05 -74.01 -76.30

2010-11 1200 1847.8 370.59 539.27

2011-12 752 690.91 -37.33 -62.61

Source : Status of microfinance in India 2007-2008 to 2011-2012 from www.nabard.org

Table 7 : Status of Microfinance Loan Distribution by Co-operative Banks (Amount in lakh in Indian rupees)

Co-operative Bank

Year No of SHG Bank Loan Growth rate of SHG

Growth rate of Bank Loan

2007-08 627 545.59 0 0

2008-09 1024 1008.34 63.32 84.82

2009-10 1700 1584.07 66.02 57.10

2010-11 2292 3005.93 34.82 89.76

2011-12 2243 2982.29 -2.14 -0.79

Table 8: Combined Status of Microfinance Loan Distribution by Commercial Banks, Regional Rural banks and Co-operative Banks (Amount in lakh in Indian rupees)

Total

Year

No of

SHG Bank Loan

Growth rate of SHG

Growth rate of Bank Loan

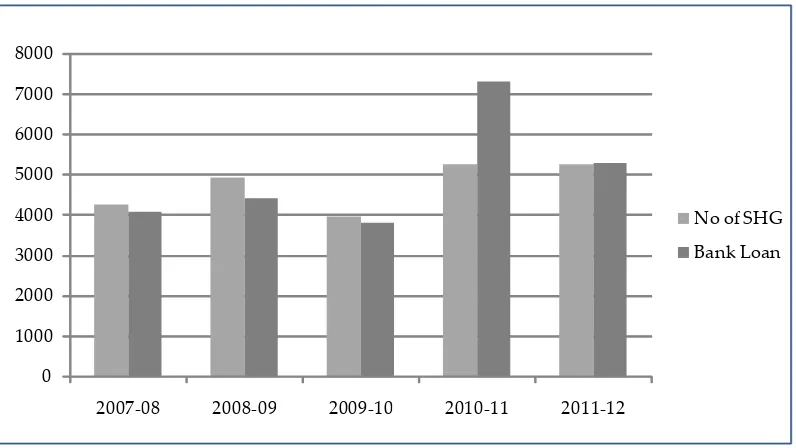

2007-08 4297 4116.59 0 0

2008-09 4957 4432.03 15.36 7.66

2009-10 3997 3821.6 -19.37 -13.77

2010-11 5293 7329.43 32.42 91.79

2011-12 5269 5324.46 -0.45 -27.36

Average 4762.20 5004.82 5.59 11.66

Coefficient of variance 0.12 0.28 3.47 4.00

Source : Status of microfinance in India 2007-2008 to 2011-2012 from www.nabard.org

Graph 3: Combined Status of No. of SHGs. and Bank Loan by Commercial Banks, Regional Rural Banks and Co-operative Banks (Bank loan in lakh in Indian rupees)

0 1000 2000 3000 4000 5000 6000 7000 8000

2007-08 2008-09 2009-10 2010-11 2011-12

No of SHG

Graph 4: Combined Status of Growth Rates of SHGs and Bank Loans by Commercial Banks, Regional Rural Banks and Co-operative Banks

-40 -20 0 20 40 60 80 100

2007-08 2008-09 2009-10 2010-11 2011-12

Growth rate of SHG

Growth rate of Bank Loan

This data shows the growth rate of bank loan disbursed to SHGs. Bank loan to SHGs are sourced through NABARD. Growth rate of SHGs linked to commercial banks is decreasing and negative in 2011-2012 i.e. -29.26%. So there is direct link between the growth rate of SHGs and loan disbursed to these SHGs. Growth rate of number of SHGs as well as bank loan is negative in year 2011-2012. Growth rate of both SHGs and bank loan is very high in the year 2010-2011. But in year 2011-2012 the percentage of growth has decreased drastically.

Table 9: SHGs linked with public sector commercial banks as on 31st March 2012 in Himachal Pradesh (Amount in lakh in Indian rupees)

Name of banks

Details of SHGs Saving Out of Total SHGs Out of Total SHGs linked with Banks Under SGSY Scheme Exclusive Women SHGs No. of SHG No of member Saving amount No. of SHG No of member Saving amount No. of SHG No of member Saving amount

Allahabad Bank 14 140 1.2 14 140 1.2 14 140 1.2

Bank of Baroda 120 1200 12.22 0 0 0 1 10 0.5

Bank of India 58 485 11.85 51 485 11.85 0 0 0 Canara Bank 129 1540 5.2 70 680 1.89 120 1690 3.35 Central Bank of India 424 4371 50 350 3665 37 334 3483 35 Indian Bank 45 810 2.27 13 208 0.75 45 802 2.25 Punjab National

Bank 18567 185670 603.24 468 4680 52.69 12807 128070 460.43 Punjab & Sind Bank 62 625 8098 12 122 1.39 40 408 5.62 State Bank of India 7222 86664 131 841 10096 14 5778 69341 105 State Bank of Patiala 1865 27975 144.26 805 12520 110.5 660 8615 102.5

Syndicate Bank 1 15 0.06 0 0 0 0 0 0

UCO Bank 1114 11742 392.2 696 7670 233.65 818 9255 329.6

Table-9 shows the contribution of public sector banks towards the Self Help Group Bank linkage programme. Punjab National bank is linked to most of the SHGs out of various banks. The data shows that the women play a vital role in formation of SHGs out of 29621 SHGs linked to public sector commercial banks, 20617 SHGs have women as members in Himachal Pradesh. The second place is held by State Bank of India in which 7222 SHGs are linked to the bank having saving amount of 131 lakh with 86664 members. Out of total SHGs 5778 are exclusively women SHGs with saving amount of 105 lakh. Syndicate bank has the least contribution toward the Self Help Group Bank Linkage programme with only one SHG linked to the bank in the year 2011-2012.NGOs are also acting as an intermediary for the promotion of SHGs and linking these to banks in Himachal Pradesh. 9987 Self-help groups are promoted during the year 2011-2012. Hence NGOs are also playing a vital role for the betterment of the poor people.

Conclusion

NABARD is really playing a vital role in the growth of microfinance sector by promoting self-help group bank linkage programme. Various innovative products and programmes are launched by NABARD for reaching poor and fulfilling their needs. SHG bank linkage programme is one of the most widely accepted microfinance programme. As per the data available commercial banks are contributing the most toward the growth of SHG bank linkage programme in Himachal Pradesh. NGOs are acting as SHGs promotion institute for the benefit of poor household and making accessible to the financial services which were not available to them earlier.

References

1. Basu , P. and Srivastava , P. (2005), “Scaling-up Microfinance for India’s Rural Poor”, World Bank Policy Research Working Paper [ No. 3646] , World Bank, Washington, DC.

2. Dahiya , Prem Singh, Pandey, N.K. , and Karol , Anshuman (2001), “Socio-economic Evaluation of Self-help Groups in Solan District of Himachal Pradesh: Impact, Issues and Policy Implications”, Indian Journal of Agricultural Economics, Vol. 56, No. 3, pp. 486-87.

3. Gurumoorthy, T. R. (2000), “Self-Help Groups Empower Rural Women”, Kurukshetra, Vol. 48, No. 5, pp. 31-37.

4. Hema , B. (2003), “SHG Bank Linkage Programme: An Overview”, Journal of Microfinance,Vol. 5, No. 1, pp. 21-49.

Paper Presented in International Conference on Self-employment, 24-26 September, Burlington.

6. Mishra, J. P., Verma , R. R. and Singh , V. K. (2001), “Socio-economic Analysis of Rural Self-help Groups Schemes in Block Amaniganj, District Faizabad (Uttar Pradesh)”, Indian Journal of Agricultural Economics, Vol. 56, No. 3, pp. 473-74.

7. NABARD (2006), SHG-Bank linkage programmes in Karnataka, Annual Report 2005-2006.

8. Satish, P. (2005) , “Mainstreaming of Indian Microfinance” , Economic and Political Weekly, Vol. 4, No.17 , pp. 131-139, Available at : http://www.jstor.org/stable/ 4416532 (Accessed on 2nd July 2013)

9. Websites (Electronic resources): www.rbi.org.in (Accessed on 1st July 2013)