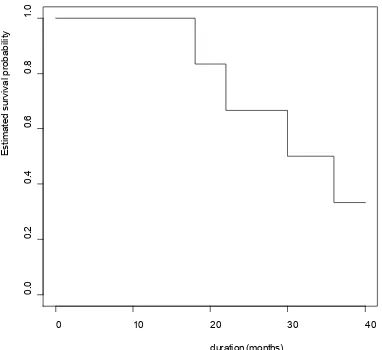

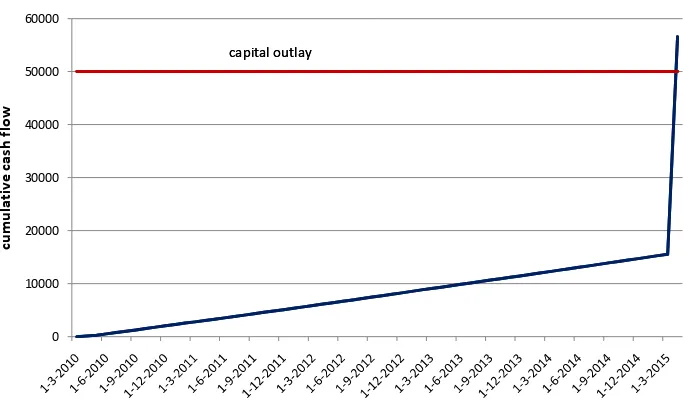

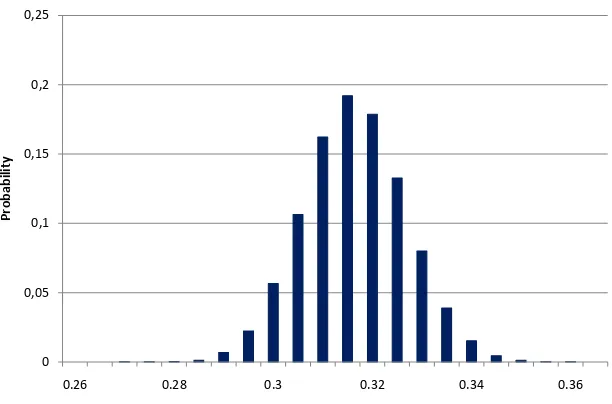

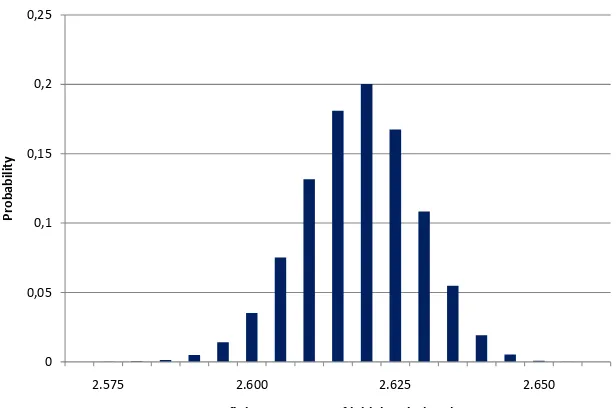

Cash flow modelling for Residential Mortgage Backed Securities: a survival analysis approach

Full text

Figure

Related documents

Atropine treatment decreased MMP2, TGF- β , and c-Fos expression and in- creased COL1 expression in the sclera and retina of MFD eyes com- pared to eyes treated with PBS

— Extends the location based positioning mode — Goal: same signal strength to both notebooks.. Notification

This course targets users who create and maintain financial reports within Prologue General

The critical defect length leading to thermal runaway is determined as a function of the current decay time constant s dump , RRR of the SC cable copper matrix, RRR of the bus

The FSC logo, the initials ‘FSC’ and the name ‘Forest Stewardship Council’ are registered trademarks, and therefore a trademark symbol must accompany the.. trademarks in

A further breakdown analysis shows the average current balance for mortgages in the RMBS dataset is higher, at €171,490, compared with the average current balance in the

The goals for sprint 3 were to design and begin the development of the wizard page of the application, to be used in the processing of cases defined in incoming?.

mortgage backed securities rates today developed to today, the money are backed by national mortgage securities. In respect to mortgage backed securities