Conditional Portfolio Choice in the U.S. Bond Market: The Role of Liquidity

Full text

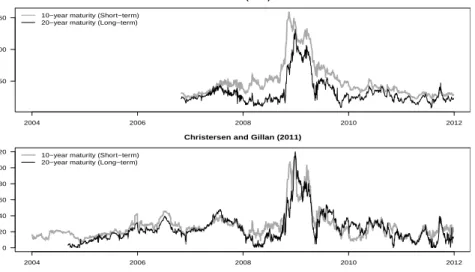

Figure

Related documents

HMSA will review the information and determine whether the physician is locum tenens or a temporary hire.. Should the physician qualify as a temporary hire, the physician

With our fully integrated practice management software, you will be able to work more efficiently, lower risk and improve client service … l egal calendaring software, contact

5 (describing Assumption Reinsurance Agreement) ("The estimated payments to Philadelphia American of approximately $7.9 million included $4.1 million (reserve estimate

To address present-day issues, The Power of Their Song will also include key testimony from several folk and rock musicians throughout Central, South and North America (from

Information Networks Division October 2014 Page 4 Master FILE Premier covers full text articles, images, reference books and primary source documents in a wide range of

However, the RTP protocol is very vulnerable to flood attacks as the data are transmitted in real time and the attacker can flood any of VoIP components (IP phone,

Economic theory suggests we should measure the government's generational policies with generational accounts. These accounts indicate in present value what the typical member of

Accordingly, we broke down the over-arching question of the project, namely “Who shall perform what function in an efficient value chain?” into four work packages (WP A-D). WP A