The Effects of China's Tariff Reductions on EU Agricultural Exports

Full text

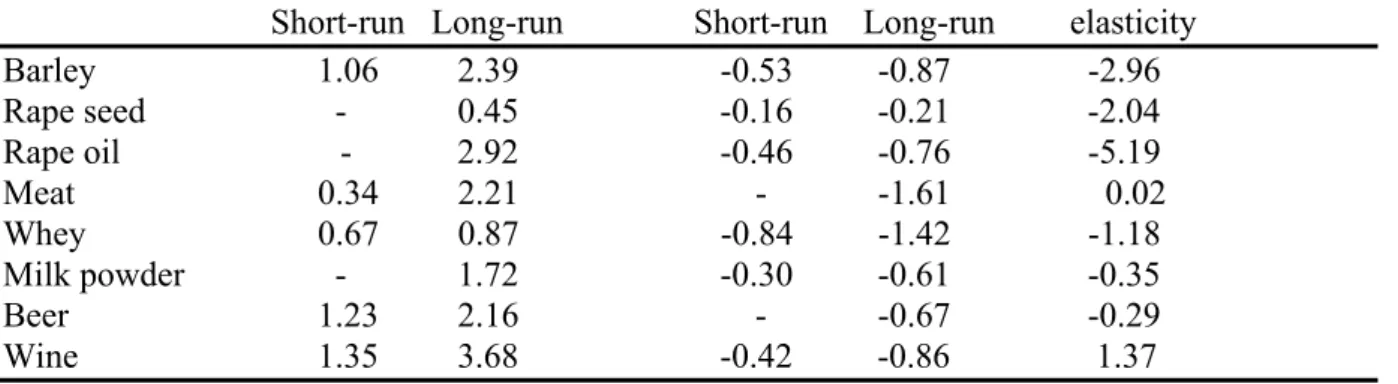

Figure

Related documents

Following Barbier and Strand (1997), we simulate multiple scenarios to examine the comparative static effects of changes in staghorn area on equilibrium conditions. This approach

Specifically, the most effective intervention (free cessation aids plus $600 in redeemable funds) helped 2.9% of participants stop smoking through six months after their target

Looking for assistance within your department, by asking others on the college circuit, and asking the local high school circuit are by no means the only places you can look,

1 Ali, I.; Cawkwell, F.; Dwyer, E.; and Green, S.; 2016 , "Modelling managed grassland biomass estimation by us- ing multitemporal remote sensing data—a machine learn-

stocks (crossed circles), adding international unhedged stocks (crosses), proceeding with interna- tional fully hedged stocks (circles) replacing the unhedged stocks, and finally

8. A comprehensive study of the demand and supply situation for access to financial services in the country, conducted by the National Statistical Bureau with support from the

The purpose of the present study was to determine whether differences in effectiveness exist among treatment approaches applied to the youth by (a) conducting a meta-analysis of

Sandmo (1970) and Levhari and Srinivasan (1969) prove that individuals with high risk-aversion and time-separable, power utility increase their optimal savings when capital