RELATIONSHIP BETWEEN KNOWLEDGE MANAGEMENT

AND PERFORMANCE OF COMMERCIAL BANKS IN KENYA

BY

GODFREY MUIGAI KINYUA: BED (EGERTON), MBA (UON)

D86/CTYIPT/25168/2011

A THESIS SUBMITED TO THE SCHOOL OF BUSINESS IN

PARTIAL FULFILMENT OF THE REQUIREMENTS FOR THE·

AWARD OF THE DEGREE OF DOCTOR OF PHILOSOPHY IN

BUSINESS ADMINISTRATION OF KENY ATTA UNIVERSITY

OCTOBER, 2015

DECLARATION

This thesis is my origirial work and has not been presented for a degree or other award

in any other University. No part of this thesis should be reproduced without authority

of the author or/and ofKenyatta University.

Signature:

~F--"'-"-Date:

0

6

I~

':L()

I

J;

.

Godfrey Muigai Kinyua

Department of Business Administration

We confirm that the work reported in this thesis was carried out by the candidate

under our supervision

Signature:

----..~0!'5:::::== ••.=

=

--

--

'

"

--Dr. Muathe SMA (PhD)

Department of Business Administration .School of Business

Kenyatta University

Signatur

~~

_q_

<

1_\T_\}V

'

_~

__

m..

_

~'!:

Dr. Kilika J.M. (PhD)

Department of Business Administration School of Business .

DEDICATION

This thesis is dedicated to my wife Ruth

,

our sons Eddy and Lee for their

l

ove

,

under

s

tanding and support during the many long hours when I had to juggle between

•work, family and study, my siblings for their kind words of encouragement

,

and my

ACKNOWLEDGEMENT

I am highly indebted to my supervisors, Dr. Muathe SMA (PhD) and Dr. Kilika J

.

M.

(PhD), for their sustained commitment, expert guidance and mentorship through the

entire process of developing this thesis.

I am grateful to the members of staff in the

School of Business of Kenyatta University for their invaluable input, suggestions and

constructive criticisms that contributed immensely in enhancing the quality of this

research work

.

My appreciation also extends to the members of staff of Kenyatta

University Library for helping me to access requisite information and materials for

developing this thesis.

I am equally grateful to all my colleagues in the PhD class for

their invaluable contributions toward the successful completion of this scholarly

pursuit

.

Indeed, I cannot forget the contribution of Saveliah Printing Enterprise for

facilitating timely printing and binding of this thesis during critical stages of its

TABLE OF CONTENTS

DECLARATION

ii

DEDICATION iii

ACKNOWLEDGEMENT .iv

TABLE OF CONTENTS v

LIST OF TABLES viii

LIST OF FIGURES ix

OPERATIONAL DEFINITION OF TERMS

x

ABBREVIATIONS AND ACRONYMS xii

ABSTRACT xiii

CHAPTER ONE: INTRODUCTION 1

1.1 Background of the Study 1

1.1.1 Organization Performance 5

1.1.2 Knowledge Management 8

1.1.3 Human Capital Repository 9

1.1.4 Organization Culture 10

1.1.5 Commercial Banks inKenya : 12

1.2 Statement of the Problem. 15

1.3 Objectives of the Study 18

1.3.1 General Objective of the Study 18

1.3.2 Specific Objectives of the Study 19

L4 Research Hypotheses 19

1.5 Significance of the Study 20

1.6 Scope of the Study 21

1.7 Limitations of the Study 21

1.8 Organization of the Study 22

CHAPTER TWO: LITERATURE REVIEW 23

2.1 Introduction 23

2.2 Theoretical Literature Review 23

2.2.1 Resource-Based View of the Finn 23

2.2.2 Knowledge-Based View of the Firm 27

2.2.3 Organizational Learning Theory 29

2.3 Empirical Literature Review. 34

2.3.1.Knowledge Conversion and Performance : 34

2.3.2 Knowledge Transfer and Performance 36

2.3.3 Knowledge Application and Performance 38

2.3.4 Human Capital Repository and Performance 39

2.3.5 Knowledge Management and Human Capital Repository .40

2.3.6 Organizational Culture and Performance 42

2.4 Summary of Literature Review and Research Gaps .46

2.5 Conceptual Framework 51

CHAPTER THREE: RESEARCH METHODOLOGY 53

3.1 Introduction 53

3.2 Research Philosophy 53

3.3 Research Design 54

3.4 Empirical Model 55

3.5 Target Population 60

3.6 Sampling Design and Procedure 61

3.7 Data Collection Instrument. 62

3.7.1 Test of Validity 63

3.7.2 Test of Reliability 66

3.8 Data Collection Procedure 67

3.9 Data Analysis and Presentation 67

3.10 Ethical Considerations 72

CHAPTER FOUR: RESEARCH FINDINGS AND DISCUSSION 73

4.1 Introduction 73

4.2. Descriptive Analysis 73

4.2.1 Analysis of Response Rate 73

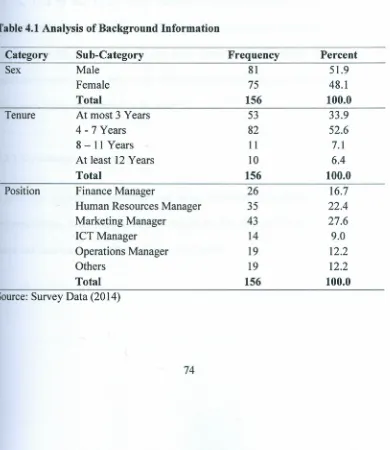

4.2.2 Respondents' Biographical Information 74

4.2.3 Knowledge Conversion 75

4.2.4 Knowledge Transfer 79

4.2.5 Knowledge Application 80

4.2.6 Human Capital Repository 81

4.2.7 Firm's Culture 83

4.2.8 Performance of Commercial Banks 85

4.3.1 Diagnostic Tests 86

4.3.2 Test of Hypotheses 92

4.5 Qualitative Data Analysis 111

CHAPTER FIVE: SUMMARY, CONCLUSION AND RECOMMENDATIONS 113

5.1 Introduction 113

5.2 Summary 113

5.3 Contribution of the Study to Knowledge 115

5.4 Conclusion 117

5.5 Recommendations for Policy and Practice 118

5.6 Recommendations for Further Study 120

REFERENCES 121

APPENDICES 146

Appendix I: Letter of Introduction 146

Appendix II: Questionnaire 147

Appendix Ill:CFA Path 152

Appendix IV: CFA Output · 153

Appendix

V

:

List of Banks 157Appendix VI: Document Review Guide 158

Appendix VII: Research Permit. 159

LIST OF TABLES

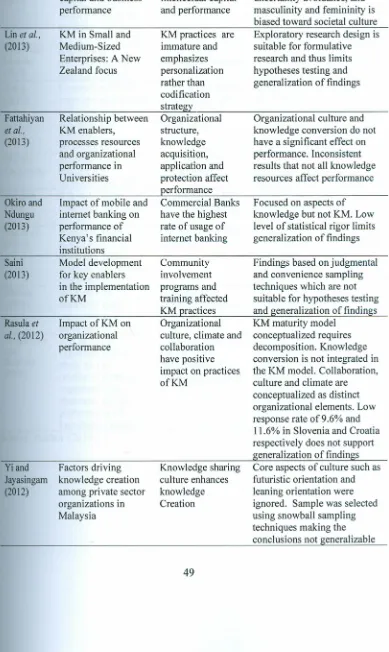

Table 2.1 Summary of Literature Review .49

Table 3.1 Decision Criteria for Mediation 58

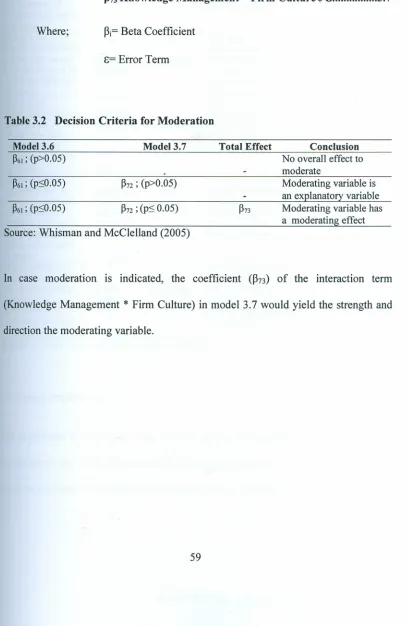

Table 3.2 Decision Criteria for Moderation 59

Table 3.3 Operationalization of the Research Variables 60

Table 3.4 Distribution of Target Population 61

Table 3.5 Distribution of Sample Size 61

Table 3.6 Confirmatory Factor Analysis 65

Table 3.7 Results of Reliability Test 66

Table 3.8 Hypotheses Testing 71

Table 4.1 Analysis of Background Information 74

Table 4.2 Descriptive Statistics for Knowledge Conversion 76 Table 4.3 Descriptive Statistics for Knowledge Transfer.. 79 Table

4.4

Descriptive Statistics for Knowledge Application 80 Table 4.5 Descriptive Statistics for Human Capital Repository 81 Table 4.6 Descriptive Statistics for Firm's Culture 83Table 4.7 Descriptive Statistics for Performance 85

Table 4.8 KMO and Bartlett's Test 87

Table 4.9 Shapiro-Wilk Statistics 88

Table 4.10 Collinearity Statistics 89

Table

4.11

Levene Statistic 90Table 4.12 Analysis of Variance 91

Table 4.13 Durbin Watson Test. 92

Table 4.14 Regression Results for Direct Relationship 93 Table

4.15

Regression Results for Knowledge Management on Performance 100 Table 4.16 Regression Results Human Capital Repository on Performance 101 Table 4.17 Effect of Knowledge Management on Human Capital Repository 102Table 4.18 Regression Results for Mediation 103

Table 4.19 Decision Criteria for Mediation 105

Table 4.20 Regression Results for Moderation 107

Table 4.21 Decision Criteria for Moderation 109

LIST OF FIGURES

Figure 1.1 Interactive Drivers ofHigh-Perfonnance Organizations 2 Figure 2.1 Strategy, Resources, Capabilities and Competences 26 Figure 2.2 Building an Organization's Learning Capability 33

Figure 2.3 Conceptual Framework 51

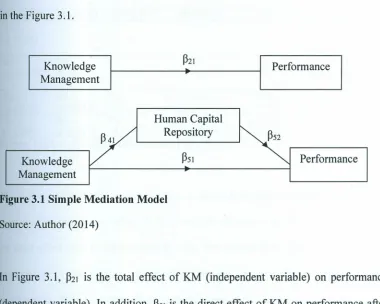

Figure 3.1 Simple Mediation Model.. 57

OPERATIONAL DEFINITION OF TERMS

Commercial Bank:

Commercial

Bank

ISan

institution

that

undertakes

banking

businesses

including

accepting and making payments on deposits and

current

account,

making

payment

on

and

accepting cheques, and employing money held

on deposit or on current account, or any part of

the money through lending, investment o

r

in any

other manner for the account and at the risk of

Explicit Knowledge:

the person so employing the money.

Explicit knowledge is the knowledge tha

t

is

consciously

understood

and

applied.

This

knowledge is easy to articulate and can be more

Human Capital repository:

precisely and formally articulated

.

Human capital repository is the knowledge

,

skills, and abilities residing within and util

i

zed

by individuals.

KM is the systematic, explicit and del

i

berate

building, renewal and application of knowledge

Knowledge Management:to maximize an enterprise's knowledge-related

effectiveness and returns on its knowledge

assets.

Knowledge Transfer:

Knowledge transfer

seeks to orgarnze and

distribute knowledge in order to ensure

i

ts

Learning Organization:

Organizational Performance:

Performance Drivers:

Tacit Knowledge:

A learning organization is an organization tha

t

quickly and deliberately plans and structures

learning into all its processes, such as des

i

gn

,

manufacturing,

marketing

and

accounting

.

Furthermore

,

the value chain

of

such an

organization includes a domain of integrated

learning

.

This organization encourages people to

grow and develop, share their knowledge and

learning with others

,

and to learn from others

.

Organizational performance is the extent to

which an organization achieves a set of

pre-defined targets that are unique to its m

i

ssion.

These

targets

include

.

both

objective

(quantitative)

and

subjective

(qualitati

v

e)

indicators.

Performance drivers are the key dimensions of

an organization's functioning that are critical to

its capacity to perform.

Tacit knowledge is the "know-how

"

kind of

knowledge.

Tacit

knowledge

i

s

automatic,

requires little or no time or thought and helps

determine how organizat

i

ons make dec

i

sions

and influence the collective behaviour of their

members

.

This knowledge is embedded in

ABBREVIATIONS AND ACRONYMS

AMA

CBK

CFA

ICT

KBA

KBV

KM

KMP

KMPC

KMPI

MDCM

MSC

NACOSTI

R&D

RBV

SMEs

SPSS

American Management Association

Central Bank of Kenya

Confirmatory Factor Analysis

Information Communication Technology

Kenya Bankers Association

Knowledge Based View

Knowledge Management

Knowledge Management Practices

Knowledge Management Process Capabilities

Knowledge Management Performance Index

Multimedia Development Corporation of Malaysia

Multimedia Super Corridor

National Commission for Science, Technology and Innovation

Research and Development

Resource Based view

Small and Medium Enterprises

.ABSTRACT

The knowledge-based view has identified innovative knowledge as what companies

require to dominate in an industry. Past studies have dealt with knowledge

management too broadly without considering specific aspects of knowledge

management which has led to a limited level of understanding on the extent to which

the comprehensive nature of knowledge management has influenced firms'

performance

.

Even

though

some

companies

have

implemented

knowledge

management, there is no conclusive empirical evidence on the influence of knowledge

management on performance. It has been noted that performance of Commercial

Banks suffer because knowledge is hoarded in scattered silos, fragmented by division

,

department, region and a host of other organizational factors such as culture

,

CHAPTER ONE: INTRODUCTION

1.1 Background of the Study

A key ingredient of the theory of the firm is its attempt to explain performance heterogeneity among firms, an issue that has been in the focus of strategic

management research over the years (Hughes and Morgan, 2007). The resource-based view (RBV) holds that companies gain sustainable competitive advantages by

deploying valuable resources and capabilities that are inelastic in supply (Grunert and

Hildebrandt,2004). RBV focuses on characteristics of firm's resources that contribute

to performance in form of competitive advantage. It assumes resource heterogeneity

between competing firms, and further contends that these resources are not mobile,

which makes long term, sustainable competitive advantage possible based on internal

configuration of strategically relevant resources.

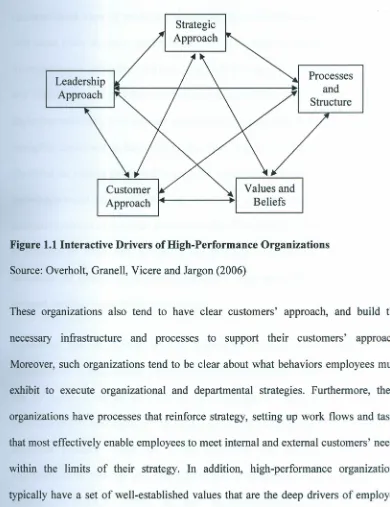

American Management Association (AMA) observes that there are five major drivers of organizational performance (AMA, 2007). These drivers are shown in Figure 1.1

and include strategic approach, leadership approach, values and beliefs, processes and structures,and customer approach. Each of these factors interacts with and influences

the others, creating a whole system. A change in one factor creates changes in the others. Subsequently, the system tends to be in continual flux. High-performance

Figure 1.1 Interactive Drivers of High-Performance Organizations

Source: Overholt, Granell, Vicere and Jargon (2006)

These organizations also tend to have clear customers' approach, and build the necessary infrastructure and processes to support their customers' approach.

Moreover, such organizations tend to be clear about what behaviors employees must exhibit to execute organizational and departmental strategies. Furthermore, these organizations have processes that reinforce strategy, setting up work flows and tasks that most effectively enable employees to meet internal and external customers' needs within the limits of their strategy. In addition, high-performance organizations

typically have a set of well-established values that are the deep drivers of employee behavior and are well understood by the vast majority of employees. The values and beliefs are embedded in the organization and are consistent with the company's

approach to leadership (AMA, 2007).

Since the early days of strategic management, researchers and managers have tried to find general rules for developing successful and competitive business strategies. The

resource-based view of strategic management has explored research questions like;

why some firms are more profitable than others or what are the successful strategies

to outperform a competitor (Grunert and Hildebrandt, 2004). Furthermore, Grunert

and Hildebrandt asserted that companies gain sustainable competitive advantage by

deploying valuable resources and capabilities that are inelastic in supply. In particular,

intangible assets such as knowledge, innovation, and intellectual properties have been

identified as value drivers and sources of company's competitive advantage. The

knowledge-based view (KBV) has identified innovative knowledge as what

companies require to dominate an industry (Malik and Malik, 2008). Companies need

to innovate to create new processes and products in order to sustain competitive

advantage for without innovation a company's value proposition will eventually be

imitated, eroding its competitive advantage.

Knowledge has increasingly been recognized as the new strategic imperative of

organizations. A fundamental paradigm considers knowledge as power; therefore, one

has to hoard it so as to maintain an advantage (Uriarte, 2008). Multimedia

Development Corporation of Malaysia (MDCM) considered knowledge as an

important resource which has to be effectively and efficiently managed for

organizations to leverage and obtain competitive advantage in a dynamic business

environment (MDCM, 2005). The new, knowledge-based economy places great

importance on creation, use and effective diffusion of knowledge (Metaxiotis,

Ergazakis and Psarras, 2005; Ford and Staples, 2006). Each firm must be able to

accumulate certain intangible knowledge assets that are relevant to its diverse

operations. In addition, Uriate noted that in the new paradigm, knowledge must be

Different resources such as technological infrastructure, organizational structure and organizational culture are linked to a firm's knowledge infrastructure capability (Lee and Sukoco, 2007). In addition, knowledge acquisition, knowledge conversion, knowledge application and knowledge protection are linked to the firm's knowledge process capability. Lee and Sukoco also argued that the contribution that each resource makes to organizational performance is likely to vary across firms. It is this unique make-up that enables benefits such as competitive advantage and improved performance to be realized.

An organization in the knowledge age is one that learns, remembers, and acts based on the best available information and know-how (Dalkir, 2005). In order to be successful in today's challenging organizational environment, companies need to learn from their past errors and not re-invent the wheel again and again.The effectiveness of building knowledge within firms depend on the abilityto monitor and absorb newly acquired knowledge from many sources and then integrate this knowledge into the existing knowledge base.It has been noted that firms can acquire external knowledge from research on previous products, therefore gaining valuable

insights about the product; excel at benchmarking with industry leaders, and rely on strategic alliances to acquire knowledge resources needed for their business (Danskin, Englis, Solomon, Goldsmith and Davey, 2005). Firms can also acquire external knowledge about the market from their customers and distributors.

The creation and diffusion of knowledge have become an increasingly important factor in competitiveness. More and more, knowledge is being regarded asa valuable commodity that is embedded in products and in tacit knowledge of highly mobile employees. Although knowledge is increasingly being viewed as a commodity or an

intellectual asset, it possesses some paradoxical characteristics that are radically

different from those of other commodities. Dalkir (2005) observed that application of

knowledge does not result in its consumption neither does transfer of knowledge

result in losing it. Moreover, Dalkir observes that even though knowledge may be abundant in any given organization, the ability to use it is scarce and that much of

valuableknowledge walks out ofthe organization at the end of the day.

Knowledge sharing is critical to a firm's success as it leads to faster knowledge

deployment to portions of the organization that can greatly benefit from it.However, employees need a strong motivator in order to share knowledge (Syed-Ikhsan and

Rowland, 2004). It is unrealistic to assume that all employees are willing to easily

offer knowledge without considering what may be gained or lost as a result of this

action. It has been argued that organization culture allows the members to create,

acquire, share, and manage knowledge within a context (Jones, Cline and Ryan,

2006). Moreover, organization culture helps in creating competitive advantage by

determining the boundaries, which facilitates individual interaction, and/or by

defining the scope of information processing to relevant levels (Krefting and Frost,

1985; Tseng, 2010). Many leaders are aware that performance comes from

interdependent behavior like cooperation, knowledge sharing, and mutual assistance.

Hence, organizations must foster the underlying culture necessary to support

knowledge conversion, transfer and application.

1.1.1Organization Performance

Understanding the determinants of firm performance has long been a key goal within

performance is considered the most important criterion in evaluating organizations,

their actions, and environments. In the last decade, the influence of knowledge

management (KM) on performance has been an enduring research theme in

organizational theory (Feng 2004; Gan, Ryan and Gururajan, 2006; Li and Seidel,

2013) providing empirical evidence that KM significantly affect performance (Choi

and Lee 2002; Droge, Claycomb and Gennain, 2003; Sabherwal and Sabherwal,

2005). Extant researchers (Mohnnan, Finegold and Mohrman, 2003; Abdul, Yahya,

Beravi and Wah, 2008; Yusoff and Daudi, 2010) identified knowledge conversion,

knowledge transfer and knowledge application as key dimensions of KM whose

integration can improve firm's performance.

Wilcox King and Zeithaml (2003) observed that KM is intended to increase the

quality and performance of the organizational and help a company to compete

effectively with other companies in the market. In addition, Bogner and Bansal (2007)

distinguished the ability to generate new knowledge as a fundamental mechanism of

KM systems that influence the performance of a company. Zaim, Tatoglu and Zaim,

(2007) noted that effective operation of KM enables companies to perform more

efficiently and survive in the business competitive environment through sustaining

their competitive advantages and developing their knowledge assets. RBV and KBV

consider knowledge and KM as critical resources which substantially influence

organizational success (Beesley and Cooper, 2008).

.However, there is a need to extend the empirical literature through the inclusion of

mediating and moderating variables in the relationship between KM and performance

in knowledge-intensive organizations (Lara, Marques and Devece, 2012). The

well equipped with skills and information are essential success ingredient for any KM

implementation presents a strong case for the need for mediating role of human

capital repository on the effect of KM on performance. In addition, it has been noted

that KM cannot be effectively implemented without significant behavioral and

cultural change in an organization (Akhavan, Jafari and Fathian, 2006; Lai and Ho,

2006; Rasula.Vuksic and Stemberger, 2012).

Commercial Banks are considered as typical knowledge-intensive organizations

where performance is driven and sustained by information and thus KM is a source of

competitiveness (Shih, Chang and Lin, 2010). As noted by Rono (2011), competition

and most of the work in the banking sector are knowledge-based; therefore, effective

management of knowledge can help Commercial Banks to improve internal

processes, customer service and products. In this study, non financial indicators of

performance such as new products, product improvement, speed of response to

market crises, customer retention and new processes were adopted from Maltz,

Shenhar and Reilly (2003), Raymond and St-Pierre (2005), and Kaplan and Norton

(2007).

According to Jafari, Jalal, Akhavan and Mehdi (2010), non-financial indicators are

suitable for measuring performance because they can be implemented at all levels of

organizations and represent a more precise picture than financial indices whose results

are superficial. Furthermore, Zhang and Li (2009) observed that financial indicators

. can only reflect the performance of banks in the past and cannot reflect the bank's

current and future operating conditions. Financial measures of performance which are

based on traditional accounting practices and emphasizes short-term indicators such

7

as profit, turnover, cash flow and share prices, are not fully suitable for measuring

corporate performance (Lee, Lee and Kang, 2005).

1.1.2 Knowledge Management

Knowledge Management (KM) is the new era technological application of knowledge

in critical planning, appraisal, decision making, evaluation and redesign of firm's

operative systems (Kipchumba, Chepkuto, Nyaoga and Magutu, 2010). It is obvious

that knowledge is slowly becoming the most important factor of production, next to

labor, land and capital (Sher and Lee, 2004). Knowledge-based assets or resources

such as patents provide heterogeneous capabilities that give each company its unique

character and are the essence of competitive advantage (Liu and Wei, 2009). KM

represents a deliberate and systematic approach to ensure full utilization of

organization's knowledge base, coupled with the potential of individual skills,

competences, thoughts, innovations and ideas to create a more efficient and effective

organization (Dalkir, 2005).

Abdul et al., (2008) considered knowledge management processes to include

knowledge identification, creation, acquisition, transfer, sharing, and exploitation.

Becerra-Fernandez, Gonzales and Sabherwal (2004) noted that KM processes can

help create knowledge, which can then contribute to improved firm's performance.

Furthermore, firm's performance is improved when organisations create, transfer, use

and protect knowledge (Mohrman et al.,2003; Marques and Simon, 2006).

Yusoff and Daudi (2010) used KM processes, including knowledge acquisition,

knowledge conversion and knowledge application, to manage and increase social

enhanced through KM processes that allow acquisition, conversion and application of

existing and new knowledge through addition of value to social capital while

remaining competitive in the market.Moreover, Yusoff and Daudi were emphatic that organisations need to generate knowledge continually, facilitate sharing of knowledge

within the organisation and apply knowledge so that the organisation can generate

new products or services.

1.1.3 Human Capital Repository

The knowledge-based view of the firm considers knowledge as the most strategically

significant resource of within an organization. This view considers a firm to be a

"distributed knowledge system" composed of knowledge-holding employees, and

holds that the firm's role is to coordinate the work of those employees so that they

create knowledge and value for the firm (Spender, 1996; Yusoff and Daudi, 2010). It

has been noted that KM can directly cause improvements in people, processes,

products and firm's performance (Marques and Simon,2006).

Individuals and their associated human capital repository are crucial for exposing an

organization to technology boundaries that increase its capability to absorb and

deploy knowledge domains (Hill and Rothaermel, 2003). Human capital is the

collective value of the capabilities, knowledge, skills, life experiences, motivation of

workforce and abilities residing within and utilized by individuals (Schultz, 1961;

Kaplan and Norton, 2004). Chong and Choi (2005) observed that employees and

managers who are well equipped with skills and information to fulfill their

responsibilities are essential success ingredient for any KM implementation. The set

to the firms' operations (Lesser, 2006). This is what may be construed to depict

human capital repository.

Knowledge as embodied in human beings has always been central to performance of

organizations. KBV acknowledges innovative knowledge as what companies require

to in order to outperform others within an industry (Malik and Malik, 2008). KM activities can assist the organisation in acquiring, storing and utilising knowledge for

processes such as problem solving, dynamic learning, strategic planning and deci

sion-making (Takeuchi and Nonaka, 2004). In addition, KM has the ability to protect

intellectual assets from decay and loss (Lang, 2004). Knowledge assets should be

maintained and managed so as to sustain competitive advantage whence conventional

assets are depreciated or replaced. In this context, knowledge management raises

strategic implication for companies (Warner and Witzed, 2004; Stam, 2007; Curado,

2008).

1.1.4 Organization Culture

Daft (2010) contends that in an organization, culture integrates members so that they

know how to relate to one another and helps the organization to adapt to the external

environment.When organizational members (Jones and Hill, 2009) subscribe to the organization's cultural norms and values, this bond them to the organization and

increase their commitment to find new ways to help it succeed. A variety of

characteristics describe a healthy culture such as acceptance and appreciation for

diversity, respect for each employee's contribution, effective communication,

investment in and orientation to innovation, customer service, learning, training, and

employee knowledge (Modaff, DeWine and Butler, 2011).

It has been noted that effective KM cannot be implemented without a significant

behavioral and cultural change (Rasula et al., 2012). Linn (2008) considers

organizational culture as the most critical factor that shapes behavior and as such

allows employees to create, acquire, share, and manage knowledge within a context. Therefore, an appropriate culture should be established to encourage employees to

create and share knowledge amongst themselves (Lee and Choi, 2003).

Organizational performance comes from interdependent behavior such as cooperation,

knowledge sharing, and mutual assistance (Jones et al., 2006). Extant researches

(Mathi, 2004; Wong and Aspinwall, 2005; Wong, 2005; Akhavan et al., 2006)

identified organization's culture as an enabler of knowledge management. In this case,culture is used to stimulate knowledge creation, utilization and protection and

facilitate knowledge sharing within an organisation (Lee and Choi, 2003; Yeh, Lai

and Ho,2006).

Pollard (2005) argues that the challenges faced today in getting people to share what

they know and to collaborate effectively are not caused or cured by technologies,

since they are cultural impediments that need culture based solutions. This culture

differs across different sectors. The differences may be accounted bythe kind ofwork

done and the specific type of knowledge that characterizes the industry. Linn (2008)

asserts that there is a need to have a strong culture of trust and transparency in all

areas ofthe organization.

'Banking is a typical knowledge-intensive industry that involves activities of

knowledge exchange (service) rather than exchange of goods (Shih et al., 2010). In

this case, knowledge creation and integration are key elements in value creation anda

source of competitiveness for Commercial Banks. Therefore, managing knowledge is

much more important to Commercial Banks than it is for other kinds of organizations.

Indeed, the last open frontier for banks to create competitive advantage may reside in their ability to leverage knowledge, since banking is not just a business of handling

money but also a business that is driven and sustained by information.

1.1.5 Commercial Banks inKenya

The banking sector in Kenya comprises of the Central Bank of Kenya (CBK), Commercial Banks, non-banking financial institutions and foreign exchange bureaus.

According to the CBK, as at 31stDecember 2014, the sector comprised of forty three

Commercial Banks, one mortgage finance company, nine deposit taking microfinance institutions, thirteen money remittance providers, eight representative offices of

foreign banks, eighty seven foreign exchange bureaus and two credit reference bureaus. Thirty five of the banks, most of which are small to medium sized are locally owned. The industry is dominated by a few large banks most of which are foreign owned. Six of the major banks are listed on the Nairobi Stock Exchange (CBK, 2014).

The Companies Act,the Banking Act,the Central Bank of Kenya Act and the various prudential guidelines issued by the Central Bank of Kenya govern the banking industry in Kenya (Banking Act,Chapter 488 Laws of Kenya; CBK Act, Chapter 491,

Laws of Kenya). The CBK which falls under the supervision of the National Treasury

is responsible for formulating and implementing monetary policy and fostering the

liquidity, solvency and proper functioning ofthe financial sector.The Central Bank of Kenya publishes information on Kenya's Commercial Banks and non-banking

financial institutions, interest rates and other publications and guidelines. Banks in

Kenya have come together under the Kenya Bankers Association (KBA), which

serves as a lobby for the bank's interests and addresses issues affecting its members.

Commercial Banks offer corporate and retail banking services but a small number,

mainly comprising the larger banks, also offer other services including investment

banking.

The CBK Bank Supervision Annual Report of 20 13 indicates that the Kenyan banking

sector registered improved performance in 2013 notwithstanding the marginal growth

of the economy. The sector registered a 15.9 percent growth in total net assets from

Ksh. 2.33 trillion in December 2012 to Ksh. 2.70 trillion in December 2013. Equally,

customer deposits grew by 13.5 percent from Ksh. 1.71 trillion in December 2012 to Ksh. 1.94 trillion in December 2013. Profit before tax for the sector increased by 16.6 percent from Ksh. 107.9 billion in December 2012 to Ksh. 125.8 billion in December

2013. This growth has been mainly underpinned by increased deposit mobilization by

banks as they expanded their outreach and opened new branches to tap new

customers, adoption of agency banking model, increased diversification of income

sources including commissions and earnings from foreign exchange trading, reduction

in interest expenses and adoption of cost effective delivery channels. Competition in

the sector has intensified over the last few years largely driven by increased

innovations and new entrants into the market.

The banking industry is commonly recognised for its contribution to the economic

activity, employment, innovation and wealth creation of a country. Stress tests

. conducted by the CBK for the quarter ending on June 30, 2012 showed that the

financial sector grew by 9 percent in 2010 and 7.8 percent in 2011 while the economy

grew by 5.8 percent and 4.4 percent in 2010 and 2011 respectively. It has been pointed out that Commercial Banks play a significant role in the economic growth of

countries through their intermediation function which facilitates efficient allocation of

resources through mobilizing resources for productive activities (Ongore and Kusa,

20l3).

The dynamic nature of the global business environment led to liberalization of the

banking sector in 1995 with inherent lifting of exchange controls (CBK, 2012). In

addition, these changes have led banks to rationalize their products and services and

examine the role of KM in improvement of competitiveness. Okira and Ndungu

(20l3) identified adoption of Automated Teller Machines, smart cards, internet and

mobile banking as new innovations in the Kenyan banks, which raises a strong case

for a KM approach to management of the banking industry. However, KM is

supported by both structural and cultural systems that should be aligned with strategic

goals leading to sustainable competitive advantage. As noted by Rono (2011), KM is

indispensable in the banking industry because competition and most of the work in

the industry are knowledge-based.

Thestate of theory on KM may need further integration with management literature to

model the relationship between KM and performance outcomes. As noted by Gray

and Durcikova (2005), banks suffer in their performance because knowledge is

hoarded in scattered silos, fragmented by division, department, region and host of

other organizational factors such as culture, processes and management style among

others. However, CBK (2014) observed that through the use of technology

. Commercial Banks have continued to enhance efficiency in offering financial

services. Moreover, in 2013, one employee could serve an average of 642 customers

whereas in 2014 the same employee served 770 customers, a development that raises

implicationsfor KM and resultant performance of Commercial Banks

1.2 Statement of the Problem

Performance of Commercial Banks in Kenya has improved tremendously over the last

ten years (Mwega, 2009). Moreover, only two banks have been put under CBK

statutory management in this period compared to 37 bank-failures between 1986 and

1998.However, despite the overall good picture a critical analysis indicates that there

has been heterogeneity in performance of different Commercial Banks. It has been

noted that small and medium sized banks which constitute about 57 percent of

Commercial Banks posted a combined loss before tax, of Ksh 0.09 billion in 2009

compared to a profit before tax of Ksh 49.01 billion posted by the big financial

institutions (CBK, 2009). The huge profitability enjoyed by the large banks vis-a-avis small and a medium banks suggests that there are some significant factors that

influence the performance of Commercial Banks in Kenya.

As noted by Rono (2011), KM is indispensable in the banking industry because

competition and most of the work in the industry are knowledge-based. The dynamic

nature of the global business environment have led commercial banks to rationalize

their products and processes as well as examine the role of KM in improvement of

performance (CBK, 2012). Commercial Banks have continued to leverage on

knowledge assets in the development of quality services that are efficient and on a

wider scope in the fight for market share and enhanced performance (CBK, 2014).

The knowledge-based view of the firm has identified innovative knowledge as what

organizations require to dominate in an industry (Malik and Malik, 2008). The vast

body of knowledge documented indicates that there are several dimensions of

2003; Sabherwal and Sabherwal, 2005,). Extant researchers (Mohrman et al., 2003;

Abdulet al.,2008; David and Yusoff, 2010) have identified knowledge conversion,

knowledge transfer and knowledge application as key dimensions of knowledge

management whose integration can improve firm's performance.

Lara et al., (2012) further suggested that there is a need to extend the empirical

literature through inclusion of mediating and moderating variables in assessing the

relationship between KM and performance in knowledge-intensive organizations. The

argument advanced by Chong and Choi (2005) that employees and managers who are

well equipped with skills and information are essential success ingredient for any KM

implementation presents a strong case for possibility of mediating role of human

capital repository on the effect of KM on performance. As noted by a stream of recent

researchers (Akhavan et al.,2006; Lai and Ho, 2006; Rasula et al., 2012), KM cannot

be effectively implemented without a significant behavioral and cultural change in the

organization. There should be a strong culture of trust and transparency in all areas of

the organization.

Furthermore, extant empirical literature (Mathi, 2004; Wong and Aspinwall, 2005;

Wong,2005) has identified organization's culture as an enabler of KM. In this case,

culture is used to stimulate knowledge conversion, transfer and application within

organisations (Lee and Choi, 2003; Yeh et al., 2006), and therefore, moderates the

effect of KM on performance. Danish, Munir and Butt (2012) concluded that the

relationship between KM practices and organizational effectiveness is positively

moderated by organizational culture. Although this study utilized regression analysis,

fundamental diagnostics tests were not conducted to establish the appropriateness of

16

-..:.--the data for making inferences. In addition, the study failed to integrate specific

dimensions of KM.

Stevens (2010) utilizing exploratory research design concluded that companies must

design knowledge transfer strategies conducive to multi-generational workforce

dynamics keeping in mind the generational diversity that exists in the workplace.

Nevertheless, these results could not be generalized owing to the nature of the

research design adopted. Yusoff and Daudi (2010) using correlation analysis and

regression analysis concluded that knowledge application positively influences

performance. However, the conclusion of the study cannot be generalised owing to a

low response rate of thirty eight percent which is below the fifty percent threshold

recommended by Mugenda and Mugenda (2003).

Bourini, Khawaldeh and AI-qudah (2013) concluded that KM activities are positively

correlated to strategy. However, this study was based on exploratory research design

which does not support formulation and testing of research hypotheses. Zaied,

Hussein and Hassan (2012) concluded that knowledge conversion, storing and human

resources affect performance. Nevertheless, this study failed to integrate knowledge

transfer in the KM framework and also concluded that knowledge application and

culture do not affect performance. Mosoti and Masheka (2010) concluded that

knowledge management practices influence efficiency of not-for-profit organizations.

However, this conclusion was based on descriptive statistics and thus lacked the

statistical rigor for making inferences. Ongore and Kusa (2013) utilized such

measures of profitability as return on equity, return on asset and net interest margin as

significantly affect performance, it ignored non-financial indicators which offer a

more precise representation of performance on the basis of current and future

operating conditions (Zhang and Li, 2009).

Thus considering these scenarios, KM needs to be modeled in such a way that its

effect on performance can be better explained. In the case of Commercial Banks in

Kenya that have registered mixed performance results in an era characterized by rapid

knowledge development, contribution of knowledge needs to be investigated.

However, extant empirical literature has shown that there are limitations in the

attempt to explain how the comprehensive nature of KM has influenced performance

(Carlucci, Marr and Schiuma, 2004). In addition, the understanding of the influence of

KM on performance is still developing and further research and collation of

knowledge is required to develop this understanding, model new relationships and

formulate universally enduring guidelines for appropriate KM practices. Therefore,

there was a need to investigate the relationship between KM and performance of

Commercial Banks in Kenya while integrating the mediating and moderating role of

human capital repository and firm's culture respectively.

1.3 Objectives of the Study

1.3.1 General Objective of the Study

The general objective of this study was to investigate the relationship between

1.3.2 Specific Objectives of the Study

The specific objectives of this study were;

i) To determine the relationship between knowledge conversion and performance of

Commercial Banks in Kenya.

ii) To establish the relationship between knowledge transfer and performance of

Commercial Banks in Kenya.

iii) To determine the relationship between knowledge application and performance of

Commercial Banks in Kenya.

iv) To establish the mediating effect of human capital repository on the relationship

between knowledge management and performance of Commercial Banks in

Kenya.

v) To determine the moderating effect of firm's culture on the relationship between

knowledge management and performance of Commercial Banks in Kenya.

1.4 Research Hypotheses

The research hypotheses of this study were;

Hot: Knowledge conversion has no relationship with performance of Commercial

Banks in Kenya.

Ho2: Knowledge transfer has no relationship with performance of Commercial

Banks in Kenya.

H03: Knowledge application has no relationship with performance of Commercial

Banks in Kenya.

H04: Human capital repository has no mediating effect on the relationship between

Hos: Firm's culture has no moderating effect on the relationship between knowledge management and performance of Commercial Banks in Kenya.

1.5Significance of the Study

This study provided a basis for establishing the relationship between knowledge

management and performance of Commercial Banks in Kenya. In addition, the study

has provided a basis for understanding the influence of human capital repository and

firm's culture on the link between knowledge management and performance. The

findings of the study would consequently be relevant for policy formulation in

Commercial Banks. Indeed, this study would ultimately facilitate efficient and

effective utilization of knowledge resources resulting in enhanced performance.

Policy makers in other organizations would equally benefit from the findings of this

research study. The result of the study provides a pool of knowledge on the role and

contribution of knowledge resources in building and sustaining competitive advantage

in an industry. This knowledge if well harnessed would result in above average

performance of a firm in an industry.

Furthermore, scholars would also benefit from the study as the findings add to the

existing body of knowledge in knowledge management and performance. Moreover,

the results of the study would underscore the fundamental role of utilization of

knowledge resources in order to leverage on organization's performance. In addition,

1.6 Scope of the Study

This study was delimited to all Commercial Banks in Kenya. Commercial Banks were

chosen because they are knowledge-intensive (Shih et al., 2010), and as such, they are

at the "cutting edge" of KM applications in Kenya. A knowledge-intensive firm relies

heavily on its unique knowledge as an input and produces innovative products. The

study involved the five functional areas of human resource, finance, marketing,

information communication and operations in each Commercial Bank. The heads of

the functional areas that were identified are part of senior management team that

operates from the headquarters of Commercial Banks.

1.7 Limitations of the Study

This study sought to investigate the relationship between KM and performance of

Commercial Banks in Kenya. It also sought to establish the mediating and moderating

role of human capital repository and firm's culture on the effect of KM on

performance. In carrying out this study the researcher experienced difficulties in

accessing the target respondents particularly due to policy requirements and the nature

of their positions. This limitation was mitigated through the use of the research permit

from the National Commission for Science, Technology and Innovation (NACOSTI),

seeking consent from Commercial Banks and placing appointments with the

concerned managers.

The researcher also encountered a challenge as a result of the sensitive and strategic

nature of some of the information needed. Nevertheless, this challenge was mitigated

by reassuring the respondents of confidentiality in handling the research data which

Commercial Banks. In addition, the researcher experienced difficulties in reviewing

empirical literature owing to the fact the area of focus is not adequately researched in

developing countries and more so in the local setting. However, this limitation was

mitigated through the review of similar empirical work in other sectors and developed

countries.

1.8 Organization of the Study

This thesis comprises of the preliminary part and five chapters. The preliminary part

consists of the title page, declaration, dedication, acknowledgement abstract, table of

contents, list of figures, list of tables, abbreviations and acronyms, and definition of

terms. Chapter one presents the background of the study, statement of the problem,

objectives of the study, significance of the study, scope, limitations and organization

of the study. Chapter two comprises of the theoretical review, empirical review,

summary of literature review and research gap and conceptual framework. Chapter

three encompasses the methodology which presents the research philosophy, research

design, empirical model, target population, sampling design and procedure, data

collection instrument, validity of the instrument, reliability of the instrument, data

collection procedure, data analysis and ethical considerations. Chapter four comprises

research findings and discussion which presents the background information,

descriptive statistics, inferential statistics and qualitative data analysis. Chapter five

presents the summary, contribution of the study to knowledge, conclusion,

CHAPTER TWO: LITERATURE REVIEW

2.1 Introduction

This chapter focuses on reviewing the available literature on the various aspects of

KM that influence performance of firms. The review delves into various theories and

empirical findings that act as a foundation for this research study. The theories and

findings from past studies unearth the research variables for the study. The chapter

also presents the research gap and a conceptual framework that shows the relationship

between the research variables.

2.2 Theoretical Literature Review

This section presents a critical review of theoretical arguments regarding the linkages

between the research variables.

2.2.1 Resource-Based View of the Firm

According to the resource-based view (RBV), a firm may be perceived as an

aggregation of resources which are translated by management into strengths and

weaknesses of the firm. RBV holds that companies gain sustainable competitive

advantages by deploying valuable resources and capabilities that are inelastic in

supply (Grunert and Hildebrandt, 2004). This perspective contends that a firm's

competitive advantage is due to endowment of strategic resources that are valuable,

rare, costly to imitate, and costly to substitute. It assumes that organizations must be

successful in obtaining and managing valued resources in order to be effective. In the

organization in either absolute or relative terms, to obtain scarce and valued resources

and successfully integrate and manage such resources (Dess, Lumkin, Eisner,

Lumpkin and McNamara, 2012).

RBV recognises the strategic importance of social and behavioural interactions in

conceivability of choice and implementation of organization's strategies.

Furthermore, this approach integrates two perspectives; internal analysis of

phenomena within a company, and external analysis of an industry and its competitive

environment (Dess et al., 2012). In addition, RBV proposes that firm's resources must

be evaluated on the basis of how valuable, rare, and hard they are for competitors to

duplicate. In the absence of such valuable resources the firm attains only competitive

parity. Makhija (2003) suggests that these valuable resources are frequently found in

organizations in the form of tacit knowledge.

Resources are financial, physical, social or human, technological, and organizational

factors that allow a company to create value for its customers. Company resources are

either tangible or intangible (Jones and Hill, 2009). Intangible resources are

non-physical entities that are creation of managers and other employees, such as brand

names, the reputation of the company, the knowledge that employees have gained

through experience, and intellectual property of the company, including that which is

protected through patents, copyrights, and trademarks. Tangible resources are

physical and include land, buildings, plant, equipment, inventory, and money.

Although physical resources may be the origin of above average returns, intangible

complex dimension, are responsible for creating and sustaining competitive advantage

(Makhija, 2003).

RBV assumes resource heterogeneity between competing firms, and further contends

that these resources are not mobile, which makes long term, sustainable competitive

advantage possible based on internal configuration of strategically relevant resources

(Grunert and Hildebrandt, 2004). In case a resource is firm-specific and difficult to

imitate, a company is likely to have a distinctive competence. Furthermore, a

distinctive competence is a unique firm-specific strength that enables a company to

better differentiate its products and/or achieve substantially lower costs than its rivals

andthus gain competitive advantage. A resource that leads to distinctive competences

is inimitable, valuable, unique, and non-substitutable (Jones and Hill, 2009).

A company may have firm-specific and valuable resources, but unless it has the

capabilities to use those resources effectively, it may not be able to create a distinctive

competence (Jones and Hill, 2009). Capabilities refer to a company's skills at

coordinating and putting resources to productive use. It has been argued that these

skills reside in an organization's rules, routines, and procedures-that is, the style or

manner through which a company makes decisions and manages its internal processes

to achieve organizational objectives. A company's capabilities are a product of its

organization structure, processes, and control systems which are used to specify how

and where decisions are made within a company, the kind of behaviours that should

Distinctive competencies shape the strategies that are pursued by a company.

Moreover, strategies help 'in building superior efficiency, quality, innovation, or

customer responsiveness resulting in competitive advantage and superior profitability.

However, it is also important to realize that the strategies that are adopted by a

company can build new resources and capabilities as well as strengthen the existing

resources and capabilities of the company, thereby enhancing distinctive competences

of the enterprise. In this case, the relationship between distinctive competencies and

strategies is not a linear one; rather, it is a reciprocal one in which distinctive

competencies shape strategies, and strategies help to build and create distinctive

competences (Kim and Mauborgne, 2005).

Resources

J

Distinctive Competitive Superior

Competences

••••••

Strategies ~ Advantage ~ Profitabilityt

Capabilities

Figure 2.1 Strategy, Resources, Capabilities and Competences

Source: Jones and Hill (2009:59)

Intangible resources can be more difficult to imitate. Furthermore, imitating

company's capabilities tend to be more difficult than imitating its tangible and

intangible resources because it is hard for competition to discern the way in which

decisions are made and process managed deep within the company. However, on its

own, the invisible nature of capabilities would not be enough to halt imitation;

away from that company. Nevertheless, a company's capabilities rarely reside in a

single individual. Rather, they are the product of how numerous individuals interact

within a unique organizational setting. A company's competitive advantage tends to

be more secure when it is based upon intangible resources and capabilities, as

opposed to tangible resources. Capabilities can be particularly difficult to imitate,

since doing so requires the imitator to change its own internal management processes

-something that is never easy, owing to organizational inertia (Jones and Hill, 2009).

The resource-based view of a firm is suited for studying the effect KM on

performance. It proposes that strategies adopted by an organization such as KM can

be utilized in building and creating new resources and capabilities as well as

strengthen the existing resources and capabilities of the company, thereby enhancing

distinctive competences and performance of the enterprise. It also proposes that

intangible resources such as knowledge asset and capabilities as KM can be used as

source of sustainable competitive advantage. This proposition raises a strong case for

the need to investigate the relationship between KM and performance. If indeed KM

influences performance, Commercial Banks can leverage the resulting competitive

advantage and superior performance since RBV considers KM as rare, unique, firm

-specific and difficult to imitate. Thus, in this study, the postulates of RBV were used

to inform the independent variable.

2.2.2 Knowledge-Based View of the Firm

According to the knowledge-based view (KBV), innovative knowledge is what

companies require to outperform others in an industry (Malik and Malik, 2008). KBV

holding employees, and this view holds that the firm's role is to coordinate the work

of those employees so that they can create knowledge and value for the firm. Carlucci

et aI., (2004) contends that knowledge assets are as important for competitive

advantage and survival, if not: more important, than physical and financial assets.

Knowledge and capabilities-based views in strategy have largely extended resource

-based reasoning bysuggesting that knowledge is the primary resource underlying new

value creation, heterogeneity, and competitive advantage (Barney, 2001; Felin and

Hesterly, 2007). Furthermore, Felin and Hesterly contend that research and practice

arereplete with empirical and anecdotal evidence of the primacy of individuals as the

locus of knowledge and source of new value. An organizational capability (Tsai, Li,

Tsai and Lin, 2012) is often established by a bundle of related knowledge which

includes knowledge items and the level of such items.

KBV considers knowledge as the most important source for firms' competitive

advantage (Feng, Chen and Liou, 2005). It has been argued that knowledge is a

crucial resource of firm's strategies and the origin of competitive advantage as the

integration of a bundle of knowledge rather than individual knowledge (Grant, 1996;

Felinand Hesterly, 2007). Moreover, knowledge aids firms in strategic development

ofproducts and market, and provides an alternative way of achieving differentiation

andcompetitive advantage.

KBV has facilitated a shift from a competitive advantage that is based on market

position to one that focuses on firm's capabilities (Felin and Hesterly, 2007).

Moreover, the orientation of firm's strategies has been also changed from

capabilities from collaborative partners by alliance (Kale and Singh, 2007) or

developing effective models (Capron and Mitchell, 2009). KBV stresses

knowledge-based competition and illustrates that firms can differentiate themselves on the basis

of their KM strategies. While each of the individual knowledge assets is complex to

acquire and difficult to imitate, firms that achieve competitive advantage through KM

have also learned to combine their knowledge assets to effectively create an overall

KM capability.

KBV provides a relevant theory for underpinning KM, human capital repository and

performance. This theory considers knowledge assets such as conversion, transfer and

application as primary resources that can be used in strategic development of

products, processes and markets within knowledge intensive organizations, In

addition, this value creation process requires the abilities residing within and utilized

by employees and managers so as to expose an organizations to technology

boundaries that increase its capability to absorb and deploy knowledge assets. This

theoretical proposition raises a conceptual implication on the need for human capital

repository in mediating the effect of KNI on performance. In this case, the

propositions ofKBV were used to inform the mediating variable in this study.

2.2.3 Organizational Learning Theory

A learning organization is the term given to an organization or a firm that facilitates

the learning of its members and continuously transforms itself. Learning organizations

develop as a result of the pressures facing modern organizations and enables them to

main features; systems thinking, personal mastery, mental models, shared vision and

team learning. The learning organization concept encourages organizations to shift to

a more interconnected way of thinking. Organizations should become more like

communities that employees can feel a commitment to and therefore will work harder

(Serenko, Bontis and Hardie, 2007).

Organizational learning theory argues that, in order to be competitive in a changing

environment, organizations must change their goals and actions to reach those goals

(Janz and Prasarnphanich, 2003). However, for learning to occur, the firm must make

a conscious decision to change actions in response to a change in circumstances,

consciously link action to outcome, and remember the outcome. Organizational

learning has many similarities to psychology and cognitive research because the

initial learning takes place at the individual level: however, it does not become

organizational learning until the information is shared, stored in organizational

memory in such a way that it may be transmitted and accessed, and used for

organizational goals (Cha, Pingry and Thatcher, 2008).

The first part of the learning process involves data acquisition. A firm acquires a

"memory" of valid action-outcome links, the environmental conditions under which

they are valid, the probabilities of the outcomes, and the uncertainty around that

probability. The action-outcome links are acquired through experiential, experimental,

benchmarking, grafting, among others, but they must be a conscious effort to

discover, confirm, or utilize-a cause and effect, or they are simply blind actions

relying on chance for success. Notably, a firm's actions will - and must - change in

specified in terms of applicable conditions. Ultimately, successful firms scan their

environment to determine when change is necessary: this, of course, presupposes that

they have learned the important indicators to scan and have learned what degree of

change in environmental indicator does or does not require change in actions (HuIt,

Tomas, Hurly, Giunipero and Nichols, 2000).

The second part of the process is interpretation. Organizations continually compare

actual to expected results to update or add to their "memory". Unexpected results

must be assessed for causation, actions adapted or new action-outcome links specified

if necessary, and learning increased. This stage does not imply that any action is

taken. Some theorists insist that there must be action for learning to occur, but others

argue that what matters is expansion of the knowledge base or change in

understanding. Consequently, the third stage is adaptation/action. The firm uses the

interpreted knowledge to select new action-outcome links appropriate to the new

environmental conditions. Once adaptation has occurred, the firm's knowledge base is

updated to include the new action-outcome link, probabilities, uncertainty, and

applicable conditions and the process continues. This feedback is a continual and

iterative process, and occurs at all stages ofthe process (Serenko et al.,2007).

Organizations (Debowski, 2006) have experienced many changes in the ways they

operate as a result of the shift to a knowledge economy and the increased streamlining

of work activities because of technological innovations. Furthermore, the shift in

focus from products to services has encouraged greater recognition of the importance

of the knowledge held within an organization. Any organization that desires to attain

and failures. In a learning organization, new ideas and information are infused by

constantly scanning the external environments, hiring new talent and expertise when

needed, and devoting significant resources to train and develop their employees

(Kinicki and Kreitner, 2009). Moreover, employees' mistakes should be viewed as

potential sources of new ideas and ways of doing things (Marquardt, 2011).

Organizations seek to use a range of authoritative sources, including knowledge held

by individual and within knowledge systems maintained by the organization. Explicit

knowledge can be documented, categorised, transmitted to others as information, and

illustrated to others through demonstrations, explanations and other forms of sharing.

However, tacit knowledge is difficult to duplicate, replace or interpret, as it is

grounded in a blend of experience, research and induction which may have been

refined over many years (Debowski, 2006). A learning organization proactively

creates, acquires, and transfers knowledge (Kinicki and Kreitner, 2009). New ideas

are a prerequisite for a learning organization; indeed it's on the basis of new

knowledge and insights that the organization changes its behaviour.

Strategic knowledge management ensures corporate strategic knowledge grows,

learns and matures alongside its individual members. Marquardt (2011) considers the

prime task of management in learning organizations as facilitating employees'

experimentation and learning from experience enhanced by timely feedback and

complete disclosure. Opportunities are created across the entire organization to

develop knowledge, skills, and attitudes. The two major contributors to an

InternalStructure and Processes

~

Customer

--+

Sales GrowthSatisfaction FacilitatingFactors

~---~r---~~

LearningMode

Organizations Learning Capability

Organizati onal

Performance

--+

Profitabilityt

Cultureand Experience

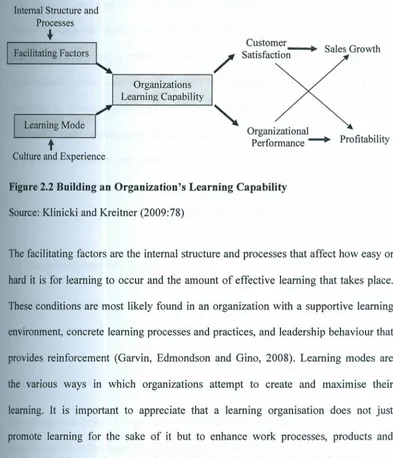

Figure 2.2 Building an Organization's Learning Capability

Source: Klinicki and Kreitner (2009:78)

The facilitating factors are the internal structure and processes that affect how easy or

hard it is for learning to occur and the amount of effective learning that takes place.

These conditions are most likely found in an organization with a supportive learning

environment, concrete learning processes and practices, and leadership behaviour that

provides reinforcement (Garvin, Edmondson and Gino, 2008). Learning modes are

the various ways in which organizations attempt to create and maximise their

learning. It is important to appreciate that a learning organisation does not just

promote learning for the sake of it but to enhance work processes, products and

services. In this case, in an organisation that has a learning culture, individuals move

from fearing mistakes to viewing problems and errors as information to help III

decision-making processes and facilitate success (Kinicki and Kreitner, 2009).

This study uses the theory of learning organization as a framework for integrating and

understanding the role of firm culture in KM and performance. As noted, KM cannot

be effectively implemented without a significant behavioral and cultural change. A