GENERAL INFORMATION

Management Board

Miros

ł

aw Kochalski

Rafa

ł

Pasieka

Marek Trosi

ń

ski

Wojciech Wardacki

Supervisory Board

Grzegorz Mi

ś

Alicja Pimpicka

Wiktor Cwynar

Tomasz Karusewicz

Dariusz Krajowski – Kukiel

Registered Office

ul. Pow

ą

zkowska 46/50

01-728 Warsaw

Poland

Statutory Auditor

Deloitte Audyt Sp. z o.o.

ul. Pi

ę

kna 18

00-549 Warsaw

Poland

CONTENTS:

TU

REPORT ON THE OPERATIONS OF THE CIECH GROUP FOR THE 1ST HALF OF 2007UT... 4

TU

1UT TUDESCRIPTION OF THE CIECH GROUPUT... 4

TU

2UT TUMAJOR ACHIEVEMENTS OF THE CIECH GROUP IN THE FIRST HALF OF 2007UT... 5

TU

3UT TUCOMMENTS ON THE FINANCIAL RESULTS OF THE CIECH GROUPUT... 9

TU

4UT TUCLARIFICATION REGARDING THE CIECH GROUP'S SEASONAL TYPE OR PERIODICAL TYPE ACTIVITYUT... 16

TU

5UT TUEXPLANATION OF THE DIFFERENCES BETWEEN THE FINANCIAL RESULTS AND THE FORECASTS PUBLISHED EARLIERUT17

TU

6UT TUFACTORS SHAPING CIECH GROUP’S FINANCIAL PERFORMANCEUT... 18

TU

7UT TUUSE OF THE ISSUER'S FUNDS COMING FROM THE ISSUE OF SHARESUT... 18

TU

8UT TUMAIN PRODUCTS, GOODS, OR SERVICESUT... 18

TU

9UT TUCHANGES IN THE MARKETSUT... 18

TU

10UT TUCHANGES IN SUPPLY SOURCES OF MANUFACTURING MATERIALS, GOODS, AND SERVICESUT... 18

TU

11UT TUCONCLUDED CONTRACTS SIGNIFICANT TO CIECH GROUP'S ACTIVITY (INCLUDING CONTRACTS CONCLUDED

BETWEEN SHAREHOLDERS AND INSURANCE OR COOPERATION CONTRACTS)UT... 19

TU

12UT TUDESCRIPTION OF TRANSACTIONS WITH AFFILIATESUT... 19

TU

13UT TUBORROWINGS, LOAN AGREEMENTS, AND SURETIES AND GUARANTEES GRANTEDUT... 19

TU

14UT TUSIGNIFICANT OFF-BALANCE SHEET ITEMSUT... 19

TU

15UT TUINFORMATION ON EMPLOYMENTUT... 19

TU

16UT TUSIGNIFICANT RESEARCH AND DEVELOPMENT ACHIEVEMENTS OF THE CIECH GROUPUT... 19

TU

17UT TUINFORMATION CONCERNING THE PROTECTION OF THE NATURAL ENVIRONMENTUT... 21

TU

18UT TUINVESTMENT ACTIVITYUT... 25

TU

1.1.1UT TUInvestments in the first half of 2007UT... 25

TU

1.1.2UT TUInvestment plans for the next 6 monthsUT... 27

TU

19UT TUCHANGES IN CORPORATE LINKAGE OF THE CIECH GROUPUT... 29

TU

20UT TUDESCRIPTION OF MAJOR EQUITY INVESTMENTS AND METHODS OF THEIR FINANCINGUT... 30

TU

21UT TUINFORMATION ON SECURITIES ISSUES IN CIECH SAUT... 31

TU

22UT TUPURCHASE OF TREASURY SHARES BY THE PARENT COMPANYUT... 31

TU

23UT TUCHANGES IN THE BASIC MANAGEMENT PRINCIPLES OF THE COMPANY/GROUPUT... 31

TU

24UT TUCHANGES IN THE MANAGING AND SUPERVISORY BODIES - PREVIOUS YEARUT... 32

TU

25UT TURULES OF APPOINTMENT AND DISMISSAL OF THE MANAGING BODIES AND AUTHORISATION OF THE MANAGING

BODIES, IN PARTICULAR THE RIGHT TO TAKE DECISIONS ON SHARE ISSUE OR BUYOUTUT... 32

TU

26UT TUCONTRACTS CONCLUDED BETWEEN THE ISSUER AND THE MANAGING BODIES, PROVIDING FOR REIMBURSEMENT IN

THE CASE OF THEIR RESIGNATION OR LAY-OFF WITHOUT ANY JUSTIFIABLE REASON OR WHEN THEIR DISMISSAL OR LAY-OFF TAKES PLACE DUE TO THE ISSUER'S MERGERS THROUGH TAKEOVERSUT... 32

TU

27UT TUREMUNERATION FOR THE MANAGEMENT BOARD AND THE SUPERVISORY BOARDUT... 33

TU

28UT TUTOTAL NUMBER AND NOMINAL VALUE OF THE COMPANY’S SHARES AS WELL AS SHARES AND STOCKS IN AFFILIATES

HELD BY MEMBERS OF THE MANAGEMENT AND SUPERVISORY BODIESUT... 33

TU

29UT TUSHAREHOLDERS ENTITLED TO AT LEAST 5% OF VOTES AT CIECH SA’S GENERAL MEETING OF SHAREHOLDERSUT33

TU

30UT TUCONTRACTS WHICH MAY CHANGE THE OWNERSHIP INTERESTS OF THE CURRENT SHAREHOLDERS AND BOND

HOLDERSUT... 35

TU

31UT TUINFORMATION ON HOLDERS OF ANY SECURITIES WHICH EMPOWER TO EXERCISE SPECIAL CONTROLLING POWERS

IN RELATION TO THE ISSUER, WITH A DESCRIPTION OF THE POWERS ENCLOSEDUT... 35

TU

32UT TUINFORMATION ON ANY LIMITATIONS CONCERNING THE TRANSFER OF THE OWNERSHIP OF THE ISSUER'S SECURITIES

AND ANY LIMITATIONS IN EXERCISING THE RIGHT TO VOTE PER THE ISSUER'S SHARESUT... 35

TU

33UT TUINFORMATION ON THE CONTROL SYSTEM OF EMPLOYEE SHARE PLANSUT... 35

TU

34UT TUINFORMATION ON CONTRACTS CONCLUDED WITH ENTITIES ENTITLED TO AUDIT THE CONSOLIDATED FINANCIAL

STATEMENT OF THE CIECH GROUPUT... 36

TU

35UT TUFINANCIAL RESOURCES MANAGEMENT IN THE CIECH GROUPUT... 37

TU

36UT TUEXPECTED FINANCIAL SITUATION OF THE CIECH GROUPUT... 40

TU

37UT TUASSESSMENT OF THE POSSIBILITIES TO CARRY OUT INVESTMENT ASSUMPTIONS IN COMPARISON TO THE AMOUNT

OF FUNDS HELD, TAKING INTO ACCOUNT POSSIBLE CHANGES IN THE FINANCING STRUCTURE OF THAT ACTIVITYUT.... 40

TU

38UT TUMATERIAL EVENTS THAT IMPACTED THE COMPANY’S OPERATIONS AND FINANCIAL RESULTS IN THE FIRST HALF OF

2007 OR ARE LIKELY TO IMPACT THEM IN THE FOLLOWING PERIODSUT... 40

TU

39UT TUPROSPECTS FOR GROWTH IN THE CAPITAL GROUPUT... 41

TU

40UT TUINTERNAL AND EXTERNAL FACTORS SIGNIFICANT TO THE CIECH GROUP'S GROWTHUT... 41

TU

41UT TUMATERIAL RISK AND THREAT FACTORS, AND THE DEGREE OF THE GROUP'S EXPOSUREUT... 43

TU

42UT TUANTICIPATED GROWTH OF THE GROUPUT... 44

TU

43UT TUGOALS AND PRINCIPLES OF FINANCIAL RISK MANAGEMENTUT... 45

TU

APPENDIX NO. 1UT... 45

TU

MAIN PRODUCTS, GOODS AND SERVICESUT... 45

TU

APPENDIX NO. 2UT... 53

TU

CHANGES IN THE MARKETSUT... 53

TU

APPENDIX NO. 3UT... 60

TU

TU

INTERIM CONSOLIDATED FINANCIAL STATEMENT OF THE CIECH GROUP FOR THE FIRST HALF OF 2007UT 66

TU

CONSOLIDATED PROFIT AND LOSS ACCOUNT FOR THE PERIOD OF JANUARY 1ST TO JUNE 30TH, 2007UT... 67

TU

CONSOLIDATED BALANCE SHEET AS AT JUNE 30TH, 2007UT... 68

TU

STATEMENT OF CHANGES IN CONSOLIDATED EQUITY FOR THE PERIOD OF JANUARY 1ST TO JUNE 30TH, 2007UT... 70

TU

CONSOLIDATED CASH FLOW STATEMENT FOR THE PERIOD OF JANUARY 1ST TO JUNE 30TH, 2007UT... 73

TU

ADDITIONAL INFORMATION AND NOTES FOR THE INTERIM CONSOLIDATED FINANCIAL

STATEMENTUT... 75

TU

1.UT TUGENERAL INFORMATIONUT... 75

TU

2.UT TUBASIS FOR PREPARING CONSOLIDATED FINANCIAL STATEMENTSUT... 75

TU

3.UT TUBUSINESS SEGMENTSUT... 92

TU

4.UT TUOTHER INCOME AND EXPENSEUT... 102

TU

5.UT TUINCOME TAXUT... 105

TU

6.UT TUDISCONTINUED OPERATIONS AND NON-CURRENT ASSETS HELD FOR SALEUT... 108

TU

7.UT TUEARNINGS PER SHAREUT... 109

TU

8.UT TUDIVIDENDS PAID AND DECLAREDUT... 110

TU

9.UT TUPROPERTY, PLANT AND EQUIPMENTUT... 111

TU

10.UT TUINVESTMENT PROPERTYUT... 118

TU

11.UT TUPERPETUAL FREEHOLD RIGHTSUT... 120

TU

12.UT TUINTANGIBLE ASSETSUT... 121

TU

13.UT TUIMPAIRMENT LOSSUT... 126

TU

14.UT TUMEASUREMENT OF IMPAIRMENT LOSSES ON GOODWILLUT... 129

TU

15.UT TUINVESTMENTS IN ASSOCIATESUT... 129

TU

16.UT TUBUSINESS MERGERS – INITIAL SETTLEMENT ESTABLISHED ON A PROVISIONAL BASISUT... 132

TU

17.UT TULONG-TERM RECEIVABLESUT... 139

TU

18.UT TUOTHER LONG-TERM INVESTMENTSUT... 140

TU

19.UT TUINVENTORIESUT... 140

TU

20.UT TUTRADE AND OTHER RECEIVABLESUT... 141

TU

21.UT TUSHORT-TERM INVESTMENTSUT... 142

TU

22.UT TUCASH AND CASH EQUIVALENTSUT... 142

TU

23.UT TUCAPITALUT... 143

TU

24.UT TULONG-TERM LIABILITIES DUE TO BORROWINGS AND OTHER DEBT INSTRUMENTSUT... 145

TU 25.UT TURESERVESUT... 158 TU 26.UT TUEMPLOYEE BENEFITSUT... 162 TU 27.UT TUSHORT-TERM LIABILITIESUT... 163 TU

28.UT TUOFF-BALANCE SHEET ITEMSUT... 191

TU

28.1.1UT TUCIECH SAUT... 191

TU

28.2UTTUINVESTING OBLIGATIONSUT... 195

TU

28.3UTTUSURETIES AND GUARANTEES, AND OTHER OFF-BALANCE SHEET RECEIVABLES AND LIABILITIESUT... 198

TU 29.UT TUFINANCIAL LEASEUT... 201 TU 30.UT TUOPERATING LEASEUT... 201 TU 31.UT TUAFFILIATESUT... 202 TU

31.1UTTULIST OF COMPANIES COVERED BY THE CONSOLIDATED FINANCIAL STATEMENT OF THE GROUPUT... 202

TU

31.2UTTUSCOPE OF THE CIECH GROUP COMPANIES' CORE BUSINESSUT... 203

TU

31.3UTTUBASIC DATA OF THE NON-CONSOLIDATED SUBSIDIARIESUT... 204

TU

31.4UTTUTOTALS FROM TRANSACTIONS WITH THE AFFILIATESUT... 206

TU

31.5UTTUSIGNIFICANT AGREEMENTS CONCLUDED BETWEEN THE AFFILIATES:UT... 211

TU

31.6UTTUTRANSACTIONS WITH KEY MANAGEMENTUT... 211

TU

32.UT TUGOALS AND PRINCIPLES OF FINANCIAL RISK MANAGEMENTUT... 211

TU

33.UT TUFINANCIAL INSTRUMENTSUT... 212

TU

34.UT TUEVENTS OCCURRING AFTER THE BALANCE SHEET DATEUT... 228

TU

35.UT TUFINANCIAL STANDING OF THE SUBSIDIARY PRZEDSIĘBIORSTWO CHEMICZNE CHEMAN S.A.UT... 228

TU

36.UT TUTHE PROGRAM FOR PERMANENT PROFITABILITY ACHIEVEMENT OF S.C. UZINELE SODICE GOVORA – CIECH

CHEMICAL GROUP S.A.UT... 230

TU

37.UT TUPLANNED MERGER OF THE SODA COMPANIESUT... 231

TU

38.UT TUINFORMATION CONCERNING IMPORTANT EVENTS REGARDING THE PREVIOUS YEARS, INCLUDED IN THE FINANCIAL

STATEMENT FOR A FINANCIAL YEARUT... 231

TU

39.UT TUOTHER INFORMATION NOT MENTIONED ABOVE THAT COULD HAVE A CONSIDERABLE IMPACT ON THE ASSESSMENT

OF THE FINANCIAL STANDING AND THE FINANCIAL RESULT OF THE CIECH GROUPUT... 231

TU

40.UT TUDIFFERENCES BETWEEN EQUITY PRESENTED IN THE STATEMENT FOR THE SECOND QUARTER OF 2007 AND THE

FIGURES SHOWN AT THE MOMENTUT... 231

TU

INTERIM CONDENSED FINANCIAL STATEMENT OF CIECH SA FOR 6 MONTHS ENDING ON JUNE 30TH, 2007, WITH A REPORT ON THE AUDIT BY THE STATUTORY AUDITORUT... 234

TU

INDIVIDUAL PROFIT AND LOSS ACCOUNT FOR THE PERIOD FROM JANUARY 1ST TO JUNE 30TH, 2007UT... 234

TU

INDIVIDUAL BALANCE SHEET AS AT JUNE 30TH, 2007UT... 234

TU

TU

INDIVIDUAL CASH FLOW STATEMENT FOR THE PERIOD FROM JANUARY 1ST TO JUNE 30TH, 2007UT... 239

TU

NOTES TO THE FINANCIAL STATEMENTS PREPARED FOR 6 MONTHS ENDED ON JUNE 30TH, 2007UT... 240

TU

1UT TUBASIS FOR PREPARING THE ACCOUNTING PRINCIPLES (POLICY)UT... 240

TU

2UT TUEARNINGS PER SHAREUT... 241

TU

3UT TUSEASONALITY AND CYCLICALITY OF THE OPERATIONSUT... 242

TU

4UT TUAMOUNTS THAT IMPACTED ASSETS, LIABILITIES, CAPITAL, NET PROFIT OR LOSS OR CASH FLOWSUT... 242

TU

5UT TUCHANGES IN ACCOUNTING ESTIMATESUT... 242

TU

6UT TUDISCLOSURES REGARDING THE ISSUE, REDEMPTION, AND REPAYMENT OF DEBT SECURITIES AND EQUITY

SECURITIESUT... 243

TU

7UT TUDIVIDENDS PAIDUT... 243

TU

8UT TUINCOME AND PROFITS/LOSSES BY SEGMENTS OF ACTIVITYUT... 244

TU

9UT TUMATERIAL EVENTS THAT OCCURRED AFTER THE INTERIM PERIOD AND HAD NOT BEEN REFLECTED IN THE INTERIM

CONDENSED FINANCIAL STATEMENTSUT... 245

TU

10UT TUCHANGES IN THE ENTITY STRUCTUREUT... 245

TU

11UT TUCHANGES IN CONTINGENT LIABILITIES OR CONTINGENT ASSETSUT... 245

TU

12UT TUREVALUATION WRITE-DOWNS ON INVENTORIES, PROPERTY, PLANT AND EQUIPMENT, INTANGIBLE AND OTHER

ASSETSUT... 245

TU

13UT TUREVERSAL OF PROVISIONS FOR RESTRUCTURING COSTSUT... 246

TU

14UT TUPURCHASE AND DISPOSAL OF PROPERTY, PLANT AND EQUIPMENT, AND COMMITMENTS TO PURCHASE PROPERTY,

PLANT AND EQUIPMENTUT... 246

TU

15UT TUFINANCIAL STANDING OF THE SUBSIDIARY PRZEDSIĘBIORSTWO CHEMICZNE CHEMAN S.A.UT... 246

TU

16UT TUTHE PROGRAM OF PERMANENT PROFITABILITY ACHIEVEMENT BY S.C. UZINELE SODICE GOVORA – CIECH

CHEMICAL GROUP S.A.UT... 248

TU

17UT TUCOURT PROCEEDINGSUT... 249

TU

18UT TUOTHER LIABILITIESUT... 251

TU

19UT TUADJUSTMENTS OF ERRORS FROM THE PREVIOUS YEARSUT... 254

TU

20UT TUUNPAID LOANS OR BREACH OF LOAN AGREEMENT PROVISIONSUT... 254

TU

21UT TUTRANSACTIONS WITH AFFILIATESUT... 254

TU

22UT TURECONCILIATION OF DATA PRESENTED IN THE SECOND QUARTER OF 2007 AS COMPARED TO DATA DISCLOSED IN

THE STATEMENT FOR THE FIRST HALF OF 2007UT... 255

TU

T

REPORT ON THE OPERATIONS OF THE CIECH GROUP FOR THE

1ST HALF OF 2007

1 Description of the Ciech Group

The Ciech Group is a group of domestic and foreign manufacturing, distribution and trade companies operating in the chemical industry. As at June 30th, 2007 it comprised 52 business entities, including:

• parent company CIECH SA, • 34 subsidiaries, including:

- 26 domestic subsidiaries, - 8 foreign subsidiaries, • 15 domestic associates,

• 2 foreign associates.

The Ciech Group comprises direct subsidiaries and directly associated companies, for which CIECH SA is the parent company, as well as indirect subsidiaries and indirectly associated companies, whose parent companies are direct subsidiaries of CIECH SA.

The Ciech Group conducts a manufacturing activity connected with the sale of own products, and a trading activity related to trading of goods. The trading activity is carried out mainly by CIECH SA and by domestic and foreign commercial companies being CIECH SA's subsidiaries. The manufacturing activity, however, is carried out by CIECH SA's manufacturing type subsidiaries.

The Ciech Group sells chemicals in the Polish market, and is a major contributor to Poland’s foreign trade with regard to the import and export of chemical industry products. The main goods sold by the Group in the Polish market in the first half of 2007 were: soda ash, fertilizers, glass blocks and glass packaging, salt, liquid fuel, sodium tripolyphosphate, plastics, resins, plant protection agents, and other chemicals. The main goods exported by the Group included: soda ash, isocyanates (TDI), sulphur, epichlorohydrin, PVC, mineral fertilizers, resins, salt, and calcium chloride. The Ciech Group’s largest markets were the European Union countries.

When preparing the consolidated financial statement for the first half of 2007 the following companies were taken into consideration:

• full consolidation method: 1. CIECH SA – parent company

2. Zakłady Chemiczne "Alwernia" Spółka Akcyjna 3. Przedsiębiorstwo Chemiczne Cheman Spółka Akcyjna 4. "VITROSILICON" Spółka Akcyjna

5. "CIECH POLFA" Spółka z ograniczoną odpowiedzialnością 6. Zakłady Chemiczne "Organika-Sarzyna" Spółka Akcyjna

7. Przedsiębiorstwo Transportowo-Usługowe TRANSCLEAN Spółka z ograniczoną odpowiedzialnością 8. CIECH FINANCE Spółka z ograniczoną odpowiedzialnością

9. POLSIN PRIVATE LIMITED 10. DALTRADE PLC

The consolidated financial statement also includes four lower-level capital groups: 1. FOSFORY Group, including:

- Gdańskie Zakłady Nawozów Fosforowych "FOSFORY" Spółka z ograniczoną odpowiedzialnością – parent company

- "AGROCHEM" Spółka z ograniczoną odpowiedzialnością – in Człuchów - "AGROCHEM" Spółka z ograniczoną odpowiedzialnością – in Dobre Miasto 2. Group of SODA MĄTWY, including;

- Inowrocławskie Zakłady Chemiczne SODA MĄTWY Spółka Akcyjna – parent company - Elektrociepłownie Kujawskie Spółka z ograniczoną odpowiedzialnością

- TRANSODA Spółka z ograniczoną odpowiedzialnością

- Polskie Towarzystwo Ubezpieczeń Spółka Akcyjna (a company valuated using the equity method)

3. JANIKOSODA Group, including:

- Janikowskie Zakłady Sodowe JANIKOSODA Spółka Akcyjna – parent company

- Polskie Towarzystwo Ubezpieczeń Spółka Akcyjna (a company valuated using the equity method)

4. ZACHEM Group, including:

- Zakłady Chemiczne ZACHEM Spółka Akcyjna – parent company - ZACHEM UCR Spółka z ograniczoną odpowiedzialnością - ZACHEM Barwniki Spółka z ograniczoną odpowiedzialnością The parent company does not have branches.

As at June 30th, 2007 the composition of the Management Board of CIECH SA was as follows: Mirosław Kochalski President of the Management Board

Rafał Pasieka Member of the Management Board Marek Trosiński Member of the Management Board Wojciech Wardacki Member of the Management Board

The commercial representative of the parent company was Mr. Kazimierz Przełomski. As at June 30th, 2007 the composition of the Supervisory Board of CIECH SA was as follows: Grzegorz Miś – Chair of the Supervisory Board

Alicja Pimpicka – Deputy Chair of the Supervisory Board Wiktor Cwynar – Member of the Supervisory Board Tomasz Karusewicz – Member of the Supervisory Board Dariusz Krajowski - Kukiel – Member of the Supervisory Board

2 Major achievements of the Ciech Group in the first half of 2007

U

CIECH SA

On January 12th, 2007 and on January 22nd, 2007 the District Court of the capital city of Warsaw, 11th Economic Division - Registry of Liens made entries in the registry of liens on shares in Janikowskie Zakłady Sodowe JANIKOSODA S.A. (CIECH SA holds 99.26 % of shares in JANIKOSODA S.A.) in favour of Bank Pekao S.A. The established pledge (total number of pledged shares 4,134,448) secured a loan of PLN 216,000 thousand taken on December 13th, 2006 for the purchase of the Zakłady Chemiczne "Organika- Sarzyna" Spółka Akcyjna shares.

On January 15th, 2007 CIECH SA signed a contract with Z.Ch. "POLICE" S.A. for the purchase of fertilisers worth EUR 781 thousand, intended for the Spanish market. It was another agreement for chemical nitrogenous fertilizers, two-component and multicomponent phosphatic fertilisers and other chemicals

(sodium compounds) concluded with this supplier since May 30th, 2006 until now. Total value of the agreements amounts to PLN 72.4 million.

The Extraordinary General Shareholders' Meeting of CIECH SA on January 31st, 2007 adopted a resolution concerning expansion of the Company's Management Board, appointing Mr Marek Trosiński to the Management Board of CIECH SA.

On February 5th, 2007 the subsidiary Elektrociepłownie Kujawskie Spółka z ograniczoną odpowiedzialnością signed an annex to the long-term sales contract for coal dust with Kompania Węglowa SA. The annex concerns the purchase of coal-dust in 2007, a basic raw material for Elektrociepłownie Kujawskie Spółka z ograniczoną odpowiedzialnością.

On February 26th, 2007 CIECH SA received a decision by the District Court for the capital city of Warsaw, 11th Business Division of February 13th, 2007 on a pledge entry in the registry of pledges. A total of 6,792,000 registered shares of Zakłady Chemiczne "Organika - Sarzyna" Spółka Akcyjna, worth PLN 300 million, are the subject of the pledge. The Court's decision results from the Contract on Registered Pledge concluded on December 20th, 2006 which provided for establishment of CIECH SA as the Pledger for Nafta Polska S.A. (the Pledgee) of the registered pledge on shares securing payments for contractual penalties in the event of CIECH SA's failure to perform or improper performance of some contractual obligations under the Sales Agreement for shares in Zakłady Chemiczne "Organika-Sarzyna" Spółka Akcyjna.

On March 26th, 2007 CIECH SA acquired 6,062 shares in Janikowskie Zakłady Sodowe JANIKOSODA Spółka Akcyjna, which increased its share in the company's equity to 99.61%. Furthermore, CIECH SA acquired 15,684 shares in Inowrocławskie Zakłady Chemiczne SODA MĄTWY Spółka Akcyjna and holds 99.85% of the Company's capital.

On March 27th, 2007 conditions of the sale of dense soda ash for 2007 were signed by CIECH SA with entities belonging to the Owens Illinois group (a manufacturer of glass containers) with its registered office at One Michael Owens Way, Perrysburg. The expected total value of supplies amounts to approx. PLN 78 million.

On March 30th, 2007 two contracts between the Polish Steamship Company and

CIECH SA were signed. The first one concerns dispatch of Polish sulphur to Moroccan ports i.e. Casablanca and Safi, carried out between February and December 2007. The value of the contract is approx. PLN 11.6 million. The second contract is related to transport of phosphorites from Casablanca to Gdańsk, carried out between February 2007 and February 2008. The value of the contract is PLN 43.4 million.

On April 3rd, 2007 annexes to the contracts concluded on January 20th, 2005 were signed by

CIECH SA and the subsidiary JANIKOSODA S.A. New purchase-sales prices of soda ash, aragonite chalk, carbon dioxide and sodium bicarbonate (annex to the contract of approx. PLN 265 million) and vacuum pan salt (annex to the contract of approx. PLN 76 million) were set.

On April 3rd, 2007 annexes to the contracts concluded on January 20th, 2005 were signed by

CIECH SA and the subsidiary SODA MĄTWY S.A. New purchase-sales prices of soda ash (annex to the contract of approx. PLN 240 million) and baking soda, calcium chloride, precipitated chalk and others (annex to the contract of approx. PLN 70 million) were set for 2007.

On April 3rd, 2007 CIECH SA in cooperation with Office Cherifien des Phosphates (OCP) Morocco approved the terms and conditions of the contract on phosphorite import between April 1st, 2007 and March 31st, 2008. The recipients are the subsidiaries of CIECH SA, i.e. GZNF "FOSFORY" Sp. z o.o. and Z.Ch. Siarkopol Tarnobrzeg. The value of the contract totals approx. PLN 37.44 million. The conditions of sulphur sales in 2007 under the long-term contract for 2002 - 2010, were also discussed with Maroc Phosphore S.A. belonging to the OCP Group. The value of the contract amounts to approx. PLN 95 million.

On April 10th, 2007, CIECH SA resolved to conclude a contract with Procter & Gamble International Operations S.A. on deliveries of dense soda ash and light soda ash in 2007 - 2008. The expected total value of the contract stands at approx. PLN 63 million.

On April 27th, 2007 CIECH SA acquired 366 shares in Janikowskie Zakłady Sodowe JANIKOSODA Spółka Akcyjna, which increased its share in the company's equity to 99.62%.

On May 11th, 2007, the Supervisory Board of CIECH SA passed a resolution on the appointment of Deloitte Audyt Sp. z o.o. as the statutory auditor to conduct an audit of the financial statement of CIECH SA and the financial statement of the Ciech Group for the 2007 financial year.

On May 31st, 2007, after due diligence of and proposals to acquire Sodawerk Stassfurt Gmbh & Co. KG., CIECH SA was notified of another partner entering in the final round of negotiations intended for the acquisition of the German company. The above refers to negotiations held by CIECH SA since January 26th, 2007 intended for the acquisition of Sodawerk Stassfurt Gmbh & Co. KG.

On June 20th, 2007 the Management Board of CIECH SA delivered particulars of the new strategy for the Ciech Chemical Group for 2007 - 2011 which assumes a considerable increase in the Group's income and profit for that period. The Group growth strategy provides for development of new divisions. Presently, there are three divisions in Ciech: Soda, Organic and FosChem Divisions. The two new divisions, Agro Division and Silicates and Glass Division, will be created as a result of the transformation.

Investments and acquisitions

Acquisition of a nitrogenous fertiliser manufacturer will account for a significant element in the Agro Division's growth. Completion of this scenario, defined as "Concentrated growth", will require investments worth at least PLN 4.8 billion by 2011 and will bring an income of approx. PLN 8 billion. Furthermore, a series of investments and acquisitions will be carried out to increase the production potential and in consequence to increase income even in the case of CIECH SA not acquiring the nitrogenous fertiliser manufacturer. This option is defined by the Management Board of CIECH SA as the "Balanced growth" scenario. Its completion will require less expenditure (approx. PLN 3.1 billion) and will result in a lesser increase of income, up to PLN 5.6 billion, but will ensure a greater profitability.

Growth of the four Divisions

Top priority measures to be taken are as follows:

Organic Division - increase of competitiveness through a reduction of TDI production costs and a moderate improvement of manufacturing capacity is assumed. In the case of EPI, epoxy resins, polyester resins and PUR foams, reduction of costs, enlargement of the product portfolio and improvement of the manufacturing capacity will add to the overall effect. The investment expenditure is expected to amount to PLN 0.7 – 1.0 billion and the full-year estimated impact on EBITDA in 3 or 4 years shall reach the level of PLN 150 million.

Soda Division - strengthening of Ciech Group's positioning in the market of soda ash requires pricing and geographical optimisation of sales, restoration of profitability in S.C. Uzinele Sodice Govora – Ciech Chemical Group S.A., and development of manufacturing capacity in the soda companies. Apart from the effects of the soda companies' merger, other options of acquisition will be sought.

Silicates and Glass Division - development requires organic growth and acquisitions. Investments will be targeted at production of sodium silicates in lumps and sodium glass, and at leadership in a profitable niche of potassium silicates. Marketing campaigns, present also in the foreign markets, should affect an increase in glass block sales. Acquisitions are considered in the segment of lanterns and jars.

Agro Division – the scale of the division's growth will be dependent on attractive acquisitions available. A strong competitive position in Poland requires consolidation of the fertilizer market. Appropriate acquisitions must enable production and material synergies with other Divisions of the Group. The objective is to provide a comprehensive service for agriculture in terms of fertilizers and plant protection agents. Development of an efficient system of distribution shall serve the purpose.

Advancement to the chemical companies top twenty

The new strategy was created in response to strengthening of Ciech Group's positioning in Central and Eastern Europe. Completion of the two scenarios guarantees that CIECH SA will be recognized among the top twenty largest chemical companies in Europe.

Furthermore, the new strategy entails a change in Ciech Group mission. The current mission is outlined by the following formula: "We create value in those segments of the chemical marketplace where our expertise is used and where we acquire a strong and long-term competitive position".

Articulation of a new mission is not only an effect of consistent growth but CIECH SA's response to the privilege of competing with the largest economic organisations of Europe.

On June 21st, 2007 the Ordinary General Meeting of Shareholders approved the financial statement of CIECH SA and the consolidated financial statement of Ciech Group for the 2006 financial year. Moreover, the

General Meeting passed a resolution on the distribution of CIECH SA profit recorded in the financial year 2006, to be assigned as dividend for Shareholders in the amount of PLN 58,800 thousand and as reserve capital of the company in the amount of PLN 107,939 thousand.

U

S.C. Uzinele Sodice Govora – Ciech Chemical Group S.A.

On January 8th, 2007 an agreement was signed by the heat and power station S.C. CET Govora S.A., on the one hand, and the soda company S.C. Uzinele Sodice Govora - Ciech Chemical Group S.A. and CIECH SA, on the other hand, concerning restructuring of the S.C. Uzinele Sodice Govora - Ciech Chemical Group S.A. debt towards CET Govora for energy deliveries. The repayment of the principal of EUR 18 million shall take place within 9 years with a 1-year grace period. At the same time CET Govora S.A. undertook to convert the interest debt in the amount of EUR 5.8 million to 7,943,853 shares in S.C. Uzinele Sodice Govora - Ciech Chemical Group S.A. The signed agreement is a phase of the restructuring process in the Romanian soda company.

On January 24th, 2007 CIECH SA opened a bank guarantee at Bank Pekao S.A. in the amount of EUR 18,054,692. The guarantee was issued for C.E.T. Govora S.A. in Romania. It was issued to secure the payment of amounts resulting from the purchase of receivables of S.C. Uzinele Sodice Govora - Ciech Chemical Group S.A.

On February 6th, 2007 the General Shareholders' Meeting of S.C. Uzinele Sodice Govora - Ciech Chemical Group S.A. adopted a resolution on an increase in the company's share capital by 15,887,706 shares, with a par value of RON 2.5. The heat and power station S.C. CET Govora SA shall hold 7,943,853 shares as part of conversion of the interest debt of S.C. Uzinele Sodice Govora - Ciech Chemical Group S.A. (agreement of January 8th, 2007). The existing shareholders, i.e. AVAS (2.89% shares), CIECH SA (93.14% shares) and others (3.97% shares), according to the right of priority, are entitled to hold 7,943,853 shares after the resolution of GSM becomes final, that is after February 16th, 2007.

On February 26th, 2007 CIECH SA signed an agreement with its subsidiary S.C. Uzinele Sodice Govora - Ciech Chemical Group S.A. on restructuring of the S.C. Uzinele Sodice Govora - Ciech Chemical Group S.A. debt towards CIECH SA in the amount of EUR 18 million. The repayment shall take place within 9 years with a 1-year grace period. This agreement is a result of an agreement signed on January 8th, 2007 between S.C. CET Govora S.A., on the one hand, and S.C. Uzinele Sodice Govora - Ciech Chemical Group S.A. and CIECH SA, on the other hand, on restructuring of the S.C. Uzinele Sodice Govora - Ciech Chemical Group S.A. debt for energy supplies.

On April 27th, 2007 the General Shareholders Meeting of S.C. Uzinele Sodice Govora – Ciech Chemical Group S.A. resolved to invalidate 7,943,853 unsubscribed shares from the previous issue. Shares from the previous issue will be subscribed only to the heat and power station S.C. CET Govora S.A. as a part of conversion of the interest debt of S.C. Uzinele Sodice Govora – Ciech Chemical Group S.A. as agreed in the contract of January 8th, 2007. Registration of new issue of shares took place on June 25th, 2007.

On the same day the General Shareholders Meeting of S.C. Uzinele Sodice Govora – Ciech Chemical Group S.A. resolved to reduce the nominal value from RON 2.5 to RON 0.25. Thereby, the company's share capital diminished from RON 105,421 thousand to RON 10,542 thousand.

On April 27th, 2007 the Board of Directors of S.C. Uzinele Sodice Govora – Ciech Chemical Group S.A. resolved to convert liabilities towards CIECH SA into capital (in the amount of EUR 8 million) and to call an Extraordinary General Meeting of Shareholders on July 10th, 2007 in order to pass a resolution concerning the matter.

Launch of gas cooling system after RH distillation based on panel heat exchangers (RHCD), as assumed in the investment plan.

U

SODA MĄTWY Group

System to produce monohydrate dense soda ash in Inowrocławskie Zakłady Chemiczne SODA MĄTWY Spółka Akcyjna was activated.

In 2007 SODA MĄTWY S.A. sold surplus of 105,000 allowances for COB2B, resulting from revising the 2005

report and the surplus planned for 2006 and 2007. Its subsidiary Elektrociepłownie Kujawskie Spółka z ograniczoną odpowiedzialnością, sold surplus of 460,000 allowances for COB2B, resulting from the revision of

SODA MĄTWY S.A. 2005 2006 2007 Total

Assignment of allowances 97 300 97 300 97 300 291 900

Revised emission for 2005 and planned

emission for 2006 and 2007 63 402 58 000 62 300 183 702

Surplus of assignment 33 898 39 300 35 000 108 198

Disposal 33 898 39 300 31 802 105 000

Elektrociepłownie Kujawskie

Spółka z ograniczoną odpowiedzialnością 2005 2006 2007 Total

Allocation of allowances 1 786 500 1 786 500 1 786 500 5 359 500

Revised (used) allowances / planned 1 594 404 1 598 067 1 704 628 4 897 099

Surplus of allocation 192 096 188 433 81 872 462 401

Disposal 192 096 188 433 79 471 460 000

U

JANIKOSODA S. A.

A new manufacturing system for pelletizing salt with a maximum capacity of 20 thousand tonnes per year has been launched in Janikowskie Zakłady Sodowe JANIKOSODA Spółka Akcyjna.

JANIKOSODA S.A. ceased manufacture of chalk as of January 1st, 2007 by means of a Resolution of the Management Board and a separate Resolution of the Supervisory Board. This production was not profitable and the analysis carried out confirmed this tendency in the following years.

U

"Alwernia" S.A.

Mechanical and technological start-up of a system to produce PK/NPK granular fertilizers (based on use of waste product disposal) has been performed.

U

Cheman S.A.

Cheman S.A. Is handling negotiations with a potential investor interested in the purchase of property in Błaszki. All the necessary documentation has been prepared and the preliminary sales contract has been signed in the form of a Notarial Deed (the contract has not been finalized due to the investor's failure to pay the advance payment).

U

ZACHEM Group

On January 2nd, 2007 ZACHEM S.A. sold Ośrodek Wypoczynkowy CHEMIK in Sopot for PLN 9,250 thousand.

On February 7th, 2007 ZACHEM S.A. sold Sanatorium Uzdrowiskowe CHEMIK in Ciechocinek for PLN 5,183 thousand.

On February 7th, 2007 ZACHEM S.A. sold Production Department T-7300 for PLN 3,651 thousand.

Extension of a derogation by the European Commission to use asbestos in the electrolysis systems, which ensures the utilization of the existing electrolysis system by ZACHEM S.A. until it requires replacement. 3 Comments on the financial results of the Ciech Group

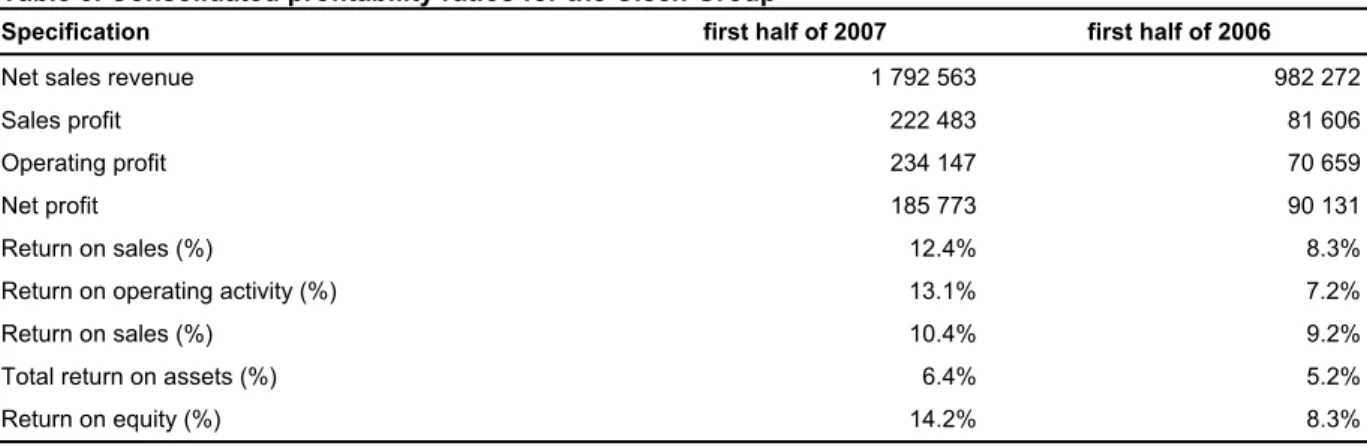

Ciech Group's consolidated net profit reached PLN 185,773 thousand in the first half of 2007, the balance sheet total amounted to PLN 2,919,290 thousand, and the changes in net cash increased by PLN 41,588 thousand (as compared to PLN 68,177 thousand in the corresponding period of the previous year). The tables below present the selected financial figures along with basic financial ratios for the first half of 2006 and 2007.

In PLN thousands first half of 2007 first half of 2006 2007 / 2006 dynamics Net sales revenue 1 792 563 982 272 82.5%

Prime cost of sales 1 319 879 742 270 77.8%

Gross profit 472 684 240 002 97.0%

Costs of sales 117 822 76 982 53.1%

Administrative expenses 132 379 81 414 62.5%

Other Operating Income / Expense 11 664 (10.947)

-Operating profit 234 147 70 659 231.4%

Financial income / expense (6 921) 9 464

-Share of the net profits of subsidiaries accounted

for using the equity method 2 758 852 223.7%

Income tax 44 211 17 653 150.4%

Sales profit relative to discontinued operations - 26 809

-Net profit 185 773 90 131 106.1%

Net profit attributable to minority interests 764 564 35.5%

Profit attributable to equity holders of the

parent company 185 009 89 567 106.6%

EBITDA 307 624 116 808 163.4%

30.06. 2007 30.06. 2006 2007/2006 dynamics Value of assets 2 919 290 1 724 283 69.3%

Non-current assets 1 661 312 878 693 89.1%

Current assets, including: 1 257 978 845 590 48.8%

- inventories 223 259 128 261 74.1% - short-term receivables 836 459 498 670 67.7% - cash and cash equivalents 192 491 161 513 19.2% - short-term investments 5 769 57 146 (89.9%)

Total equity 1 311 963 1 090 023 20.4%

Parent company's equity 1 261 212 1 040 374 21.2%

Minority interest 50 751 49 649 2.2%

Long-term liabilities 586 084 135 038 334.0%

Short-term liabilities 1 021 243 499 222 104.6%

first half of 2007 first half of 2006 2007 / 2006 dynamics

Cash flow from operating activities 90 016 89 066 1.1%

Cash flow from investment activities (90 115) (55 832) 61.4%

Cash flow from financing activities 41 687 34 943 19.3%

Total cash flow 41 588 68 177 -39.0%

first half of 2007 first half of 2006 2007 / 2006 dynamics

Net earnings per share 6.63 3.20 108.1%

Net profit margin 10.3% 9.1% 13.7%

EBIT% 13.1% 7.2% 81.6%

EBITDA % 17.2% 11.9% 44.3%

Current ratio 1.2 1.7 (29.4%)

Quick ratio 1.0 1.4 (28.6%)

Total debt ratio 55.1% 36.8% 49.7%

Equity to assets ratio 44.9% 63.2% (28.9)%

Calculation principles:

net earnings per share – net earnings / weighted average number of ordinary shares in the given period (pursuant to the definition of IAS 33 "Earnings per share")

net return – net profit for a given period / net income from sales of products, services, goods and materials in the given period, EBIT% – operating profit for a given period / net income from sales of products, services, goods and materials in the given period,

EBITDA% – (operating profit + depreciation for a given period) / net income from sales of products, services, goods and materials in the given period,

current ratio – current assets at period-end / current debt at period-end,

quick ratio – current assets less inventories at period-end / current debt at period-end, total debt ratio – short- and long-term debt at period-end / total assets at period-end, equity to assets ratio – total equity at period-end / total assets at period-end

U

Sales revenues

Consolidated net sales income of the Group was at PLN 1,792,563 thousand in the first half of 2007. Revenues increased by PLN 810,291 thousand, which is approx. 83%, in comparison with the corresponding period in 2006. The increase was mainly attributed to sales generated by the companies acquired in the fourth quarter of 2006: Z.Ch. "Organika-Sarzyna" S.A., ZACHEM S.A. and S.C. Uzinele Sodice Govora – Ciech Chemical Group S.A. The economic situation was favourable as far as sales of Ciech Group products in the first half of 2007are concerned. Sales prices of the main products from the soda segment were higher than in the corresponding period of the previous year. High dynamics of the main organic product prices (TDI and EPI), as well as high demand resulted in considerably higher revenues than expected in 2006 being recorded by the Organic Division. More favourable pricing and demand relations than those of the previous year were also present in the markets where GZNF "FOSFORY" Sp. z o.o. and "Alwernia" S.A. operate.

The 1H 2007 income by business segments was as follows: Figure 1. Structure of the income on sales

Pozostały 1,2% Segment Sodowy 26,1% Segment Petrochemiczny 2,5% Segment Agrochemiczny 17,1% Segment Nieorganiczny 8,2% Segment Organiczny 38,4% Segment Farmaceutyczny 1,3% Segment Energetyczny 0,8% Segment działalność zaniechana 0,0% Segment krzemiany i wyroby ze szkła 4,2%

[Translation starting with Segment Organiczny, read clockwise: Organic Segment 38.4%

Silicates and Glass Product Segment 4.2% Power Generation Segment 0.8% Other 1.2%

Segment of Discontinued Operations 0.0% Soda Segment 26.1%

Petrochemical Segment 2.5% Agro-chemical Segment 17.1% Inorganic Segment 8.2%]

Source: CIECH SA

In the first half of 2007, Ciech Group business focused on the four fundamental segments of its activity: the soda, agrochemical, organic and inorganic segments. These segments generated a total of 91% of the Group's sales income.

Soda Segment

The soda segment generated 27% of the Group's sales income in the first half of 2007. The parent company, CIECH SA, plays a key role in the sales operations, processing sales of the output manufactured by the subsidiaries SODA MĄTWY S.A. and JANIKOSODA S.A. The Group's companies are the sole manufacturers of soda in Poland. Sales in the soda segment are handled by S.C. Uzinele Sodice Govora – Ciech Chemical Group S.A., the Romanian soda company acquired in the fourth quarter of 2006. The main product in this segment is soda ash, which accounted for 78% of sales in this segment in 2006. As compared to the corresponding period in 2006, sales revenues in the segment increased by 17%; almost entirely due to inclusion of S.C. Uzinele Sodice Govora – Ciech Chemical Group S.A. in the consolidated income. Average sales prices of the main products made by the Polish companies were higher in 2007 than in the corresponding period of the previous year. Furthermore, the sales volume was lower due to: (a) failure of steam boilers in JANIKOSODA S.A. and (b) smaller sales volume of calcium chloride by SODA MĄTWY S.A. (recipients are still storing the product due to mild winter and as a result collections are lower than in the corresponding period of the previous years). Prices for coke, one of the main raw materials in the segment, were unfavourable in 2007. A possible increase in manufacturing cost was curbed thanks to the application of anthracite in the production process, which fully compensated for the increase in coke prices.

Agro-Chemical Segment

The agrochemical segment generated approx. 17% of the Group's sales income in the first half of 2007. The following organisations operate within the agrochemical segment: the FOSFORY Group dealing with production of fertilizers and their sales in the domestic marketplace, Z.Ch. "Organika - Sarzyna" S.A. manufacturing mainly plant protection agents and CIECH SA, the parent company, exporting products of GZNF "FOSFORY" Sp. z o.o., acting as an agent in sales of the Z.Ch. "Organika - Sarzyna" S.A. products and of other domestic manufacturers and finally importing raw materials intended for fertilizer production. Fertilizers (50%) and plant protection agents (43%) take the leading positions generating the segment's income. The segment's income more than doubled in relation to the corresponding period of the previous year and was most of all an effect of Z.Ch. "Organika -Sarzyna" S.A. income consolidation. The following factors had a less significant effect on the agro-chemical segment results: increase in sales, improvement of the result recorded by the FOSFORY Group (the market conditions were unfavourable for GZNF "FOSFORY" Sp. z o.o. products in the first half of this year mostly due to bad weather conditions).

Organic Segment

The organic segment generated approx. 38% of the Group's sales income in the first half of 2007. ZACHEM S.A., the manufacturer of the main products in the segment, namely TDI and EPI, has a leading role in this segment. Sales of these products are carried out by CIECH SA, which it is entitled to do so under exclusive granted rights. The organic segment also covers the products of "Organika - Sarzyna" S.A. to an inconsiderable extent (mainly resins). CIECH SA renders export agency services of chosen Z.Ch. "Organika – Sarzyna" products (on a consignment basis) and handles foreign trade in products from suppliers outside the Group. The main products of this segment are as follows: TDI - 42% of segment sales, plastics (including resins) – 34% and epichlorohydrin (EPI) - 7%. The organic segment income more than quadrupled as compared to the records of the corresponding period in 2006. The main reason for the increase was the inclusion of profit from products sold by the companies acquired in the fourth quarter of 2006 such as ZACHEM S.A. and Z.Ch. "Organika - Sarzyna" S.A., in the Ciech Group results. A good economic situation was recorded for TDI and EPI in 2007. Despite reduction of TDI and EPI prices in the second quarter of 2007 (in relation to the first quarter), the CIECH Group still achieved higher prices than estimated in the Financial Plan for 2007. The second quarter saw a decrease in the sales volume of segment products, which resulted mostly from the planned production downtime.

Inorganic Segment

The inorganic segment generated over 8% of the Group's sales income in 2007. The subsidiary - "Alwernia" S.A. - which manufactures sodium tripolyphosphate (24% of segment sales), phosphorus compounds (18% of segment income) and chromium compounds (6%) is the main manufacturer in this segment. The company imports raw materials and exports some of its products through CIECH SA. The segment comprises such products as sodium hydroxide (17% of the segment sales) and hydrochloric acid (8%), whose suppliers are ZACHEM S.A. and companies outside the Group, sold by CIECH SA and other commercial companies of the Group. Sulphur, accounting for 11% of the segment income, is sold by CIECH SA on a consignment basis. The segment income increased by 29% in the first half of 2007 in relation to the corresponding period in 2006. This was an effect of: (a)

higher demand for the products of "Alwernia" S.A. than previous in the year (specifically in the first quarter), (b) inclusion of the inorganic products of ZACHEM S.A. in the consolidated results and (c) increased sales of sulphur. Silicates and Glass Segment

Share of the silicates and glass segment in the Group's sales income exceeded 4%. The subsidiary "VITROSILICON" Spółka Akcyjna, which manufactures silicates, glass blocks, and glass lanterns, is the main manufacturer in this segment. "VITROSILICON" Spółka Akcyjna is the sole manufacturer of glass blocks in Poland. Glass blocks and lanterns accounted for 57% of the segment income and contributed the most to the segment's revenue along with soda glaze (30% of segment income) and sodium water glass (10% of segment income). The growth of sales in the segment as compared to the corresponding period in 2006 was 32% and was caused by an increase in sales of particular product groups in the segment, resulting from investments in manufacturing property carried out by "VITROSILICON" Spółka Akcyjna since 2006 and from market growth and higher demand.

Other Segments

Having sold the Petrochemia Blachownia S.A. shares in 2006 and having completed the strategy of withdrawal from production in the petrochemical segment, the Group saw an irrelevant degree of participation in sales from this segment (it accounts for 3% of income). Currently, the segment consists of commercial agency transactions handled by CIECH SA and by CHEMAN S.A. The pharmaceutical segment includes the business activity of CIECH POLFA Sp. z o.o. EC KUJAWY Sp. z o.o. operates within the power generation segment handling production and distribution of electricity for the purposes of SODA MĄTWY S.A. and JANIKOSODA S.A. and third parties.

The figure below shows the Group's sales income distribution by leading products. Figure 2. Sales income distribution by leading product shares

Zywice; 7,2% soda kalcynowana; 20,3% nawozy; 8,2% tworzywa sztuczne; 12,8% epichlorohydryna; 2,9% pozostałe; 11,8% szkło wodne sodowe; 1,3% słoje i lampiony szklane; 2,4% izocyjaniany (TDI); 16,7% sól; 2,9%

środki ochrony roślin; 7,8% smoła surowa; 1,0% trójpolifosforan sodu; 2,0% soda oczyszczona; 1,5% farmaceutyki; 1,3%

[Translation starting with Żywice 7.2%, read clockwise: Resins 7.2%

Soda ash 20.3% Fertilizers 8.2%

Plastics 12.8% Salt 2.9%

Plant Protection Agents 7.8% Crude tar 1.0%

Epichlorohydrin 2.9% Isocyanates (TDI) 16.7% Jars and glass lanterns 2.4% Baking soda 1.5%

Sodium tripolyphosphate 2.0% Pharmaceuticals 1.3% Sodium water glass 1.3% Other 11.8%]

Source: CIECH SA

U

Gross sales profit

The consolidated gross profit on sales in the first half of 2007 was PLN 472,684 thousand. The profit increased by PLN 232,682 thousand as compared to the previous year. The profit results almost doubled, mainly thanks to consolidation of the Polish companies acquired in the fourth quarter of 2006, such as Z.Ch. "Organika - Sarzyna" S.A. and ZACHEM S.A. and thanks to an increase of sales profit from these companies' products in CIECH SA.

U

Operating profit (EBIT)

In the first half of 2007, the operating profit was equal to PLN 234,147 thousand (PLN 70,659 thousand in the corresponding period in 2006). Dynamic growth of the Organic Division was the main source of profit in 2007 including: (a) inclusion of the profit of Z.Ch. "Organika - Sarzyna" S.A. and ZACHEM S.A. in the Group results and (b) increase of CIECH SA profit from trade in organic products (mainly TDI and EPI). The following factors had also a positive effect on the operating result: (a) increase in the main product prices of the soda segment, (b) improvement of the balance of other operating activity in the SODA MĄTWY Group – including income from sales of COB2B emission rights carried out in 2007 (PLN 6.3 million) and (c) improvement in the results of GK FOSFORY

and "Alwernia" S.A. (more favourable market conditions as compared to the first half of 2006). The negative EBIT of S.C. Uzinele Sodice Govora – Ciech Chemical Group S.A. (approx. PLN 19.6 million) and to a lesser extent: (a) decreased production in JANIKOSODA S.A. caused by steam boiler failure, (b) lower sales of calcium chloride (the mild winter in 2007 contributed to lower sales of the product as it is still stored by the recipients) and (c) higher costs than the year before of the provisions raised and revaluation write-downs in CIECH SA had an adverse effect on the operating profit. The EBIT margin rate amounted to 13.1% in the first half of 2007 (7.2% the year before). The increase in return on operating activity in the largest part was caused by the results of Z.Ch. "Organika - Sarzyna" S.A. and ZACHEM S.A., whose EBIT margin rates were considerably higher during the first 6 months of 2007 than those recorded by other companies of the Group.

U

Net result

The consolidated net profit for the first half of 2007 was PLN 185,773 thousand, including PLN 185,009 thousand accounting for net profit of the shareholders in the parent company. Net return was 10.3 % (9.2% the year before). The Group recorded an increase of PLN 95,642 thousand in the net result in relation to the corresponding period of the previous year. It is attributable almost entirely to an increase in the operating profit (of PLN 163,488 thousand). Increase in costs of bank financing (effects of intensified use of bank loans by the Group to finance growth investments) had a negative effect on the net profit and an unfavourable situation on the foreign exchange market in 2007 resulting in negative foreign-currency settlement valuation (a considerable number of foreign transactions were hedged in 2007, which eliminates potential losses on realised exchange differences).

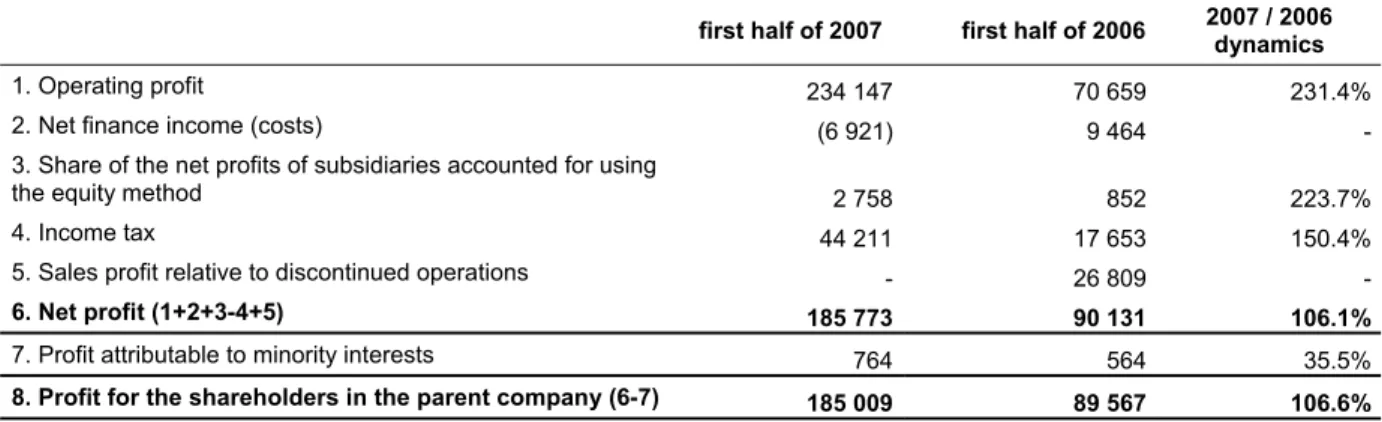

Table 2. Financial performance by type of business operations (PLN thousands)

first half of 2007 first half of 2006 2007 / 2006 dynamics

1. Operating profit 234 147 70 659 231.4%

2. Net finance income (costs) (6 921) 9 464

-3. Share of the net profits of subsidiaries accounted for using

the equity method 2 758 852 223.7%

4. Income tax 44 211 17 653 150.4%

5. Sales profit relative to discontinued operations - 26 809

-6. Net profit (1+2+3-4+5) 185 773 90 131 106.1%

7. Profit attributable to minority interests 764 564 35.5%

Source: CIECH SA Balance Sheet

U

Equity

The consolidated equity of the Group as at June 30th, 2007, was PLN 1,311,963 thousand (including the equity of the parent company of PLN 1,261,212 thousand) and was higher than last year's equity by PLN 221,940 thousand. The decisive factor affecting the increase in equity was the generation of a net profit in the first half of 2007 in the amount of PLN 185,773 thousand.

U

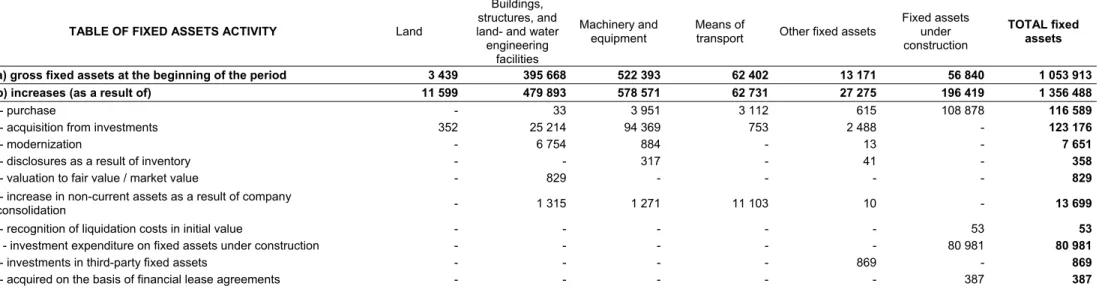

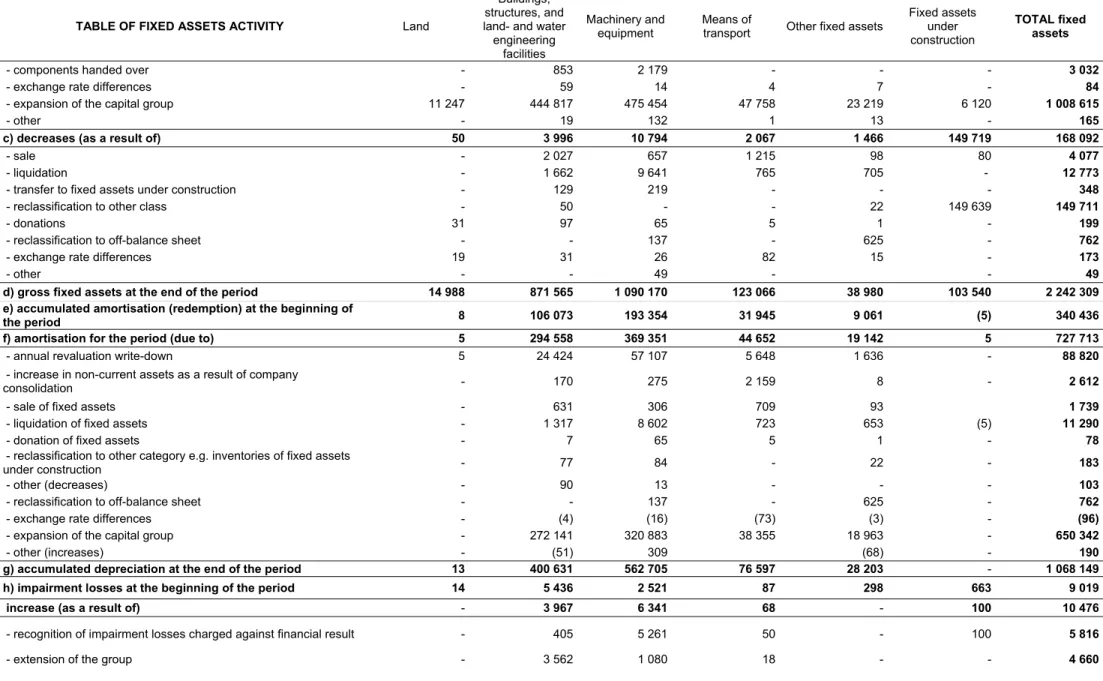

Non-current assets

Non-current assets of the Group were worth PLN 1,661,312 thousand at the end of the first half of 2007. The value of the non-current assets almost doubled (increased by PLN 782,619 thousand), as compared to the status as at June 30th, 2006. The increase concerned mainly acquisitions conducted in the fourth quarter of 2006; which resulted in increase of non-current assets by PLN 732,008 thousand (including increase by the goodwill of PLN 317,417 thousand). Furthermore, between July 2006 and June 2007 the Group companies carried out investment projects (mainly in manufacturing property) in order to keep up with the current pace of organic growth. This particularly applies to the following companies: JANIKOSODA S.A., SODA MĄTWY Group and "VITROSILICON" Spółka Akcyjna. An increase in non-current assets' share in total assets up to 57% (51% the year before) was prompted within 12 months.

U

Current assets

The Group's current assets amounted to PLN 1,257,978 thousand as at June 30th, 2007. In the current asset structure the following elements were dominant: (a) trade and other receivables – 66% of current assets, (b) inventories – 18% and (c) cash and cash equivalents – 15%. In comparison to the status at the end of the first half of 2006, current assets increased by PLN 412,388 thousand, an increase of 49%. For the most part it resulted from the inclusion of assets of the companies acquired in the fourth quarter of 2006, in the consolidated balance sheet.

U

Consolidated liabilities

The total short-term and long-term debt of Ciech Group as at June 30th, 2007 stood at 1,607,327 thousand, which is PLN 973,067 thousand more than at the end of the first half of 2006. The long-term liabilities were worth PLN 586,084 thousand. This balance sheet item increased several times mostly due to the increase of (a) liabilities due to long-term borrowings by PLN 217,432 thousand, (b) other long-term liabilities by PLN 116,776 thousand and (c) other long-term provisions by the amount of PLN 84,315 thousand. Loans increased mainly in CIECH SA by PLN 174,629 thousand mostly due to financing acquisition purchases and to a lesser extent due to financing development projects: (a) in the Polish soda companies by a total of PLN 36,851 thousand and (b) in "VITROSILICON" Spółka Akcyjna (by PLN 7,774 thousand). An increase in other long-term liabilities was prompted primarily by the inclusion of: (a) liabilities concerning the future buyout of shares from the State Treasury and employees of ZACHEM S.A. and Z.Ch. "Organika-Sarzyna" S.A. and (b) debt towards CET Govora (the supplier and shareholder of S.C. Uzinele Sodice Govora – Ciech Chemical Group S.A.) in the balance sheet. The increase in other long-term provisions resulted almost entirely from figures in the balance sheets of Z.Ch. "Organika-Sarzyna" S.A., ZACHEM S.A. and S.C. Uzinele Sodice Govora – Ciech Chemical Group S.A. Short-term liabilities were worth PLN 1,021,243 thousand, which marked an increase by PLN 522,021 thousand as compared to the status as at June 30th, 2006. The following liabilities were subject to increase: (a) trade and other payables by PLN 225,709 thousand (mainly due to acquisitions conducted in the fourth quarter of 2006) and (b) borrowings by PLN 219,353 thousand (in the largest part increase in CIECH SA by PLN 151,151 thousand – mainly financing investments carried out in the fourth quarter of 2006 and increase in use of bank resources for activity financing).

U

Consolidated debt

Net debt at the end of the first half of 2007 (comprising bank loans, other loans, and other financial liabilities less cash) amounted to PLN 467,711 thousand (PLN 41,831 thousand the year before). Such an increase in net debt ensued from growing bank liabilities (mainly financing investments). The Group debt index (calculated as the ratio of net debt to the total assets) increased from 2.4% to 16.0% since June 30th, 2006. The financial leverage (the ratio of net debt to the total net debt and total equity) at the end of the first half of 2007 was 26.3%. The year before the same index was at 3.7%.

Ciech Group has the full capacity to repay its total debt. The current ratio, calculated as the ratio of total current assets to short-term debt, amounted to 1.2 as at June 30th, 2007, while the increased cash flow ratio amounted to 1.0. For the previous year the same indexes were higher. The decrease was mostly prompted by acquisition and

investments. Short-term loans, which were one of the resources of project financing, increased. In addition, ZACHEM S.A. and S.C. Uzinele Sodice Govora – Ciech Chemical Group S.A. are characterised by lower liquidity than that recorded in Ciech Group before the acquisitions. Improvement in the liquidity is one of the key restructuring assumptions of the acquired companies.

The non-current assets to fixed assets cover ratio (total equity, liabilities and long-term reserves) amounted to 114% at June 30th, 2007 and despite the fall (139% as at June 30th, 2006) it remained at a level considered to be secure.

The net debt ratio / equity stood at 35.6% at the end of the first half of 2007 (3.8% the year before).

The Ciech Group’s debt was stable at the end of the first half of 2007. The total liabilities were valued at 55.1% of the assets. The increase from 36.8% (as at June 30th, 2006) evidences use of potential, as announced in the strategic plans of acquisitions financed from foreign resources the Group obtained after the stock exchange entry in 2005.

U

Cash flow

The net cash flow in the first half of 2007 amounted to PLN 41,588 thousand. The Group generated PLN 26,589 thousand higher cash flow in the corresponding period of the previous year (most of all due to finalisation of the sales transaction of Petrochemia Blachownia S.A. shares in 2006; proceeds from the transaction amounted to PLN 99 million). Net cash from operating activities was PLN 90,016 thousand and was similar to the corresponding period in 2006. The main source of cash from operating activity in the first half of 2007 was the result attained on core business (gross sales profit less sales costs and overhead costs) along with depreciation. The change in current assets was negative and amounted to PLN -171,553 thousand, which basically ensued from: (a) more intensive growth of commercial receivables than liabilities in the agrochemical segment - deferred payments from recipients dealing with agricultural production are typical of the first half of the year and (b) increases of receivables decreasing liabilities of S.C. Uzinele Sodice Govora – Ciech Chemical Group S.A. – within restructuring. Sales were intensified. However, due to problems with suppliers' credibility, raw materials are purchased in cash; while past due payables have been partially repaid. The negative cash flow from operating activities was additionally affected by: (a) interest paid (mainly from loans – the Ciech Group increased the use level of bank financing resources in 2007 as compared to the corresponding period of the previous year) and (b) income tax paid (higher than the year before due to more favourable financial conditions of the Group's companies).

The surplus of investment expenditure over investment inflows amounted to PLN 90,115 thousand in the first half of 2007. The main expenditures were: (a) investment expenditure incurred in manufacturing property within development projects and modernization (almost all companies of the Group took such initiatives; however, the largest expenditure was incurred by the Polish soda companies totalling PLN 62,329 thousand) and (b) deposit issued by CIECH S.A. in the amount of PLN 15,046 thousand, accounting for a collateral of the bank guarantee issued as part of the restructuring of S.C. Uzinele Sodice Govora – Ciech Chemical Group S.A.'s debt. Sales of property, plant and equipment by ZACHEM S.A. (PLN 15,601 thousand - the company completed the restructuring program within the area of removal of unnecessary assets) was the main source of investment inflows.

Net cash generated in financing activities totalled PLN 41,687 thousand. A surplus of taken borrowings and loans over the repaid ones, amounting to PLN 42,358 thousand, was the source for the positive cash flow. This was an effect of external financing of the investment projects held in the manufacturing companies of the Group, including, but not limited to, JANIKOSODA S.A. and "VITROSILICON" Spółka Akcyjna.

Cash as disclosed in the cash-flow statement at the end of June 2007 totalled PLN 170,945 thousand.

4 Clarification regarding the Ciech Group's seasonal type or periodical type activity

The Ciech Group's level of income and financial performance depends to a large extent on the general standing of the economy. Cyclic fluctuations in income and profit are especially noticeable in the organic segment, which is marked by high-demand cycles. Due to the fact that approx. 38% of the Group's revenues are achieved owing to sales of organic chemical products, the markets of which are known for high cyclicality, prompted by fluctuations in the world economies, fluctuations of revenues and results of the Group may be relatively large. TDI, EPI and epoxy resins are basic products sold in the organic segment. Presently, the market prices for these products are at record levels. Various factors affect this phenomenon and they include:

− these products, due to oil-related raw materials being needed for their production (mainly: toluene, propylene) are associated with oil prices which currently tend to be high. The high raw material prices are reflected in the prices of TDI, EPI and epoxy resins. The political situation in the Middle East is a final

factor heavily influencing oil prices. On the one hand, a rapidly growing economy and the unstable political situation at the main manufacturers of oil signify that high prices will continue for some time. On the other hand, high oil prices prompted interest in alternative sources of energy and in implemented savings plans concerning use of oil. It is necessary to assume that in the long run prices of oil are likely to fall, while in the short run they will remain high.

− high gas prices, the main raw material in the chemical industry, also affects the high prices of chemical products.

− forecasts expect a rapid growth of the global economy, whereas, production of the chemical industry is likely to go up above the GDP level. Consequently, prices should continue to remain high.

− rapid growth of the worldwide economy is being recorded. China's economic growth above 10% is noteworthy. Despite seasonal attempts made by the Chinese government to cool down their economy, the growth rate remains vivid. The rapid growth of the global economy brings about huge demands for raw materials, including TDI, EPI and epoxy resins. The high demand causes problems with acquisition of these products and, consequently, an increase in prices. Additionally, in the case of TDI, several serious system failures and technical problems connected with launch of new systems resulted in season shortages and an increase in prices.

− forecasts regarding three basic products of the organic segment assume a decrease in their prices in the nearest future. Due to their high price, new systems are planned. In a few years the systems will contribute to their considerable overproduction. Furthermore, high prices introduce recipients' interest in substitutes, which may result in a decrease in demand in the long run.

− it is not possible to unambiguously identify or estimate the cyclicality of prices for basic organic chemical commodities. In history, cyclicality is observed once per several years. High prices and large demand induce taking decisions concerning launching new systems. Further on, an increase in production is introduced, followed by market saturation and a decrease in prices. When a weakening situation is experienced, ineffective systems are closed down, and while demand goes up, the prices for the commodities are still low, thus causing another shortage in the market and another increase in prices. Markets of the other segments of Ciech Group's activity (the soda and inorganic segments) are characterised by good stability, thus fluctuations of revenues and results are relatively small.

The seasonality resulting from the periodic demand and supply fluctuations have a certain impact on the general sales trends in Ciech Group. Products especially prone to seasonality are the goods tightly associated with agriculture, i.e.:

chemical fertilizers,

base stock for manufacture of fertilisers, plant protection agents.

The intensification of fertilizer sales takes place in the third quarter of the year. This is because of intensive field fertilisation in the autumn. The majority of plant protection agents are used in the first half of the year, in the period of intense plant growth, when approx. 90% of total sales of these goods occur.

Seasonality of sales is recorded in the two key product ranges of the glass product segment: glass blocks and glass lanterns. The highest sales for those products are recorded between May and October (blocks) and June and November (lanterns). Measures were taken in Q1 2005 to reduce the impact of seasonality by introducing longer payment deadlines and factoring solutions.

In the case of other products, the Group's annual income and profits are not impacted by any major seasonal fluctuations. On account of this, seasonality plays a relatively small role in the overall sales.

5 Explanation of the differences between the financial results and the forecasts published earlier In its Current Report 33/2007 of May 10th, 2007, the Management Board of CIECH SA published a forecast of the consolidated profit of Ciech Group for 2007. The projected consolidated sales revenues were PLN 3,500 million and the consolidated net profit of Ciech Group was PLN 220 million.

In the consolidated report for the second quarter of 2007, Ciech Group showed PLN 1,793 million in income on sales and PLN 194 million in net profit. Going beyond the key Companies' expected financial results had a very positive impact on the results of the Ciech Group's key companies.

Having analysed the financial results of the Ciech Group's key companies for 6 months of 2007 and on the basis of the prepared estimates of the financial forecasts for Ciech Group for (6+6) 2007, the Management Board of CIECH SA resolved to restate the forecast for the Group's consolidated net financial result for 2007 to the level of PLN 251 million.

•

increase of TDI prices in the first half of 2007 and their estimated continuation for the following six months;•

policy of hedging TDI and soda prices, which stimulates an increase of financial income for exchange rate differences,•

increase of agrochemical product sales and increase of phosphatic fertilisers and phosphorus-potassium fertiliser prices.The forecast update was published in Current Report No. 57/2007 of August 9th, 2007.

6 Factors shaping Ciech Group’s financial performance

U

Positive factors

A considerable increase in the sales of the domestic chemical industry in total (dynamics higher by several percentage points than the relevant index for the entire Polish industry; according to figures for 6 months of 2007).

A very high increase of several dozen percentage points in sales of building output, for which the chemical industry manufactures many materials and semi-finished products.

A good standing of the European glass industry (chief recipient of soda ash).

A considerable increase in the domestic output of phosphatic fertilizers and plant protection agents (over 12% and over 7% respectively, as compared to the corresponding period of the previous year; according to figures for 6 months of 2007).

A considerable increase in global pricing of phosphatic fertilizers and multicomponent fertilisers (by several dozen percent during the last half of the year) triggered by growing demand, especially in developing countries.

A several percentage point increase in European pricing of soda ash in relation to the previous year.

U

Negative factors

An increase in oil pricing inducing an increase in pricing of raw materials intended for the organic industry. Continuing high exchange rate of the Polish currency (against EUR and USD) unfavourable for improvement of export profitability of Ciech Group.

7 Use of the Issuer's funds coming from the issue of shares

CIECH SA’s prospectus was published on January 6th, 2005, while on February 10th, 2005 CIECH SA's shares were successfully floated on the Warsaw Stock Exchange. In the prospectus the Issuer defined the investment program covering the series of projects at a total value of PLN 500 - 600 million carried out in 2005 - 2006. In order to finance the investment plan, CIECH SA used funds from the issues, its own funds and external financing in the form of long-term investment loans. In the first half of 2007 funds from the issues were not used.

8 Main products, goods, or services

Detailed information is disclosed in Schedule No. 1.

9 Changes in the markets

Detailed information is disclosed in Schedule No. 2.

Detailed information is disclosed in Schedule No. 3.

11 Concluded contracts significant to Ciech Group's activity (including contracts concluded between shareholders and insurance or cooperation contracts)

The significant contracts have been defined in item 2 of the Report on the activity of Ciech Group for the first half of 2007.

12 Description of transactions with affiliates

A description of transactions with affiliates has been disclosed in item 31.5 of the additional information and notes for the interim consolidated report of Ciech Group.

13 Borrowings, loan agreements, and sureties and guarantees granted

The particulars have been disclosed in items 24, 27 and 28.3 of the additional information and notes for the interim consolidated report of Ciech Group.

14 Significant off-balance sheet items

The particulars have been disclosed in item 28 of the additional information and notes for the interim consolidated report of Ciech Group.

15 Information on employment

Employment in the Ciech Group (the parent company CIECH SA and the fully-consolidated subsidiaries) was estimated at 7,031 persons in the first half of 2007. In the corresponding period, the first half of 2006, the employment was 2,752 persons.

A considerable increase in employment in the Ciech Group at the end of the first half of 2006, as compared to the corresponding period of the previous year, is an effect of new companies joining the Group. Total employment in the newly acquired companies stands at 3,601 employees as at the end of the first half of 2007.

16 Significant research and development achievements of the Ciech Group

Research and Development achievements in the production potential of Ciech Group Companies

SODA MĄTWY S.A. - as far as research and development of the Company's production potential are concerned, the chief projects were handled in the following areas of activity: