PAPERLESS BANKING AND FINANCIAL PERFORMANCE OF COMMERCIAL BANKS IN KENYA

DUNCAN IREGI MUHORO.

D53/OL/21311/2012

A RESEARCH PROJECT SUBMITTED TO THE SCHOOL OF BUSINESS, IN PARTIAL FULFILMENT OF THE REQUIREMENTS FOR THE AWARD OF MASTER OF BUSINESS ADMINISTRATION (FINANCE) OF KENYATTA

UNIVERSITY

ii

DECLARATION

This research project is my original work and has not been submitted for the purpose of a

degree course in any university. No part of this research project should be reproduced without

authority of the author and/or Kenyatta University.

Signature……….. Date………..

DUNCAN IREGI MUHORO

D53/OL/21311/2012

This research project was done by the candidate under my supervision and has been

submitted to the University for Examination with my approval as the University Supervisor.

Signature……….. Date………..

DR.JOHN MUNGAI

Department of Accounting and Finance, School of Business,

iii

DEDICATION

iv

ACKNOWLEDGEMENT

I give thanks to the Almighty God for granting me the grace to expedite this project this far. I

am greatly indebted to my supervisor Dr. John Mungai for guidance, support and his

encouragement. I thank him specifically for his exquisite attention to detail and demand for

excellence.

I am also greatly indebted to my family who have always been very understanding and

supportive both financially and emotionally and through their encouragement and prayers

that have brought me this far.

Finally, my fellow MBA students specifically; Mr. Erastus Muchira and Mr.Eliud Gitari who;

encouraged me throughout the research period. Thank you all and may God bless you

v

TABLE OF CONTENTS

DECLARATION ... ii

DEDICATION ... iii

ACKNOWLEDGEMENT ... iv

TABLE OF CONTENTS ... v

LIST OF TABLES... Error! Bookmark not defined. LIST OF FIGURES ... ix

OPERATION DEFINITION OF TERMS... x

ABBREVIATIONS AND ACCRONYMS ... xi

ABSTRACT ... xii

CHAPTER ONE: INTRODUCTION ... 1

1.1 Background of the study ... 1

1.1.1 Internet Banking ... 6

1.1.2 Mobile Banking ... 7

1.1.3 Real Time Gross Settlement ... 8

1.1.4 Financial Performance ... 9

1.1.5 Commercial Banks in Kenya ... 10

1.2 Statement of the problem ... 11

1.3 Objectives of the study ... 12

1.3.1 General Objective ... 12

1.3.2 Specific Objectives ... 12

1.4 Research Hypotheses ... 13

1.5 Significance of the Study ... 13

1.6 Scope of the study ... 14

1.7 Limitations of the study ... 14

1.8 Organization of the Study. ... 14

CHAPTER TWO: LITERATURE REVIEW ... 16

2.1 Introduction ... 16

2.2 Theoretical Review ... 16

2.2.1 Technology Acceptance Model ... 16

2.2.2 Theory of Reasoned Action ... 17

2.2.3 Theory of Planned Behaviour ... 18

vi

2.3 Empirical Review ... 20

2.3.1 Financial performance ... 20

2.3.2 Internet Banking and Financial Performance ... 22

2.3.3 Mobile Banking and Financial Performance ... 23

2.3.3 Real Time Gross Settlement and Financial Performance ... 25

2.4 Summary of Literature Review and Research gaps ... 26

2.5 Conceptual Framework ... 29

CHAPTER THREE: RESEARCH METHODOLOGY... 30

3.1 Introduction ... 30

3.2 Research Design ... 30

3.3 Target Population ... 30

3.4 Data Collection ... 31

3.4.1 Data Collection Instruments ... 31

3.4.2 Data Collection Procedure ... 31

3.5 Data Analysis and Presentation ... 31

3.6 Operational Measurement of Variables ... 32

3.7 Empirical Model ... 32

3.8 Diagnostic tests... 34

3.8.1 Normality Test ... 34

3.8.2 Autocorrelation Test ... 34

3.8.3 Heteroscedasticity Test ... 34

3.9 Ethical Considerations ... 35

CHAPTER FOUR: DATA ANALYSIS, PRESENTATION AND INTERPRETATION ... 36

4.1 Introduction ... 36

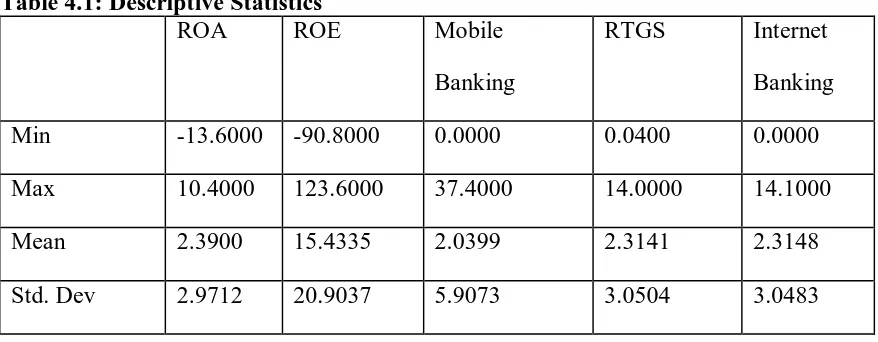

4.2 Descriptive Statistics ... 36

4.3 Diagnostic test ... 38

4.3.1 Normality test ... 38

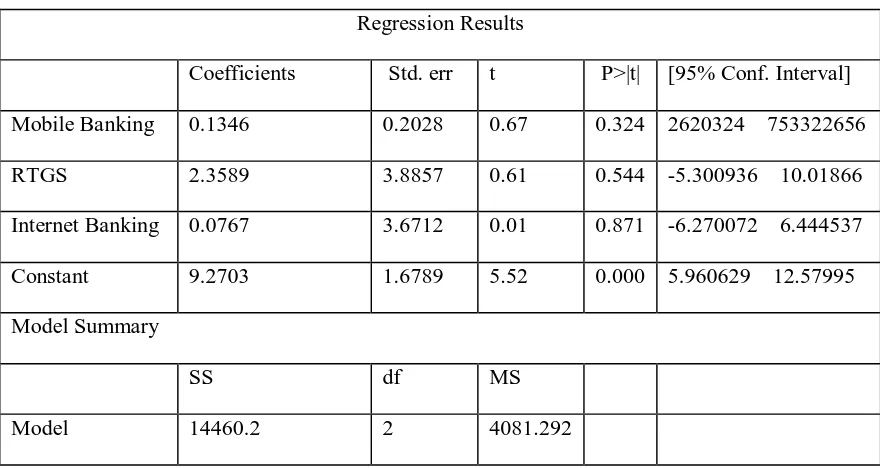

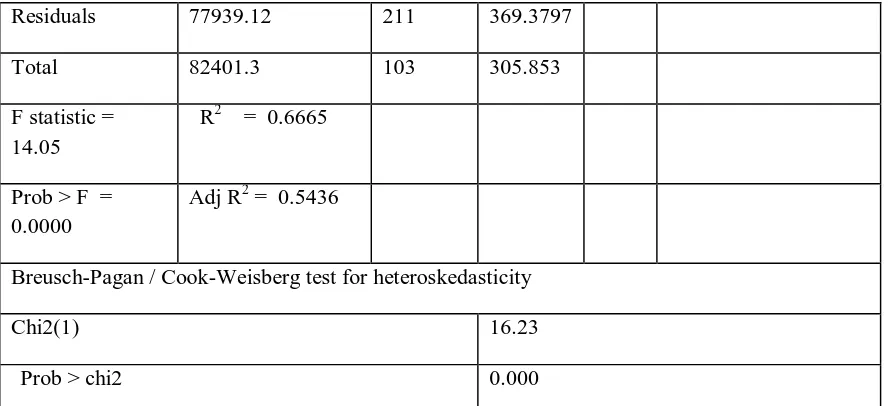

4.3.2 Heteroskedasticity for ROA ... 39

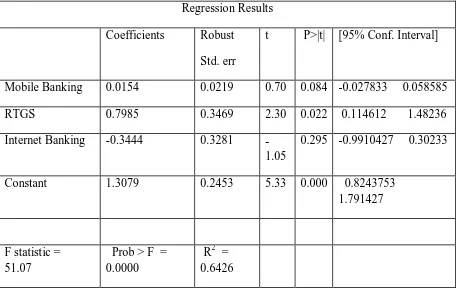

4.3.3 Heteroskedasticity for ROE ... 41

4.4 Financial Performance ... 43

4.5 Correlation Matrices ... 43

4.6 Hypotheses Testing ... 44

CHAPTER FIVE: SUMMARY, CONCLUSION AND RECOMMEDATIONS ... 46

5.1 Introduction ... 46

vii

5.3 Conclusion ... 47

5.4 Recommendations ... 48

5.5 Implication of the study on policy, theory and practice ... 48

5.6 Areas of Further Study ... 48

REFERENCES ... 49

APPENDIX 2: Data Collection Schedule ... 58

Appendix 3 ... 59

viii

LIST OF TABLES

Table 1: Summary of literature review and gaps………... 25

Table 2: Operationalization of variables………. 32

Table 4.1: Descriptive Statistics………. 34

Table 4.2 Regression Model for ROA before………... 37

Table 4.3 Regression Model for ROA after……….. 37

Table 4.4 Regression Model for ROE before……… 38

Table 4.5 Regression Model for ROE after……….. 39

Table 4.6 Banks Financial Performance……… 45

Table 4.7: : Correlation Matrix ROA………. 49

ix

LIST OF FIGURES

x

OPERATION DEFINITION OF TERMS

Financial Performance A personal degree of how well an entity can make use of possessions from its chief style of trade and generate incomes.

Internet Financial transaction Is an automated payment method that allows clients of a bank to conduct a range of monetary transactions through the bank’s website.

Mobile Banking The use of a smartphone or other cellular stratagem to do virtual investment jobs.

Paperless Banking The use of online and digital means to access ones banking platform.

Profitable Bank A money making financial institution (bank) that has

been reporting financial gains over the years. Real Time Gross Payment A transmission method where the transmission of

xi

ABBREVIATIONS AND ACCRONYMS

KBA Kenya Bankers Association

M-BANKING Money Banking

MPMT Mobile Phone Money Transfer

PBC Perceived Behavior Control

PDA Personal Digital Assistant

PEOU Perceive Ease of Use

ROA Return on Assets

ROE Return on Equity

S2B Straight to Bank

SN Subjective Norm

TAM Technology Acceptance Model

TPB Theory of Planned Behavior

xii ABSTRACT

1

CHAPTER ONE

INTRODUCTION

1.1 Background of the study

In the modern world of commercial activities, with speedy growth of economic events there

is no qualm on the predictability of presence of a performance assessment scheme in all

societies. This requisite is palpable in that; lack of an assessment system would be considered

as a sign of a society’s unhealthiness. Financial valuations ensure that corporations attain a

sophisticated level of performance by showing present financial situation of a business in

relation to other businesses and creating a modest environment. Such assessments are also

worthwhile in improving and refining weaknesses through appreciation of the strong point of

past activities. Financial performance is considered as a suitable step in achieving a

self-evaluation technique and therefore improves accountability. Financial performance

directories are in fact an exploit guide from what it is concerning what it is supposed to be.

Assessing the performance of companies and industrial units can act as a parameter that

surfaces the way for impending resolutions, concerning venture, growth, and most

prominently, control, and observation (Tehrani & Brahmana, 2010). Financial assessments

are one of the oldest and the most significant approaches used for assessing the performance

of firms which are mostly based on monetary statements.

Oke and Goffin (2011) noted that in United States of America, innovation has been used by

financial institutions as a strategy to give direction which realizes benefit in a fluctuating

setting through its formation of competences, and resources with the aim of satisfying

investors’ anticipations Innovation is the outcome of man’s erudite and assimilated

knowledge or his practical skills concerning how to handle things in a better way. Quinn

2

employees to innovate, because innovation covers every aspect of all organizations. A

company’s performance is the assessment of agreed pointers or principles of efficiency,

efficiency, and ecological responsibility such as production, sequence time, controlling

acquiescence and surplus lessening. Performance also talks about the metrics on how a

certain appeal is handled, or the action of doing something efficiently.

In South Africa financial institutions have been able to create competencies and in order to

sustain them the banks have invested in online marketing, mobile banking, and paperless

banking and customized customer service. This has helped them to come up with favourable

core banking systems, marketing strategies, products as well as organization innovation. This

has improved the financial performance of financial institution. This can be found through

increased number of customers, increased profit growth and development of new banking

products (Ndunga, Njati & Rukangu, 2016). Due to the improved financial performance, the

financial inclusion has improved especially in developing countries. As a result of the rapidly

changing technology and improved financial performance commercial banks have employed

skilled and knowledgeable workers who are innovative to and able to deliver change. (Khalil,

2012)

Paperless banking in the banking industry has evolved over the years; the first bank to use

ATM was Barclays Bank in Enfield Town in north London, United Kingdom, on 27 June

1967. Since then, there have been important developments in the paperless investment sector

in the previous years. According to Delving (1995), until the early 1970s functional

demarcation was principal with several supervisory restraints enacted. One key result of this

was partial rivalry both locally and globally, consequently there was heavy dependence on

3

Paperless banking depends heavily on information and communication technology (ICT) to

24 hours accessibility, cheaper, and faster delivery of economic services; when seeing

paperless investment, bank websites stage, regularly come to mind foremost but paperless

banking needs several good website. ATM banking is one of the most primitive and

extensively embraced paperless banking amenities in Kenya (Nyangosi et al., 2009).

However, according to a yearly article by Central Bank of Kenya (CBK), its acceptance, and

usage has been beaten by mobile banking (M-banking) in the last few years (CBK, 2014).

Currently, there are about 8 million users of M-banking services related to 4 million people

who hold accounts in conventional financial institutions in Kenya (CBK 2014). The

remarkable upsurge in the number of people embracing M- banking has been credited to ease

of use, and large number of mobile phone customers.

Michael Zhang (2010) expressed that E-banking is the most recent delivery network for

banking amenities. Banks have used automated channels for several years to communicate

and conduct business with both local and global business clienteles. With the growth of the

Internet, and the World Wide Web in the last half of the 1990s, banks are gradually using

paperless networks for getting guidelines and carrying their products, and amenities to their

consumers. This form of banking is generally referred to as paperless banking, e-banking or

Internet banking, although the range of products and services provided by banks over the

electronic channel vary widely in content, capability and sophistication (Menson, 2010).

Paperless banking is the computerized supply of modern and outdated banking products, and

services straight to clienteles through paperless, cooperating communication channels.

Every bank in Kenya reports its financial results at the end its financial year. (Alton et al.,

2007), methods of after-tax rates of return, for example, the return on regular overall assets

(ROA), and the return on total equity (ROE), are extensively used to measure the

4

used ROA and ROE to evaluate business performance, and estimate tendencies in market

configuration as contributions in numerical models to forecast bank catastrophes, and fusions,

and for a diversity of other drives where a quantity of productivity is anticipated. Return on

assets is the percentage of yearly net revenue to middling total chattels of a corporate during a

business year. It measures competence of the corporate in using its possessions to make net

revenue. ROA is calculated by dividing annual net income by Average total assets. Average

total possessions are premeditated by allotting the sum of total possessions during the start,

and the end of the business year. The sum of assets at the beginning, and at the end of the

year can be gained from year ending balance sheets of two successive monetary years,

Irfanullahjan (2013).

ROE evaluates the stockholders rate of return on their venture in the firm (Majed et al.,

2012).Kenyan banks that have embraced paperless banking have ended up becoming the

market leaders, (Muthini, 2013). For instance, Kenya commercial bank introduced mobile,

and agency banking here in Kenya. Today, KCB has become the largest bank in the region by

both assets and profitability (CBK, 2014). The use of internet banking by equity bank has

improved the bank’s performance over the past few years. One of the benefits for the banks

with paperless banking service is improved labelling and enhanced reply to the flea market.

Other benefits are probable to assess in financial terms.

The highest goal of each company is to maximize incomes for its holder and other investors.

According to Allen, and Hamilton (2002), a predictable cost of providing the repetitive

business of a complete service branch in United States of America is $1.07 per business deal,

as related to 54 cents for mobile banking, 27 cents for ATM banking and 1.5 cent for internet

banking. On the other hand, the benefits for the consumers are important time saving, and

condensed costs in retrieving, and using the several banking merchandises and service,

5

According to Wright and Ralson, (2002), internet Banking delivers clear returns to both the

financial institutes and the clienteles. From the banks’ viewpoint, Internet Banking has very

cheap businesses, as compared to human teller banking. According to The Fourth ICEB

conference in Beijing (2004), paperless banking lowers head count, stationery costs because

bank statements and disclosures are presented online. For customers, Internet banking

provides suitability, reduce service charges, more reachable information about bank accounts,

and a pretty option for eventful people because it saves time to go to the bank branches and

offers 24 hours access, Khalil (2012).

The advantages of paperless banking are diverse, and are to be taken from the viewpoint of

the banks themselves, consumers, and even the managers (Glenn, 2015). The study further

expressed that paperless banking offers diverse and possibly lower obstacles to entry, chances

for important cost reduction, the capacity to rapidly reengineer business processes and greater

opportunities to sell cross border. For consumers, the possible benefits are: more choice;

better competition and healthier value for money; more information; improved tools to

manage and relate information and quicker service.

Paperless and Electronic banking (E-banking) allows customers to do their banking 24 hours

a day in a week. E-banking consumers are able to check their account balances, pay bills,

apply for a loan, trade securities, and conduct other financial dealings. Paperless banking is

divided into five main categories namely Personal computer banking, internet banking,

TV-based banking, telephone banking, and Mobile phone banking. Technological inventions in

latest decades have enabled the move towards paperless banking. The growing competition

for consumers in banking, and necessity to lower the cost of offering banking services has

6

Due to the comparative newness of this hastily developing industry, banks as well as

consumers had serious disquiets about the security of Internet right of entry to client

accounts, which was the major test, (Rebecca, 2013). Internet banking is taking over the

ground. Banks gradually control websites through which clienteles are able to ask about

account balances, interest and exchange rates, and carry out a number of transactions.

Regrettably, there is a low data on Internet banking, and diversity in definitions make cross-

country contrasts difficult, John, and Davies (2011).The study also highlighted on the

presence of risks in paperless banking which include reputational risk, operative risk, legal

risk, and regulatory risk.

1.1.1 Internet Banking

Internet banking is a system that enables bank consumers to access their accounts, and

general data of the bank products, and facilities through banks website, without the

interference or inopportuneness of sending letters, original signatures, faxes, and telephone

confirmation, (Thulani, Tafara & Langton , 2009, cited in Yahiya 2011). IB is defined as the

use of internet knowledge in the transfer of banking and monetary amenities using the

omnipresent nature of the internet (George and Gireeshkumar, 2012); It is can also be defined

as the act of performing commercial transactions tenuously over the internet via a bank’s

devoted website (Salehi & Alipour, 2010)

Customers are able to do personal and profitable banking activities speedily, competently and

appropriately via bank’s internet banking website from their homes or offices which is

economical. Internet banking also helps the bank to replicate the same services offered

usually at bank branches to their online clients at a cheaper operational cost (Dosh &

Mohanty, 2011). Internet banking has spread promptly worldwide as a result of its

7

is internet network (Auta, 2010). IB is not distribution channel but also a driver for inclusive

industrialized change in the banking sector, which results to the diffusion of internet banking

technology internationally.

1.1.2 Mobile Banking

The terms mobile banking, m-transfers, m-payments, and m-finance jointly refer to a set of

submissions that enable the general public to use their mobile telephones to operate their

bank accounts, store value in an account allied to their phones, access credit or even transfer

funds (Donner,2008).

Various factors play a vital role in the acceptance of these comparatively new-fangled

services. These factors include economic, social, and technological. However, there are also

social factors which include awareness, attitude towards change (embracing technology),

conceptualizing electronic money, the social context of transactions, trust in one’s bank or

service provider, convenience of the service and the comfort that people have in using these

services. Economic factors include mobile phone access, cost of the service, marketing

strategies and availability of alternatives. The banking industry has come a long way in

ensuring its survival having experienced improved rivalry over the last few years caused by

increased inventions among the traders, and new competitors into the monetary market,

through the provision of mobile banking services (CBK, 2014). Safaricom launched the

M-Pesa in 2007, and within a relatively short period it already has more than 10-million

consumers and is providing many poor and countryside Kenyan citizens with admittance to

financial amenities that were formerly inaccessible, since either banking services were too

expensive for them or were almost out of reach. With M-PESA, client's cash can only be

8

ways to compete effectively and profitably, and started coming up with their own mobile

banking solutions and forming partnerships with these telecommunication service providers.

1.1.3 Real Time Gross Settlement

Real Time Gross Settlement (RTGS) is a service obtainable by the standby banks of countries

to process great value cash businesses securely between two accounts (Rodrigo Andrés de

Souza Peñaloza, 2011). Kenya banker top-notch wordpress.com site (2013) defines Real time

gross settlement systems (RTGS) as a funds transmission structures where money or

sanctuaries are conveyed between banks on a real time and on gross basis. Settlement on real

time means there is no waiting period and the imbursement is reflected as final and

irreversible. Gross settlement business is settled on a face to face basis without batching or

netting with another business. Once processed, expenses are final and irreversible. An RTGS

scheme can therefore considered as a funds transference scheme which enables provision of

continuous intraday conclusiveness for separable transfers. A Real Time Gross Settlement

system where interbank transfers are developed on a gross base as they arrive at the Central

Bank.

In RTGS systems expenditures are, as designated above, settled separately and directly after

the payment teaching, delivered that the remitter has cover for the payment in question.

Payments in RTGS systems are characteristically credit businesses that is, payments started

by the remitter (debtor). Members obtain wateriness through monetary-policy finances from

the central bank, that loan with development of least possible one day, or by appropriating

from other members in the coinage market. RTGS is a developing invention in the banking

zone. Bank modernism includes; internet banking, mobile banking, Point of Sale Terminal,

9

organization that fails to influence these inventions loses its modest advantage and market

share to the participants (Mabrouk & Mamoghli, 2010).

1.1.4 Financial Performance

Generally, bank performance implies that a bank has fared well in a trading period to

meet its objectives. The only manuscript that clarifies this is seemingly the printed financial

statements. According to Rose (2008) , a reasonable assessment of a bank’s

performance should commence by estimating if it has been able to attain the aims set

by administration and shareholders. Undoubtedly, several banks have their own exclusive

intentions. Some wish to develop quicker, and realize some lifelong growth objectives,

others appear to favour unobtrusive life, reducing risk and transmitting the carbon copy

of a complete bank, but with diffident plunders to their stockholders Ibid .

Normally, stock prices and its conduct are thought to replicate the presentation of a company.

This is a market pointer and are unreliable. Nevertheless, the size of the bank, the volume

of deposit, and its productivity could be believed as more dependable performance

pointers. For the benefit of this research, effectiveness gages, exactly the Return on

Equity Capital (ROE), and the returns on Assets (ROA) are used to evaluate bank

performance. These ratios are gauges of supervision productivity, and rate of returns.

According to Rose (2008), these effectiveness procedures differ considerably over time and

between banking market. The ROE and ROA are generally in use nowadays. Nikolai &

Bazley (2010) postulate that the total net income made in relation to total possessions is a

pointer of how professionally a business uses its financial resources. They continue stressing

that when the ROE is greater than the ROA, the company has a satisfactory financial

10 1.1.5 Commercial Banks in Kenya

According to CBK by the end of June 30th 2014 the Kenyan banking zone has 43 commercial

banks, 9 microfinance banks, 1 mortgage finance company, 8 representative offices of

foreign banks, 2 credit reference bureaus, 5 money remittance providers, and 97 foreign

exchange bureaus. The Banking Sector improved its performance, and assets amplified to

Ksh. 3.0 trillion from Ksh2.5 trillion between 2013 and 2014 whereas loans, and advances

grew by 20% during the same period. The deposit base expanded by 10%, Profits before tax

grew by 15% (CBK, 2014).

In June 2013 the banking sector gross loans and advances increased from Ksh 1.5 trillion to

Ksh1.9 trillion in June 2014 which is estimated to be a growth of up to 22.6%. The consumer

deposits were the main source of funding for the banking sector assets, accounting for 72.3

percent of total accountabilities. The deposit base increased by 16.5 percent from Ksh 1.9

trillion in June 2013 to Ksh. 2.1 trillion in June 2014 mainly attributed to branch expansion,

remittances, receipts from exports and agency banking. The deposit accounts improved by

33.9 per cent from 18.9 million accounts to 25.3 million between June 2013 and June 2014

(CBK, 2014).

Additionally, the yearly report (2014) shows that the banking sector made improved capital

levels in the financial year that ended in June 2014 with total capital, which encompasses

core, and additional capital, growing by 19.9 percent from Ksh 364.0 billion to Ksh 436.6

billion in June 2013. The stockholders’ funds improved by 16.5% from Ksh 394.4 billion to

Ksh 459.4 billion between June 2013 and June 2014. However, the ratios of total and core

capital to total risk-weighted possessions reduced from 23.3% and 20.2% in June 2013 to

17.5% and 15.0% in June 2014 correspondingly. The deterioration in capital competence

ratios is caused by higher increase in total risk prejudiced possessions than the upsurge in the

11

charge for market, and operative risks which in effect upsurges their weighted possessions

base. This requirement was to effect from January 2014.

1.2 Statement of the problem

In Kenya the banking business has continued to operate in a competitive environment, most

banks have introduced new innovative products, processes, technology and organization

innovation leading to greater efficiency and product differentiation. On technology, banks

have had to offer a wide range of deposit, investment and credit products through distinct

channels of distribution which include improved ATMs, branches, telephone and Internet.

Regardless of the possible profits of ICT, and e-commerce, there is discussion on whether

and how their acceptance progresses bank’s financial performance. Numerous efforts have

been made to investigate the influence of microelectronic banking on bank performance. A

research study carried out by Kingoo (2011), explore the association between e-banking and

monetary performance of profitable banks in Kenya. The study recognized that those banks

with great revenue development are more probable to be using better statistics of progressive

ICTs. It settled that e-banking leads to greater revenues although in long-run because of high

ICT venture cost and also to decrease delinquencies; security check should be done which

will be cooperative in improving client service, upsurge methodical competence and thus

improved productivity.

There has also been mixed conclusions on the result of e-banking on the monetary

performance of profitable banks in Kenya. A research done by Okiro (2013) found that banks

with internet banking services were normally more lucrative and inclined to trust less deeply

on old-style banking activities as compared to banks with no internet. Exclusion to the larger

performance of internet banks was the de novo (new start-ups) internet banks, which were

12

Regardless of the importance of paperless banking in explanation of banking performance,

the association of paperless banking on banks financial performance is still misinterpreted for

two motives; lack of considerate drivers of paperless banking and paperless banking effects

on group’s financial performance is unknown. Previous researchers such as Pooja and Singh

(2009), Batiz-Lazo and Woldesenbet (2006), Francesca and Claeys (2010), Mwania and

Muganda (2011) have shaped mixed outcomes concerning the effect of internet banking and

e commerce on bank’s performance, and banks financial performance have stagnated despite

the adoption of paperless banking . It is from the background of such mixed conclusions

which necessitated and created the necessity to do a study to examine the relationship of

paperless banking and the financial performance of profitable banks by use of such other

relative measure as return on Asset and return on Equity, which are better indicators of

financial performance.

1.3 Objectives of the study 1.3.1 General Objective

The universal objective of the research was to establish the outcome of paperless banking on

financial performance of Commercial banks in Kenya.

1.3.2 Specific Objectives

The study was guided by the following specific objectives

(i) To determine the effects of internet banking on financial performance of commercial

banks in Kenya

(ii) To establish the effects of mobile banking on financial performance of commercial

13

(iii)To find out the effects of real time unrefined settlement on financial performance

of commercial banks in Kenya

1.4 Research Hypotheses

In view of the research objectives the study sought to test the following null hypotheses.

H01: Internet banking has no significant effect on financial performance of commercial banks in Kenya?

H02: Mobile banking has no significant results on financial performance of commercial banks in Kenya?

H03: Real time gross settlement has no significant consequence on financial performance of commercial banks in Kenya?

1.5 Significance of the Study

The research findings will be of value to:

The regulators will gain a deeper consideration of the paperless banking technology under

their policy. It would be useful to them in that they will use the knowledge gained to tailor

regulations to safeguard the interests of consumers while still and carry out their operations

profitably.

Paperless banking operators will improve and expand their services in a way that facilitates

economic empowerment to all the parties involved. They will gain a deeper understanding of

the services that consumers prefer to operate under. The information will thus be used to

tailor the Provider’s services to suit the customers’ needs and expectations and hence gain a

14

Consumers shall be educated on the many avenues and platforms that paperless banking

affords to them. Business owners may choose to use paperless banking methods in their trade

as a result of understanding their customer base. Academicians and researchers will have new

areas to push forward knowledge boundaries on the concept of paperless banking.

1.6 Scope of the study

The populace for this study contained of all commercial banks in Kenya recorded with CBK.

There are 43 profitable banks in Kenya which formed the objective populace of the research.

The study covered a 5 years period prior to paperless banking, between 2001 and 2005; and

2012 to 2016 post paperless banking. This period was significant because there was a major

political activity which changed the system of government from a central government to a

devolved system of government. During such activities the business are very anxious and

huge movements in the securities exchange were evident (NSE, 2013). During the period of

the study, the Kenyan currency depreciated against the US dollar by about 30% (CBK 2014).

1.7 Limitations of the study

The study was restricted by the point that it only covered a period of five years which cannot

be considered representative enough. This challenge was addressed by prudent analysis of the

available data. The researcher encountered inconsistent data and in some cases lack of the

data, this was as result of merger ,acquisition and receivership of some banks. The researcher

was also constrained by funding and time. The problem was addressed by the use of a

research assistant who assisted in speeding up the study.

1.8 Organization of the Study.

Chapter one of the project covers the background of the project, statement problem,

objectives of the project; as well as the hypotheses developed for empirical testing, the scope

15

review the relevant literature and studies carried out on the delinquent addressed in the study.

The third chapter presents the procedure and the technique to be used for data assemblage

and study. The fourth contains an examination of data, and demonstration of outcomes. The

fifth chapter offers a summary and argument of the investigator’s findings, insinuations for

16

CHAPTER TWO

LITERATURE REVIEW

2.1 Introduction

The chapter outlines the current writings on the result of paperless banking and performance

of commercial banks. Specifically, this chapter analyses theories relied on, empirical studies,

summary of the literature review and gaps, and conceptual framework.

2.2 Theoretical Review

Several theories are offered to investigate and illustrate the attitude that consumers have on

the acceptance and usage of paperless banking amenities. Some of the philosophies that have

been developed to clarify how e- banking expertise is adopted include: the concept of

reasoned action (Fishbein, et al., 1975), concept of planned behaviour (Ajzen, 1985),

Diffusions of innovation theory (Robinson, 2009) and technology acceptance model (Davis et

al., 1986).

2.2.1 Technology Acceptance Model

The proponent of technology acceptance model (TAM) is Davis et al., (1986). TAM

emphases on clarifying the boldness behind the meaning to use a definite technology or

facility. TAM model conjectures that structure use is unswervingly single-minded by social

purpose to use, which is in turn prejudiced by consumers’ approaches toward using the

system and the professed expediency of the structure. Approaches and superficial practicality

are also affected by apparent comfort of use.

Perceived usefulness (PU) is explained as the degree to which a being considers that using a

scheme will upsurge his or her work performance. Thus for users of online banking, will

assume the scheme if they consider the system will bring profits such as decreasing time used

17

is “the degree to which the prospective adopter expects the new technology adopted to be a

free effort regarding its transfer and utilization” (Davis et al.,). Consequently if consumers

feel that online banking is cool to use and open to hustle, then the probabilities of them to

make use the scheme will be better.

However, several research show that TAM itself is inadequate to clarify users' choices to

accept expertise, consequently they use TAM as an improper model and protracted the model

by tallying extra variables to the model relying on the kinds of expertise they studied. For

instance, Kamarulzaman (2007) on his research of internet errands acceptance depicted upon

TAM, and incorporated personal and reasoning influence. Amin (2007) also adapted the

original TAM by including apparent trustworthiness and the amount of data on mobile credit

card were added to his study of mobile credit card usage purposes.

2.2.2 Theory of Reasoned Action

The Theory of Reasoned Action (TRA) conveyed in by Fishbein and Ajzen (1975) has been

used expansively in marketing study. TRA has been functional to explain the conduct beyond

the receipt of technology and comprises four universal ideas: behavioural attitudes, personal

norms, objective to use and real use. It debates that individuals evaluate the consequences of

a particular behaviour and create intentions to act that are consistent with their evaluations.

More specifically, TRA states that individuals' behaviour can be predicted from their

intentions, which can be predicted from their attitudes and subjective norms. Following the

chain of forecast further back, approaches can be foretold from a personality's principles

about the results of the behaviour. Personal norms can be foretold by acknowledging how

important other persons think the conduct should or should not be done (Ajzen, I., 2006).

A predominantly useful feature of TRA from a technology viewpoint is its declaration that

any other issues that affect performance do so only circuitously by swaying boldness and

18

system design characteristics, and user characteristics (including cognitive styles and other

personality variables). Therefore, TRA is fairly suitable in the setting of forecasting the

performance of using hypermedia technology. Though TRA, is a very universal concept and

as such does not specify what particular principles would be applicable in specific situations.

On the other hand, the addition of personal norm signifies a significant variable, which is not

even encompassed in more general models (Fishbien, 2014)

2.2.3 Theory of Planned Behaviour

The proponent of this theory is Ajzen who developed it in 1988. This theory of planned

behaviour (TPB) started as the concept of rational action to forecast a person’s intent to

involve in a performance at a particular time and domicile. This theory propose that a

principal factor in social behaviour is developmental intention, which is pretentious by

approach toward conduct, individual norm, and alleged behavioural control (Ajzen, 1985).

Personal norm articulates the apparent structural or collective pressure of a person who

anticipates to perform the comportment in question. Additionally, the personal norm is

comparative to normative beliefs about the prospects of other people. Apparent behavioural

control replicates an individual’s insight of the easiness or difficulty of applying the

behaviour in question. It concerns principles about the existence of control factors that may

enable or impede their performing the conduct.

TPB is came up with three factors as observed behavioural control, subjective norms, and

attitude. Hence, behavioural objective is predisposed by alleged behavioural control,

subjective norms, and attitude. Real behaviour is, therefore dogged by behavioural purpose.

Among all, apparent behavioural control talk about to person’s perceived simplicity or

difficulty of performing the specific behaviours. Recently, use of internet has been extensive,

and more expanded. Studies on TPB relating on electronic market have improved. Huang et

on-19

line tax filing. Hsu et al., (2006) analyses consumers’ frequent conduct towards internet

shopping by longitudinal study, which not only use TPB factors (attitude, subject norms and

perceived behaviour control) but also assimilate anticipation disconfirmation concept to

hypothesis the research model. The experiential results show that personal norms, perceived

behaviour, and attitude control are the main factors influencing consumers’ unceasing

objective of internet shopping. In summary, the experiential results of the above- mentioned

writings prove that TPB can be applied to clarify the developmental process of human being

involved in or putative information technology (Fishbein and Ajzen,2010).

2.2.4 Diffusions of Innovation Theory

According to Robinson (2009), dissemination of inventions seek to clarify how inventions are

taken up in a populace. Diffusion of invention suggests five qualities that influence the

adoption of any given technology namely: relative benefit, compatibility with current values

and practices, trial ability, and observable results, easiness and comfort of use. Relative

benefit is the point to which an invention is professed better than the impression it succeeds

by a specific group of consumers dignified in terms that matter to those consumers, such as

social prestige, economic advantage, convenience, or satisfaction. The better the professed

relative benefit of an invention, the more prompt its rate of acceptance is probable to be.

There are no complete rules for what institutes “relative advantage”. It hangs on the specific

insights and wants of the user group (Robinson, 2009).

Compatibility with prevailing principles and practices is the point to which an invention is

seemed as being reliable with the past experiences, values, and needs of possible adopters.

An idea that is un harmonious with person’s values, standards or practices will not be

accepted as quickly as an invention that is harmonious. Straightforwardness and ease of use -

is the gradation to which an invention is professed as challenging to comprehend and use.

20

that need the adopter to change new skills and considerations. Trial ability is defined as the

gradation to which an invention can be investigated with on a restricted basis or a discovery

that is sample able signifies less risk to the person who is considering it. Noticeable results

mentions to how tranquil it is for people to see the results of an invention, the more probable

they are to accept it. Noticeable results lessen indecision and also arouse peer debate of the

invention (Robinson, 2012).

2.3 Empirical Review

This section provides an analysis of the empirical literature, which has been done according

to the variables of the study.

2.3.1 Financial performance

Monetary ratios are used by interior and exterior monetary data users for making their

financial decisions; including capitalizing, and performance assessment decisions. Numerous

financial and secretarial models were advanced during earlier decades. Nevertheless, the

monetary ratios still keep it’s standard and important power either as part of these monetary

and secretarial models or as added significant helpful examination with it. Due to the

established power of the ratio scrutiny in the concrete monetary and planning study, this

research will discover the result and power for more or less key ratios ROA, ROE together

and distinctly in explanation the financial performance of 43 commercial banks in Kenya

between 2012 and 2016 (CBK,2014).

Almazari (2011) tried essentially to measure the monetary performance of seven Jordanian

commercial banks from the year 2005 to 2009, by using modest reversion in order to assess

the influence of autonomous variable signified by; asset management, the bank size, and

operational competence on reliant variable financial performance signified by; return on

assets, and interest income size. It was established that banks with advanced total deposits,

21

productivity performance. Additionally, there subsists a confident association between

financial performance and asset utilization, asset size, and operational competence, which

was also established with reversion study that financial performance is importantly

prejudiced by these sovereign factors.

Kumbirai, and Webb (2010), examined the performance of South Africa’s commercial

banking sector between 2005 and 2009.Financial ratios are used to measure the productivity,

fluidity and credit quality performance of 5 large South African founded commercial banks.

The research found that overall bank performance amplified significantly in the first two

years of the study. An important change in trend is seen at the start of the global financial

watershed in 2007, reaching its highest between 2008 and 2009. This caused low liquidity

falling profitability, and deteriorating credit eminence in the South African Banking sector.

Raza et al., (2012) have briefed several new studies from 1972 to 2012 in their evaluation

papers using content analysis, presenting that financial measures such as stock market

returns, and accounting incomes ratios such as return on assets (ROA), return on sales

(ROS), and return on equity (ROE) are targeted Ibid. Most researchers pick out ROE, ROA,

ROIC, and EPS, as significant financial variables in their researches. Scholtens (2008) uses

standard returns as a monetary index Ibid. McGuire et al., (2012) compare both stock

market-based and accounting-market-based procedures that emphasis on dissimilar features of financial

performance. The accounting-based agencies stress on the firm’s antique performance and

apprehend a wide variety of pointers such as ROA, ROE, Expensive Rate of Net Assets Ibid,

and Growth Rate of Main Operating.

Aduda et al. (2012) carried out a research entitled “the relationship between e-banking and

financial performance among commercial banks in Kenya”. The research recognized that

22

variable as measured by investments in paperless banking, number of ATMs, and the number

of debit cards dispensed to consumers as proxy of paperless banking. The research exposed

that paperless banking has strong and significance marginal effects on ROA in the Kenyan

industry. Thus there occurs a constructive correlation between bank performance, and

paperless banking.

2.3.2 Internet Banking and Financial Performance

Internet banking and financial performance is a type of e-banking facility where

consumers’ directions are taken and attended to through the internet. Internet banking

gives clienteles the opportunity of appreciating banking services from the ease of their

homes and offices. (Onay, Ozsoz, and Helvacioglu, 2008) postulates that the rate of

acceptance of a new invention is connected to apparent relative advantage: The better the

perceived related benefit, the quicker the acceptance. In addition, the wish to advance

organizational performance is seen to be an enabler for technical change. Nevertheless,

the profits of electronic banking include a broad variety of purposes and include:

Electronic mail increases communication between persons, and the bank, in the bank,

with the bank, and peripheral parties, and amongst banks. Banks can deliver information,

and services online which consumers can pay for and collect. Banking procedures are

made more well-organized and cost operational by assimilating other features of

banking operations such as management and financial control.

De Young et al., (2006) perceived the variation in financial performance of internet

community banks in U.S. between 2009 and 2011. The outcomes found that internet

acceptance upgraded community banks’ profitability, predominantly through improved

incomes from deposit service custodies. Internet acceptance was also related with movements

of credits from checking accounts to money market deposit accounts, better use of brokered

23

of vicissitudes in loan selection mix. The findings recommended that internet acceptance was

connected with a parsimoniously and statistically important development in bank

profitability.

Ceylan et al., (2008) did a study entitled “The effect of e-banking on banks’ profitability in Turkey”. In this study, they have used bank specific variables and macroeconomic variables

to assess the result of e-banking on financial performance pointers of 14 commercial and

saving banks in Turkey in the period between the years 1996 and 2005. Results showed that

venture in e-banking is a steady process and e- banking activities has had an optimistic

consequence on performance of Turkey banking system.

Maiyo (2013) conducted a research on the result of electronic banking on financial

performance of profitable banks in Kenya. The research discovered that payments and

commission from mobile banking, debit cards, and credit cards has a important result on

returns on benefit while fees and commission from internet banking as well as the amount of

money that commercial banks capitalize in paperless banking to fix, train staff and uphold the

platforms has no or negligible consequence on return on possessions. The acceptance of

paperless banking has improved performance of commercial banks because of improved

effectiveness, efficiency, and productivity.

2.3.3 Mobile Banking and Financial Performance

Mobile banking is a deal offered by financial institutions in collaboration with mobile phone

machinists. It allows customers with busy lives to conveniently do their banking using their

phones anytime. It is about getting banking amenities to the unbanked, those who do not have

bank contact or bank accounts, and those who are at the lowest of the financial pyramid, often

living in remote areas. They obtain the profits of banking services such as being able to invest

24

Sullivan (2010) established that click and sealant banks in the 10th Federal Reserve District

experienced somewhat greater operating expenditures but balance these incidentals with

somewhat advanced fee revenue. On average, this research found no methodical indication

that banks were either aided or harmed by posing the internet delivery channel. Comparable

to the outcomes of Furst et al., this research also found that de novo click and grout banks

performed meaningfully worse than de novo brick and grout banks.

Siam (2006) assessed the properties of paperless banking on the productivity of Jordanian

banks. The outcomes of the study exposed that paperless banking services had a undesirable

influence on the productivity of banks in the short run due to improved capital costs involved

in technical and microelectronic infrastructure, cost of training to employees, and also the

cost complicated in creation of environment where the banks can function efficiently.

Nevertheless, these amenities had an optimistic influence in the long run on the productivity

of banks. The scholar suggested that banks need to carry out consciousness and elevation

campaigns to teach clients and aware them of possibility via reduced effort, time, cost, and

also to hold teaching courses for staffs to understand the e- banking business policies.

Okiro et al. (2013) conducted a study on the influence of mobile banking and internet

banking on performance of monetary institutions in Kenya. They found out that adoption of

mobile and internet banking has been sluggish because of reduced inaccessibility of

infrastructure and lack of helpful regulation for mobile and internet banking. However, the

adoption has improved performance of the banking industry as a result of improved

productivity, efficiency and productivity.

Njogu (2014) instituted that there exists a very robust relationship amongst financial

performance of profitable banks in Kenya and the electronic banking technology adoption.

25

banking, via technology which has formed greater chances to the banks to offer great

suppleness to the customers. The study also found out that the size of the bank has an

optimistic influence in the financial performance of profitable banks in Kenya. Mungai,

Maingi, Muathe, & Ndungu (2015) found out that technology and loan repayment had an

inverse relationship in Muranga County however, the study further argue that in other

countries namely Malawi, South Africa, Mozambique and India, groups who have embraced

technology have improved their micro credit loans repayment.

The banking sector has had to embrace technological variation to continue being competitive.

In search of reasonable benefits in the technical financial service industry, banks have

recognized value and differentiated themselves from other monetary institution via new

service dissemination channels (Onav et al., 2008). Banks administrative process of account

opening cut out several bucolic unfortunate as they could not be eligible to own accounts.

With antagonism banks had to streamline the procedure, and had to come up with

ground-breaking ways of doing so. Relatively a number of banks have invented various M-banking

products such as KCB Mobi-bank, Equity bank M-Kesho, M-shwari of Commercial bank of

Africa, and Family bank Pesa pap.

2.3.3 Real Time Gross Settlement and Financial Performance

RTGS is the quickest imaginable money transmission system via the banking networks that is

offered by the standby banks of countries to develop great value cash transactions securely

from one account to another. In RTGS systems disbursements are settled independently, and

instantaneously after the payment instruction, given that the remitter has cover for the

imbursement in query. Payments in RTGS systems are characteristically credit businesses,

payments introduced by the debtor. Members obtain liquidity through finance-policy loans

from the central bank, loans with development of at least one day, or by borrowing from

26

Innovation comprises of firms increasing new products or new production procedures to

better perform their processes, in which case the new produces could be based on the new

procedures (Lawrence, 2010). In the monetary services industry, invention is seen as the act

of creating and propagating new monetary instruments, institutions, technologies, and

markets, which ease access to data, trading and means of imbursement (Solans, 2003).

According to Nofie (2011), inventions in the finance sector is the influx of a new or improved

product and/or a process that depresses the cost of producing current financial services. Bank

invention includes; internet banking, mobile banking, Point of Sale Terminal, electronic

funds transfer, credit and debit cards, and real time gross settlement. The organization that

fails to influence these inventions loses its competitive benefit and market share to the

participants (Ngumi, Gakure, Waititu & Njuguna, 2013).

Makokha et al., (2015) recognized that use of RTGs does not affect the monetary

performance of the University. It also found that RTGS only safeguarded condensed cheque

leaves when paying creditors, low accounts maintenance costs, and facilitating of funds

transmission between two accounts in a shorter duration but there was other influences that

openly affected financial performance.

2.4 Summary of Literature Review and Research gaps

The researcher reviewed past researches and noted several gaps which this project pursues to

27 Table 2.1: Summary of literature review and gaps

Author Title Findings Gap

Almazari

(2011)

Measure of

monetary

performance of

seven main

Jordanian banks

Found that there is a helpful relationship

between monetary

performance and asset size, asset operation

and operational

efficiency

The research used different

variables and it was

conducted in Jordan

Kumbirai and Webb (2010)

Performance of

Monetary banks in South Africa 2005-2009

The research found that

general bank

performance improved significantly in the first

two years of the

analysis. An important change in trend is

noticed at the

beginning of the global fiscal crisis in 2007,

reaching its peak

during 2008-2009

The Study used different Variable and was conducted in South Africa

Raza et al., (2012)

Use of financial ratios to measure financial

performance

Most Scholars and

researchers use

financial to measure financial performance

Used different variables

De Young et

al., (2004)

How the internet Touches

production of and

performance at

public Banks.

Internet acceptance

upgraded community

banks effectiveness via improved revenue from

deposit service

charges.

This study was conducted in

the United states of

America.

Siam A. Z.

(2006)

Title role of the electronic

banking

amenities on the

incomes of

Jordanian banks.

The results revealed

paperless banking

amenities had an

undesirable influence on the productivity of banks in the short run.

This study focused on short run profitability of the banks and used cost of infrastructure, cost of staff

training and cost of

environment creation.

Ceylan et al., (2008)

The effect of e-banking on bank productivity in Turkey

E-banking was a steady

procedure and e-

banking activities had a confident result on

performance of

banking system.

The study used

macroeconomic variables to assess the result of e- banking.

Sullivan R. J (2010)

How has the

acceptance of

internet banking

The research found no methodical indication that banks were either

28 influenced

performance and risk at banks?

aided or harmed by giving internet delivery channel.

Adudo &

King’oo (2012)

The correlation

between e-

banking and

monetary performance among profitable banks Kenya

The research

established that there exists a correlation

between reliant

variable as measured

by ROA and the

liberated variable as

measured by

investment in paperless banking.

The relationship established is a reverse relationship and ROE and performance have not been investigated.

Maiyo (2013) The result of

automated

banking on

financial

performance of

commercial banks in Kenya.

The research revealed that commissions from debt cards, credit cards and mobile banking has an important result on returns on asset.

The study covers only one delivery channel.

Okiro et al., (2013)

The influence of

mobile banking

on performance

of commercial

institutions in Kenya.

The study established that adoption of mobile and internet banking has been sluggish due

to impaired

inaccessibility of

infrastructure and lack of helpful regulation of mobile and internet banking.

The study used different variables and the focus was also different.

Njogu (2014) The relationship

of financial

performance of profitable banks

and electronic

banking technology

The research found out that exists a very

durable correlation

between financial

performance of

profitable banks in Kenya and electronic banking

The study addressed only one delivery channel.

Makokha et

al., (2015)

Result of real

time gross

settlement on

monetary

performance of

public

universities in Kenya

The research

established that the use of RTGs does not affect the monetary

performance of the

University

Used different variables

29 Internet Banking

• Electronic Money

• Electronic Bill Payment

Mobile Banking • Cash transfers • Deposit taking

•

Real Time Gross Settlement • Interbank Transfers • Interbank settlement

Financial Performance • Return on asset

• Return on equity

2.5 Conceptual Framework

A theoretical framework is a systematic tool with numerous differences and settings. It is

used to make theoretical differences and consolidate ideas. In this study there are two key

variables that have been identified; independent and dependent variable.

Independentvariables Dependentvariable

Figure 2.1: Conceptual frame work Source: Researcher, 2017

The conceptualization seeks to examine the relationship between internet banking, mobile

banking, real time gross settlement and financial performance of commercial banks in Kenya.

In the model, the dependent variable is monetary performance of profitable banks while the

independent variables are internet banking, real time gross settlement, and mobile banking

30

CHAPTER THREE

RESEARCH METHODOLOGY

3.1 Introduction

This chapter gives a brief description of the methodology that was used in steering the

research study. This chapter is organized into the following sections; section 3.2 explains the

research design used section 3.3 shows the populace and sample design of the study, section

3.4 shows the information collection instruments used, and lastly section 3.5 explains the data

analysis techniques and models used.

3.2 Research Design

The research design talks about the overall plan that integrates the different mechanisms of

the study in a logical way, ensuring that the research successfully address the research

problem (De Vaus, 2011). This study adopted a descriptive design in order to describe the

data and characteristics about the population. This method attempts to discover the source of

a specific event or situations. It also presents evidences concerning the nature and status of a

situation as it happens at that time of the study. Such a method tries to define present

circumstances founded on the impersonations or reactions of the participants of the research.

It seeks to answer questions such as who, what, where, when, and how. Evocative approach is

quicker and more real-world in terms of funding and therefore allows space for flexibility

when more important new issues, possibilities and queries come up during the time of the

research (Sekaran,2010).

3.3 Target Population

The target population for the study was census of 43 commercial banks in Kenya. The

31

that; target populace denotes to the whole group of personalities or objects to which scholars

are interested in simplifying the assumptions.

3.4 Data Collection

The study used census of 43 commercial banks as population. This universe method allows

greater data accuracy. It also gave the researcher an opportunity to gather more knowledge on

the study problem.

3.4.1 Data Collection Instruments

The study relied on secondary data extracted from Central bank of Kenya bank’s supervision

reports and printed audited yearly reports of the 43 commercial banks. With the secondary

data composed, returns on assets and Equity for the pertinent years was calculated. The

data collected covered the period 2012-2016.

3.4.2 Data Collection Procedure

The study used ancillary data found in the central bank performance results for the period

covered in the study. The researcher used secondary data and adopted the hypothesis driven

approach, a priori the researcher used the hypothesis and looked for dataset to address the

hypothesis.

3.5 Data Analysis and Presentation

The study used both descriptive and inferential figures in evaluating the data. Examination

was carried out with the assistance of Statistical Package for Social Scientists (SPSS).The

study used secondary data. The data was be fed into the computer, and study was done.

Descriptive statistics such as mean score, rate of recurrence or frequencies and percentages

for each variable were computed and formulated using frequency distribution tables. In order

to test the relationship between the variables the inferential tests including the Pearson