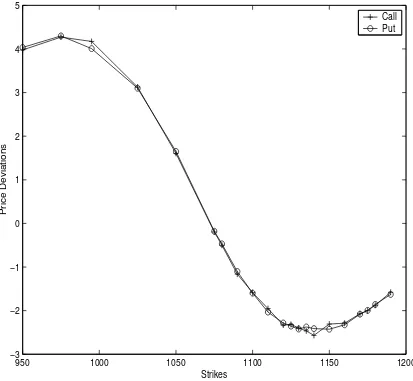

Price Deviations of S&P 500 Index Options from the Black Scholes Formula Follow a Simple Pattern

Full text

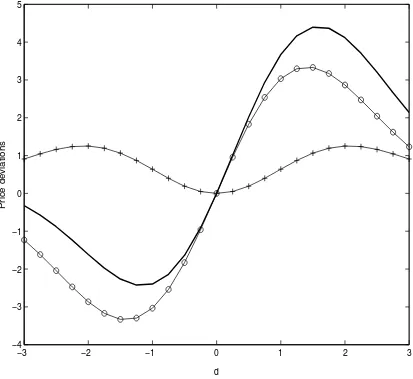

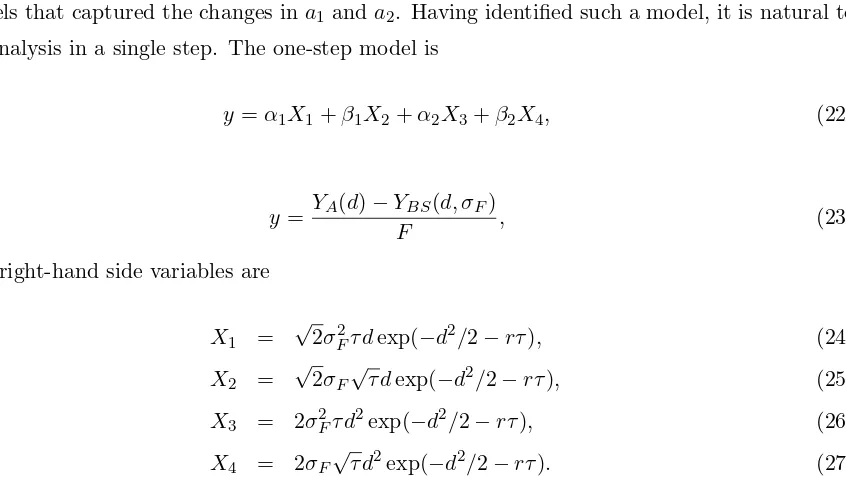

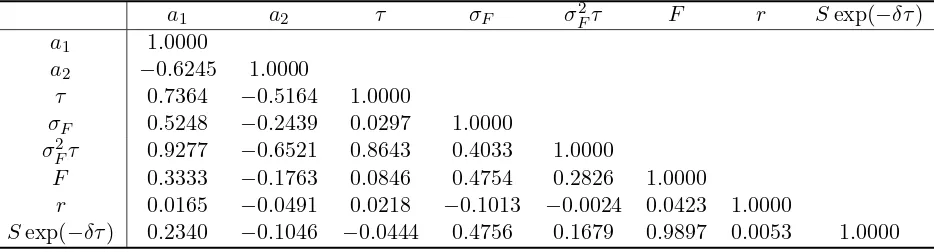

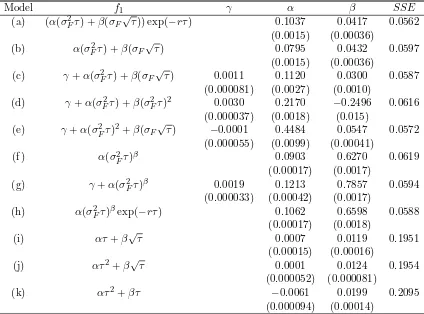

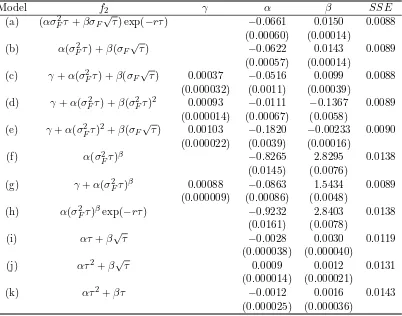

Figure

Related documents

One course (or 3 CU) from non-Emory study abroad programs may be applied toward the GHCS, Predictive Health, or Nutrition Science minor elective requirements.. (Courses taken

Implied Volatility Futures Price Strike Time to Expiry Interest Rates Volatility Options Pricing Model (e.g., Black Formula) Option Price Futures Price Strike Time to Expiry Implied

respective attorneys or accountants, the United States Trustee, or any other person employed in the office of the United States Trustee, except th.at I represent the

Away from the hustle and bustle of the city, Faber Peak Singapore (formerly The Jewel Box) features a vibrant cluster of dining and entertainment, cable car joyrides

In view of the fact that users’ personal information can have impact on their future decisions and that users are not able to assess this circumstance in

En la primera parte de este artículo se espera darle relevancia y objetividad al concepto de democracia y las variantes entre lo real y lo ideal; en un segun- do momento, se

Now suppose the firm has talked with its investment banker and has gotten assurances that it can issue up to $600 of debt at a 10% interest rate.. If the firm takes the advice of

Like the extraordinarily organized way in which I had learned energy anatomy and was later led to read archetypal patterns, divine order makes itself known in all areas of our