High Order Portfolio Optimization Problem with Transaction Costs

Full text

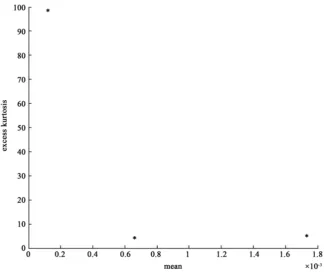

Figure

Related documents

The risk structure developed from this study shows that logistics practitioners perceive four distinct # of risk, which were formulated in the ISM" based modelling

Additionally, it is important to note that opioid users did not report decreased pain levels or improved functioning at the start or end of treatment, which would have been expected

The Rural School and Community Trust identified ten research-based reasons why small works: (1) students participate more, both in curricular and co-curricular

Stages in the Turnaround Cycle: Chapter 10, Pages 91-109 Management Change Stage; Evaluation Stage; Emergency Stage; Stabilization Stage; Return to Normal Growth Stage?. Key

Estimates of the effectiveness of these mitigation measures to limit potential flood damage in the river delta indicate that prevented damage and reduced risk could be

Gera Assessment of hydro- meteorological drought in the Danube Plain, Bulgaria Procjena hidrometeorološke suše u Dunavskoj ravnici u Bugarskoj and forecasting future

Later on this role has been taken over by non-profit organizations in co-operation with the government (similar situation as in Slovakia, where the strong state took care