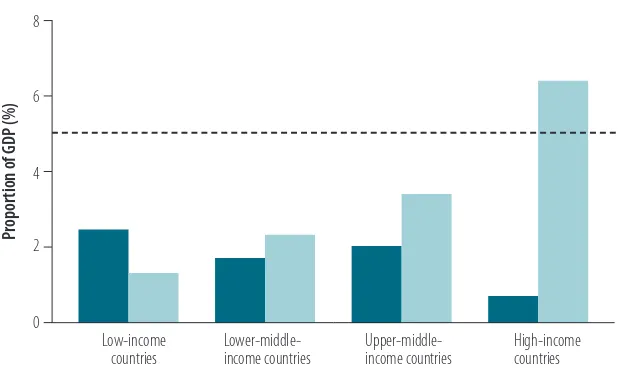

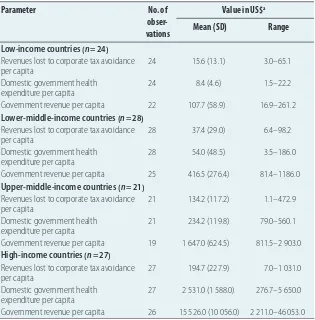

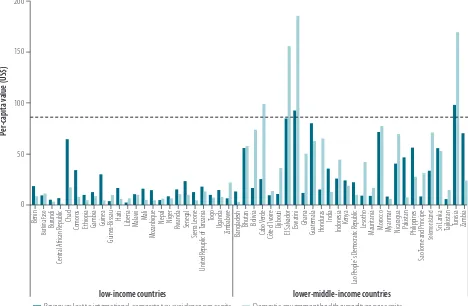

International corporate tax avoidance and domestic government health expenditure

Full text

Figure

Related documents

To date, large numbers of genetic association stud- ies using the candidate gene approach for asthma and asthma-related phenotypes have been conducted in different populations..

We find that the announcement effect of SWF investments in listed companies is positive and the level of transparency of SWFs influence the positive impact of

Notwithstanding substantial evidence that increasing the level of disclosure will enhance individual investor participation in stock markets, other work has argued that

ever, if inflation and domestic macroeconomic overheating are a concern, sterilization of the liquidity injected by interven- tions may be necessary. But sterilization can

Financial Fraud Action UK works in partnership with The UK Cards Association on industry initiatives to prevent fraud on credit and debit cards, with the Fraud Control Steering

NetVanta 2000 Series of security appliances employ an expanding array of seamlessly integrated services featur- ing anti-virus, intrusion prevention, Application Intelligence

RE Retained earnings statement SCF Statement of cash flows Based on the Starbucks Corporation financial statement data shown in Exercise 1–22, pre- pare an income statement for the