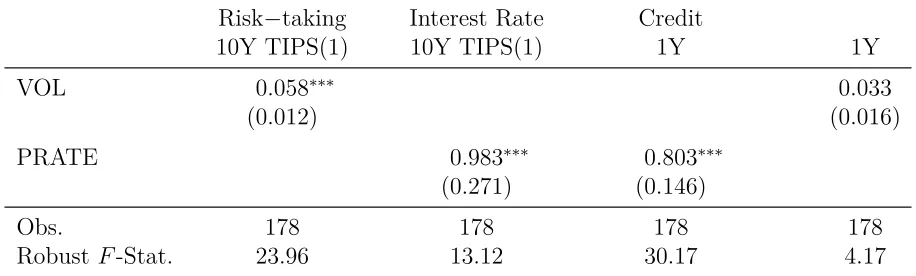

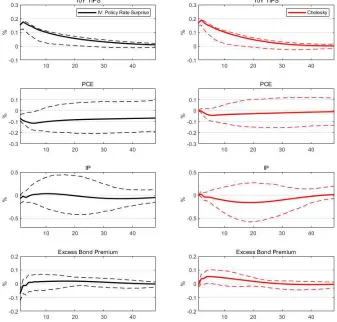

The Long term Rate and Interest Rate Volatility in Monetary Policy Transmission

Full text

Figure

Related documents

Pastry Arts Diploma - for Restaurant Page 17 Superior Culinary Arts Diploma Page 15 Superior Pastry Arts Diploma - for Restaurant Page 19 PROFESSIONAL PROGRAMS

This study is one part of a larget· project which addresses: (1) accessibility of pre-professional clinical contact hours in a variety of settings and (2) the perceived value

There is an established tradition of social and environmental accounting (SEA) research that has examined organisational motivations for undertaking Corporate

Intangible assets have grown in importance for both investors and managers in recent years. With the growth of global markets, the service sector, and the level of mergers

Farmers’ optimal land allocation strategy, producers’ biofuel production plan, blenders’ optimal biofuel blend, biomass prices between farmers and producers, cellulosic bio- fuel

First, we apply bivariate DCC-MGARCH models to extract dynamic conditional correlations between European stock markets, which are then explained by interest rate spreads,

First, this Comment will examine the underlying technology behind cryptocurrencies and the inherent regulatory challenges the technology produces. It will focus primarily upon