This report identifies how top performing organizations

automate the planning, budgeting, and forecasting processes to lead towards business success.

April, 2015

Nick Castellina, Research Director, Business Planning and Execution

Report Highlights

Best-in-Class organizations are 39% more likely to automatically guide users through the planning, budgeting, and forecasting process.

The Best-in-Class are 50% more likely to be able to assign resources and workflows for budgeting and forecasting activities.

Organizations with automated processes are 49% more likely to enable business units to work

collaboratively with finance throughout the budget process.

Organizations that automate financial planning create 20% more accurate forecasts.

correct process, and therefore, rely on guesswork while taking less valuable information into account. This is a huge mistake, because accurate plans, budgets, and forecasts provide business leaders with the confidence that they can use when making decisions that guide the business towards success.

Organizations must provide employees with tools that can help them to complete these processes quickly, comprehensively, and accurately. This report, based on a survey of over 200 organizations, identifies how top performing organizations automate the planning, budgeting, and forecasting processes to lead towards business success.

The Trouble with Forecasting

In Aberdeen's 2014 Financial Planning, Budgeting, and Forecasting and Enterprise Performance Management

benchmark survey, respondents were asked to identify the ‘‘top two’’ pressures that they face in planning, budgeting and

forecasting (Figure 1).

Figure I: It’s Never Easy

26% 30%

32% 37%

0% 10% 20% 30% 40%

Inability to trace business success to its key components Poor communication, coordination, and collaboration across departments or divisions Market volatility creates the need to dynamically account for change Current budgeting and forecasting process is too long and resource-intensive

Percentage of Respondents, n = 201

Source: Aberdeen Group, August 2014

forecasts can be a

challenge, and

unfortunately, many

employees are not

trained or do not

possess the

knowledge on how to

execute these

correctly. Top

performers automate

these processes to

improve efficiency

and accuracy.

www.aberdeen.com company performance. Classified by their self-reported performance across several key metrics, each respondent falls into one of three categories:

• Best-in-Class: Top 20% of respondents based on performance

• Industry Average: Middle 50% of respondents based on performance

• Laggard: Bottom 30% of respondents based on performance

• Sometimes we refer to a fourth category, All Others, which is Industry Average and Laggard combined. frustration, resulting in less effective planning than is needed.

Further, even if these tasks were easily completed, there is still a chance that the plans, budgets, and forecasts that are produced would be inaccurate due to frequently changing markets. Lack of visibility and transparency is a common theme in business planning, and this is no exception. If employees aren’t able to access the right information to assist in their planning at the time when their plans are being made, then the forecasting process becomes very difficult.

Solving the Problem

So what is an organization that struggles with completing the financial planning, budgeting, and forecasting processes to do? The number one strategy of Best-in-Class organizations is to automate the workflows related to these processes. Automation requires reliance on technology that can provide enhanced capabilities. For example, Best-in-Class organizations are 39% more likely to automatically guide users through the planning, budgeting, and forecasting process (Figure 2). The purpose of this is to ensure that all essential stakeholders are included, and required information is identified and used, and that information is centralized and aligned.

Enterprise Performance Management Benchmark Survey, respondents were ranked on the following criteria:

• Percentage of financial reports delivered in the time needed for decision-making:

o Best-in-Class - 94% o Industry Average - 72% o Laggard - 63%

• Percentage that actual costs are within budgeted costs (above or below):

o Best-in-Class - 4%, o Industry Average - 11% o Laggard - 35%

• Percentage that actual revenue is within forecasted revenue (above or below):

o Best-in-Class - 3% o Industry Average - 12% o Laggard - 37%

Automation comes from the software available to business users intended to aid in all aspects of financial planning, budgeting, and forecasting. Top performers have implemented a variety of different types of software stretching from Enterprise

Performance Management (EPM) to applications devoted specifically to financial planning, budgeting, and forecasting (Table 1). Sixty-six percent (66%) of the Best-in-Class have planning, budgeting, and forecasting applications which help to provide structure to these processes. Additionally, the Best-in-Class are 38% more likely to utilize EPM to ensure that they have accurate insight into performance data and can make more informed decisions. Similarly, the Best-in-Class are 69% more likely to utilize Business Analytics to improve their ability to predict outcomes. Combined, these tools can provide the automation referenced above by providing end users with guidelines, process flows, and valuable data and analysis capabilities.

43% 36%

24%

0% 20% 40%

Participants in the planning / budgeting / forecasting process are automatically

guided through steps

Per

cent

ag

e

of

R

espo

nd

ent

s,

n =

2

www.aberdeen.com Source: Aberdeen Group, August 2014

The Benefits of Automation

The essential capabilities related to automation in financial planning,

budgeting, and forecasting make these processes easier to complete quickly, more accurately, and are now repeatable. In fact, organizations that

automatically guide users through the process are more likely to have a variety of capabilities that ensure that all essential steps are completed (Figure 3).

Figure 3: Crossing the Ts and Dotting the Is

55% 48% 87% 75% 69% 36% 32% 52% 53% 37% 0% 20% 40% 60% 80% 100% Standard workflow for decision-making

Ability to assign resources and workflows for budgeting and forecasting activities Budget templates are used to communicate and manage input Corporate process for budget revisions, roll-ups, and approvals has been established and implemented

Ability to create allocation tables to assign costs throughout the organization Per cent ag e of R espo nd ent s, n = 2 01

Automated Not Automated

Source: Aberdeen Group, August 2014

Corporate / Enterprise

Performance Management 44% 32%

Planning, Budgeting, and

Forecasting Applications 66% 51%

Business Analytics 49% 29%

Dashboards 70% 35%

these activities. This means they can ensure that each and every employee knows what they are responsible for and what they need to do in the process. The

organization can ensure that no essential part of the process is overlooked. This is because these organizations are 67% more likely to have budget templates. Next, since the entire process is automated, the organization can more efficiently

consolidate and approve the information before allocating finalized budgets across the organization.

Automation in financial planning, budgeting, and forecasting helps to ensure that essential information is available and utilized in order to improve accuracy and agility (Figure 4). For example, organizations that have automated these processes are almost twice as likely to be able to incorporate business drivers into the ongoing forecasting process. It is possible because employees can easily find and integrate real-time data. For example, this creates the ability to reforecast as market

conditions change, which would be extremely difficult with a cumbersome forecasting process.

Figure 4: Integrating Essential Data

52%

44%

55%

50%

41%

27% 25%

38% 35%

27%

0% 20% 40% 60%

Ability to incorporate business drivers into the on-going

forecasting process

Real-time updates to financial metrics

Ability to re-forecast as

market conditions

change

Ability to perform “what if” scenarios and change analysis

Business users are able to create reports / charts in a self-service

capacity

Per

cent

ag

e

of

R

espo

nd

ent

s,

n =

2

01

Automated Not Automated

www.aberdeen.com service capacity. Employees will be much more likely to follow

the process since it’s easy to access the information they need. While these organizations are very clearly being walked through the steps to complete plans, budgets, and forecasts, they can also understand when it is time to include some advanced analysis in hopes of improving accuracy.

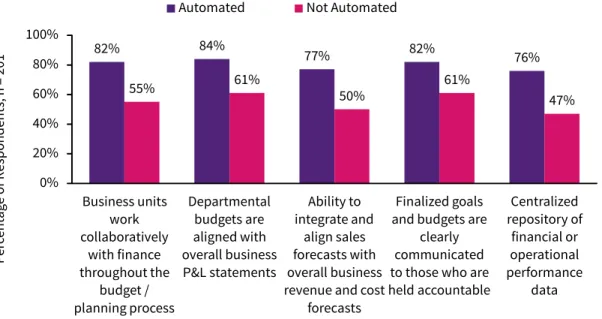

Lastly, automating the financial planning, budgeting, and forecasting process allows for cross-organization collaboration, ensuring that all key stakeholders are involved and that budgets are aligned (Figure 5). In the past, there may have been

employees on the line of business with real insight into future performance that were not consulted when creating forecasts. With automation, that is no more.

Figure 5: Automating Collaboration

82% 84% 77% 82% 76%

55% 61% 50% 61%

47% 0% 20% 40% 60% 80% 100% Business units work collaboratively with finance throughout the budget / planning process Departmental budgets are aligned with overall business P&L statements Ability to integrate and align sales forecasts with overall business revenue and cost

forecasts

Finalized goals and budgets are

clearly communicated to those who are held accountable Centralized repository of financial or operational performance data Per cent ag e o f R espo nd ent s, n = 2 01

Automated Not Automated

Source: Aberdeen Group, August 2014

automated

processes are 62%

more likely to have

a centralized

repository of

across the organization and have budgets add up to goals. It’s the only way to ensure that the organization’s plans and strategies will actually lead to profits. Automated processes also help to ensure that everyone is held accountable to their goals. Employees are able to monitor their performance on an ongoing basis. In fact, organizations with automated processes are 62% more likely to have a centralized repository of performance data. This completes the lifecycle from planning through execution.

The capabilities provided by automation in the planning process lead to several tangible benefits (Table 2). First, these organizations are able to

provide more accurate financial reports to more key stakeholders. This leads to improvements in time to decision as well as more accurate budgets and

forecasts. With this information, business leaders can make decisions that will grow the business and lead to improved productivity and profit margins.

Table 2: The Results

Source: Aberdeen Group, August 2014

Average Performance Automated Not Automated

Percentage of reports delivered in the time needed by

managers 80% 75%

Percentage of stakeholders with access to

performance data 74% 58%

Decrease in time-to-decision over the past year 12% 9%

Increase in operating margins over the past 24 months 6% 4%

Increase in productivity over the past 24 months 6% 4%

Percentage within budgeted costs of actual costs 12% 15%

Percentage within forecasted revenue of actual

www.aberdeen.com difficult task. Unfortunately, many employees just do not have

the time, knowledge, and access to data that would allow them to complete these processes correctly. Still, without accurate forecasts, organizations will not be able to have confidence when making decisions to grow the business. Therefore, Best-in-Class organizations are 39% more likely to automatically guide users through the planning, budgeting, and forecasting process. As a result, these organizations can better standardize and streamline the process, increase access and utilization of data and analysis, and improve collaboration and communication. In fact, organizations that have automated these processes are:

67% more likely to have budget templates

50% more likely to be able to assign resources and workflows for budgeting and forecasting activities 76% more likely to have real-time access to financial

metrics

43% more likely to have the ability to perform ‘‘what if’’ scenarios

49% more likely to enable business units to work collaboratively with finance throughout the budget process

By relying on dedicated software, automation is the key to efficient and accurate financial planning, budgeting, and forecasting.

Let’s Do This Together: Collaborative Financial Planning, Budgeting, and Forecasting; January 2015

Staying Ahead of the Curve with Agile Financial Planning, Budgeting, and Forecasting; October 2014

Mobile EPM: Improving Decision-Making when Time is of the Essence; June 2014

Beyond Spreadsheets: The Next Level in Planning, Budgeting, and Forecasting; May 2014

Author: Nick Castellina, Research Director, Business Planning and Execution (nick.castellina@aberdeen.com)

About Aberdeen Group

Since 1988, Aberdeen Group has published research that helps businesses worldwide improve performance. We identify Best-in-Class organizations by conducting primary research with industry practitioners. Our team of analysts derives fact-based, vendor-agnostic insights from a proprietary analytical framework independent of outside influence. The resulting research content is used by hundreds of thousands of business professionals to drive smarter decision making and improve business strategy.

Aberdeen's content marketing solutions help B2B organizations take control of the Hidden Sales Cycle through content licensing, speaking engagements, custom research, and content creation services. Located in Boston, MA, Aberdeen Group is a Harte Hanks Company.

This document is the result of primary research performed by Aberdeen Group. Aberdeen Group's methodologies provide for objective fact-based research and represent the best analysis available at the time of publication. Unless otherwise noted, the entire contents of this publication are copyrighted by Aberdeen Group, Inc. and may not be reproduced, distributed, archived, or transmitted in any form or by any means without prior written consent by Aberdeen Group, Inc.