THE BENEFIT OF

THE CRISIS: GAINING EFFICIENCY

RETAIL

BANKING

IN CEE

The benefit of the crisis:

Gaining efficiency

1

CONTENT

PREFACE FOREWORDEXECUTIVE SUMMARY

PART I – CEE RETAIL BANKING MARKET EVOLUTION 2008-2014

HARSHENING MARKET CONDITIONS TRIGGER EFFICIENCY IMPROVEMENT MEASURES PART II – THRIVING TOWARDS OPERATIONAL EXCELLENCE

HOLISTIC OVERVIEW OF APPLIED EFFICIENCY IMPROVEMENT MEASURES ACROSS CEE RETAIL BANKS

PART III – SUMMARY AND OUTLOOK

SEVEN KEY AREAS TO FURTHER IMPROVE EFFICIENCY APPENDIX

METHODOLOGY AND SCOPE OF THE STUDY ABOUT US 3 5 6 11 15 33 37 40 42 CONTENT

3

PREFACE

PREFACE

Frigyes Schannen Managing Director

Roland Berger Strategy Consultants

Patrick Desmarés Secretary General Efma

In the last five years, the majority of the CEE banks executed significant optimization programs in order to adjust resources and adopt the operation to the turbulent market environment. The banks in the region significantly increased the level of cost consciousness and adjusted their operating/business model to a new level, where the cost focused approach gained significant role. Overall, in the whole region the structural changes transformed the CEE banking sector’s landscape into the next level of banking.

There have been several individual and important studies already focusing on selected impacts of the crisis on its own, e.g. assessing the challenges and impacts of the crisis on risk management and in collection. Well, in reality, the impacts are never separated and always interlinked, so our aim with this report to better understand the overall picture. Therefore, Roland Berger Strategy Consultants and Efma, kindly endorsed by Sberbank Europe, conducted a holistic review on gaining efficiency and governance model optimization efforts in the CEE banking region. In the study, we do not just review the events of the past, but also present the identified key success factors and outline further improvement potentials.

This report in your hand contains the summary of results and provides an insight into how retail banks in the region handled the crisis covering the following main questions:

> How did banks change their governance/organizational setups? > How were client segment/target group focuses redesigned?

> How did the channel priorities change (e.g. role of branch network)? > How to focus on personnel and material costs optimizations? > How did banks increase transparency?

During the last months, we have also personally interviewed board members of sixty large retail banks all across CEE. These findings were combined with the market and methodology knowledge of Roland Berger and the insights obtained during numerous projects in the region.

We still see that in the coming years cost efficiency improvement will remain a key strategic element. Even though the crisis is becoming pale as majority of the CEE financial markets now display cautious growth trends, the profitability of the sector is still below the historical benchmarks. The players are facing new challenges in gaining back the trust of customers and keeping the pace of the digital solutions across all retail markets.

It is our clear aim that this report can support you and your organization in assessing your governance model and strategy with identifying further improvement potentials to consequently better cope with the changing market environment in CEE.

5

FOREWORD

FOREWORD

András Hámori Member of the Board Sberbank Europe AG Looking back six years ago, it’s important to remember that 2008 began the most challenging time for the banking sector in Central and Eastern Europe for 20 years. The CEE region was hit doubly hard as downturns in local economies coincided with outflows of funding to Western European banks.

But with many countries beginning to recover, it’s now less a crisis, more the status of today’s reality. We have to live with it, draw the conclusions and lessons learned and find the opportunity for gaining efficiency in these circumstances. In Sberbank Europe, we realized the demand for the mindset change as our competitors. We had to develop new strategies for CEE countries, set new “rules of the game”, define new steering and governance models and new value propositions and focus areas.

We were forced by the new setup to take the next step and begin focusing on actual growth opportunities. Doing this exercise meant taking into consideration all the available know-how, good and bad practices. Reshaping our cost efficiency and governance model is still a high priority for us along with clear definition of our target segment and channel priorities in each CEE country.

These challenges motivated us in Sberbank Europe to follow this study closely. We consider it a useful insight, a detailed status report as at 2014 on the previous six years and the current issues and capabilities of the CEE retail banking sector complemented with valuable recommendations for future development. It is clear to us that there is still scope to increase efficiency – similarly to other banks – hence this study will hopefully help us and other readers to identify how to redesign governance models and increase efficiency based on experience and insight.

6

EXECUTIVE SUMMARY

EXECUTIVE SUMMARYThe crisis affected all retail banks, but the impacts are different in each CEE sub-region

Strategic focus is needed – Shift from product towards client centricity with transforming channel functions

100%

2008 2013

76%

MARKET ENVIRONMENTThe financial crisis has heavily hit the entire CEE banking market. While all surveyed banks were profitable in 2008, five years later every fourth bank realized losses. However, the impact of the crisis and recovery differs by subregion: Poland, Czech Republic and Slovakia (North Central Europe) managed to remain profitable in terms of ROE, whereas Hungary, Slovenia and Romania (Central Europe) had to cope with serious market downturns – yet there are already signs of recovery. In South Eastern Europe profitability plummeted, but due to the significantly increased NPL ratios a recovery still seems to be a long process.

Figure 1. Challenging market developments [% of banks with positive PBT within the sample]

After years of uncontrolled growth, the crisis forced CEE banks to realize that without more emphasis on operational efficiency and costs, profitable operations cannot be achieved with the desired result anymore. Everywhere, efficiency

improvement became a key concern. Moreover in today’s volatile, uncertain, complex and ambiguous world, a strategy where all market segments are equally targeted, cannot be maintained and a clearly set focus area is required. The entire industry is undergoing an enormous transformation process utilizing some of the best practices from other industries as well.

On the stagnating markets nearly all banks launched a huge variety of efficiency improvement programs from governance model changes to large scale process optimizations. In many cases, it was only enough to balance the negative effects of the top-line: solely 46% of the banks could achieve a real efficiency improvement in terms of their cost-to-income ratio.

7 EXECUTIVE SUMMARY

Holistic approach is required for definition of strategic focus

Revenue focus

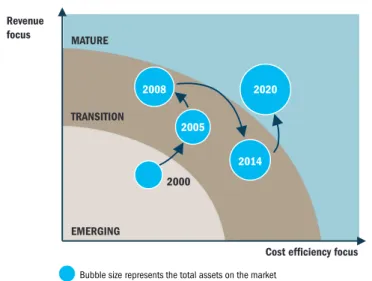

Cost efficiency focus MATURE TRANSITION EMERGING 2020 2014 2005 2008 2000

Bubble size represents the total assets on the market

Figure 2. Development and outlook on of the CEE banking market 2000-2020 – Overview of key phases

1. STRATEGIC FOCUS

In order to achieve sustainable, efficient and effective operations a holistic approach is required: optimizing not only the resources, processes, organization and improving the transparency, but also changing the general mindset of the bank. Following rather improvised, ad hoc counter measures to overcome the most difficult times of the crisis, it is now time to define strategic focal points for the future.

Banks are clearly moving from product centric operations towards client centricity providing differentiated treatment for predefined client subsegments. Along this road, affluent and micro clients are becoming the important growth targets – nearly at all banks. In order to excel in client relations, banks should learn how to be proactive in all possible client interactions from target segment definition to their value proposition. Channel efficiency and client needs should be optimized together and should reach an improved next level of service.

In order to better serve the clients, banks are applying a more balanced channel approach with changing roles. The branches are undergoing a transformation to become more advisory focused than before, while local administrative tasks are declining. This is a clear consequence of centralization and cost optimization measures based on the digital solutions.

In order to have an optimal product portfolio, banks need to master the delicate art of finding the right balance between a tailored value proposition and the standardization of product offerings. This is not equal to a forced shrinking of the product portfolio, but a rather intelligent review and adjustment of products.

8

2. GOVERNANCE MODEL

There were no tremendous governance model shifts in the past six years – The largest transformations were triggered by acquisitions/re-nationalizations. However, major banking groups present in the region adjusted their operations to enable stricter monitoring and control on their local subsidiaries. Clear indicators of these actions are the increasing presence of independent control functions (CFO, CRO) in Management Boards (+15%) with a considerable expatriate share (35%).

In the local organization setup we are again in the era of centralization on all levels: back-office functions and managerial roles are being centralized. With these measures the level of transparency and control has increased significantly.

The largest wave of outsourcing came to an end even before the crisis, when the increased capacity/quality need in some areas (IT, legal, CC) triggered further utilization of external capacities. However, many banks are now considering to (re) insource – at least partially – these same functions.

3. TRANSPARENCY

KPI systems have become more detailed and the frequency of reporting has

significantly increased. The demand for more numbers originated from three sources: regulators, headquarters and local management. The underlying issue of KPIs, which created a lot of frustration in the banks, that these requestors were not aligned and a lot of reporting was generated simultaneously, doubling/tripling the data and capacities. With time, a lot of efforts were invested to streamline the huge information flow into a level which can be sustained.

Some of the KPIs had direct and real value impact. For example, they provided the basis for sales force efficiency projects launched across the whole region. Nevertheless, further automation, streamlining and integration of KPIs are some of the key

challenges for the future. 4. RIGHTSIZING

CEE banks have made tremendous efforts to decrease their cost base to a lower level, and then again, through increased efforts to an even lower level. Actually, various cost reduction programs launched, year after year. The reason is partly a moving target: to reach a lower level due to market conditions. The other reason is the efficiency of the programs; only a part of the programs could really reach the target in reality. And only those were successful in the long run, which were able to combine a top-down (management commitment, clear target setting, responsibility, holistic thinking) with a bottom-up (structured analysis, long-term thinking, detailed-feasible adjustments) approach. IT and marketing (following serious cuts in past years) are the cost blocks that are expected to increase again in the future.

EXECUTIVE SUMMARY

Stable governance models

Increased level of transparency

9

5. PROCESS IMPROVEMENT

Standard process improvement methodologies (LEAN or Six Sigma) have been extremely popular: 53% of the banks applied them or something similar in the last years. Another 27% ran projects with their own or a group developed methodology. Opinions on the results have been mixed, since the majority of benefits are still to be realized in the future. Overall, these structured approaches are affecting the general mindset and the cost culture of the bank at the highest level. These impacts of course are rarely measurable, but we have seen structural changes due this impact and the real successful changes were rooted in this.

6. IT SYSTEMS

IT has transformed itself from a simple functional enabler to a real driver. All banks cutting IT expenditures (or postponing investments) are now regretting the missed opportunities to create a competitive advantage on the market.

Nevertheless, the structure of IT expenditures has changed. The forced prioritizations of projects enabled the organizations to achieve more focus on topics, which are really important. We can see a clear shift toward strategic business drive behind the major cost blocks and we tend to highlight that one of the greatest challenges for the future is still how to facilitate business decisions on IT investments.

7. CORPORATE CULTURE

Finally, we are all aware that sustainable operational excellence can only be realized with skilled employees who are actually involved day by day. This is a mindset change or a cultural shift including cost consciousness and need for continuous improvement, which is inevitable in order to reach the next level of banking. One might forget, this is not a single project to achieve, but a long lasting, meticulois step by step approach. Our review of the sector showed that lot of banks stand only at the beginning of this path.

EXECUTIVE SUMMARY

Popular process improvement methodology

IT became a real driver

True mindset change required

42

ABOUT US

Efma

As a global not-for-profit organisation, Efma brings together more than 3,300 retail financial services companies from over 130 countries. With a membership base consisting of almost a third of all large retail banks worldwide, Efma has proven to be a valuable resource for the global industry, offering members exclusive access to a multitude of resources, databases, studies, articles, news feeds and publications. Efma also provides numerous networking opportunities through working groups, online communities and international meetings.

Visit www.efma.com

Roland Berger Strategy Consultants

Roland Berger Strategy Consultants, founded in 1967, is the only leading global consultancy with German heritage and of European origin. With 2,400 employees working from 36 countries, we have successful operations in all major international markets. Our 50 offices are located in the key global business hubs. The consultancy is an independent partnership owned exclusively by 220 Partners. Roland Berger Strategy Consultants has also made a name for itself beyond the standard consulting business, establishing itself in the field of research and development. Numerous studies on current business and management issues bear the company’s logo.

The Roland Berger Strategy Consultants Academic Network, an association established in 1998 and comprising various universities, puts the company at the core of a continuous exchange of theoretical and practical knowledge. In addition, Roland Berger sponsors, chairs at several universities and publishes the Roland Berger Strategy Consultants Academic Network and the Papers on European Management series. Visit www.rolandberger.com

44

Many thanks to the following persons for collaborating in the production of this study:

Roland Berger Partners, Principals, Project Managers and Consultants who helped collect the data with the participating companies: Przemyslaw Vonau, Nikita

Ponomarev, Roland Zsilinszky, Codrut Pascu, Vladimir Preveden, Adrian Weber, Ioana Leaua, Alexander Klimov.

Furthermore, we would like to thanks for providing their insights, industry expertise and overall guidance:

From Efma – Patrick Desmarès, Lubomir Olach and Lukas Dzuroska From Sberbank Europe AG – András Hámori.

Roland Berger Financial Services team for analyzing the data and writing the study: Frigyes Schannen, Iván Radnai, Johanna Járai, Kristóf Schum, Balázs Zoletnik, Ákos Újlaki and Dávid Soós.

© Roland Berger Strategy Consultants, Efma 2014, all rights reserved

www.rolandberger.com www.efma.com

THE BENEFIT OF

![Figure 1. Challenging market developments [% of banks with positive PBT within the sample]](https://thumb-us.123doks.com/thumbv2/123dok_us/9245923.2411285/7.892.257.754.496.735/figure-challenging-market-developments-banks-positive-pbt-sample.webp)