Taxable Income Responses to 1990s Tax Acts: Further Explorations

Full text

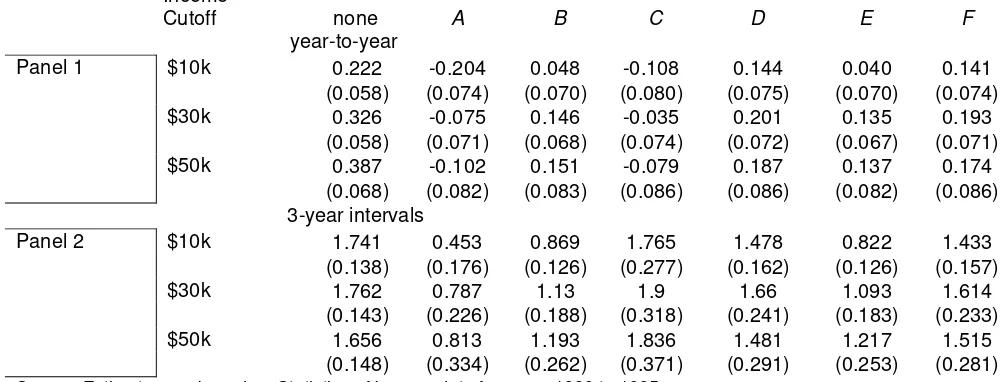

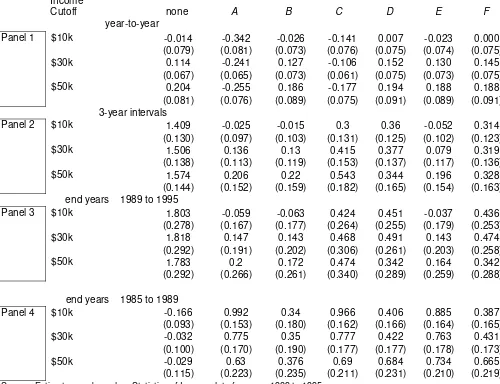

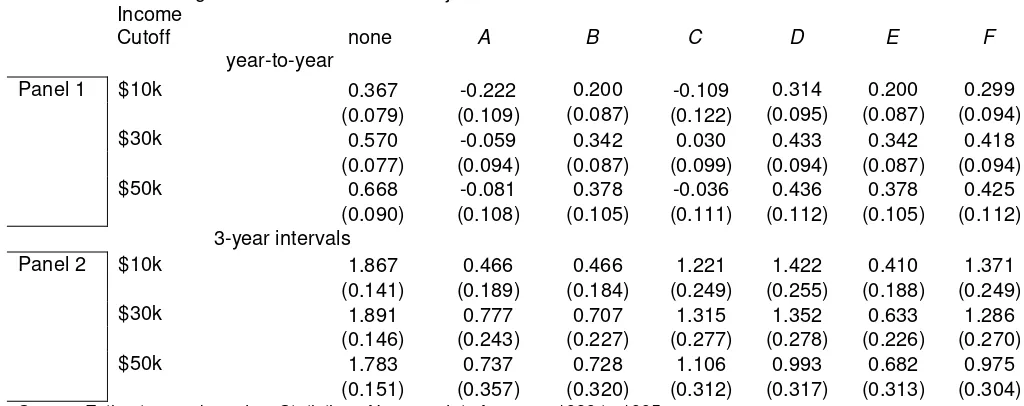

Figure

Related documents

In each taxation year, Dundee Industrial REIT will generally be subject to tax under Part I of the Tax Act on its income for the year, including net taxable capital gains for

investment income gross, the resident investor is required to declare such investment income in his tax return and be charged to tax on such income under normal rates. As from year

Rs.10,000 is to be deducted from Gross Income, before arriving at taxable income.. i) Calculation of tax in the present year including arrears ii) Calculation of tax in the

Section 80 CCE provides for the contribution made by the Central Government or any other employer to a pension scheme under section 80CCD(2) shall be excluded

The addresses of any creditors listed in my bankruptcy petition must be the address used by the creditor within the last 90 days and the creditor has not given me any other

Israel also changed its tax regime for reporting foreign (non-Israeli) income from 2003 in addition to the regular tax on Israeli source income and has recently instituted a new

Adjusted Income is calculated by firstly adding the total amount of the specified reliefs actually used by an individual for a tax year to his or her taxable income for that year

Corporate income tax is levied on the taxable profits of private companies at a rate of 18 % for year 2012 with a special rate of 0% for investment funds, pension funds, insurance