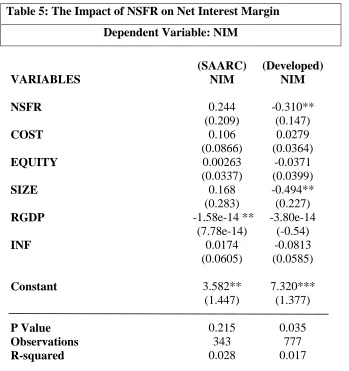

Impact of Net Stable Funding Ratio Regulations on Net Interest Margin: A Multi-Country Comparative Analysis

Full text

Figure

Related documents

Pressurising the ratio acts as a statutory liquidity analysis regarding liquidity ratio shows how quickly increase or cash reserve bank deposits, the liquidity ratio and hence does

Other funding with residual maturity between six months and less than one year not included in the above categories, including funding provided by central banks and

The primary categories of assets that compose RSF include securities (residential mortgage-backed securities, corporate debt securities, securities representing claims on sovereigns

characteristics have unquestionably changed, and it is appropriate that this is reflected in an adjustment to the relevant RSF factor. Moreover, the 65 per cent RSF for

Vindicia leverages our billing and marketing solution when working with SaaS clients to perform cohort analyses across different product groups.. We also help them understand

Furthermore, there are inconsistent rental policies across the industry that could undermine the sales-only windows.31 If the studios' sales-only window applies only

To do so, decision makers should integrate real options—e.g., options to defer, abandon, and expand—into the defense R&D project evaluation.. As soon as new information

is recorded is linked to retail deposits and not corporate. As the data goes back to January 2008, the results include and spans across the financial crisis. The data illustrates