(

Translation)

Opinion of the Independent Financial Advisor on

Acquisition of Asset Transaction

for

Inter Far East Engineering Public Company Limited

Prepared by

JVS Financial Advisory Company Limited

18 September 2015

Disclaimer: The English translation report has been prepared solely for the convenience of foreign shareholders only. If there is discrepancy between the English translation and Thai report, the Thai report shall be definitive and the official document and supersede the English translation report in all aspect of any inconsistency with this English translation report.

Table of Contents

Executive Summary 5

Part 1 Acquisition of Asset Transaction

1. Characteristics and Details of Acquisition of Asset Transaction

1.1 Transaction Date 10

1.2 Related parties and Relationship with the Company 10 1.3 General Characteristics of the Transaction 10

1.4 Transaction Size 10

1.5 Detail of Asset Being Acquired 12 1.6 Total Value of Consideration 18 1.7 Basis for Determining Value of Consideration 18

1.8 Sources of Fund 18

1.9 Expected Benefit to the Company 19 1.10 Conditions for entering into the Transaction 19

2. Objectives, Benefits, Cons, and Risk Factors of the Transaction

2.1 Background and Objectives of the Transaction 20 2.2 Benefits of the Transaction 43

2.3 Cons of the Transaction 43

2.4 Risk Factors 44

2.5 Sources of Fund 45

3. Return Evaluation and Rationale of Project 45

3.1 Return Evaluation of Lomligor Project 45 3.2 Condition of the Transaction 82

4. Summary of the Independent Financial Advisor’s Opinions 83

Part 2

Details of Inter Far East Engineering Public Company Limited 87

Details of Inter Far East Wind International Co., Ltd. 100

Details of Lomligor Co., Ltd. 104

Annex

Report on Feasibility Study of Wind Farm Project along the Coast of Pak Phanang, Nakhon Sri Thammarat (Prepared by management of the Company and amended by Independent Financial Advisor) 109

Abbreviations and Definitions

SEC, The Office of SEC Securities and Exchange Commission of Thailand

SET, The Stock Exchange Stock Exchange of Thailand

The Company, IFEC Inter Far East Engineering Public Company Limited

IWIND Inter Far East Wind International Co., Ltd., formerly named Green Growth Co., Ltd.

(GG), a subsidiary of the Company

LLG Lomligor Co., Ltd., formerly named SGC Wind Energy Co., Ltd. (SGC), a subsidiary of Inter Far East Wind International Co., Ltd. (IWIND)

GG Former name of Inter Far East Wind International Co., Ltd.

SGC SGC Wind Energy Co., Ltd., former name of Lomligor Co., Ltd.

IFA, Independent Financial Advisor

JVS Financial Advisory Company Limited

Acquisition of Asset Transaction Acquisition of asset which is investment in wind power plant of Lomligor Co., Ltd.

Pak Phanang Project 1 Wind Power Plant with a capacity of 10 MW. The project is located in Banpeang Sub-district, Pak Phanang District, Nakhon Si Thammarat. The power purchasing contract No. VSPP-PEA-004/2556 was signed on April 22, 2013 with agreed sales of 10 MW. Commercial Operating Date (SCOD) is expected within late September 2015.

Lomligor Project Wind Power Plant with a capacity of 10 MW. The project is located in Banpeang Sub-district, Pak Phanang District, Nakhon Si Thammarat. The power purchasing contract No. VSPP-PEA-006/2557 was signed on June 23, 2014 with agreed sales of 8.965 MW. It is expected that the Commercial Operating Date (SCOD) would be in late of Q2 2016.

Base Tariff, TOU Rate This rate calculated based on the true cost of transmission line and distribution line investment. It reflects the true cost at a given time under the assumption on cost of fuel, inflation, foreign exchange rate, and efficiency improvement of the power utilities at a certain level.

Automatic Adjustment Mechanism (Ft)

Ft is a variable tariff. It will be adjusted in line with changes in cost of fuel and power purchase which are beyond control of the power utilities and differ from base tariff

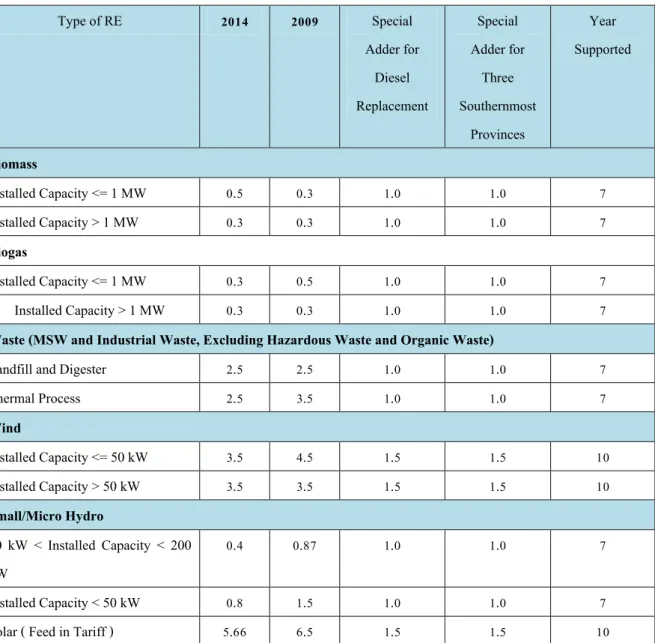

Adder In order to promote renewable energy, the Adder was introduced. It is an additional rate on top of the power purchase price with an objective to subsidize renewable energy project or alternative energy project. It will mark up on the electricity price during On Peak (the period of high electricity consumption) and Off Peak plus Ft.

FiT FiT (Feed in Tariff) is calculation of investment return considering all costs such as technology trend, materials, land, construction, wage, inflation, interest, etc. Unlike Adder, which adjusted in line with Base tariff and Ft, the state will pay FiT at fixed rate throughout the period of contract.

No. Jor. 146/2558

18 September 2015

Subject: Opinion of the Independent Financial Advisor on Acquisition of Asset of Inter Far East Engineering Public Company Limited.

To: Audit Committee and Shareholders

Inter Far East Engineering Public Company Limited

Refer: 1) Resolution of Inter Far East Engineering Public Company Limited Board of Directors’ meeting No. 11/2558

held on August 28, 2015, which the Board of Directors had resolved to approve the Acquisition of Asset (and its amendment).

2) Information Memorandum of Inter Far East Engineering Public Company Limited regarding the Acquisition of Asset Transaction (and its amendment).

3) Financial Statements of Inter Far East Engineering Public Company Limited and its subsidiaries as of December 31, 2012, December 31, 2013, and December 31, 2014 audited by AST Master Co., Ltd. and Karin Audit Co., Ltd. respectively. Financial Statements of Inter Far East Engineering Public Company Limited and its subsidiaries as of June 30, 2015 reviewed by Karin Audit Co., Ltd.

4) Financial Statements of Inter Far East Wind International Co., Ltd. and Lomligor Co., Ltd. as of December 31, 2012, December 31, 2013, December 31, 2014, and June 30, 2015.

5) Report on Feasibility Study of Wind Farm Project along the Coast of Pak Phanang, Nakhon Sri Thammarat (Jointly prepared by management of the Company and Gold wind)

6) Notification regarding details about the acquisition of Green Growth Co., Ltd. dated September 24, 2014. 7) Notification regarding Acquisition of shares of SGC Wind Energy Co., Ltd. dated May 29, 2015.

8) Notification Regarding investment in 16 subsidiaries and investment in Wind Power Plant Project dated August 21, 2015.

9) Company Certificate, Memorandum of Association and other documents, including interviews with the management and relevant advisors, of Inter Far East Engineering Public Company Limited and/or its subsidiaries.

Disclaimers:

1) The study results and opinions, rendered by JVS Financial Advisory Company Limited (“Independent Financial Advisor” or “JVS FA”) in this report, are based on information and assumptions obtained from the management of Inter Far East Engineering Public Company Limited and its subsidiaries and also from publicly disclosed information available in websites of the Office of the Securities and Exchange Commission (www.sec.or.th) and of the Stock Exchange of Thailand (www.set.or.th).

2) The Independent Financial Advisor will not be responsible or liable for any profit, loss or effect incurred by the Transaction and/or by the Company’s future performance from the Transaction.

3) The Independent Financial Advisor's study was conducted by using knowledge, skills, and cautions, based on sound professional practices.

4) The Independent Financial Advisor determined and analyzed the Transaction based on current situations and information available to our knowledge. If there is any material adverse change and effect of the situations and information, it may affect the opinions provided herein by the Independent Financial Advisor.

5) The Independent Financial Advisor’s opinions provided to the Inter Far East Engineering Public Company Limited’s Board of Directors, Audit Committee and shareholders do not ensure any success or completeness of the Transaction including the success of the Company to operate Lomligor Co., Ltd. to complete its construction and operation to produce and sell electricity to Provincial Electricity Authority, which might impact Lomligor operating result in the future.

Executive Summary

The Board of directors’ meeting of Inter Far East Engineering Public Company Limited (the “Company” or “IFEC”) No. 11/2558 held on August 28, 2015 had resolved to approve Inter Far East Wind International Company Limited (“IWIND”), a subsidiary of the Company which produces and distributes electricity from wind power, to make an additional investment in its subsidiary namely Lomligor Company Limited (“LLG”), formerly named SGC Wind Energy Company Limited. IWIND’s directors were authorized by the Board of Directors of the Company to consider, contact and negotiate to the seller as well as settle final conditions before entering into the transaction with total investment value not exceeding 800,000,000 baht.

The above transaction is considered an acquisition of assets pursuant to the Notification of the Capital Market Supervisory Board No. ThorJor. 20/2551 entitled Rules on Entering into Material Transactions Deemed as Acquisition or Disposal of Assets and its amendments and the Notification of the Board of Governors of the Stock Exchange of Thailand entitled Disclosure of Information and Other Acts of Listed Company concerning the Acquisition and Disposition of Assets, B.E. 2547 (2004) and its amendments (collectively referred to as the “Acquisition or Disposal Notification”). When considering the transaction size pursuant to the Acquisition or Disposal Notification, the size of the above transaction is of the highest value when calculated from Total Value of Consideration, based on the latest reviewed consolidated financial statement ended June 30, 2015, which equals to 10.12%. In addition, when aggregating the above transaction with other thirteen transactions entered into by the Company within the past six months, the cumulative transaction size together with the thirteen acquisitions during the past six months were equivalent to 55.32%. This is calculated based on Total Value of Consideration (44.12 per cent calculated based on Net Profit or 16.52 per cent calculated based on Asset Value) which is higher than 50 per cent but lower than 100 per cent and classified as Class 1 Transaction under the Acquisition or Disposal Notification.

Accordingly, the Company is required to disclose certain information regarding the entering into the above transaction to the Stock Exchange of Thailand (“SET”) and is required to hold a Shareholders’ Meeting to consider and approve the investment which requires an affirmative vote of not less than three fourths of the total number of votes of the shareholders attending the meeting and eligible to vote, excluding the vote of the shareholders having a special interest on this matter. As such the Board of Directors’ meeting resolved to convene the Extraordinary General Meeting of the Shareholders No. 1/2015 on October 9, 2015 to propose to shareholders for an approval of the Company’s entering into Acquisition of Asset Transaction.

Appropriateness of the Fair Price

Summary of investment in Lomligor Project

The Independent Financial Advisor opined that Free Cash Flow to Project (FCFP) Valuation Approach is appropriate for this valuation on wind power plant business, namely Lomligor Project. Net Present Value (NPV) of the project after deducting investment in the project is between 125.85 – 324.95 million baht while Internal Rate of Return of the project (Project IRR) is between 10.39 – 14.05%. The Project’s Equity IRR is between 11.36 – 17.59% and its payback period is approximately 7.36 – 7.95 years.

Therefore it can be seen that Net Present Value (NPV) of the project after deducting investment in the project discounted with the rate of 8.00% is between 125.85 – 324.95 million baht, so the project has positive NPV. The Project IRR is between 10.39 – 14.05%, which is appropriate rate of return. As such Independent Financial Advisor opined that the Company’s investment in Lomligor project under this Acquisition of Asset Transaction is appropriate.

Reasonableness of the Transaction.

Independent Financial Advisor opined that investing in Lomligor Project will enable the Company to expand its business of production and distribution of electricity from wind power in order to achieving sustainable growth and reducing the company’s risk from rely on its business of production and distribution of electricity from Solar Power. The investment will expand business scope of the Company. After the Commercial Operation Date (COD), the Company will realize revenue and profit of IWIND and LLG in its financial statement. The Company expected to realize income in the beginning of the 2nd half of 2016. This investment will help diversify the Company’s business risk as the Company will invest in various types of alternative energy business. As such it will stabilize the growth of the Company’s revenue from production and distribution of electricity in the future, which will help IWIND to achieve business continuity in its business of production and distribution of electricity from wind power. The Company planned to expand its wind power business via IWIND in the future. The Company might also plan to spin-off or issue new share and offer for sale to public, and list IWIND securities on the Stock Exchange of Thailand in the future. This would create value added and generate income to the Company in the long term.

Nonetheless, this acquisition of asset transaction by investing in Lomligor project is a new project (the construction and the distribution of electricity have not yet acheived). There is uncertainty on the completion of its construction and operation to produce and sell electricity to Provincial Electricity Authority. Moreover, by investing in Lomligor project, wind power, which will be used to produce electricity, is uncontrollable due to the uncontrollable nature of wind. Thus wind power source is depends on times and wind direction. Although the Company had tested the wind power and conducted the feasibility study of the project based on yearly average wind power on site. The Company cannot set and control the wind power due to uncontrollable nature of wind source. In addition, the Company’s investment in Lomligor Project will be exposed to certain risks as investment in other investment in other alternative energy business including changing of government’s policies and supports, and wholesale power purchasing price in the future.

Benefits, Cons, and Risk Factors of the Company’s investment in Lomligor Project under this Acquisition of Asset Transaction can be summarized as follow:

Benefits of the Transaction

1. By investing in Lomligor project, the Company will engages in business of wind power production and distribution, which is expected to generate revenue from the production and distribution of electricity. It would also expand the business operation of the Company. After the Commercial Operation Date (COD), the Company will realize revenue and benefit of IWIND and LLG in its financial statement. The Company expected to realize income from the beginning of the 2nd half of 2016.

2. By investing in Lomligor project, the Company will has 1 more investment in wind power project as it had already invested in its 1st wind power project, namely Pak Phanang Project 1, via IWIND, its subsidiary. By investing in 1

more wind power project with regard to the Company’s 16 projects in production and distribution of electricity as of 30 June 2015 (12 projects have started Commercial Operation Date with total capacity of 24.16 MW and the other 4 projects are in the preparation process), the Company will diversify its business risk as the Company will invest in various types of alternative energy business. As such it will stabilize the growth of the Company’s revenue from production and distribution of electricity

3. By investing in Lomligor project, the Company will has 1 more investment in wind power project as it had already invested in its 1st wind power project, namely Pak Phanang Project 1, via IWIND, its subsidiary. Pak Phanang

Project 1 is the first a wind power project of the Company. The Project is located nearby the Lomligor project. So in the future the Company can save some of its investment through lower operating cost, maintenance expenses, and management and administration expenses.

4. Investing in Lomligor project is one of the project that serves the government’s policies and it increase the number of alternative energy project in Nakhon Si Thammarat and nearby province. The wind power used to generate electricity is free, clean, and can be used to generate electricity during both day and night time. Generating electricity with alternative energy (wind power) does not pollute the environment and does not create greenhouse effect. Thus, it differs from generating electricity with other fuels. Lomligor project serves the government’s policies regarding electricity generating, which have targeted to increase the portion of electricity from the renewal and alternative energy to at least 25% of total electricity generation that rely on fuels by within 2021.

5. Investing in Lomligor project will help IWIND to achieve business continuity in its production and distribution of wind power business. The Company has planned to expand its wind power business via IWIND in the future. According to the interview with the management of the Company, the Company might also planned to spin-off or issue new share and offer for sale to public, and list IWIND securities on the Stock Exchange of Thailand in the future.

Cons of Transaction

1. Investing in Lomligor project is a new project (the construction and the distribution of electricity has not yet started). There is uncertainty on the completion of its construction and operation to produce and sell electricity to Provincial Electricity Authority.

2. Investing in Lomligor project, wind power which will be used to produce electricity is uncontrollable due to the uncontrollable nature of wind and period of time. It is beyond control of the Company. Although the Company had tested the wind power and conducted the feasibility study of the project based on yearly average wind power, the Company cannot set and control the wind power due to uncontrollable nature of wind.

3. By investing in Lomligor project, the Company will have to make large investment of approximately 800 million baht. According to the Company’s expected sources of fund, the Company’s Debt to Equity ratio will be approximately 2.25 times. The Company had already invested in Lomligor in the amount of 250 million Baht. 4. Lomligor project is located nearby the existing wind project namely Pak Phanang Project 1, located in Banpeang

Sub-district, Pak Phanang District, Nakhon Si Thammarat. Both of the wind power projects of the Company are located in the same area so the Company cannot diversify its risk by having its projects located in different areas such as risk from natural disaster.

Risk Factors

1. Risk from the completion of its construction and operation to produce and sell electricity to PEA.

By investing in Lomligor project, the Company might has risk from the completion of the business operation to meet its investment objectives such as budgeting control, completion of the construction, cost control, direct and indirect expenses.

2. Risk from the completion of the project construction.

Risk from completion of the construction to the point where the wind power project can operate.

Risk from acquisition of land for the project which the Company is purchasing from current land owner.

Risk from the project delay.

Risk from obtaining loan from financial institution.

3. Risk from the business operation of the Lomligor project.

Risk on wind speed.

Risk from natural disasters.

Risk from policies and support from government.

Risk of dilapidated equipment.

Nonetheless, the Company is conducting system testing for its Pak Phanang Project 1 and starting to sell electricity to Provincial Electricity Authority, which expected to start its Commercial Operation Date within September or early October 2015. As it will be completed before the approval of the Company’s investment in Lomligor project, the Company will has data and experience regarding wind power electricity production in the same area. Therefore the Company can reduce certain investment risks such as installment, capacity, nature of wind in Pak Phanang area, and proper qualification and types of wind turbine.

Therefore, considering the benefits, cons, risk of the transaction, and appropriateness of investing in Lomligor project of Lomligor Co., Ltd., a subsidiary of the Company. Independent Financial Advisor deems that the Acquisition of Asset is appropriate and benefits to the Company and its shareholders mutually. The Company’s shareholders should

resolve to approve the Acquisition of Asset Transaction.

Nonetheless, the consideration whether to approve the Company to enter into the Transaction mainly depends on discretion of the Company’s shareholders. The Company’s shareholders can review the Company’s other information and the report of the Independent Financial Advisor’s opinions as shown below

Part 1

1. General Characteristics, Type of Transaction, and Transaction Value:

(1) Transaction Date

The Board of directors’ meeting of Inter Far East Engineering Public Company Limited (the “Company” or “IFEC”) held on August 28, 2015 had a resolution to approve Inter Far East Wind International Company Limited

(“IWIND”) to invest in Lomligor Company Limited (“LLG”) with total investment value not exceeding Baht 800,000,000

in order to finance the construction of wind power plant with installed capacity of 10.00 MW.

(2) Counterparties and their relation to the company

Currently the Company is processing and negotiating precondition in order to find its contractor to undertake the Company’s wind turbine installment and equipment, and production testing, including construction of electric substation and construction of infrastructure in the project (Engineering Procurement and Construction Agreement : EPC). Moreover the Company has initially set the specification of the wind turbine as follow: 4 wind turbines branded Goldwind, Model GW 121/250, capacity of 2.5 MW per unit totaling 10.00 MW at an altitude of 120 metre. The project is expected to be completed within Q2 2016 including the construction of electric substation, and utilities infrastructure of the power plant such as road, waterworks system, and electrical system in the project that is unrelated to connecting transmission line to the wind turbine.

(3) General Characteristics, Type of Transaction, and Transaction Value

The Board of directors’ meeting of Inter Far East Engineering Public Company Limited No. 11/2015 held on August 28, 2015 had a resolution to approve Inter Far East Wind International Company Limited (“IWIND”), a subsidiary of the Company, to make an additional investment in wind power project of Lomligor Company Limited (“LLG”) with total investment value not exceeding Baht 800,000,000 (including land value of approximately 50.0 million Baht). This is in accordance with power purchase agreement to buy electric generated by wind power with the capacity of 8.965 MW (VSPP-PEA-006/2557). The project is located at Pak Phanang, Nakhon Sri Thammarat.

(4) Type of Transaction, and Transaction Value

The mentioned transaction is considered an acquisition of assets pursuant to the Notification of the Capital Market Supervisory Board No. ThorJor. 20/2551 entitled Rules on Entering into Material Transactions Deemed as Acquisition or Disposal of Assets (and its amendments) and the Notification of the Board of Governors of the Stock Exchange of Thailand entitled Disclosure of Information and Other Acts of Listed Company concerning the Acquisition and Disposition of Assets, B.E. 2547 (2004) (and its amendments). The size of the transaction calculated based on the latest reviewed consolidated financial statement ended June 30, 2015 is detailed as follows:

IFEC’s financial information Unit: million Baht

Total Asset 7,907.26

Deduct Intangible asset -1,531.99

Deduct Total Liabilities -2,885.74

deduct Non-controlling interest -63.32

Net tangible asset (NTA) 3,426.21

Profit (loss) attributable to majority interests in the past 12 months 162.93 Remark: Financial statement of the Company as of 30 June 2015 reviewed by the Company’s auditor.

Transaction sizes calculated by four methods under the Acquisition or Disposal Notification are as follows: Calculation Basis Formula Transaction size

1. Net Tangible Asset % of NTA in proportion to acquisition Not applicable * (NTA) NTA of the Company

2. Net Profit % of net profit in acquisition to the disposition Not applicable * Net profit of the Company

3. Total value of Total consideration paid (800.0 million Baht) 10.12% consideration Total asset of the Company (7,907.26 million Baht)

4. Equity share value Number of shares issued for payment Not applicable as the Company Total issued and paid up shares of the Company does not issue shares

for payment

Highest value 10.12%

Remark: *not applicable for comparison as the transaction is not an acquisition of common shares.

The calculation of transaction size as detailed above has the highest value of 10.12% which derived from the total value of consideration method based on the latest reviewed consolidated Financial Statement ended June 30, 2015. In addition, when aggregating the above transaction with other thirteen transactions entered into by the Company within the past 6 months, the cumulative transaction size together with the thirteen acquisitions during the past six months was equivalent 55.32 percent calculated based on Total Value of Consideration (44.12 per cent calculated based on Net Profit or 16.52 percent calculated based on Asset Value) which is higher than 50 per cent but lower than 100 percent and classified as Class 1 Transaction under the Acquisition or Disposal Notification as mentioned above.

Accordingly, the Company is required to disclose certain information regarding the entering into the above transaction to the Stock Exchange of Thailand (“SET”) and is required to hold a Shareholders Meeting to consider and approve the investment which requires an affirmative vote of not less than three fourths of the total number of votes of the shareholders attending the meeting and eligible to vote, excluding the vote of the shareholders having a special interest on this matter. Such information and Independent Financial Advisor’s Opinion Report will be sent to its shareholders at least 14 days prior to the date of the Shareholders Meeting.

(5 ) Details of asset being acquired

The Board of directors’ meeting of Inter Far East Engineering Public Company Limited No. 11/2015 held on August 28, 2015 had a resolution to approve the investment in wind power project of LLG with total investment value not exceeding Baht 800,000,000. The details are as follow:

Summary of key points.

Name Lomligor project (Pak Phanang 2)

Agreement No. VSPP-PEA-006/2557

Agreement Date 23 June 2014

Project Location Banpeang Sub-district, Pak Phanang District, Nakhon Si Thammarat

Nature of Business Production and distribution of wind power

Electricity Seller Lomligor Co., Ltd.

Electricity Buyer Provincial Electricity Authority

Total Capacity 10.0 MW

Promotion Certificate (BOI) The Company is applying for investment promotion.

Agreed Sales Volume 8.965 MW, as stated in Power Purchase Agreement (VSPP-PEA) No. 006/2557 dated

23 June 2014, for a period of 5 years from the started COD and automatically renew every 5 years for total period of 25 years.

Adder 3.50 Baht for a period of 10 years since COD is granted by PEA.

Started Commercial Operation Date (SCOD)

Within Q2 2016 (according to the existing power purchase agreement, SCOD was set to be on February 19, 2016, which the Company had informed 2nd postpone and the new

SCOD was set to be on February 19, 2017).

The approval of investment budget of not exceeding 800,000,000 million Baht for the construction of wind power plant with capacity of 10 MW. Sources of fund are financial support by the Company and loan from financial institution. Details are as follow:

5.1 Wind turbine, Transportation, and other equipment 500.0 million baht 5.2 Construction 230.0 million baht 5.3 Land and Land Improvement 50.0 million baht

5.4 Others 20.0 million baht

Source: Report on feasibility study of Lomligor project of IWIND on 2015.

Production process of electricity from wind energy has major elements as follows: 1.) Wind turbines with wind speed and direction censor for wind turbine control. 2.) Generator

3.) Control Systems

4.) Electricity distribution to transmission line system.

Details of project and investment

Project Location: Banpeang Sub-district, Pak Phanang District, Nakhon Si Thammarat

Under the authority of Pak Phanang District, consist of 8 villages as follows: No. 1 Ban Bang Rad, No. 2 Ban Boon Lorm, No. 3 Ban Nhong Sri Phrom, No. 4 Ban Mhak, No. 5 Ban Bang Mhun, No. 6 Ban Perng, No. 7 Ban Tha Phraya, No. 8 Ban Bang Chatra

Area: The sub district is a coastal area located along the Gulf of Thailand. It lay from west to the Gulf of Thailand in the east.

Boundary: Northern border: border with Banpeang Sub-district, Pak Phanang District, Nakhon Si Thammarat

Southern border: border with Khanabnak Sub-district and Pakprak Sub-district, Pak Phanang District, Nakhon Si Thammarat

Eastern Border: border with Gulf of Thailand and Banpeang Sub-district, Pak Phanang District, Nakhon Si Thammarat

Western border: border with Pak Phanang River and Pakprak Sub-district, Pak Phanang District, Nakhon Si Thammarat

Transportation approximately 3 km of BangYa – Kao Fai Rd., approximately 4 km of Bang Chatra – Ban Tha Phraya Road, approximately 3.5 km of Ban Pak Bang – Tha Khen Rd., and approximately 2.5 km of Ban Perng – Wat Jang Road.

Project design

The Company has planned to install 4 units of wind turbine in a straight line with one another. The project location is an open area with strong wind. The project of LLG is located in Banpeang Sub-district, Pak Phanang District, Nakhon Si Thammarat. Each wind turbine will be installed approximately 360 meters from one another in the project area of approximately 122 rais.

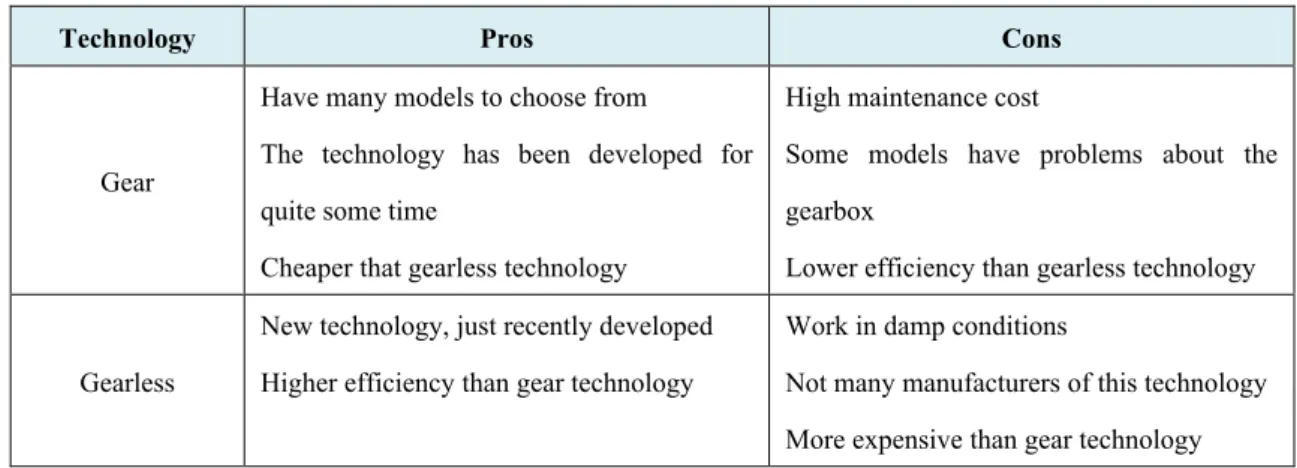

- Wind turbine The Company planned to install Horizontal Axis Wind Turbine, Low Speed Wind Turbine, IEC class

III, which is gearless wind turbine (GearlessTechnology). Electricity production capacity of each unit is approximately 2.5 MW totaling 10 MW for 4 units. The total electricity offer for sale is 8.965 MW. The altitude of wind turbine is 120 metre. It will be lifted with crane to place on its foundation. The rotor diameter is approximately 121 metre. Low Speed Wind Turbine, IEC class III-B is best suit for the project location as the average wind speed is 5.0 – 6.0 metre per second.

Specification of 2.5 MW Wind Turbine branded GOLDWIND (PMDD WIND TURBINE SERIES)

Parameter GW121/2500

Operation Parameters

IEC Wind Class IIIB Rated Power 2500 kW Cut-in Wind Speed 3 m/s Rated Wind Speed (Static) 9.3 m/s Cut-out Wind Speed 22 m/s

Rotor

Diameter 121 m Number of Blades 3

Power Control Collective Pitch Control / Rotor Speed Control Swept Area 11595 m²

Safety System Independent Blade Pitch Control / Hydraulic Disk Brake /Hydraulic Rotor Lock

Generator Permanent Magnet Direct Drive Synchronous Generator

Yaw System 4 Induction Motors with Hydraulic Brakes Tower Tubular Steel Tower

Foundation Flat Foundation (Others Possible)

Converter Full Power Converter (IGBT) Modular System Control System Microprocessor Controlled with Remote Monitoring

Dynamic Power Curve

Currently the Company is in its initial stage of contractor selection, to find its contractor to undertake the Company’s wind turbine installment and equipment, and production testing, including construction of electric substation and construction of infrastructure in the project (Engineering Procurement and Construction Agreement : EPC). Moreover the Company has initially set the specification of the wind turbine as follow: 4 wind turbines branded Goldwind, Model GW 121/250, capacity of 2.5 MW per unit totaling 10.00 MW at an altitude of 120 metre. The contract shall be signed within Q4 2015.

- Wind Speed Testing

The wind testing was conducted using wind energy monitoring station located in Pak Phanang District, Nakhon Si Thammarat. The Company had installed the wind speed and direction censor, namely NRG Data Logger Symphonies PLUS, which is capable of monitoring wind speed in the range of 0 – 44 m/s with the resolution of 0.19m/s. The error is less than 3% at the wind speed of 17-30 m/s. The censor has 360 degree radius with the resolution of 1.4 degree. The automatic recording equipment branded NRG was used to collect and record the wind speed and temperature. The time accuracy of the equipment is in between 0-2 second for the first set of collected data of approximately every 5 second per week recorded at 25 degree Celsius. It is installed in the weatherproof container. Since August 2011 the wind and temperature have been recorded every 10 minutes.

- Construction period

The construction of foundation, machine installment, and production testing will take around 8 months. In the beginning stage, the budget for construction which will be paid by the end of 2015 is not exceeding 150 million baht. The details are as follow:

Schedule of Lomligor project construction

Details Period

(months)

2015 2016

Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun - Machinery orders 4

- Plant construction 5 - Transmission line construction 5 - Sub station construction (PEA) 5

- Wind turbine logistic (from plant to

installment area)

5

- Road construction and land reclaimation

before wind turbine installment

5

- Wind turbine foundation construction 4 - Sub station construction 4

- Wind turbine installment 4 - Production system testing and data

analysis

2

- Wind turbine testing 2 - Commercial Operation Date 1

- Project Administration

The personnel required for the project operation are power plant manager, engineer, technician, accountant, general service officer, housemaid, and community relation officer. The work hour of personnel that responsible for system maintenance will be divided into 3 shifts of 8 hours.

- Environmental Impact

The operation of wind power plant does not fall under Notification of the Ministry of Natural Resources and Environment Re: defining type, size and procedure for Project or Activity which require to prepare environmental impact assessment report and principle, method, procedure and guideline in preparation environmental impact assessment report, dated September 24, B.E. 2557 (2014).

(6) Total value of consideration

The Company will make an additional investment in LLG with an objective to invest in importing wind turbine equipment and wind power plant construction, which located in Nakhon Sri Thammarat. The wind power project has capacity of 10 MW (4 units of wind turbine with capacity of 2.5 MW each). Total investment will not exceed 800 million baht.

(7) Basis Used to Determine Total Value of Consideration and Payment

According to the feasibility study, prepared by analysts of the Company, using Discount Cash Flow method for the project period of 25 years. It is expected that LLG will start its COD within Q2 2016. The Company sees that the project will provide proper rate of return on investment to the Company, calculated with level of electricity generation of P50, having Project IRR of approximately 12.04% and payback period of approximately 10 – 12 years. The Company will be able to engage in business that is related to core business of the Company and realize income and profit of the project in the Company’s financial statement after COD has started within Q2 2016.

The total value of consideration was set in regard to the investment in construction of 10 MW wind power project (4 wind turbines with capacity of 2.5 MW each) with the electricity generation of 8.965 MW. The investment in the project will not exceed 800 million baht (including land value of 50.0 million baht). The study was referred to the current wind power project of the Company which is 10 MW Wind Farm Project along the Coast of Pak Phanang Wind Park (Pak Phanang 1). The construction of Pak Phanang 1 has been completed and it is ready for sale of electricity.

(8) Sources of Fund

The sources of fund to for LLG’s investment in construction of wind power plant will rely on cash flow of the Company and loan from financial institution. Details are as follow:

Unit: million baht

Estimated sources of fund Estimated use of fund

- Capital of the Company (Cash flow of the Company) 240.0 - Loan from financial institution (70% of investment) 560.0

- Investment in construction of wind power plant 800.0

Total 800.0 Total 800.0 Sources: Financial projection prepared by analysts of the Company.

In the beginning, investment in construction of wind power plant of approximately 800.0 million baht will be funded by the Company’s cash flow and the issuance of short term financial instrument such as bill of exchange. The payment will be made in line with progress of the construction. The Company is seeking long term loans from commercial bank, which at this stage some commercial banks has already shown interest in providing financial support for the project.

(9) Expected benefit to the Company

The Company will engage in business of wind power production and distribution which is expected to continuously generate income, profit, and cash flow in the future. The investment will expand the boundary of business operation of the Company and the Company is in a position to recognize IWIND’s revenue and earnings in its financial statements when COD has started.

(10) Conditions for entering into the transaction

The Company will make an additional investment in LLG with total investment value not exceeding Baht 800,000,000. IWIND’s directors were authorized by the Board of Directors of the Company to consider, contact and negotiate to the seller as well as settle final conditions before entering into the transaction. Moreover, for the convenience of construction preparation and construction of foundation, road, and others by completing construction work before rainy season, the Company will take control and monitor the progress of the project to make sure the relevant personnel keep the project on schedule and operate within the approved budget.

2. Objectives, Benefit, Cons, and Risks of the Transaction 2.1 Objectives and Background of the Transaction

The Board of directors’ meeting of Inter Far East Engineering Public Company Limited (the “Company” or “IFEC”) No. 11/2015 held on August 28, 2015 had a resolution to approve Inter Far East Wind International Company Limited (“IWIND”), a subsidiary of the Company which produces and distributes electricity from wind power, to make an additional investment in its subsidiary namely Lomligor Company Limited (“LLG”), formerly named SGC Wind Energy Company Limited. IWIND’s directors were authorized by the Board of Directors of the Company to consider, contact and negotiate to the seller as well as settle final conditions before entering into the transaction with total investment value not exceeding Baht 800,000,000.

The above transaction is considered an acquisition of assets pursuant to the Notification of the Capital Market Supervisory Board No. ThorJor. 20/2551 entitled Rules on Entering into Material Transactions Deemed as Acquisition or Disposal of Assets and its amendments and the Notification of the Board of Governors of the Stock Exchange of Thailand entitled Disclosure of Information and Other Acts of Listed Company concerning the Acquisition and

Disposition of Assets, B.E. 2547 (2004) and its amendments (collectively referred to as the “Acquisition or Disposal Notification”). When considering the transaction size pursuant to the Acquisition or Disposal Notification, the size of the above transaction is of the highest value when calculated from Total Value of Consideration, based on the latest reviewed consolidated financial statement ended June 30, 2015, which equals to 10.12 per cent. In addition, when aggregating the above transaction with other thirteen transactions entered into by the Company within the past six months, the cumulative transaction size together with the thirteen acquisitions during the past six months was equivalent 55.32 per cent calculated based on Total Value of Consideration (44.12 per cent calculated based on Net Profit or 16.52 per cent calculated based on Asset Value) which is higher than 50 per cent but lower than 100 per cent and classified as Class 1 Transaction under the Acquisition or Disposal Notification.

Accordingly, the Company is required to disclose certain information regarding the entering into the above transaction to the Stock Exchange of Thailand (“SET”) and is required to hold a Shareholders Meeting to consider and approve the investment which requires an affirmative vote of not less than three fourths of the total number of votes of the shareholders attending the meeting and eligible to vote, excluding the vote of the shareholders having a special interest on this matter. As such the Board of Directors’ meeting resolved to convene the Extraordinary General Meeting of the Shareholders No. 1/2015 on October 9, 2015 to propose to shareholders for an approval of the Company’s entering into Acquisition of Asset Transaction.

2.1.1 Details of investment in Inter Far East Wind International Co., Ltd. (“IWIND”)

The meeting of the Board of Directors of Inter Far East Engineering Public Company Limited (the "Company" or "IFEC") No. 18/2557 held on September 23, 2014, had passed the resolution to approve the Company's investment in Green Growth Co., Ltd ("GG"), which operates wind power plant with a capacity of 10 MW located in Banpeang Sub District, Pak Phanang District, Nakhon Si Thammarat of which GG has entered into a power purchase agreement with the Provincial Electricity Authority on September 24, 2014.

Green Growth CO., Ltd. Had been renamed to Inter Far East Wind International Co., Ltd., which operates in production and distribution of electricity generated with wind power under its Pak Phanang 1 project. Details are as follow: Name Pak Phanang 1

Project Location Banpeang Sub-district, Pak Phanang District, Nakhon Si Thammarat Nature of Business Production and distribution of wind power

Promotion Certificate (BOI) No. 1324(1)/2557 Total Capacity 10.0 MW

Agreed Sales Volume 10 MW, as stated in Power Purchase Agreement No.VSPP-PEA-004/2556 dated 22 April 2013, for a period of 5 years from the date of COD and automatically renew every 5 years for total period of 25 years.

Adder 3.50 Baht for a period of 10 years after the date COD is granted by PEA. Started Commercial Operation

Date (SCOD)

25 September 2015

The Company’s Board of Directors’ meeting no. 10/2558 held on 21 August 2015 had passed the resolution to invest in wind power project named Pak Phanang 1, which located in Pak Phanang District, Nakhon Si Thammarat. The Company had approved the investment of approximately 800,000,000 baht in 10 MW wind power plant, which the construction was funded by the Company and loan from financial institution. Details are as follow:

Pak Phanang 1 unit: million baht

1. Wind turbine, Transportation, and other equipment 508.0

2. Construction 230.0

3. Land and Land improvement 32.0

4. Others 30.0

Total 800.00

Construction progress

For Pak Phanang 1, the construction of foundation, electrical system, and wind turbine installment had been completed. Currently the project is under production testing and SCOD is expected to be in the end of September 2015.

Financial Position of IWIND

Statement of Financial Position 31 December 2014

(Audited)

30 June 2015 (Reviewed)

million baht % million baht %

Cash and cash equivalents 210.97 66% 466.65 31% Account receivable – trade and others 18.08 6% 11.03 1% Short term loan to company and others 44.85 14% - 0% Other current assets - 0% 15.15 1%

Total Current Assets 273.89 86% 492.84 33%

Deposit pledged as collateral - 0% 140.25 9% Investment in subsidiary - 0% 330.64 22% Property, plant and equipment 41.35 13% 543.78 36%

Intangible assets - 0% 0.26 0%

Other non-current assets 3.21 1% 0.07 0%

Total Non-Current Assets 44.56 14% 1,015.01 67%

Total Assets 318.45 100% 1,507.85 100%

Short-term loans from financial institutions - 0% 600.00 40% Account payable-trade and others 5.15 2% 598.12 40% Current portion of liabilities under finance lease

agreements

0.33 0% 0.38 0% Other current liabilities - 0% 0.88 0%

Total current liabilities 5.49 2% 1,199.37 80%

Liabilities under finance lease agreements 0.48 0% 0.27 0% Retirement benefit obligations - 0% 0.06 0%

Total Non-Current Liabilities 0.48 0% 0.33 0%

Total Liabilities 5.97 2% 1,199.71 80%

Authorized share capital and Issue and paid up share capital

225.00 71% 225.00 15% Premium on share capital 110.00 35% 110.00 7% Retained earning -22.52 -7% -26.86 -2%

Total shareholders’ equity 312.48 98% 308.14 20%

In September 2015, the Company had invested in 1,599,998 ordinary shares of Green Growth Co., Ltd. (former name of IWIND) or in the proportion of 25% at 28.125 baht per share totaling 45 million baht. The Company had also paid for capital increase of 40 million baht or in the proportion of 25%. In October 2014, the Company had subscribed remaining newly issued ordinary shares of Green Growth Co.,Ltd. at 50 baht per share totaling 80 million baht. Total investment was 165 million baht at 103.125 baht per share, accounting for 80% of registered capital. On 18 December 2014, The Company had subscribed newly issued ordinary shares of GG by the shareholding ratio at 80% equal 200,000 shares at 540 Baht per share, with the par value of 100 baht.

As of year ended 2014, the Company held 80% of IWIND’s registered capital of 225 million baht. The Company had invested in the amount of 273 million baht (calculated with share payment of 45 million baht and capital increase in proportion to current shareholding of 108 million baht in December 2014).

In 2014, IWIND’s total assets was 318.45 million baht which consist of Cash of 210.97 million baht, account receivable –trade and others of 18.08 million baht, short term loan to company and others of 44.85 million baht, and property, plant and equipment of 41.35 million baht. As of 6 months period ended June 30, 2015, IWIND’s total asset was 1,507.85 million baht which consist of cash of 466.65 million baht, account receivable –trade and others of 11.03 million baht, deposit pledged as collateral of 140.25 million baht, investment in subsidiary (Lomligor Co., Ltd.) of 330.64 million baht, and property, plant and equipment of 543.78 million baht. Meanwhile, short term loan to company and others had already been paid off.

In 2014, IWIND had invested in property, plant, and equipment in the amount of 41.35 million baht which can be separated into land of 20 million baht, construction in progress of 19.65 million baht, and others of 1.70 million baht. As of 6 months ended of 2015, the Company had made an additional investment of 543.78 million baht. It was an investment in Pak Phanang 1 project, which is wind power plant for the production and distribution of wind power with electricity generation capacity of 10 MW. Its Scheduled Commercial Operation Date (SCOD) is expected by the end of September 2015 or within Q4 2015.

In 2014, total liabilities of IWIND was 5.97 million baht which consist of account payable-trade and others of 5.15 million baht, current portion of liabilities under finance lease agreements of 0.81 million baht. As of 6 months period ended June 30, 2015, total liabilities of IWIND was 1,199.71 million baht comprised of short-term loans from financial institutions of 600 million baht, account payable-trade and others of 598.12 million baht (most of which is Lomligor’s construction expenses), liabilities under finance lease agreements of 0.65 million baht, and others of 0.94 million baht.

In 2014, IWIND’s total shareholders’ equity was 312.48 million baht consist of issue and paid up capital of 225 million baht, premium on share capital of 110 million baht, and negative retained earnings of 22.52 million baht. As of 6 months period ended june 31, 2015, total shareholders’ equity of IWIND was 225 million baht which comprised of issue and paid up capital of 225 million baht, premium on share capital of 110 million baht, and negative retained earnings of 26.86 million baht. The negative retained had increased due to the net loss of 4.34 million baht in the same period.

Financial Performance of IWIND

Income Statement 2014

(Audited)

6 months period 2015 (reviewed)

Million baht % Million baht %

Rental and service income 0.08 51% - 0%

Other income 0.07 49% 3.71 100%

Total revenue 0.15 100% 3.71 100%

Administrative expenses 8.35 5628% 8.03 216%

Total expenses 8.35 5628% 8.03 216%

Profit (Loss) before financial costs and income tax expenses

-8.20 -5528% -4.32 -116%

Financial cost 0.07 46% 0.03 1%

Profit (Loss) before income tax expenses -8.27 -5574% -4.34 -117%

Income tax expenses - 0% - 0%

Net Profit (Loss) -8.27 -5574% -4.34 -117%

In 2014, IWIND had total income of 0.15 million baht comprised of rental and service income of 0.08 million baht and other income (interest income) of 0.07 million baht. Meanwhile IWIND had administrative expenses of 8.35 million baht (most of which are paid for salary, office rental, transportation, advisory, allowance, and others). As such the Company had net loss of 8.27 million baht. For 6 months period ended June 30, 2015, IWINF had other income (interest income) of 3.71 million baht, while its administrative expenses and financial cost were 8.03 and 0.03 million baht respectively. Therefore IWIND had net loss of 4.34 million baht. IWIND is undertaking its wind power plant construction with the electricity generation capacity of 10 MW. The sale of electricity to Provincial Electricity Authority is expected to start within Q4 2015.

2.1.2 Details of Lomligor Co., Ltd., formerly named SGC Wind Energy Co., Ltd. (SGC)

The meeting of the Board of Directors of Inter Far East Engineering Public Company Limited (the "Company" or "IFEC") No. 4/2558 held on May 13, 2015, had passed the resolution to approve the Inter Far East Wind International Co., Ltd. (“IWIND”), a subsidiary of the Company which engage in business of production and distribution of wind power, to acquire ordinary shares of SGC Wind Energy Co., Ltd. in the proportion of 100% of issue and paid up share capital.

On May 29, 2015, Inter Far East Wind International Co., Ltd. (“IWIND”), a subsidiary of the Company, had invested in ordinary share of Lomligor Co., Ltd in the proportion of 99.99% of issue and paid up share capital. Lomligor Co., Ltd., a company registered in Thailand, operates in business of production and distribution of wind power. The subsidiary paid for the acquisition in cash of 330 million baht.

SGC Wind Energy Co., Ltd. (SGC) was renamed to Lomligor Co., Ltd. which engages in business of production and distribution of wind power via its Lomligor Project. Details are as follow:

Name Lomligor project (Pak Phanang 2)

Agreement No. VSPP-PEA-006/2557

Agreement Date 23 June 2014

Project Location Banpeang Sub-district, Pak Phanang District, Nakhon Si Thammarat

Nature of Business Production and distribution of wind power

Electricity Seller Lomligor Co., Ltd.

Electricity Buyer Provincial Electricity Authority

Total Capacity 10.0 MW

Promotion Certificate (BOI) The Company is applying for investment promotion.

Agreed Sales Volume 8.965 MW, as stated in Power Purchase Agreement (VSPP-PEA) No. 006/2557 dated 23

June 2014, for a period of 5 years from the started COD and automatically renew every 5 years for total of 25 years.

Adder 3.50 baht for a period of 10 years since COD is granted by PEA.

Started Commercial Operation Date (SCOD)

Within Q2 2016 (according to the existing power purchase agreement, SCOD was set to be on February 19, 2016, which the Company had informed 2nd postpone and the new

SCOD was set to be on February 19, 2017).

The approval of investment budget of not exceeding 800,000,000 million Baht for the construction of wind power plant with capacity of 10 MW. Sources of fund are financial support by the Company and loan from financial institution. Details are as follow:

Unit: million baht 1. Wind turbine, Transportation, and other equipment 500.0

2. Construction 230.0

3. Land and Land Improvement 50.0

4. Others 20.0

Financial Position of LLG

Statement of Financial Position 31 December 2014

(Audited)

30 June 2015 (Reviewed)

million baht % million baht %

Cash and cash equivalents 0.25 0% 247.67 100% Account receivable – trade and others 2.45 1% - 0% Short term loan to company and others 245.00 99% - 0%

Total Current Assets 247.70 100% 247.67 100%

Total Assets 247.70 100% 247.67 100%

Other current liabilities 0.47 0% - 0%

Total current liabilities 0.47 0% 0.00 0%

รวมหนี้สิน 0.47 0% 0.00 0%

Authorized share capital and Issue and paid up share capital

250.00 101% 250.00 101% Retained earning -2.77 -1% -2.33 -1%

Total shareholders’ equity 247.23 100% 247.67 100%

Total Liabilities and Shareholders’ equity 247.70 100% 247.67 100%

In 2014, LLG’s Total asset was 247.70 million baht comprised of cash of 0.25 million baht, account receivable – trade and others of 2.45 million baht, and short term loan to company and others of 245 million baht. As of 6 months period ended 30 June 2015, LLG’s Total asset was 247.67 million baht comprised of cash of 247.67 million baht. Meanwhile the account receivable – trade and others and short term loan to company were fully paid off.

In 2014, LLG’s total liabilities was 0.47 million baht. As of 6 months period ended 30 June 2015, LLG had fully paid its liabilities so there is no liabilities.

In 2014, LLG’s shareholders’ equity was 247.23 million baht comprised of issue and paid up capital of 250 million baht, and negative retained earnings of 2.33 million baht. The negative retained earning had decreased as the operating performance for the first 6 months of 2015 was 0.46 million baht.

Financial Performance of LLG

Income Statement 2014

(Audited)

6 months period 2015 (reviewed)

Million baht % Million baht %

Other income 2.45 100% 1.39 100%

Total revenue 2.45 100% 1.39 100%

Administrative expenses 0.02 1% 0.94 67%

Total expenses 0.02 1% 0.94 67%

Profit (Loss) before financial costs and income tax expenses

2.44 99% 0.46 33%

Financial cost - 0% - 0%

Profit (Loss) before income tax expenses 2.44 99% 0.46 33%

Income tax expenses - 0% - 0%

Net Profit (Loss) 2.44 99% 0.46 33%

In 2014, LLG had other income (interest income) of 2.45 million baht and administrative expenses of 0.02 million baht. LLG’s net profit for the period was 2.44 million baht. For 6 months period ended 30 June 2015, LLG had other income (interest income) of 1.39 million baht and administrative expenses of 0.94 million baht so LLG had net profit of 0.46 million baht. LLG is proposing to its shareholder for the approval to enter into transaction on investment in wind power plant (Lomligor) with electricity generation capacity of 10 MW. It is expected that, after receive the Shareholder’s approval, the construction will be completed and the project will start its Started Commercial Operation Date (SCOD) to Provincial Electricity Authority by the end of Q 2 2016 or beginning of Q3 2016.

2.1.3 Inter Far East Engineering Public Company Limited

Company Name Inter Far East Engineering Public Company Limited Trading Symbol IFEC

Nature of Business Engage in managing its subsidiaries which operate in business related to production and distribution of alternative energy that the Company had invested.

Industry Energy and Utilities sector under Resources industry Stock Exchange of Thailand

Authorized Capital 2,691,819,598.00 baht

Common Stock 1,824,597,829 shares with par value of 1.00 baht Paid-up Capital 1,824,597,829.00 baht

Nature of Business

Previously the Company conducted its business as a copier distributor and rental and later on in the 4th quarter of

2013 the Company has invested in businesses related to the production and distribution of electricity from renewable energy. On July 1, 2014, as the dealership agreement with Konica Minolta Business Solutions Asia Pte., Ltd. has expired, the Company sold its copier distributor and rental business to Konica Minolta Business Solutions (Thailand) Co., Ltd. pursuant to the resolution of the Extraordinary General Meeting of Shareholders No. 1/2014 on June 3, 2014. The Company's main income, therefore, has been only from business related to the production and distribution of electricity from renewable energy. The Company started to concentrate on the management and investments in subsidiaries with the business related to production and distribution of electricity from various types of renewable energy. The investment of the Company can be classified into 3 business groups as follow:

1. Alternative Energy Power Plant 1.1 Solar Power Plant 1.2 Wind Power Plant 1.3 Biomass Power Plant 2. Waste Management

Business Structure of the Company and its subsidiary as of September 30, 2015

Remarks:

Company Name Abbr. Type of Business Percentage of Holding

(%) Inter Far East Thermal Power Co., Ltd. IFEC-T Holding company investing in business of alternative

energy.

99.99 Green Energy Technology In (Thailand) Co., Ltd. GE Solar power generation and distribution 99.99

Clean City Co., Ltd. (Holding by IFEC-T) CC Waste management 99.99

J.P. Solar Power Co., Ltd. JP Solar power generation and distribution 99.99

SUNPARK Co., Ltd. SP Solar power generation and distribution 99.99

SUNPARK 2 Co., Ltd. SP-2 Solar power generation and distribution 99.99

V.O. Net Bio Diesel Asia Co., Ltd. VON Solar power generation and distribution 99.99 Scan Inter Far East Energy Co., Ltd. SFEE Solar power generation and distribution 99.99 Inter Far East Wind International Co., Ltd. IWIND Wind power generation and distribution 80.00

ISENERGY Co., Ltd. IS Solar power generation and distribution 99.99

Wangkarnkha Rongroj Co., Ltd. WR Solar power generation and distribution 99.99

True Energy Power Lopburi Co., Ltd. TEPL Biomass power generation and distribution 99.99

C R Solar Co., Ltd. CR Solar power generation and distribution 99.99

IFEC (Cambodia) Co., Ltd. ICEC-C Solar power generation and distribution 100.00

Somprasong International Co., Ltd. SPS Solar power generation and distribution 99.99 LOMLIKOR Co., Ltd. (Holding by IWIND) LLG Wind power generation and distribution 99.99

Universal Provider Co., Ltd. UP Solar power generation and distribution 99.99

Rung Ake Raya Engineering (Sa-Kaeo) Co., Ltd.

RAK Power generation and distribution using waste energy

95.00

Inter Far East Cap Management Co., Ltd.

ICAP Engage in investment and management of project other than production and distribution of electricity from alternative energy.

99.99

Smart Tree Co., Ltd. SMT Produces and distributes network

Key investment in subsidiaries for the year 2014 and first six months of 2015.

In April 2014, the Company invested in 299,997 ordinary shares of SUNPARK Co., Ltd. at a price of Baht 163.33 per share, for a total of Baht 49.00 million, which represents 99.99 percent of the registered share capital.

In April 2014, the Company invested in 419,996 ordinary shares of SUNPARK 2 Co., Ltd. at a price of Baht 116.67 per share, for a total of Baht 49.00 million, which represents 99.99 percent of the registered share capital.

In June 2014, Inter Far East Energy Company Limited had increased its authorized share capital from Baht 1 million to Baht 350 million.

In August 2014, the Company invested in 199,996 ordinary shares of V.O. Net Bio Diesel Asia Co., Ltd. at a price of Baht 245 per share, for a total of Baht 49 million, which represents 99.99 percent of the registered share capital.

In September 2015, the Company had invested in 1,599,998 ordinary shares of Green Growth Co., Ltd. or in the proportion of 25% of paid up share capital at 28.125 baht per share totaling 45 million baht. The Company had also paid for capital increase of 40 million baht or in the proportion of 25%. In October 2014, the Company had subscribed remaining newly issued ordinary shares of Green Growth Co., Ltd. at 50 baht per share totaling 80 million baht. Total investment was 165 million baht at 103.125 baht per share, accounting for 80% of registered capital. On 18 December 2014, The Company had subscribed newly issued ordinary shares of GG by the share ratio at 80% equal 200,000 shares at 540 Baht per share, with the par value of 100 baht. Green Growth Co., Ltd. was renamed to Inter Far East Wind International Co., Ltd.

In September 2014, the Company invested in 5,999,986 ordinary shares of Scan Inter Far East Energy Co., Ltd. at a price of Baht 42.97 per share, for a total of Baht 257.83 million, which represents 99.99 percent of the registered share capital.

New subsidiary company (IFEC (Cambodia) Co., Ltd.), which the Company will hold 100% of registered capital of USD 100,000 to conduct study and make an investment in business of power generation and distribution, waste manage, and environment in Cambodia. This subsidiary will sign Memorandum of Understanding with Phnom Penh Municipality. Under the MOU, the subsidiary will conduct feasibility study, means, and investment plan for waste management and waste processing in Phnom Penh.

In December 2014, the Company invested in 776,998 ordinary shares of East Energy Co., Ltd. at a price of Baht 293.32 per share, for a total of Baht 227.91 million, which represents 99.99 percent of the registered share capital.

In January 2015, the Company invested in 299,998 ordinary shares of Wangkarnkha Rongroj Co., Ltd. at a price of Baht 336.67 per share, for a total of Baht 101 million, which represents 99.99 percent of the registered share capital.

In February 2015, the Company invested in 1,299,998 ordinary shares of C R Solar Co., Ltd. at a price of Baht 119.23 per share, for a total of Baht 155 million, which represents 99.99 percent of the registered share capital.

In April 2015, the Company invested in 460,800 fully paid ordinary shares and 39,200 fully paid preferred shares of Somprasong International Co., Ltd. at a price of Baht 258.55 per share and Baht 21.99 per share, respectively, for a total of Baht 140.27 million, which represents 99.99 percent of the registered share capital.

In June 2015, the Company invested in 113,998 fully paid ordinary shares of Universal Provider Co., Ltd. at a price of Baht 238.04 per share, for a total of Baht 271.37 million, which represents 99.99 percent of the registered share capital.

In June 2015, the Company had established a subsidiary named Inter Far East Cap Management Co., Ltd. with an objective to investing and managing projects other than power plants from renewable energy. The Company holds ordinary shares of 4,999,998 shares at a price of 100 baht per share, representing 99.99% of the registered share capital of the mentioned subsidiary.

1. Somprasong International Co., Ltd. had increased its authorized share capital from Baht 24.50 million to Baht 50 million by issuing 255,000 new shares capital at the par value of Baht 100 per share, totaling Baht 25.50 million. 2. Inter Far East Thermal Power Co., Ltd. had increased its authorized share capital from Baht 350 million to Baht

000 million by issuing 25 million new shares capital at the par value of Baht 10 per share, totaling Baht 250 million. Therefore the Company had invested in whole amount of share capital of this subsidiary. Then the subsidiary invested in capital increase of other subsidiaries which are Clean City Co., Ltd. and True Energy Power Lopburi Co., Ltd. in order to enhance theirs potential.

The Company had invested through its 20 subsidiaries. The investment can be categorized into 3 business group as follow: Alternative Energy Power Plant Business: 16 subsidiaries and associated companies.

Subsidiary Name Shareholder

Percent of Shareholding

(%)

Issued and Paid-up Share Capital (million baht) Electricity Generation Capacity (MW) Adder (Baht) Operation has been started

1. Green Energy Technology In (Thailand) Co.,

Ltd.* Company 99.99 43.5 0.985 8

2. J.P. Solar Power Co., Ltd. Company 99.99 80 3 8

3. SUNPARK Co., Ltd. Company 99.99 30 0.981 6.50

4. SUNPARK 2 Co., Ltd. Company 99.99 42 0.952 6.50

5. V.O. Net Bio Diesel Asia Co., Ltd. Company 99.99 20 0.952 6.50

6. Scan Inter Far East Energy Co., Ltd. Company 99.99 60 2.5 8

7. ISENERGY Co., Ltd. Company 99.99 77.7 2 8

8. Wangkarnkha Rongroj Co., Ltd. Company 99.99 30 0.996 8

9. True Energy Power Lopburi Co., Ltd. IFEC-T 99.99 330 6.8 0.30

10. C R Solar Co., Ltd. Company 99.99 130 1 8

11. Somprasong International Co., Ltd. Company 99.99 50 0.998 8

12. Universal Provider Co., Ltd. Company 99.99 114 2.99 8

Operation has not been started

13. Inter Far East Wind International Co., Ltd. Company 80 225 10 3.50

14. IFEC (Cambodia) Co., Ltd. Company 100 33 20 33.00

15. LOMLIKOR Co., Ltd. IWIND 99.99 250 8.965 3.50

16. Rung Ake Raya Engineering (Sa-Kaeo) Co.,

Ltd. IFEC-T 95 60 6 3.50

Remark: In Q3 2015, the Company had made an additional investment in a solar power plant with capacity of 2.88 MW. The Company had also set up a new company to select and invest in business of solar power plant. Moreover, a total of 11 subsidiaries of the Company had set up a total of 16 new companies in order to support expansion of the business of solar power production and distribution in the future.

Waste Management Business: 2 subsidiaries and associated company. Inter Far East Thermal Power Co., Ltd. (IFEC-T), a subsidiary of the Company, had conducted study on the project and invested in Clean City Co., Ltd. which operated in

business of waste management.

Other business: other 2 subsidiaries of the Company engage in business other than alternative energy, business of set up network, and those related to telecommunication respectively.

Subsidiary Name Shareholder

Percent of Shareholding

(%)

Issued and Paid-up Share Capital (million baht) Other business

1. Inter Far East Cap Management Co., Ltd. Company 100 500

2. Smart Tree Co., Ltd. ICAP 100 500

Remark: In Q3 2015, ICAP set up a new company (ICON) which operates in business of dealer of machinery, equipment, and other spare parts related to transportation and others.