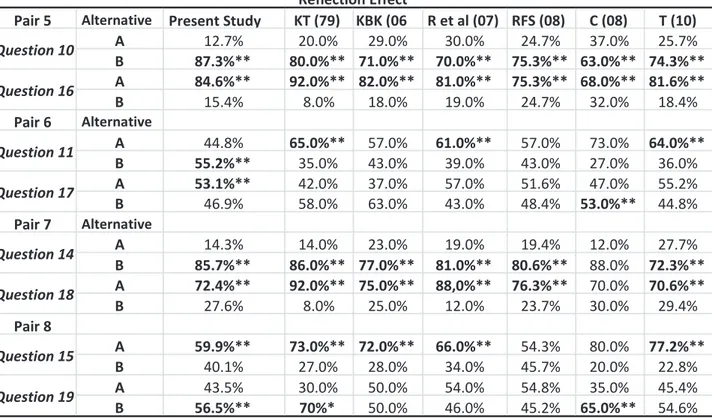

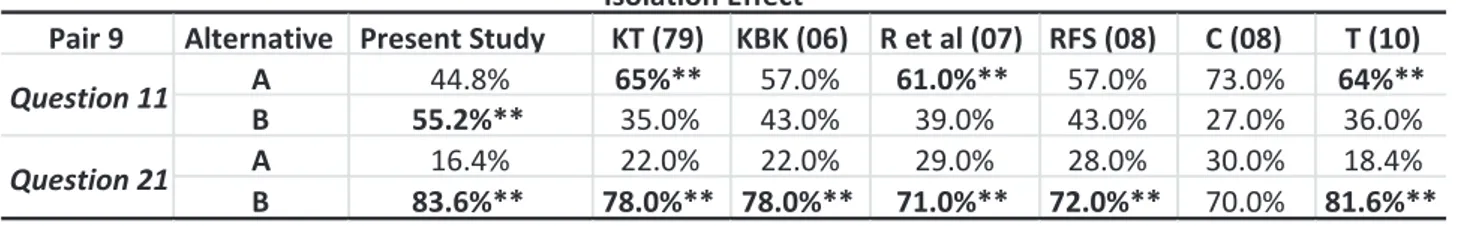

Behavioral Finance in Brazil: applying the prospect theory to potential investors

Full text

Figure

Related documents

cell type, page size, and block size, on system-level metrics such as performance, cost, and power consumption in various applications with different characteristics, e.g..

Survival was better in conventional group (96%, 25 neonates) when compared to HF ventilation (43%, 3 neonates) or mixed ventilation groups (43%, 3 neonates), and severe

As inter-speaker variability among these the two groups was minimal, ranging from 0% to 2% of lack of concord in the 21-40 group and from 41% to 46% in the 71+ generation, we

b In cell B11, write a formula to find Condobolin’s total rainfall for the week.. Use Fill Right to copy the formula into cells C11

The purpose of this research is to know the effect of giving Strychnine bush extract to the dosage to get the dose of songga extract of wood which is effective to give the

Here is the beginning of that hard-driving eighth note time and get down playing style that we associate with rock music today.. To play this style successfully

As shown in Teunissen and Khodabandeh ( 2019 ), the FDMA model is much weaker than the CDMA model in terms of the ambiguity resolution performance so that, for instance, GLONASS

(MANAGED BY JADWA INVESTMENT COMPANY) NOTES TO THE FINANCIAL STATEMENTS (Continued). For the year ended 31 December 2015 (Amounts