Volatility and correlation in financial markets: Econometric modeling and empirical pricing

Full text

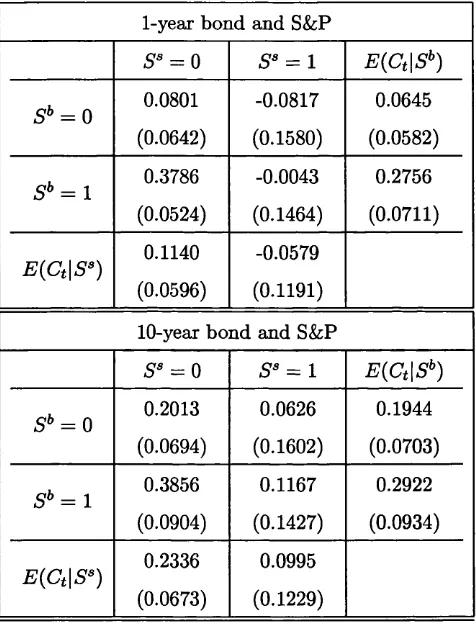

Figure

Related documents

Recommended Cluster Name_2010 2010 Nontraditional Notes 47.0103 Communications Systems Installation and Repair Technology. 3 Arts, Audio/Video Technology & Communications

He is currently a visiting Professor at the University of Johannesburg where he lectures “Behavioral Finance” course in the M.Com Financial Economics programme.. His

In order to investigate whether IL-6 might be more than an inflammatory marker in asthma, we determined the levels of IL-6, TNFa and IL-1b in induced sputum and then related this

In order to review the innovations included in each pilot, staff reviewed all pilot project applications. Pilot project quarterly reports were also reviewed to determine the effects

READABILITY OF THE “ENGLISH ON SKY FOR JUNIOR HIGH SCHOOL STUDENTS” (A Textbook Used by Seventh Grade Students of SMP N 2 Kutowinangun in the 2012/2013 Academic Year).A

After showing and testing the proposed screen mirroring product to the respondents, majority of the respondents like the screen mirroring technology and prefer

Findings of this study reveal that residents in Perhentian island have a signifi cantly higher level of perception towards the positive economic impacts of tourism than residents

Specifically, for each file it is sharing, after hashing the file to obtain the version identifier, the joining node sends into the DHT a message with the file location (IP and