Nonlinear Adjustment in US Bond Yields: an Empirical Analysis with Conditional Heteroskedasticity

Full text

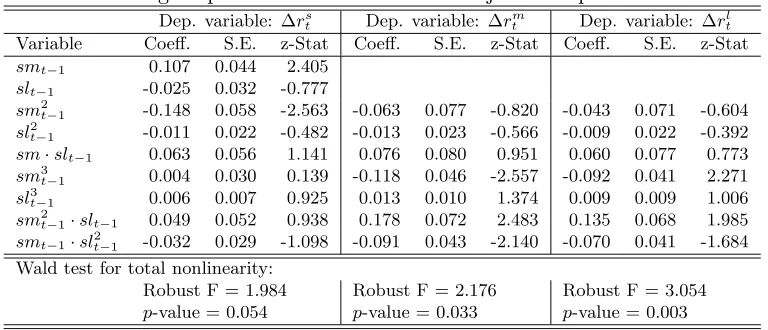

Figure

Related documents

SBIR/STTR’s Role in Air Force Acquisition – Actual Phase I Phase II STTR Concept Development $750K, 24 Months Concept Feasibility $100K, 9 months Phase I Phase II SBIR

This paper examines the effect of empathy and sympathy on tax compliance. We run a series of laboratory experiments in which we observe the subjects decisions in a series of

Significant, positive coefficients denote that the respective sector (commercial banking, investment banking, life insurance or property-casualty insurance) experienced

The National Institutes of Health (NIH) states that about 1% of Americans suffer from Hyperthyroidism and about 5% suffer from Hypothyroidism. From the global perspective also the

The control node in Plush-M also plays the role of the execution controller and barrier manager, just like the control node in Plush. The control node ensures that all participants

In the second part of the analysis, and for the years 1979, 1990, and 2000, the manufacturing sector is further subdivided into five categories according to the 1987 OECD

Users or developers on Hawala.Today can access services on the platform including those enabling wallet creation, portfolio construction, asset allocation, crypto data queries,

As evaluations were performed when half of the students had attended the Histology Laboratory session in both cohorts, there were four groups for comparison: (1) students who had