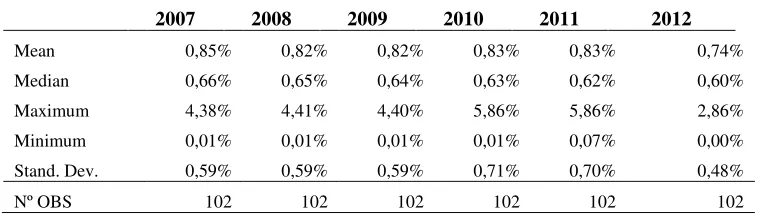

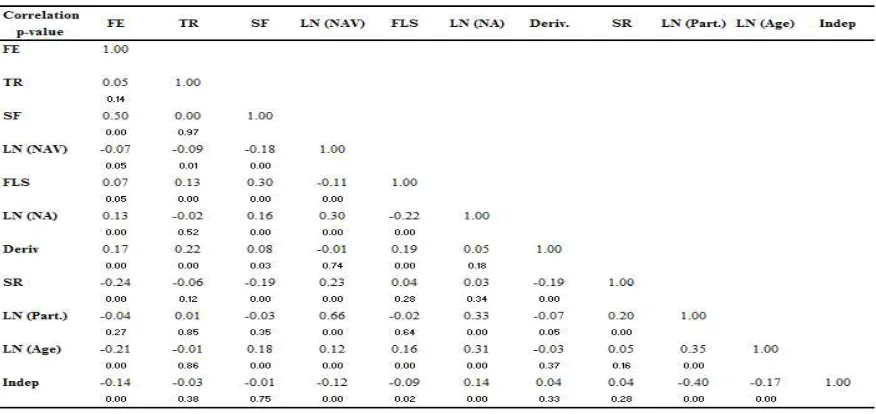

The Fees of Mutual Funds and Real Estate Funds: Their Determinants in a Small Market

Full text

Figure

Related documents

A family of funds exists when one investment company manages a group of mutual funds.. Each fund in the family has a different

We present results from a simulation study in this section to (1) demonstrate that our estimation procedure performs well in a controlled, small-sample environment, (2) illustrate

References also rated IBM very high in consulting competencies, including business acumen, industry understanding, business value and change management.. This coupling of

1.3.4 The series compensation provides a means of regulating power flowing through two parallel lines by introducing series capacitance in one of the lines,

Effective immediately, the first paragraph in the section of each Fund’s summary prospectuses entitled “Management” and prospectuses entitled

Class K Shares of the Fund are available only to (i) employer-sponsored retirement plans (not including SEP IRAs, SIMPLE IRAs and SARSEPs) (“Employer-Sponsored Retirement Plans”),

Collateralized Debt Obligations Risk — In addition to the typical risks associated with fixed income securities and asset-backed securities, CDOs carry additional risks including,

Investment Real Estate Growth Stocks & Mutual Funds Variable Life Insurance &