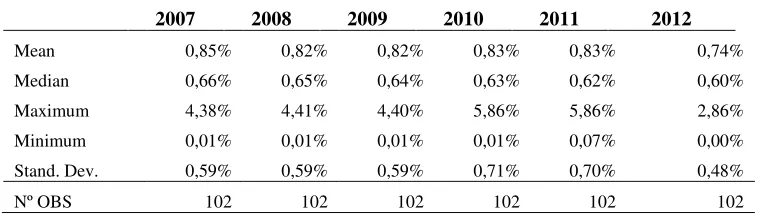

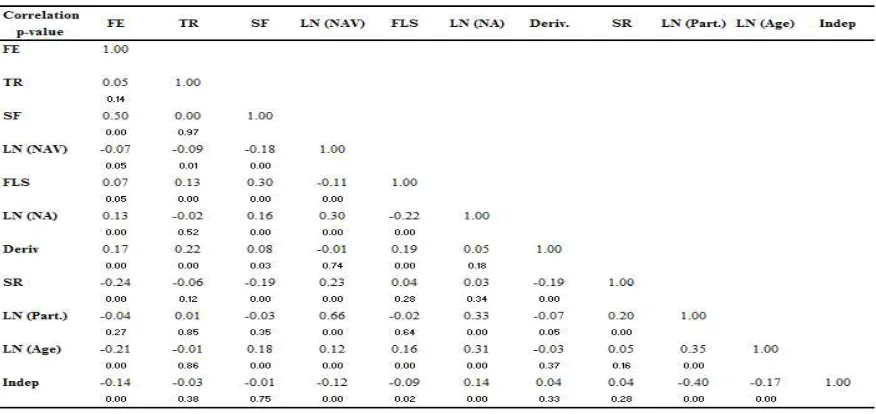

The Fees of Mutual Funds and Real Estate Funds: Their Determinants in a Small Market

Full text

Figure

Related documents

References also rated IBM very high in consulting competencies, including business acumen, industry understanding, business value and change management.. This coupling of

A family of funds exists when one investment company manages a group of mutual funds.. Each fund in the family has a different

Effective immediately, the first paragraph in the section of each Fund’s summary prospectuses entitled “Management” and prospectuses entitled

Class K Shares of the Fund are available only to (i) employer-sponsored retirement plans (not including SEP IRAs, SIMPLE IRAs and SARSEPs) (“Employer-Sponsored Retirement Plans”),

Collateralized Debt Obligations Risk — In addition to the typical risks associated with fixed income securities and asset-backed securities, CDOs carry additional risks including,

1.3.4 The series compensation provides a means of regulating power flowing through two parallel lines by introducing series capacitance in one of the lines,

Investment Real Estate Growth Stocks & Mutual Funds Variable Life Insurance &

We present results from a simulation study in this section to (1) demonstrate that our estimation procedure performs well in a controlled, small-sample environment, (2) illustrate